Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

“Do crypto with Quidax and win from a $60K QDX prize pool!” Bayo, a 28-year-old Lagosian tells Jide, his Ibadan friend seeking the most secure way to trade crypto in Nigeria after a major exchange he trades with announced its plans to leave the country. Find out more here.

When did you first clock the importance of money?

When I was about 8 years old, I noticed the kids in my neighbourhood came out to play with their bicycles every evening. I felt out of place because I didn’t have one, and the kids didn’t let me play with them. I asked my mum to buy me one, and she said, “You’ve not even seen money to eat, you’re thinking about a bicycle”.

Me, I wanted to play and make friends, and I thought I could only do that when I had money to buy my own bicycle.

What was the financial situation at home like?

My dad was a welder for offshore companies, but the early 2000s Warri Crisis forced some of these companies to leave the country. Then he didn’t get regular jobs anymore.

Plus, my dad wasn’t good with money. Whenever he got a temporary offshore job and got paid well, he’d spend it on electronic gadgets rather than follow my mum’s suggestion and invest in a business. I’d come home from school to find a new television when the old one was still working. Or he’d do some repairs on his car or buy a new freezer. So, my parents always fought about money.

I’m the firstborn, so I noticed how his financial habits contributed to the tension at home.

How did your family navigate the periods when he didn’t have a job?

My mum used to be a stay-at-home mum until things got tough. Then, she tried many things; from selling fabrics and hawking food to taking cleaning jobs, daycare and catering gigs. Her businesses hardly took off because my dad always came to borrow money, but at least she made sure we weren’t homeless and always brought food home whenever she went for catering gigs.

Watching her try several things for money, coupled with my dad’s financial habits made me think a lot about money. There was a limit to what I could get because of money, and I just wanted to make my own.

When did you first act on this need to make money?

In SS 1. My mum used to cook for a neighbour occasionally. One day, she had a small get-together and came looking for my mum to cook for her. My mum wasn’t home, and this lady said I should follow her. She assumed I could cook since my mum was a good cook. I didn’t tell her I’d never cooked in my mother’s house. I followed her home and cooked fried rice. I went from never cooking at all to cooking fried rice at 13 years old.

Please tell me it ended well

Surprisingly, it did. My heart was in my mouth when she tasted it, but she said, “This is nice. Your mother taught you well.” She even said I’d cook for her the next time my mum wasn’t around. She paid me ₦3k, which I used to buy foodstuff and cook for my siblings before my mum returned. I was feeling like a small mummy. My mum was pleasantly surprised when I told her what happened.

Did the cooking gigs become regular?

Somewhat. My mum started passing down jobs to me during the weekends. All the money I made was for the house: I never really thought of it as mine. Besides, the only thing on my mind was finishing secondary school at 16 and doing what was expected of me: studying medicine so I could become a doctor and turn the family’s fortune around.

Nigerian millennials everywhere can relate

Well, I failed two core subjects in WAEC in 2011 and couldn’t get university admission that year. Even worse, it had taken serious convincing for my dad to add to what my mum had scraped together for my WAEC fees. When I failed, he said I was useless and concluded I’d get married because he had washed his hands off my education.

Since school wasn’t on the horizon, I got a teaching job at a nearby secondary school.

How much did it pay?

₦4k/month. I did the job for a few months till some family members convinced my parents to let me write NECO and JAMB. I got into university in 2013. It wasn’t medicine sha.

But my dad refused to pay my fees, and my mum had to do a lot of running around to raise my fees. He later chipped in, but it was mostly my mum. It was clear from that moment that I’d have to take care of myself in school. They’d settled school fees. Everything else would be on me.

How did you manage this?

I had a stint serving drinks at a bar three times a week for ₦4,500/month. But I stopped after a few months because the male customers kept touching me, and the bar owner was only interested in keeping his customers.

Then, I worked as an attendant at a fuel station for ₦7k/month. Since I was still in school, I shared a shift with someone else and only worked half days. I hated the job because I had to stand for hours. I left after about three months.

Also, I had a much older boyfriend — I was 19, and he was in his 40s — who used to give me ₦10k – ₦15k every other week. He also paid for my hostel accommodation once.

My boyfriend kept saying he wanted to marry me. I didn’t mind because he had a two-bedroom apartment, a car, and seemed rich. At least, I’d be comfortable. Anyway, I saved up most of the money he gave me and began selling beaded items in school.

Did you make them yourself?

Yes, I did. I’d make the beads and post them on Facebook. A bead set went for ₦2k – ₦2,500. My profit on each sale was about ₦1k.

On the side, I was making ₦5k or ₦7k cooking for some Yahoo boys I’d befriended in my apartment building. They liked my food, so the money was regular.

While that was going on, the guys noticed I was well-spoken and started asking me to check for typos in the messages they wanted to send to “clients” to confirm there weren’t any typos. Sometimes, I’d edit; other times, I’d help them write the messages. Anytime they got paid, they’d give me between ₦30k – ₦50k as appreciation. The highest I ever got was ₦100k.

Those were my major income sources between first year and second year of uni. I was making money — approximately ₦40k weekly — and even sending some home. Because of that, I stopped paying attention to school. I hardly attended classes because I couldn’t leave someone calling me to cook for one rubbish class.

That must’ve affected your grades

It did. I had F parallel during the second semester of my 200 level. I had so many carryovers to write. But I was focused on making money. So, I started selling essential oils, too. I was also trying to raise money to start a hair business. The plan was to get hair from a distributor and resell them. It was lucrative at the time, so I saved everything I made so I could invest in it.

Around this time, my relationship with the older guy had ended, and I met another one online. The new guy was in his 30s and lived in a different city. I think he was the first person who told me he loved me. I told him about my plan to start a hair business and he seemed proud that I was so hardworking. I had saved ₦300k+ by that time.

A few weeks after I told him about my plan, he called and said he’d been in an accident. Then he ended the call.

An accident?

I was confused too. He was unreachable for the next couple of hours, and I was worried. When he eventually called back, he said he was in the police station. Apparently, he’d hit a woman and her child with his car, and the police held him, asking for about ₦600k. He said his bank app wasn’t working and asked me to lend him the money, promising to pay back as soon as he was released.

I didn’t stop to think. I just thought, “Well, he’s my boyfriend” and sent him my entire savings. He encouraged me to borrow the remaining ₦200k from people, and I did. After he got the money, I didn’t hear from him again.

Damn

I didn’t suspect anything at first. I thought he was still in danger. After three days, I borrowed more money to travel to his city to check on him. I met an empty house, and it was obvious someone had just packed out. I asked a neighbour, and they said they saw him leave a few days ago, and it looked like he was relocating.

At that point, my whole world shattered. I have no idea how I returned home that day. I was walking on the road, and tears were falling down my face. How could I have been so stupid?

I’m so sorry

I had lost everything I’d ever worked for and was about ₦300k in debt. I couldn’t tell anyone what happened. I stopped attending classes and didn’t even go out. I honestly wanted to die.

I started to “borrow from Peter to pay Paul” when my creditors started calling for their money. I’d take new loans to pay my old ones. I even used loan apps to fund a gambling habit I developed.

RELATED: The #NairaLife of a Pharmacist Who Overcame a Loan App Addiction

How did you start gambling?

I picked it up from a neighbour. I desperately needed money and I asked him to teach me how to play but he refused because “babes no dey do this kind thing”. Instead, he suggested I give him money so he’d play for me. If he won anything with my money, he’d take a small percentage and give me the rest. I thought it was a good idea, so I agreed.

I started giving him ₦500 – ₦1k here and there for him to place bets. I don’t even know if he was placing the bets or using my money to smoke weed. But every time he’d come and say the game “cut”, and I’d give him more money for another “sure game”. I don’t know if it was desperation, but I just believed I’d win big one day and clear all my debts.

Did you win big?

I didn’t win anything. I was still getting cooking gigs, but they didn’t come as frequently, and everything I made went into paying loans and feeding. At one point, I dropped out of school completely. I was keeping to myself a lot and my friends just thought I was going through heartbreak. They didn’t know about the loans. I didn’t want to ask for help because I felt like I needed to solve everything myself.

I became homeless because I couldn’t pay rent. I started moving from one friend’s house to the other. They didn’t know I was homeless. I’d just be like, “I want to come and stay with you for one week,” and then I’d move to the next friend. I ended up staying with some of them for up to a month at a stretch.

It was crazy. I sank into a bad depression and was in limbo from 2015 to 2017. In 2017, I had to open up to my friends because the compounding loans were killing me. They pulled funds together, and I started to clear the loans. But then I saw an investment opportunity that promised to triple my money in two weeks.

Hmmm

See, I was at the mercy of people giving me ₦10k – ₦20k, and I didn’t want to rely on that. I wanted to make my own money, too. So, I took ₦100k that people had gathered for me and put it in the firm, expecting to make ₦300k. That ended terribly. I never saw one kobo.

At that point, it felt like there was no end in sight to the series of bad financial decisions I was making.

Thankfully, my friends helped me clear my debts completely in 2018. That’s also when my parents realised I’d dropped out of school.

How?

My mates were already going for NYSC, so they obviously had questions. I told them, and they were so disappointed. I couldn’t even go back home because I was ashamed. By this time, I’d rented another apartment with a friend’s help, so I just stayed back around school.

But I didn’t have a job or business. My mates had finished school and moved on with their lives, and I was still there.

I had nothing to my name and didn’t even know who I was. I sank into another depressive period that lasted until 2020. This time, it came with suicidal tendencies. I’d constantly overdose on drugs, and my neighbours would break down my door and rush me to the hospital.

When I wasn’t trying to kill myself, I was just existing. I’d go for days without eating until my friends sent me money. The last time I attempted suicide in 2020, someone told me, “Maybe you should just die so everyone will rest”.

Ah

I think, in the end, it was my friends’ encouragement that restored my will to live. They kept telling me things would get better, and I started to believe them. I was angry at this “things will get better” statement for a long time, though. I mean, I was a uni dropout in my 20s without a job, no relationship, and even my parents weren’t talking to me. Where was the “better”? But my friends didn’t let me give up.

Towards the end of 2020, I decided to return to cooking. It was the constant in my life, and I thought, if I could go to culinary school, I’d even be able to make a career out of it.

In early 2021, I got two steady clients. Between the two of them, I was sure of at least ₦100k/month.

Things were looking up

A little. But then my mum became hypertensive and had a stroke, and I had to start chipping in money for drugs. She was no longer with my dad, so I was also supporting my siblings in school. For every ₦100k I made, more than half went to my siblings and mum. So, that didn’t help with planning for my life or even culinary school.

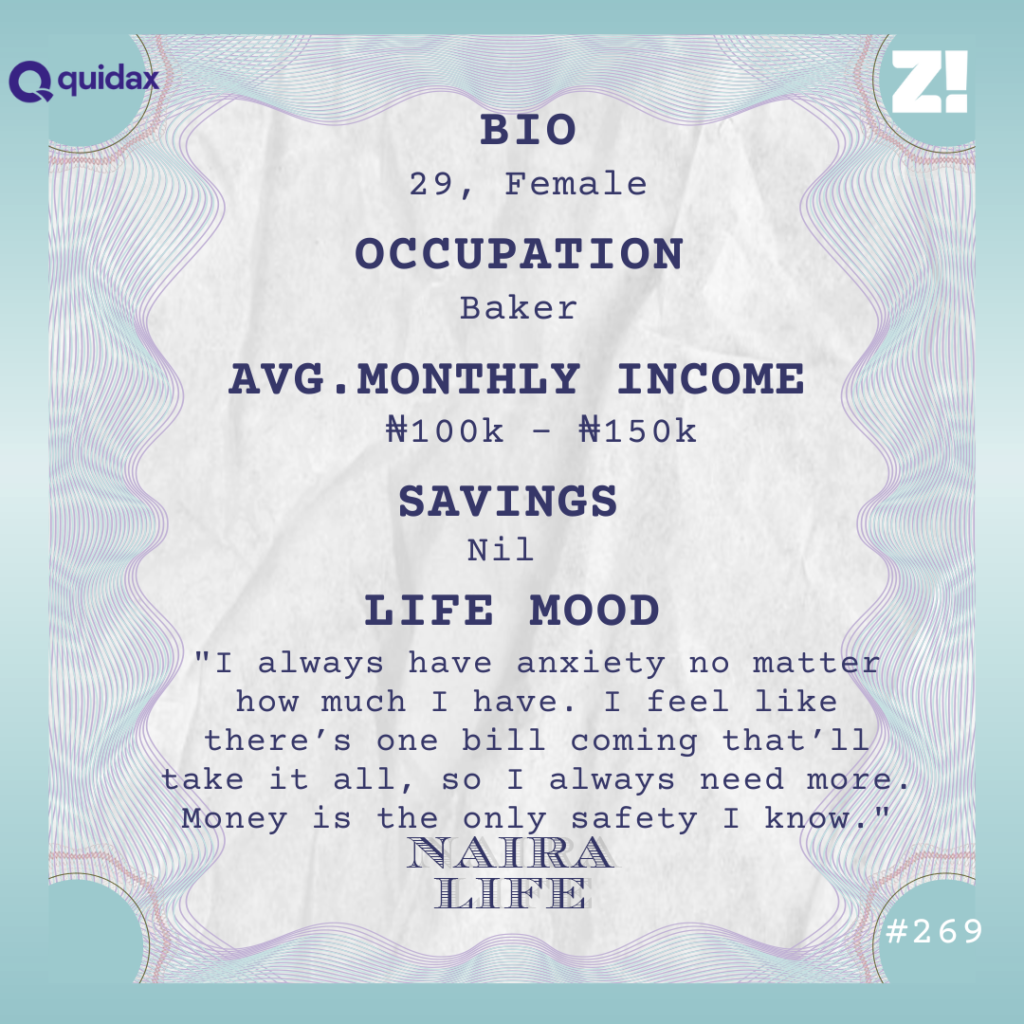

What are things like these days?

Still pretty much the same. One of my siblings is waiting for NYSC and the other one is in final year at uni, and most of my money still goes back home. I really don’t think I’m living for myself. There’s always one need back home, and money is never enough. I have things bookmarked that I’d like to buy, but I can’t even think of buying them. I always think of home first.

Do you still rely on cooking gigs?

I learnt how to bake in 2022. Since culinary school wasn’t an option, I paid about ₦300k to learn to make cakes and small chops.

My plan was to set up a cute pastry shop, but I quickly realised it was capital intensive, so with the help of my friends again, I got a bigger ₦300k/year apartment with a big kitchen so I could bake in my kitchen and save on rent. It limits the number of cake orders I can get because some orders require storing products, which is a hassle without a freezer. The last time I priced a small freezer, it was ₦185k.

In a good month, I can earn between ₦100k – ₦150k from baking and cooking gigs. Sometimes, I don’t earn anything and have to rely on the grace and kindness of my friends. My financial life is very up and down.

You’ve mentioned your friends turning up for you a lot. Do you ever worry about relying on them too much?

All the time. I struggle with asking for help until things are falling apart. Anytime I have to pick my phone to ask for something, I feel regret and shame. These are my agemates, but I have to depend on them again and again.

My friends probably don’t feel the same, but I feel like a nuisance. It’s not great being the broke friend. No matter how kind people are, nothing beats the peace that comes with having my own money.

Plus, there’s a way people treat the broke friend. For instance, when my friends do things that piss me off, I can’t react or call them out because what if they choose to be vindictive and ignore me when I need help? It’s like I have to give away little parts of my dignity because I need them.

I’m also like the last person they think about for events or get-togethers. Like, why send an invite when I probably don’t even have money to attend? It hurts seeing the people I care about doing fun things and realising I’m the only one not there. But I can’t even be angry because if they invite me, I can’t afford it.

How many times will I say, “Sorry, I can’t make it”?

That’s relatable

But my friends are really good to me o. If not for them, I probably wouldn’t be alive to talk to you. I met most of them on social media, and they’ve helped my life. I just feel foolish that I can’t reciprocate. I’m the friend who writes long notes on birthdays because I can’t buy a gift. They love the notes, but I want to buy them gifts. I feel inadequate.

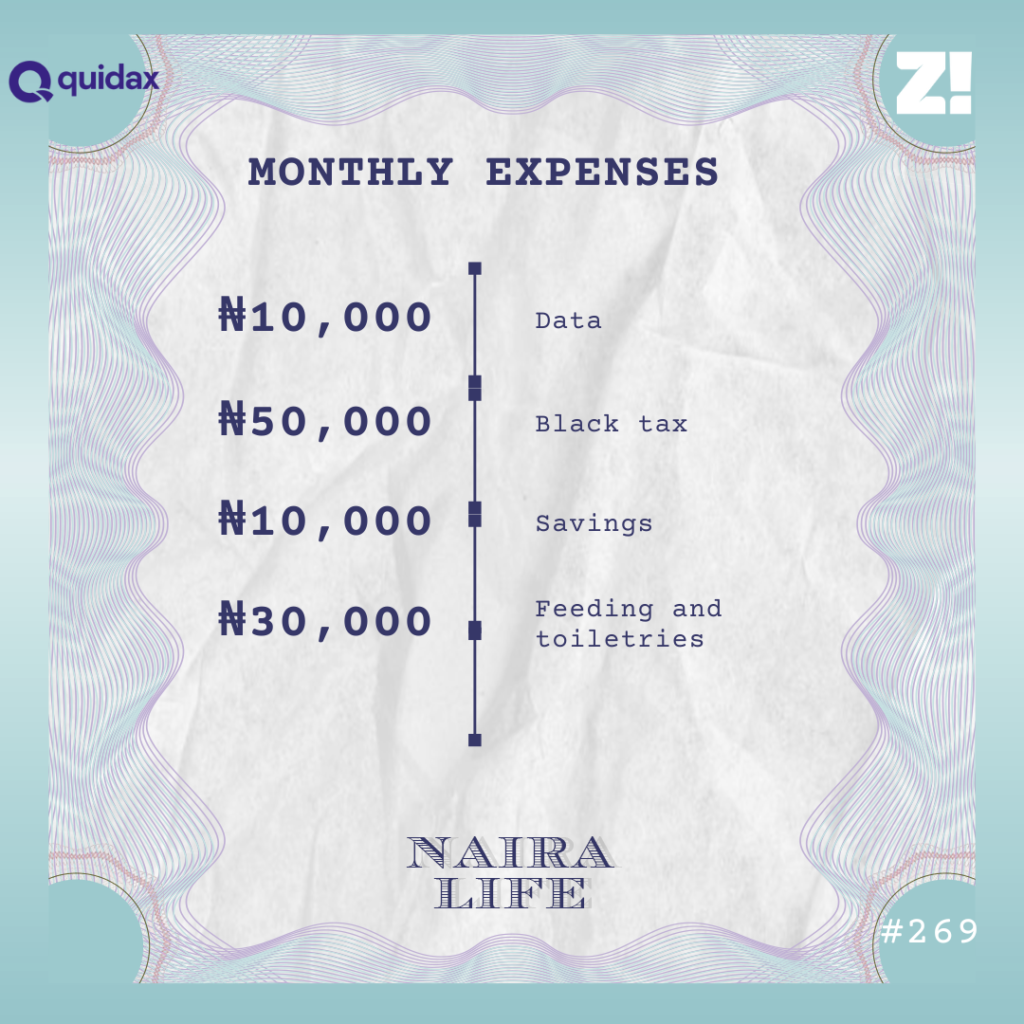

Sorry you feel that way. Let’s break down your monthly expenses

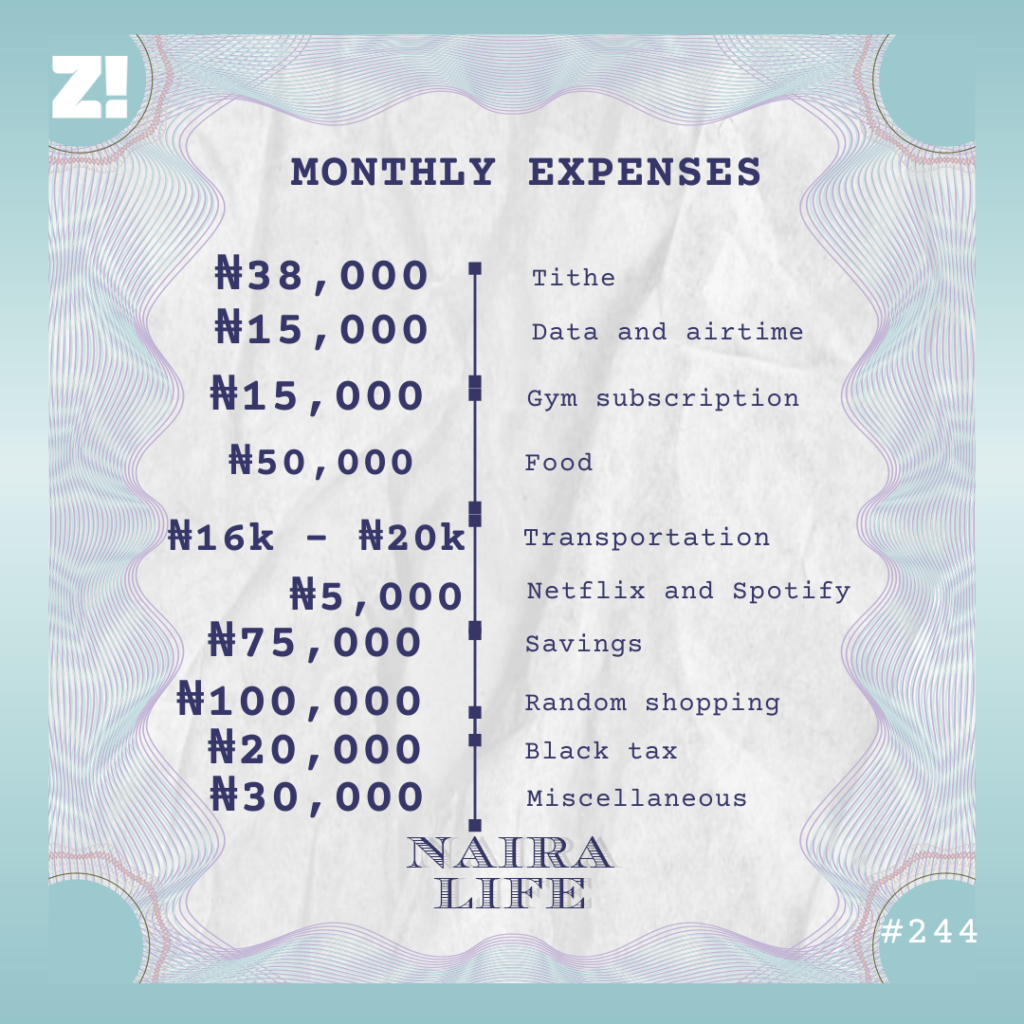

In a month that I earn ₦100k, my expenses typically go like this:

It involves a lot of manoeuvring to make it work. My toiletries are just sanitary pads and deodorant. That my savings figure is a delusional thing I like to do. I remove ₦10k and put it in a savings app, but then I collect it two days later when I need money. All my money goes into black tax and trying to survive. I honestly feel like I’m just existing.

How would you describe your relationship with money?

I always have anxiety no matter how much I have. I feel like there’s one bill coming that’ll take it all, so I always need more. Money is the only safety I know. I don’t want to return to the point I was years ago — gambling and in debt. I want to have so much money to the point where I never have to worry about it again.

How have your experiences shaped how you think about money?

Money gives you human dignity. Not having it can make you less than human. People can disagree and say, “But you can have a good quality of life without money”. It’s a lie. I’ve seen poverty, and I’ve seen how people treat me when they think I have money and when they know I’m completely broke.

It may be unintentional, but there’s this condescension towards poor people. People are always ready to advise me, like I’m completely clueless. They say, “Oh, why can’t you start a business?”. My darling, it’s money I’ll use to start it. Or “Why not learn a tech skill?” Sweetheart, it’s still money I’ll use to buy a laptop and data. People think I don’t have money because I’m stupid. Like all my problems would disappear if I only listened to their advice.

That’s a lot to think about. Are you still pursuing culinary school?

Oh yes. It’s still a dream. I want to become a chef so I can tell my mum I’ve taken her cooking gigs a step further. When this happens, I can confidently say I have a career. You can ask my friends what they do, and they quickly respond, “Software developer”. But I don’t have one straight answer. I have to start explaining how I bake, cook and write sometimes. That’s why I need this to happen.

But culinary school would require me to leave my state, move to Lagos, and spend a couple millions on school fees. I don’t have that yet. I’d also like to return to school one day and get my degree, but that feels like a far-fetched dream.

How would you rate your financial happiness on a scale of 1 – 10?

1. I can’t afford a good life. I’m always scraping the bottom. I can’t even afford to lose ₦100 from my account. I’m always anxious, and it’s not a great way to live. I feel like I’m failing at life.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]