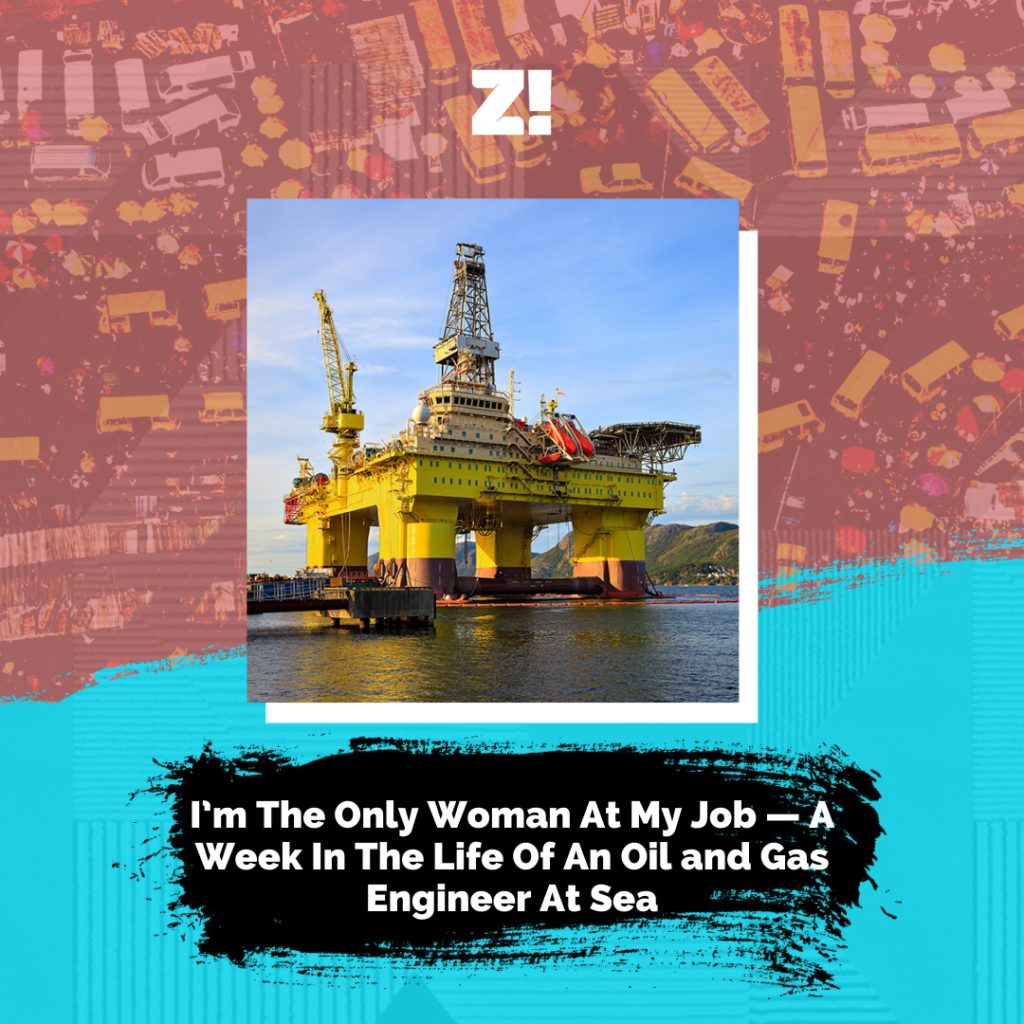

A Week In The Life” is a weekly Zikoko series that explores the working-class struggles of Nigerians. It captures the very spirit of what it means to hustle in Nigeria and puts you in the shoes of the subject for a week.

The subject of today’s “A Week In The Life” is a process engineer at an oil-producing facility. Process engineers ensure that the process of crude oil production from collection to processing for sale runs smoothly. What this means is that they spend a lot of their time solving problems or preventing problems from happening.

Our subject tells us about being the only woman at her job, life at sea, and what it takes to extract crude oil.

MONDAY:

The time I wake up depends on whether I’m working from my house or I’m working offshore at sea. At home, my body wakes up by 7:30 a.m., but my brain starts by 8:00 a.m.

When I’m offshore, my day starts at 6:00 a.m. and doesn’t end until about 2 a.m.

Today, the thing that wakes me up is the sound of my 5:30 a.m. alarm. I almost press snooze until I remember that I’m on a floating oil production facility at sea. I have just enough time to get out of bed, shower and prepare for my day.

It’s a few minutes till 6:00 a.m. when I leave my room for my first meeting of the day. Dressed in my coverall, safety goggles, hat, safety boots, and earmuffs, I slowly make my way to the meeting point.

The first meeting of the day is typically a handover shift. Because oil production is a 24-hour affair, personnel work 12-hour shifts. This means that every 12 hours, one shift is handed over to the other. At the 6:00 a.m. meetings, the technicians on the night shift inform their colleagues on the morning shift of whatever happened during the night. While the technicians get to work shifts, my job as an engineer requires me to work round the clock.

I listen attentively during these meetings because their updates determine the course of my day. If they raise an issue, my plans for the day take a backseat until I fix that issue. If there’s nothing to report, my day proceeds as planned.

Thankfully, the meeting ends at 6:15 a.m. That gives me time to relax before my 6:30 a.m. meeting. At this meeting, managers from the different teams on the platform gather to give updates about what happened the day before and also map out plans for the day.

The meeting ends at 7:15 a.m. with a reminder of safety precautions. This gives me some time to prepare my notes for the next meeting at 7:30 a.m. Here, I report to the higher-ups. As the engineering rep on board the facility, I summarise all the updates from the technical team and update my senior colleagues on our progress regarding oil production.

It’s 8:30 a.m. before I’m done with my final meeting for the day, and that’s when my day truly begins.

TUESDAY:

It’s currently 2:00 a.m. and I’ve barely slept. I started yesterday with meetings, continued with reading safety reports, extended the day by inspecting oil pipes in my facilities, and ended it in my room responding to emails.

I find engineering super fascinating. It’s interesting that some people used some super cool technology to locate crude oil-producing rocks, mapped out an area and drilled for oil. Then, the drillers not only discovered oil, but they confirmed — using various methods — that the oil was present in commercial quantities.

So they made oil pipes, machines, and other cool equipment to extract the oil from 10,000 feet below the ground to the surface. But, because this oil isn’t exactly fit for use, they now extended pipes from the spot where the oil was discovered to production facilities like mine.

On the facility, there’s me, whose job it is to ensure that oil flows smoothly from where it is produced to production facilities where we process into a form fit for sale to refineries. Whew.

The cool part of the job is that I’m always solving problems. One valve spoils and because of that, a well isn’t producing oil? I’ll brainstorm, send an instrument technician to look at it and provide technical oversight. Some machine part is not doing what it’s supposed to do? I’ll think over it, share a repair plan and send a mechanical technician to fix it. Safety precautions not being met that can spell danger for us? I’ll get in front of it. My entire job is an exercise in firefighting and proactiveness.

The downside? The subtle pressure. Being in charge of the oil production process means I must be on top of everything. The facility I’m in charge of has a target to produce more than *60,000 barrels of oil a day. Crude oil is $85 per barrel. Do the maths and tell me what it adds up to.

You don’t want to be the person who missed something that caused the company to lose 60,000 times $85 for every day the facility is down. But, no pressure. It wouldn’t be fun for me if it wasn’t this challenging and rewarding.

WEDNESDAY:

Life at sea is peculiar; the problems differ every day but the scenery remains the same. I’m surrounded by miles and miles of water with nothing else in sight. When I get stressed from work, I go out and stare at the water. Surrounded by water I feel very small and I’m reminded that not a lot of things matter. This helps to decompress and center me.

You already know how my days go, but today is different.

I have a difficult problem that I can’t quite crack: cravings. Because I’m at sea and I can’t quickly cross the road, I’m stuck with the nonsense feeling. Yesterday, I was craving puff puff. Today, I am craving waakye. I wonder what craving I will have tomorrow. The most annoying part is that when I’m on land the cravings won’t come, but immediately when I’m offshore, they’ll start to hit me. And I can’t do anything about it but endure until it passes.

The good thing is that there’s a lot of food, fruits and snacks in our offshore canteen. This is in addition to my own specially prepared offshore starter pack.

Ebeano plantain chips: present ma.

Chocolate Mcvities biscuits: present ma.

Gestid for acid reflux: present ma.

Excess sanitary pads: present ma.

Painkillers for cramps: present ma.

These are the things that make life a little bearable for me. At least, if I can’t eat waakye, I can eat plantain chips and manage myself.

THURSDAY:

Everywhere I turn on this facility, someone is always shouting, “Our Engineer,” “Well-done, Engineer.” I suspect I get special treatment offshore for two reasons: The first is that I’m an engineer which is a highly respected role in the organization hierarchy. The second is because I’m the only woman in my facility. For various reasons such as family responsibilities, marriage pressures, etc women typically don’t go offshore. For this reason, the men are usually excited to see a woman among them.

The good part? The men are some of the funniest people I know. I guess humour is how they deal with being separated from their families for long stretches in a year.

The bad part? The people who don’t know me sometimes try to proposition me. Well, up until they find out who I am and then the conversation changes to that of deference and respect.

Today, I wake up thinking that one of the reasons this role works for me is because I’m single, I don’t have kids, and nothing ties me down to one place or city. For many other women, this is not the case. With children and family responsibilities, their priorities shift and this role with its demands no longer suit them.

I don’t know what will change if I decide to start a family someday. I love engineering because of how much there is to learn and discover, and the closest I come to practising it is when I’m offshore. The thought of giving it up if push comes to shove is something I have never considered. I wonder what choice I’ll make.

But that doesn’t matter now because I have a ton of inspection and oil pipe integrity testing to do today. A perk of this job is that you can get so immersed in monitoring day to day operations that your personal problems take a back seat. And to be honest, that works for me. At least, for now.

Check back every Tuesday by 9 am for more “A Week In The Life ” goodness, and if you would like to be featured or you know anyone who fits the profile, fill this form.