How many currencies can you identify? Take the quiz:

-

14 Ways To Know Someone Who Has Done Money Rituals In 2021

These days, the prices of everything keeps going higher and higher. It’s scary how you can afford one thing today and be unable to afford it the next week. It’s almost as if the government wants us to dabble into blood money before we can afford anything at all. We need to go on our knees and beg whoever is in charge to please have mercy on us.

But before we do the actual begging, we have decided to fish out anybody who has done actual money rituals. If you know anyone who does any of the things on this list, please hold their clothes and don’t release them until they introduce you to their herbalist.

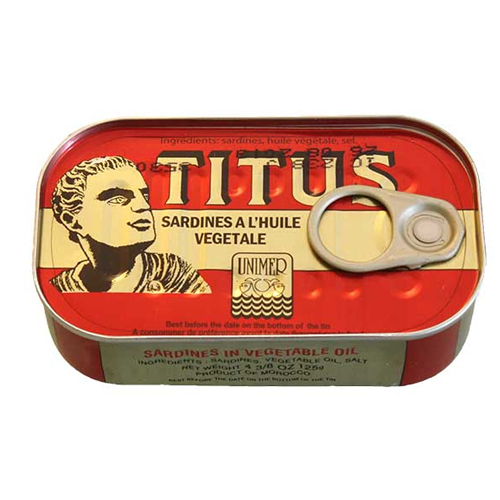

1. They still eat sardines.

Do you know how much a tin of sardine costs now? Especially Titus sardine. It has jumped from being around N250 to N600. And that is what someone is still eating in the name of satisfying their cravings. Please hold them tight and beg them to introduce you to their herbalist. If you see anyone adding Geisha to their spaghetti too, please add them to the list.

2. They can still refill their gas cylinder.

There is nothing you can tell me: Anyone who still refills their gas cylinder in these trying times is definitely seeing a herbalist on the regular. Do you know how much 1kg of gas costs now? If you see anyone that is still using gas to cook and not charcoal or firewood, please give us their number. We need them to connect us.

3. They have more than 2k in their piggyvest

More than 2k in this economy? And you believe we don’t have ritualists walking around this life like normal people? We are not ashamed to say it: if you have anything above 2k in your account, you have done blood money. Tell us, who did you sacrifice?

4. They have a dollar account.

You still want to tell me that this category of people have not done money rituals? A dollar account when many of us are still battling to fill up our naira accounts? Ahan nau. Let’s call money ritual what it is, please.

5. They are still eating beans.

A bag of beans reportedly costs up to 100k now. And this is what someone is eating regularly? If you tell me to show you someone who did money rituals without telling me they did money rituals, I will just enter their kitchen and drag out their bag of beans.

6. They are doing crypto.

Believe me, believe me not, crypto traders in this economy have done money rituals. Oh yes, they have. Where did they find the money to invest in cryptocurrency, if not through juju?

7. They are doing NFT.

In this tough economy, someone is minting NFTs and you think the source of their wealth is pure? This government has rendered us all penniless; where is anyone finding money to do NFT? Please call out money rituals when you see it, abeg.

8. They are in a serious relationship.

Being in a serious relationship requires financial commitments. You have to go on dates, buy gifts, do small cash gifts. How can one afford that in this economy where everything is upside down? Staying single is the best financial decision. Anyone who is doing love in this day and time, has plenty money and they need to show us the source.

9. They have money to run gen.

Fuel is too expensive. Anyone who isn’t using candles definitely needs to declare their assets ASAP.

10. They can still afford to eat bread

A loaf of sliced bread is now about N700, if not more. What is worse, the smaller ones have increased in price and reduced in quality. Anyone who can afford to eat bread has definitely collected money soap from their herbalist. Please beg them to cut soap for us.

11. They still cook with palm oil and vegetable oil.

One question: HOW? Please show us the way nau, we are begging.

12. They still eat turkey and chicken.

A kilo of turkey is now around N2,500. How can you eat something that cost as much as human flesh and expect us not to suspect you? Please reveal the source of your wealth.

13. They eat Titus fish.

One Titus fish is now between N700 to N1,000. If you still eat it, there’s nothing to say: you have done blood money.

14. They are still alive.

Yes oh, where are you finding the money to stay alive if not that you have done rituals? Especially in this economy where the price of everything is ready to cut your throat. So, are you ready to introduce us to your herbalist or should we blow the whistle?

[donation]

-

QUIZ: Make Some Financial Decisions And We’ll Guess Your Account Balance

How much do you have in your account? Let’s expose you:

-

How I Seamlessly Transitioned To A Six-figure Digital Career In 6 Months – Quadri Balogun R.

I’ve never really been a tech-savvy guy. As a graduate of marketing, I had a day job where all I needed to do was meet my monthly quota, then at night, I was a Canva Graphics designer. I was unhappy, unmotivated, and constantly exhausted. My guys could never relate, they had the financial flexibility and were generally in tune with technology and its latest trends. So, I figured it was time for a change.

After months of cluelessness, I finally mustered up the courage to admit my ignorance to my closest pal, Tobi, and asked the million-dollar question, “where una dey see this money?” After laughing at my question, he gracefully used the opportunity to boast about his many achievements, typical, then he went ahead to give me some insights. You see, in this race against sapa, I was ready to win at all costs.

Tobi talked about how he had taken an assessment online which helped him discover where he fits in this increasingly digital world. Some online courses and a few certifications later, he was able to get a much better job than his previous job. He kept emphasising the fact that the world was going digital and I needed to acquire skills that would “future-proof” my career.

I’d heard it all before. It was almost like an apocalypse was coming and we all had to go somewhere, anywhere. But I wasn’t about to give up. I was determined to find out how this digital thing worked and how I could take advantage of it.

He told me that first I needed to know what my digital strengths were. In my head, I was like strengths? I’m coming as a novice to the digital world and you’re asking me for my strengths?This time I was the one laughing at myself until Tobi mentioned that Jobberman had recently launched a behavioural assessment that lets you know your digital strengths, the space you occupy in the digital world, and what skills you need to develop to stay ahead.

This time I was the one laughing at myself until Tobi mentioned that Jobberman had recently launched a behavioural assessment that lets you know your digital strengths, the space you occupy in the digital world, and what skills you need to develop to stay ahead.

Without wasting any time, I took the assessment, then I got my friends to endorse me as well as identify my strengths and weaknesses. Much to my surprise, the assessment was quite simple. All you had to do was pick your top attributes from the list provided then your colleagues would pick the ones that they think are your best 6 attributes. After which, I got a report where my strength profile was compared to a set of roles and capabilities that are important in a digital business environment.

So, results were in and I was placed in the category of “citizen”. This category described me as a person who uses the tools of the digital ecosystem to drive efficiencies and grow businesses. The first thing that came to my mind was, yeah, marketing! This is what I already do, to grow businesses by increasing sales. And then it hit me, digital marketing!

Step two, take courses in that field and get certified!Two certificates and 7 weeks later, I became a certified digital marketer. Next step was to quickly update my Jobberman profile and before long, recruiters noticed me on the platform based on my assessment and recently acquired certifications. A few interviews later, I landed my first big gig! And today, I am balling with my guys and passing through gigs like water! Goodbye sapa!

I am Quadri Balogun and I am so grateful that I was able to find my digital superpower with the help of Jobberman!. You too can step up and find your digital superpower! Take the assessment, whether or not you’re interested in technology. Trust me, it will give you a sense of direction, especially now that everyone is in a frenzy about going digital.

Simply visit www.jobberman.com/findyourdigitalsuperpower to find your superpower

The world is waiting!

-

#BorrowBorrow: How Much Does Nigeria Really Owe?

Nigeria is currently in a lot of debt and Nigerians are stressed out — with good reason.

A recent cause for this stress is the news that President Muhammadu Buhari has asked the National Assembly to approve his plan to borrow over $4 billion and €710 million from international organisations to finance projects in the 2021 budget.

The President also asked the National Assembly to allow him to seek $125 million in grants for special projects.

Buhari practically said:

The new loan request is coming just four months after the President requested that the National Assembly approve his plan to borrow over $8.3 billion and €490 million from various international organizations. This request was approved.

In March 2021, the National Assembly also approved the President’s plan to borrow $22.7 billion for “infrastructure development”.

But Exactly How Much Is Nigeria Owing?

You may want to sit down for this next part. As of March 31, 2021, Nigeria’s total public debt stood at over $87.2 billion which is about ₦33.1 trillion.

Of that debt, $43.5 billion is to be paid by the federal government while the state governments and the Federal Capital Territory owe $10.8 billion.

At the time, Nigeria also owed a total of $32.8 billion or ₦12.4 trillion foreign debts while we owed $54.3 billion or ₦20.6 trillion domestic debts.

Be honest, this is what you thought when you saw what “we” owed:

These numbers are just from March and they don’t include the recent May and September loan requests by the Federal Government or any of the new loan plans by the 36 state governments. The foreign exchange rate was also different at the time of calculation.

Who Is Nigeria Owing?

As of March 31, 2021, these are the people Nigeria owes abroad:

- International Monetary Fund – $3.44 billion

- International Development Association – $11.09 billion

- International Bank for Reconstruction and Development – $410 million

- African Development Bank – $1.59 billion

- African Growing Together Fund – $210,000

- African Development Fund – $942 million

- Arab Bank for Economic Development in Africa – $5.88 million

- European Development Fund – $51.3 million

- Islamic Development Fund – $29.7 million

- International Fund for Agricultural Development – $223 million

- Exim Bank of China – $3.4 billion

- Agence Française Development – $486 million

- Japan International Cooperation Agency – $74.6 million

- Exim Bank of India – $34.5 million

- Kreditanstalt Fur Wiederaufbau – $183.7 million

- Eurobonds – $10.3 billion

- Diaspora Fund – $300 million

- Promissory notes – $179.5 million

Nigeria owes a total foreign debt of $32.8 billion as of March 31, 2021.

Nigeria Can Pay This Money Back, Right??

Borrowing money is not a bad idea if you can pay it back. But Nigeria is currently swimming in so much debt, and it is not making enough money to justify taking on more debts.

This year alone, Nigeria will be paying back ₦3.12 trillion in debts. On top of that, Nigeria plans to borrow another ₦5.6 trillion.

These debts are unsustainable because the government wants to spend ₦13.5 trillion yet Nigeria plans to make only ₦7.99 trillion, and we have not made more money since the ₦10 trillion we made in 2014.

South Africa, for instance, wants to spend R2 trillion in 2021, but the country makes R1.36 and will be borrowing R689 trillion. South Africa will also be paying back debts of R232 billion, but it has a very good tax system that can help it to generate revenues easily.

Economists say that Nigeria’s “debt to GDP ratio” (that is Nigeria’s total debt compared to Nigeria’s total productivity) currently stands at about 32% and apparently, that is still low and in line with the World Bank’s recommendations.

But economists also agree that Nigeria’s “debt to revenue ratio” (that is Nigeria’s total debt compared to how much Nigeria actually makes) is becoming a concern.

Nigeria must reduce its debts and start making more money if it does not want to be caught in a debt trap.

-

QUIZ: What Grade Does Your Money Management Skill Deserve?

How well do you manage your money? Take this quiz to find out.

-

Rivers State Tax: VAT The Hell Is Going On?

Rivers VAT not for Abuja people, I don’t care if heaven falls!”, Wike insists.

If you’re wondering why governors seem to be in a stand-off with the federal government, we have the tea. The situation is about a type of tax called Value Added Tax (VAT) and which level of government has the power to collect it — the Federal Government of Nigeria or the state governments.

Whoever wins this battle is certainly going to get richer by about ₦1.5 trillion.

The Federal High Court Ruling

On August 10, 2021, in a lawsuit marked FHC/PH/CS/149/2020, Justice Stephen Dalyop Pam of the Federal High Court ruled that it is the Rivers State Government, not the Federal Inland Revenue Service (FIRS), that should collect Value Added Tax (VAT) and Personal Income Tax (PIT) in Rivers state.

The judge granted all of Rivers State’s requests over the matter, and it agreed with the state’s argument that the Federal Government of Nigeria, through the FIRS, cannot collect VAT because it does not have the power to do so under items 58 and 59 of the “Exclusive Legislative List” of the Constitution and items 7 and 8 of the “Concurrent Legislative List” of the Constitution.

The Federal Government of Nigeria has been collecting VAT across Nigeria since 1993, but Rivers State has basically said “enough”.

What Is VAT?

The Value Added Tax is a tax that is collected at every stage of production of an item or service, from the beginning of production to when the item or service is finally sold.

In Nigeria, VAT is charged on all goods and services except on medical products, basic food items, books and educational materials, baby products, fertilizers, farming machinery, medical services and a few other goods and services in the first schedule of the VAT Act.

Nigerians pay a 7.5% VAT on everything we buy, including recharge cards, wines, cars and many other things.

What This Means

VAT is the second-highest generating tax in Nigeria after the Companies Income Tax, and Nigeria made about ₦1.5 trillion from VAT in 2020 alone. But it is not the amount of money that is provoking emotions, it is the way the money is shared.

Under Section 40 of the VAT Act, 15% of the VAT pool must go to the Federal Government, 50% to the states and 35% to the Local Government. 20% of the entire money must also be shared according to where they are gotten from.

But Rivers State is not happy with this arrangement. According to the governor, Nyesom Wike, the state generated ₦15 billion from VAT in June 2021 but only got ₦4.7 billion when the VAT pool was shared according to the current sharing formula, whereas Kano State generated ₦2.8 billion naira from VAT in June 2021 and got the same ₦2.8 billion naira it made.

If states begin to collect their own VAT following the new court ruling, it would mean that every state in Nigeria gets to keep the VAT money it makes, and states like Lagos, Rivers, Oyo, Kaduna, Delta and Katsina where up to 80% of VAT is collected will get to keep their fair share without giving it to the federal government.

Rivers State, for instance, would be able to keep its VAT money and use it to develop the state, something in the range of the ₦15 billion it generated from VAT in June 2021 alone. Already, Lagos State House of Assembly has passed the state’s VAT law to ensure that it starts keeping the VAT money it makes.

But there’s also a downside to it. Many states who don’t make as much money from VAT rely on the national sharing pool. Because Nigeria’s 36 states and 774 local governments all share 85% of the total VAT money, it means that many states get allocation from the VAT pool even though they contribute less than 20% to it. This is the reason why Gombe’s governor has pleaded with other states to be their “brother’s keeper,” because if each state begins to collect its own VAT, about 30 states in Nigeria will suffer a significant decline in their revenue. And this is because there is little production and consumption activity going on in those 30 states, so there’s only a little VAT to collect.

The Federal Inland Revenue Service (FIRS), the agency that collects taxes on behalf of the federal government, has already filed an appeal to overturn the judgement of the Federal High Court. We’ll have to wait and see where this case leads. But one thing is certain: the question about who has the power to collect VAT in Nigeria is far from over.

-

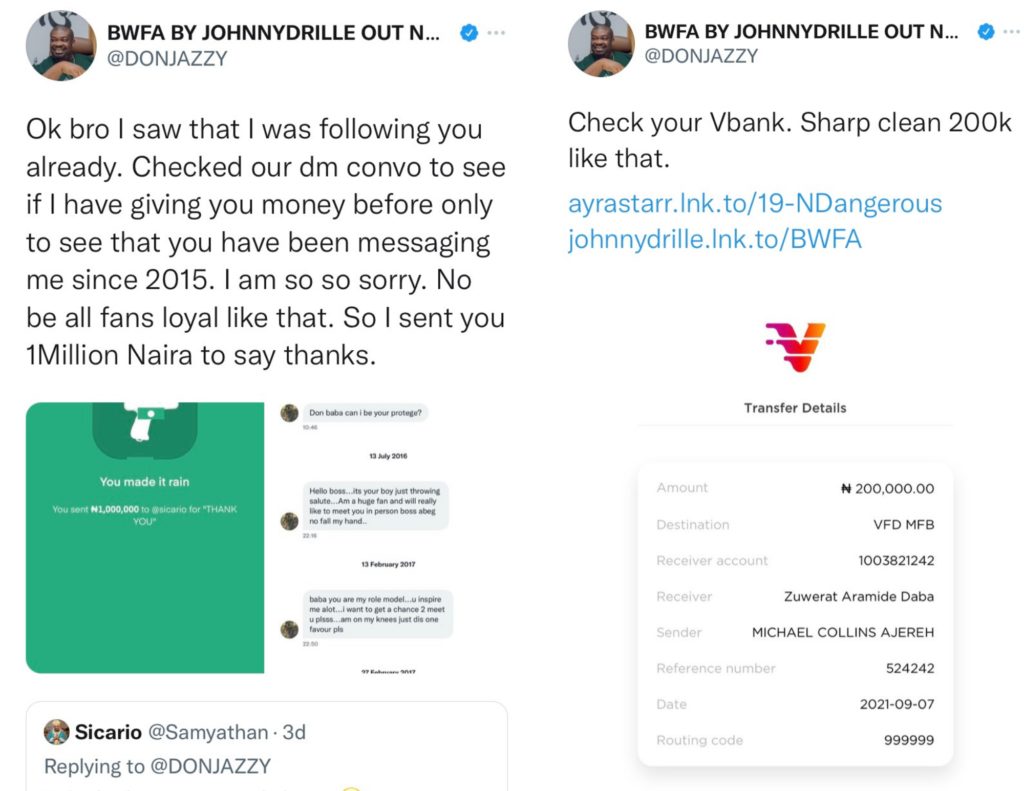

How To Win Don Jazzy’s Giveaways

You already know that Don Jazzy is the king of social media giveaways. If you don’t, then it’s either you’re inactive on social media or you don’t like good things.

Another thing you should know is that Zikoko is always here for you and because of that, we’ll show you how to win Don Jazzy’s money:

1. Add your Abeg username to your Twitter bio

If you still don’t have an Abeg account, it’s like you’re not serious. Do you expect Don Jazzy to come to your DM and ask for your account number? Please do the needful and if you’re feeling extra generous add our Abeg username (e.g. @zikokomag) to your other social media bios.

2. Comment your Vbank account number under all his tweets

You want Don Jazzy to send you money and you don’t have a Vbank account? Must be some kind of joke. What if he doesn’t feel like sending money on Abeg that day? Who will you tell your story?

3. Become Ayra Starr’s biggest fan

Don Jazzy is always hyping her so if you join him in the hyping, you’ll make this thing easier for yourself. Anywhere you hear “vibe killer“, just start dancing and tell someone to film you. Post the video on Twitter and tag everybody that needs to be tagged.

4. Become Johnny Drille’s biggest fan

Go and stream his album and take screenshots of each song. Then, every hour, post a screenshot with a caption that shows you’re enjoying his songs. Don’t forget to make sure Don Jazzy and his whole family sees your tweets.

5. Add “Don Jazzy” to your Twitter display name

Whether it’s “Don Jazzy’s Side Chick” or “I LOVE DON JAZZY” just find a way to insert his name there. It will definitely stand you out and increase your chances of being helped.

6. Sprinkle a little desperation

By desperation, we don’t mean you should go and disgrace yourself in Don Jazzy’s DM because if you mess up and he blocks you, the show is over for you. Be desperate on the TL. Mention Don Jazzy everywhere and he will notice you.

7. Laugh at all of Don Jazzy’s tweets

Even if you don’t find it funny go there and laugh. Flood those tweets with laughing emojis. You never know, one day Don Jazzy might be in a good mood and he’ll decide to help your life. Don’t go and mistakenly laugh at a sensitive tweet sha. We’ll just deny you.

8. Fight him

If everything else fails, you can pick a fight with Don Jazzy on the TL. The disadvantage of this is that you probably won’t win any money but what’s that thing they say about when the going gets tough?

Disclaimer: Whatever you see while following these steps, collect it with your chest and don’t involve us (except that part about adding our Abeg tag). Love and light!

-

“Aired Dfkm”: How To Collect Your Debt Legally In Nigeria

Nigeria is tough and the people who refuse to pay up their debt don’t make living here any easier. If you’ve been aired or blocked by someone you lent money to, here’s a guide on how you can legally get your money back.

The first thing you need to know is that if anyone in Nigeria owes you a debt, you have to act fast. If you try to get the money through a law court after six years, the court won’t answer you — and that’s according to Section 21(1) (a) of the Statute of Limitation Law.

Also, when trying to get back your debt, avoid sending any threatening or intimidating messages to your debtor. While we know that being owed can get you very angry, you also don’t want those threats of violence to backfire into a criminal case against you. So please, no violence.

And most importantly, do not involve the police in a debt recovery case in Nigeria as the police are meant to fight criminal issues, not issues between normal people. Involving a lawyer from the start is a better option.

Now, Time To Get Your Money Back

Do you have an agreement in writing with the person you lent money to about the steps you can take to recover your debt if they don’t pay up, like selling a property? If yes, then good for you. You can simply follow the steps in that agreement to recover your debt.

If you don’t, that is still alright. There’s no need to escalate things. You can try sending them a message reminding them of their debt. Sometimes that’s all you need to do.

But if all else fails, here’s how you can “gently” get your money back:

Send The Person A Letter of Reminder:

You can send your debtor a “letter of reminder”. This letter should be written by your lawyer, and it should remind the person owing you that you will take the case to court if they fail to pay up your money.

Try Mediation and Arbitration:

To get back your money, you can involve third parties — if the other party is willing to discuss it with you, of course. In mediation, a third party can help you and your debtor reach an amicable settlement.

In arbitration, you and the other person must follow the final agreement reached by the arbitrator, and the decision can be enforced in court because it is legal. But there must have been an agreement that you and your debtor will use arbitration to settle matters in the original loan agreement.

Write The Person A “Letter of Demand”:

If you are getting uneasy and your debtor is still unwilling to pay up, then you can employ the services of a lawyer to draw up a “letter of demand”, warning the person of the things that will happen if they do not pay back your debt within a period.

The letter of demand usually confirms the exact money you are owed, a clear time when the debt should be paid back and the legal consequences of failure to pay back the debt.

A letter of demand usually serves as a good notice to the debtor before you take matters to court.

Try Taking Legal Action –

Finally, in the case where the debtor has failed to pay up even if you have sent them letters and tried to be reasonable with them, then you should take the matter to court.

The court will enforce a decision for your debtor to pay you back your money, after hearing the facts of the case.

The appropriate court to take a case of debt recovery depends on the amount you are owed. But you can recover your debt in a Magistrate Court, State High Court or Federal High Court.

By involving a lawyer early on, following the relevant procedures and eventually taking the matter to court, you can recover all the debt that is owed to you without breaking a sweat, literally.

-

7 Nigerian Women Talk About Spending Money On Their Boyfriends

Some days ago, someone made a tweet asking women to ask their boyfriends for their account numbers to see his reaction.

This conversation led to a bigger question of whether or not women spend money on their boyfriends.

In this article, seven Nigerian women talk about spending money on their boyfriends.

Bukola, 25

The thing about me is that if I like someone, I will buy them gifts. It doesn’t have to be my partner. If I see something my best friend or sister might like, I would buy it for them. That’s how I buy my partner stuff too. I used to send him money in the beginning of our relationship but he’s more stable now. I prefer to spend money getting him gifts.

Two days ago, he sent me 50k because I told him I was broke, even though I told him not to worry because I would soon get paid. After he sent it, I ended up using the money to buy him a new pair of slippers and skincare products.

Esther, 20

Since I started dating, I have always spent money on my boyfriends to show them I care. I once had a rich boyfriend who made spending money on him hard. He had basically everything so picking out gifts for him was a chore. He was always so surprised that a woman was buying him gifts.

The guy I am dating now used to stop me from buying him gifts before but he is getting used to it now. He cries when I send him money out of the blues. I love how happy men feel when you send them money or buy them gifts. That’s why I do it.

Cyn, 25

It’s easy to spend on him because he’s always willing to spend on me. I like to send him lunch, buy him data or fuel his car. I also buy him clothes. Sometimes I cover the price of our spa dates or dinner dates.

He’s not used to getting gifts so he always says, “Babe, you don’t have to.” Even when it’s the smallest thing, I ignore him and do what I like.

Bola, 23

Spending money on my boyfriend comes naturally to me. Although he wouldn’t let me have his account number, I buy him gifts to make up for it. I send him food from Instagram vendors often and order shoes and clothes I think he might like. His joy when he sees it makes me happy.

Zara, 21

Giving and receiving gifts is one of my love languages so I tend to buy my boyfriend gifts often. He tells me to buy what I want and send him the bill so I repay the favor by buying him gifts often. It’s one of my favorite things to do.

F, 22

My boyfriend always spends money on me so it’s only right that I match his energy with small things like booking us a staycation at Bogobiri for 135k or buying him a care box of £200 when I travelled or paying for dinner. He’s always so happy even when it’s not expensive stuff. He tells people I’m his sugar mummy and it makes me laugh so much because he does so much more than I do.

Kachi, 26I have had only one boyfriend and while we dated I liked to buy him food — Food is my love language. Whenever I go out, I would buy him food or when I am home, I would order him something I am also eating.

The most I ever spent on him was for his birthday. I filled a box with practical things he could use like clippers, shoes, etc. I also got him cakes. He’s not a foodie like me but he really liked his birthday gift. I felt good when he said that our relationship had grown past his expectations.

Subscribe to our newsletter here.

-

We Bet You Didn’t Know The NURTW Was This Powerful

Citizen is a column that explains how the government’s policies fucks citizens and how we can unfuck ourselves.

So you’ve probably seen members of the Nigerian Union of Road Transport Workers (NURTW) in action. Usually sporting their white and green uniforms, they are the independent union behind the drivers of commercial buses, tricycles and motorcycles — danfos, kekes, and okadas as they are fondly known. But what you might not know is how much the NURTW makes daily, monthly, and yearly.

According to the International Center for Investigative Report, the Lagos State chapter of the NURTW made roughly ₦121.392 billion in 2020 alone. Yeah, e shock you.

In statements from 50 danfo drivers in 21 out of the 37 Local Council Development Areas (LCDAs) in Lagos State, NURTW’s ticket collectors, not so fondly referred to as Agberos, collect at least ₦3,000 from about 75,000 of these drivers in Lagos state alone, every day. This means that the union makes up to ₦225 million per day, ₦6.75 billion per month and roughly ₦81 billion from danfos per year.

You’d think they’d go easier on the kekes but nope. According to the Lagos State Maritime and Transport Agency (LAMATA), there are 50,000 kekes in Lagos State. The keke riders say that the union charges them at least ₦1,800 per day.

Some quick maths shows us that the union makes up to ₦90 million per day, ₦2.7 billion per month and roughly ₦32.4 billion from kekes per year.

Then there’s Okadas. There are about 37,000 okada riders in Lagos. They each pay an average of ₦600 every day to the NURTW, enriching the union with about ₦22.2 million per day, ₦666 million per month and ₦7.992 billion per year.

So you see how we finally arrive at ₦121.392 billion in a year of Lagos State levies alone. There are some other undocumented levies from taxis, tankers and trailers, but the main gist is these people are collecting serious money

But Is The NURTW Even Relevant?

A union is supposed to protect the interests of its members, but it seems that may not be the case with the NURTW. When asked by Al Jazeera if a union executive protected him from police harassment, Yusuf, a keke driver in Lagos replied, “Which union? The executive was only there to talk to the policemen to negotiate the bribe. His presence only helped to reduce it.”

In another interview with Al Jazeera, Afeez, a danfo driver in Lagos recalled that he once fought with a ticketing rep from the union who stabbed his conductor in the eye with a key because the conductor had refused to pay the “afternoon due”.

Professor Gbadebo Odewumi, a professor of transport at the Lagos State University concludes that “the union leaders just reap from the chaos of the system and enrich themselves”.

What Can Be Done About The NURTW?

The union was established in 1978 and is supposed to fight for the welfare of Nigerian drivers and road transport workers who constantly suffer abuse from security personnel like the police, traffic management and vehicle inspection officers.

Ideally, they should work with the Nigerian Labour Congress (NLC) to fight economic issues that seriously affect drivers like sudden fuel price hikes or bad roads. The dues the union collects should also be used to support its members.

Sadly, the NURTW has been riddled with corruption, bribery, nepotism and violence ever since.

State governments can suspend the activities of the NURTW if they violate the rights of citizens. But there are reports that politicians use NURTW ticket reps as thugs to fight opponents and manipulate elections, and this is the reason why the NURTW remains ‘untouchable’ in many states. Some states like Oyo have already banned the union because of the frequent violence and factional clashes by its members.

Clearly, there’s work to be done about some of the NURTW’s activities. Unions like these must do the work they were originally created for. But until the issues are fixed, we assume the ‘fees’ will continue being collected and bus fares will continue to rise. Sorry guys.

Image source: Unsplash

We hope you’ve learned a thing or two about how to unfuck yourself when the Nigerian government moves mad. Check back every weekday for more Zikoko Citizen explainers.

-

6 Ways To Find Money Nobody Is Using Anymore

If making money on your own has proved futile, then maybe it’s time to find money other people are not using urgently. Please, pay attention, these are multi-billion dollars tips.

1. Go to Agent Fash

Seek out Agent Fashola for special tutorials in the art of finding ‘The Unseen.’

2. Pray and fast

If flesh and blood does not reveal it to you, then try the supernatural. You are but a mere mortal after all.

3. Ask around

What did they say about asking and you shall receive again? Right.

4. Shine your eyes

Some people look like they’re using their money, but they might just be waiting for who they’ll give it all to because they’re tired of it. So, shine your eyes.

5. Trek more often

If you always hail cabs or other means of transportation, stop it from today. Your legs will do. You’re more likely to come across a Ghana-Must-Go bag containing 1 Million nobody is using anymore. Just don’t complain if you turn into a tuber of yam.

6. Attach a magnet to your clothes

The more you chase after something, the more it eludes you. Don’t stress. Just let the money be pulled towards you. Simple.

-

QUIZ: Can We Guess The First Thing You’d Do If You Won The Lottery?

We’re sure you’ve fantasized about winning the lottery at least once. Take this quiz and we’ll guess the first thing you’d do if you won the lottery.

-

Five Ways to Manage the Sapa Fever

The word ‘Sapa’ is one of the most used lingoes in the Nigerian social media space. It may have been the leading buzzword on microblogging platform Twitter before the Naija government trailer rammed the platform into oblivion such that only those with VPNs can engage the blue bird.’Sapa’ is street lingo for being broke. For instance, when you cannot afford your bills or immediate needs, it simply means Sapa has successfully reached your end. Condolences!But the relief is that this Sapa fever is not for everyone, especially those who are smart and can plan their finances. Remember the popular saying about what wise people do together? Yes, that’s what’s up. Clicking this link alone means you are keen to be that wise owl, poised to be the master of managing the Sapa fever. So, let’s get started. Shall we?

1. Set realistic goals to counterattack Sapa

Sapa gets serious ‘agidi’, and you must treat it with every seriousness. It is not that Sapa will give you 100% attack, and you will switch on and off like N.E.P.A. light or keep offside like it’s a football match. To effectively deal with this Sapa matter, you have to set measurable, realistic, time-bound, and smart goals. That is when you will be able to counterattack Sapa like the confident financial pro. Nor dey do like some football coach who only reaches the final and doesn’t lift the trophy. In other words, to outsmart Sapa fever, you must be a proper and strategic planner of your future goals and how to use your money wisely.

2. Splurge on a budget

“I ball differently as the freshest in this town. Sapa cannot reach my side.” Abeggi, it’s not every time – ‘I jus wanna relass and be taken kiaruf’. No, it doesn’t always work that way. There is a critical need to manage that impulsive spending at every opportunity as it is an indication of an exclusive invite for Sapa to visit you. When you control your excessive spending habit and have eliminated impulsive purchases, you can stick to a sustainable budget to cover only the necessary expenses and save for the proverbial rainy days. Only then can you properly relass and be taken kiaruf, why Sapa watches, green with envy.

3. Live within your means

Gbogbo wa la je breakfast, yen yen yen yen. Abeg, be calming down because breakfast differs per person, by your pocket and by your spending power. Breakfast and how it is served in Ikorodu is different from the one in Osapa London. What is almost the same across different places is how Sapa will hit you when you do the high-end breakfast rituals beyond your means. You will be shocked!Beating Sapa requires all hands to be on deck and sticking to a mindset that helps you prioritise savings and living within your means. You cannot be earning like Kabiru in Osogbo and spending like Davido the Baddest in Banana Island. Dis nur make sense at all. The secret to defeating Sapa is understanding your earnings and living within a specified limit, then saving on a deliberate plan.

4. Save for rainy days

Yeah, I know it sounds cliché already, but how do you wanna take overrr if you do not save now on a solid plan? The fact is, savings is the secret weapon that helps you scale when Sapa and other unexpected events hit you. That is when you’d fully understand the need and importance to save for such raining day(s). But the proper secret weapon is to have a tested and trusted brand with over 170 years of experience, solid presence in 30 countries and a superior product designed to wipe out Sapa from the face of the earth. Guess the brand now? Don’t rush; keep following me.

5. Choose O.M.S.T.S.P formula

Yes, just go with the above formula. Don’t start scratching your head before those around you become uneasy. It is the Old Mutual Short Term Savings Plan. With the Old Mutual Short-Term Savings Plan, you can beat Sapa by strategically saving towards a two-year project for 2-years to enable you to achieve a short-term financial objective. Old Mutual also threw in a sweetener that considers today’s world of unpredictability so that in case of incasity, your beneficiary (wifey, Junior and/or Princess) gets a 1 million Naira cash compensation. That na the formula for generational wealth transfer. The plan also has a dynamic arrangement that allows the policyholder to withdraw up to 50% of saved funds during the savings tenure to meet the emergency financial demand when ground no level. You see why Sapa has got nothing on you if you choose O.M.S.T.S.P.

That na the formula for generational wealth transfer. The plan also has a dynamic arrangement that allows the policyholder to withdraw up to 50% of saved funds during the savings tenure to meet the emergency financial demand when ground no level. You see why Sapa has got nothing on you if you choose O.M.S.T.S.P.

Go ahead and activate your way to financial freedom; click this link https://www.oldmutual.com.ng/home/short-term-savings and join the league of Sapa Immune Commandos.

-

12 Signs A Woman Is Dating You Just For Your Money

Dear rich kings, we’re thinking of you in a period where money is the only thing people want from relationships. If a woman exhibits at least 4 of the signs in this article, she’s only dating you for your money.

1. She likes food

If a woman has “foodie” in her bio, and constantly posts pictures of things like pasta, she’s just looking for someone that will fund her lifestyle. Run o.

2. She’s on Instagram

Any woman that is on Instagram is only there to find expensive things for men to buy for them. Avoid these types of women. On the first date, check her phone. If you see Instagram there, run.

3. She has a birthday wishlist

Are you Father Christmas? Why is she sending you her wishlist? Women are good planners. She only got with you so that you will be able to fund her birthday wishlist. Run.

4. You’re a tech bro

You don’t have to be working at PiggyVest to be a tech bro o. If you can use a phone or a laptop, you are a tech bro. Once a woman knows that you can operate a laptop, that’s the end. She will be looking for your money.

5. She says she loves you

If your babe tells you she loves you, she’s just trying to scam you into spending money on her. Break up with her.

6. She doesn’t say she loves you

If she doesn’t say she loves you, it’s obvious that she’s not in this relationship for emotional purposes, but for financial purposes. Break up with her.

7. She buys you gifts

This one is for smart gold diggers. If a woman buys a car for you, better don’t collect it. It means she wants you to buy 3 cars and 1 house for her in return. Think smart, king.

8. She has friends

Women with friends are the most dangerous. One moment you’re chilling, the next she wants an iPhone because her friends are using iPhones too. Be careful.

9. She doesn’t buy you gifts

If she doesn’t buy you gifts, she’s obviously in the relationship for one-sided financial purposes only. Run.

10. She cannot follow you to do bend down select

What is love? Is it not for better or worse?

11. She doesn’t have her own apartment

This means she’s only with you because you have an apartment. Don’t allow it happen.

12. Her love language is receiving gifts

Out of all the love languages, the only one she saw to pick was receiving gifts? That’s how you know a scammer from far away.

QUIZ: How Rich Do You Look?

Take this quiz, and we’ll tell you how rich you really look.

-

5 Wise Money Quotes About Money That Make Better Sense Now That You’re An Adult

wise quotes about money

Do you remember when you were a child and hadn’t developed a proper understanding of the concept of money so you thought that every adult always had money and that your parents were just being mean whenever they didn’t give you money or buy you something you wanted? Those were good times. Here are 5 wise quotes about money that you most likely heard back then and didn’t understand but do now that you’re older.

1) “If it sounds too good to be true, it probably is.”

Whether you’re considering a new investment scheme that promises a 50% ROI monthly or making an important purchase, stop and ask yourself if it seems too good to be true. If it seems so, then it most likely is. For example, buying the latest iPhone for 40% of its usual price from a sweaty guy under the bridge at Ikeja is how you end up with an Apple product that somehow screams “Hello Moto!” and shows the Nokia logo when you turn it on.

2) “More money, more problems”

The Notorious B.I.G wasn’t kidding when he sang this. It’s an almost magical-like problem that people who earn more over time experience. The more money you make, the more financial responsibilities you have as well. That extra money can cause as many problems as it solves in your life. Existence really is a pot of beans.

3) “You get what you pay for.”

It might seem like a good idea at the moment to buy a cheaper version of a thing so it’s easier on your wallet but that’ll cost you more in the long run. For example, if you buy low-quality shoes that cost N1000 and fall apart in 2 months but you keep replacing them with that same brand, you’ll end up spending more than you would’ve if you had just bought high-quality shoes that cost N10,000 in the first place.

4) “You have to spend money to make money.”

Everyone who has started their own business knows this one. At random points in your entrepreneurial journey, you have to invest money in your business. The key is to not sink all your money at once but to make smart and wise investments over time.

5) “A penny saved is a penny earned.”

This one is all about the importance of saving and investing. Enjoying your money is important but sacrificing a little bit now so you can have more in the future is also important. The key is to find a balance between being selfish to your present self and being selfish to your future self.

-

8 Ways To Manifest Wealth

Capitalism is the ghetto and so is being broke. Working for money is the biggest scam of all time and we are sure manifestation is better. Here’s a list of easy ways to manifest wealth:

1. Sleep with candles around you

You need the candles for the manifestation to work. don’t let the thought of fire hazards bother you, nothing can happen to you. The only thing that will happen is wealth, plenty of wealth.

2. Set your 11:11 alarm

You don’t want to ever miss 11:11, whether am or pm. The angels of manifestation walk the streets by that time. Sorry to you if you use 24hr time clock, you have only one chance.

3. Wake up in the morning and shout “i am rich”

Make sure you shout it three times in case the universe didn’t hear the first time. Do this every day till the day you are rich enough to stop.

4. Use this ✨ emoji in all your texts

The emoji contains magical manifestation powers, you won’t need to say anything once your words are written in the stars. Literally.

5. Include wealth in your name

You can include it as a prefix or suffix, whichever one works for you. Translating the word wealth to your preferred language is a better alternative, it adds to the razzle-dazzle.

6. Walk around with arrogance.

Have you met a rich man that is not arrogant?. If anyone complains, tell them it’s because they don’t know better. Let them know you are no longer on their level. This is the best way to manifest wealth.

7. Let your neighbours know that you are now rich

We all know Nigerians love and respect rich people. The respect they’ll give you would be plenty enough to translate to real wealth.

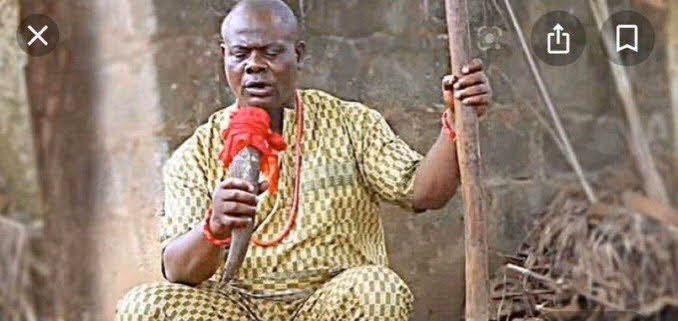

8. Visit a Babalawo

Please inform the Babalawo that you have started manifesting wealth before coming to his shop. Let him know that you’ve played your part. all that’ll be left for him to do is put the finishing touches.

-

5 Nigerians Talk About The Different Payment Platforms They Use

There are lots of payment platforms out there, all of which primarily help us manage our finances. Now, whether the services being offered are great or unsatisfactory is left for users to say.

Hence, we spoke with 5 Nigerians and here are their takes:

Habeeb, 26

I mostly use my bank apps. One of them keeps trying to show me ads every 5 seconds so that’s annoying. I like the “download receipt” feature. Also, the feature that let’s you download your transaction history. None of them have in-app customer care though, so that’s something I wish they did.

Esther, 23

I use up to three payment platforms just in case any of them tries to move mad. Call it trust issues, but it’s my money we’re talking about here. Lol. I really like that I can track my transactions to find out where the bulk of my money goes to on one of the platforms. I don’t like that my bank just started charging approximately 7 Naira for USSD transactions. I mean, I already use data to transact online, now I have to pay for offline activities too? Omo.

Dan, 25

Payment on the main platform I use is super fast and easy. I get receipts I can always forward to clients or recipients immediately. What’s not great, is the issue of generating tokens instead of using normal passwords. It’d be better if I could just input pins and make payments seamlessly. Bank transfers on the second platform are not smooth at all. I hate that I always have to input my ATM card details to carry out simple transactions. It’s super tiring. One time I was not with my card, and needed to make a transfer and I couldn’t because of this. I was so frustrated.

Bolu, 23

I hate the payment platform I’m currently using abeg. Their customer service could do with some improvement. I’m only using it because I don’t have my debit card yet.

Ola, 24

I use one payment platform for now. Their service is decent [by Nigerian standards] for the most part. The mobile app can be rather unreliable on occasion. Obviously, that could pose as an incredible challenge in emergencies. They also have this nasty habit of delivering credit/debit notifications well late & this is by sms & email. Sometimes, transactions would have happened days earlier than the notification. Even in-app, the refresh rate is slow and that can be pretty annoying.

Whichever platform you use, you’d agree that seamlessness, speed and low-cost are must-have features. The good news is: Stax offers all these and more.

Why should you use Stax?

Stax is a lightweight Android app (less than 10mbs) that dials USSD codes for you . Here are features you’ll love:

- You don’t have to worry about memorising countless USSD codes.

- You don’t need to download and switch between multiple bank apps to access your money.

- You can link ALL your bank and mobile money accounts to a simple interface that lets you send/request for money, buy airtime, and access your transactions history.

The best part? Stax works offline. So, no data, no problem. Download the app on Google Play store and start transacting with ease. No sign-up required! Just link your account and get started immediately. It’s FREE!

-

5 Nigerian Women Talk About Making Money Online

With inflation on the rise, more people are looking for more ways to double their income. In this article, 5 Nigerian women talk about making money online. If you are looking for how to make money online in Nigeria, this article is for you.

Temmy, 20

I create content for websites, ghostwrite ebooks and manage social media accounts. Sometimes, I write academic essays, CV and cover letters for few clients. I have been writing since I was in secondary school. I used to write mostly poetry but I got into professional writing last year. I made my first 50k from self-publishing a book.

This year, I made my first 100k from ghostwriting a book. So far, I have made about 400k. Most of my jobs come from referrals. I believe that creating an Upwork account will bring me more money but I am not sure how to go about it.

However, the money comes and goes because Nigeria’s economy makes it hard to save. I don’t get financial support from my family so a lot of my money goes into feeding myself.

May, 29

I started writing articles for clients on Fiverr last year. Currently, I make about $1000 every month. In some months, I make up to $1500. My articles focus on weddings and travel. I get a lot of orders every day. On a bad day, I earn $20 per order. My goal is to earn more money from my writing.

Tobi, 27

Last year, mid pandemic, I learnt User Interface and experience design. It was an engrossing experience and when I was done, I got my first gig on Twitter. One of my friends mentioned me under someone’s call for UI/UX designers and I got the job. It was an exciting project and I earned about 200k from it.

I also write culture feature stories and I have gotten most of my gigs from Twitter. I tried all those freelance sites but they never worked for me. My goal now is to make more money building websites for people.

Limah, 23

In January, I took up social media management. I am currently managing a client’s account and they pay me 25k every month. I am not satisfied with the pay but I do it because I am trying to gather experience to build my CV. It also feels good to earn money during these times.

Fola, 20

Every month, I earn about 30k – 50k writing SEO friendly articles for brands looking to grow their audience. I have been doing this since last year and I am proud of how much I have grown. I plan to expand my knowledge to other facets of digital marketing so I can get better paying gigs.

Subscribe to our newsletter here.

how to make money online in Nigeria

-

8 Annoying Things About Salary Week

Salary week is probably the most depressing week as a salary earner. The anticipation, the money that has already been spent in your head, and the bills that become more obvious don’t do much to help either. Flesh and blood did not reveal the information we are about to share below.

1. Ads become more frequent

It’s almost like the internet knows that money is about to enter your bank account. You start getting more ads, and for once you dare to consider getting those things you’ve been putting off, all the best sha.

2. Things start finishing

For some reason, things start finishing a lot during salary week. All of a sudden; your Wi-Fi finishes, foodstuff follows closely behind, DSTV, and finally, if you are unfortunate, your gas will follow suit.

3. Things start spoiling

It’s always during salary week that your car will know that it’s tired of Nigerian roads. That laptop that you have been managing will suddenly give up the ghost too, salary week has bad vibes for real.

Kuku kill me 4. The money hasn’t arrived but it has finished

You don’t even need to earn a salary for this to happen to you. Money just doesn’t like to stay in one place, If it’s not being spent, it’s not happy.

Especially banks for collecting that 50 naira. 5. Family members rise from their hiding place

All of a sudden your mum needs a new washing machine, or your uncle wants to start a new business and your younger sibling will call to cry about how broke they are. Wahala for who get family sha.

You to your family members when they call. 6. The sudden quietness

You’d never be able to put your finger on it but for that entire week before your salary comes in, there’s a quietness around, and it won’t be the peaceful type. Just deep sighing and casual anxiety. Again with the bad vibes.

7. The heart attack when you are expecting the alert

Especially if it’s a little later than normal. It’s so unnecessary because why is your brain telling you that you won’t get something you worked hard for? Everybody should get out abeg.

8. The depression after you spend the money

Post salary depression is a thing, so if you know anyone earning a salary, do the right thing and dash them small money this month.

-

QUIZ: How Long Will Your Salary Last?

We know your salary just entered or is entering soon. Take this quiz to find out how long it will last.

-

5 Types Of Credit Alerts That Just Hit Different

They say, “money is not everything” but have you seen credit alerts? Particularly these 5 Types listed below?

1. Alert from someone who said “send your account number” ages ago

This is how wide you’ll smile. May such people not sleep until they’ve credited you oh.

2. Salary alerts

Especially when your salary has finished since the first week of the month. You can even dab after seeing the alert and forget you worked hard for the money.

3. Alert for money you did not work for

Nothing is sweeter than spending free money. You deserve to be taken care of jare.

4. Alerts to yourself

Only people with 2-3 bank accounts will understand. Console yourself with the fact that if you don’t send yourself money, who will?

5. Alerts from giveaways

Imagine being chosen to win money out of all the people who must have contested in a giveaway… Your God is not asleep.

You may recall that Fidelity Bank launched its GAIM season 4 campaign in 2019, but was forced to suspend it due to the Coronavirus (Covid-19) Pandemic and the resulting global lockdown. Now that the world has returned to normalcy, Fidelity Bank is winding down the promotion, giving customers another chance to win Big. We mean BIG!

-

QUIZ: Which Currency Should You Be Sprayed With?

You did not come to this life to spend Naira and die. Take this quiz to find out which currency you deserve to be sprayed with.

You never know, your destiny helper might be watching.

Did you know there’s an FCMB Remittance offer that allows you get N5 for every $1 you receive and a free gift? Find more details here.

-

5 Nigerians Talk To Us About Their Side Hustles

Even if you’re not engaged in one side hustle or the other, you definitely have friends and family members for whom this is a reality.

5 Nigerians shared their side hustle stories with us. Read on. You might get an idea for yours.

Amy, 24

I started my side hustle because of hairs. I like all these material things a lot; the gadgets, clothes, slay mama looks, but unfortunately, I can’t afford it. I came across a page on Instagram selling mad ass hairs but extremely pricey, say, 200k plus. So, I resorted to stalking them. Finally, a friend of mine told me that she could get the hair for me at an affordable rate – 50k thereabout. Awoof dey run belle sha, because when I eventually got the hair, it was pure unadulterated synthetic. Not even the good kind of synthetic hair. I cried, then decided to start a business to afford the lifestyle I wanted. Currently, I sell different things – bags, waist trainers, and others. I initially started with hair, but that didn’t last. I found it too difficult and stressful although it is very lucrative. If you know how much these people are making! My advice for anyone who wants to start a side hustle is: don’t start anything without adequate capital, and be very loving with your clients.

Fave, 20

I’m currently serving and working as a face-to-face fundraiser. I started this side hustle thing as a source of extra income in the university, 200 level to be precise. I went to a private school and they didn’t let us cook, so we had to buy food. My dad gave me pocket money, but he didn’t really understand that I needed to buy clothes, handouts, shoes, extra food (because I can’t comman kill myself) and chill with friends. So I decided to work for my own money. I was literally the most reliable and affordable seller of female accessories in my whole school and I didn’t save a dime! That was my biggest mistake and it affected me after graduation. But we learn and relearn so, I’m becoming better in that aspect.I got into fundraising about two months ago while searching for a PPA in Abuja. Nobody tells you that the starting point of all these things is not easy at alll. My friend who introduced me to the NGO made the role seem so interesting, but then I started the job and I’m like, ‘this adulting is not for me now😭.’ Asides working as a fundraiser, I still have my business selling female accessories. I love my job because it gives me a chance to serve humanity and it is satisfying! I would recommend that every lady read Smart Money Woman and Smart Money Tribe. Then most importantly, SAVE. If you come across very reasonable investments too, invest, but make sure you get proper advice before going into it sha.

KC, 23

I started selling shoes, clothes, bags and every other fashion accessory in January. Before then, I never thought I’d venture into anything business until very much later in my life. My life plans revolved around academics, but corona, ASUU strike, and the poor academic system in the country made me rethink. I felt I was wasting away and not being productive. Every skill I wanted to learn cost a lot, so I just started a side hustle. Currently, I no longer see education as ‘the key’ and especially not in this country, Nigeria. I’m on the lookout for other prospects that will help my survival in the country. My business is online (mostly drop shipping). I lose customers sometimes because they have to pay before I supply as I don’t have the goods ready and they can’t come around to pick-up. I’m planning on running ads on multiple social media platforms because it helps with visibility and with visibility comes sales and profits. It’s not a smooth sailing side business, but it pays off eventually with consistency and advertising. My advice to anyone who wants to start a side hustle is to always have a plan B. Our country is wack and unfortunately, it doesn’t seem like there is any hope for now and in the nearest future. Concerning side hustles, consistency is key. It might look like things aren’t going well in the beginning. Don’t focus on that, in the end, your efforts will pay off if you work smart. As for me, I won’t stop my side hustle even if more lucrative opportunities come along. I am very ambitious and hopefully, this mini online store I run would turn into something bigger in the future.

Toju, 26

I work two jobs – one as a full time associate with a Big 4 in Lagos, and the second as a freelance “any work” as long as it has to do with computers. Basically, anything from building websites to building financial models and business plans, CVs, LinkedIn profiles, marketing decks, abroad school applications, and every now and then I write essays and have written a couple dissertations for abroad MBA students. I don’t code or anything. I can just figure out how to use a software, be it R studio for data analysis, Excel for modeling or Joomla and Wix for building sites. So far, I have made say 2 million in 2 years which just goes to show you that a lot of people are not willing to pay, or are unable to pay and it’s a shame, because I’m pretty good at all the things I do. That’s why I barely advertise and I keep getting referrals.I started this side hustle because my salary is not enough. Problem is, I do the side hustle to supplement and it’s still not enough. I hate that I have to do so much and still be broke. Oluwa I’m working hard. If I was to quit this hustle, I’ll probably create a model where I help with business plans and the financials for a smaller fee. Then I’ll continue to provide consulting services for a small percentage of profits. Say, around 5 – 10%. I want to get to a point where I can sit back and be collecting alat. What I would say to someone who wants to start a side hustle is: you need to learn a lot and learn very quickly but never at the expense of quality. It’s also good to have friends that are experienced in what you’re going into so they can let you know if what you’re doing is okoto meow.

Jemilade, 25

I’m not currently employed under any organisation. I used to work for a fashion house as their pattern drafter but I got sacked 8 months into. I’ve always loved to work with my hands and by myself, so I took it as the universe’s way of affirming that narrative. My only sources of income are the three businesses I run. Luckily for me, they’re sort of intertwined because they all have to do with creativity. The only downside is their time-consuming nature. To deal with that, I’ve got in-house tailors handling the production of clothes when we get orders down. I’ve also got some trusty hairdressers on speed dial that can handle hair jobs as they come. I see myself continuing these in the long run, that’s why I’m taking the time to build up a solid foundation. I don’t want them being “side hustles” alone. I see them as strong bodies capable of booming in the nearest future, such that they will become the main gigs.

You can successfully live a life of dual hustles e.g Photographer and Forex trader. Find more information here.

-

N55m Up For Grabs In Union Bank’s Save & Win Palli Promo

Union Bank has announced a nationwide campaign to give away 55 Million Naira to new and existing customers in its ‘Save & Win Palli’ promo. This is another way the Bank is offering Nigerians some relief (a.k.a. ‘palliative’) from the economic hardship brought on by the COVID-19 pandemic and other issues.

During the promo period which runs from June to December 2021, new and existing customers who save a minimum amount of N10,000 monthly, will qualify to win whopping cash rewards and prizes.

A total of 350 customers will win N100,000 each in the monthly draws, while six customers will be awarded N1,000,000 each during the quarterly draws. The grand finale will take place in December, with one customer winning the grand prize of N5,000,000. An additional 300 customers will win amazing gifts, bringing the total number of winners in the promo to 657. The Bank’s Head of Retail Banking and Digital, Lola Cardoso, while kicking off the campaign, reiterated the Bank’s consistent effort to give back to customers. She said:

“Union Bank is excited to give back to her customers through this Save & Win Palli Promo which is one of the many ways we are supporting Nigerians during these times. This campaign presents a wonderful opportunity to reward our customers in ways that matter and foster the culture of saving. Union Bank remains committed to enabling success for Nigerians.”

Union Bank customers can top up their savings with multiples of N10,000 to increase their chances of winning in the draws. The promo winners will emerge through a series of transparent, electronically- generated draws supervised by relevant regulatory institutions. Prospective customers can download the UnionMobile app on their mobile phones to open accounts, or walk into any Union Bank branch. To reactivate existing accounts, returning customers can call the 24-hour Contact Centre on 07007007000 or also visit any of Union Bank’s branches across the country.

For more updates on the Save and Win Palli promo, follow Union Bank on Facebook, and Instagram .

-

8 Reasons Why You Should Give Zikoko All Your Money

Whether you’re new to the ZiGeng, or you’ve been rocking with Zikoko since forever, there are some pretty valid reasons why giving us all your money (it’s not as if we like money oh, but who are we to say no if you actually decide to go all in?) is worth considering.

1. We make you laugh

As in, lose-your-home-training kind of laughter. Those ones where you slap your thigh and throw your head back to let it all out. Yeah, we have a PhD in that.

2. Hangouts

You stand a chance of getting invited to an exclusive, virtual monthly hangout with your favourite Zikoko writers. Prepare your Sunday cloth.

3. You are wise

You know money has wings and will still fly away even if you don’t give us. So, you will. Besides, imagining a world without Zikoko isn’t your idea of fun. Wisdom will not kill you, Sensei!

4. We work hard to tell stories that matter

Whoever said, “The Devil works hard, but Zikoko works harder” wasn’t capping. We have A1 in working tirelessly to bring you the full scoop on happenings like these.

5. You are served relatable content

You find the most relatable content on here from January to December e.g. Ways Unilag Will Seriously Frustrate You, Things That Happen When You Get Stranded On Third Mainland Bridge, and How To Pick Money From The Floor Without Turning To Yam. How cool is that?

6. You love us

Yep, you do. We can see it your eyes, darling. We love you too. Kizzez.

7. You love our projects

You love when we surprise you with our amazing ideas and projects like Jollof Road, Corona Facts Africa, EndSARS coverage, Zikoko Podcast and Ask Aunty Z and many more to life. We can’t do them without your love and support.

8. You want to toast us

If you want to toast and spoil us silly, just send one-off or monthly funds, dear. They is our love language.

Hey, are you ready to help us keep churning out the content you love on Zikoko? Awesome! Click here to make a one-time or recurring donation now.

Also, feel free to use the hashtag Proudly a #ZikokoContributor and tag us @Zikokomag on socials. Thank you!

-

5 Essential Skills Every Beginner Trader Should Learn

In 2020, the pandemic changed the world. A lot of profitable offline businesses had to close and lay off their employees. With thousands of unemployed in Nigeria and all over the world and the poor economic state of even the leading countries, thousands of people have decided to look for alternative sources of income. And Forex trading has become a response to many. If you are among those who would like to try your skills in this market, learn what qualities a successful trader should possess.

Traits of a Successful Trader

When you look at the traits of a successful trader, it becomes clear that they also have bad days. The main characteristic of a professional is the achievement of a stable result. Consider trading as a professional activity and develop useful qualities in yourself. If you would like the Forex market to become your main source of income, be ready to keep learning all the time. So, find educational resources like the ones provided by Forextime and stay tuned with the publications.

What are the qualities you need to possess?

Discipline

Discipline is a powerful weapon of a successful trader. Indiscriminate actions cause chaos and lead to a quick failure.

Patience

Patience is an important character trait that needs to be developed. As noted by the best Forex traders, it is worth waiting for one profitable deal rather than opening many positions with no effect.

Control

Which is necessary to manage risks, capital, emotions, investments, and the trading process. Such a trader always knows what to do, even if the action leads to a lower profit.

Passion

Those who are not interested in trading will not learn to trade profitably. Making a profit will be casual and short-term.

Self-control

Self-control is achieved when there is a clear plan of action and when a trader is in no hurry to take risks, thinks over every step, even if they see an overbought or oversold market.

How to become a successful trader?

In addition to a deep understanding of market trends and adaptation to trading rhythms, successful traders are distinguished by endurance, consistency, and flexibility of thinking. There are strategies with different levels of risk, but a plan is part of each one. To stick to it, here are the main recommendations for FXTM Nigeria traders who want to be successful:

- Do not give in to excitement;

- Determine the income limit for the day;

- Set the maximum allowable loss level for the day;

- Determine the optimal number of transactions for one trading session;

- Take breaks in case of failure.

The stock market is volatile, so you need to have a flexible mindset. But without setting limits on the number of trades, the size of profits and losses, it is hard to maintain a strong position. A scalper can make more deals during the day than a day trader. If you find it difficult to determine the optimal number of transactions — use the limits of income and expenses. They can be set both for one day and a week or a month. But setting limits on days will be analogous to signals for an action (entering a trade or completing a trading process).

Remember to take a break after a failure. For scalpers and day traders, a few days a week is enough. It is necessary because, after the fiasco, you will be tempted to recoup. And when emotion prevails over reason, the likelihood of losing money increases. Plus, traders can make mistakes due to fatigue. Start trading in a calm, relaxed state after studying charts and news.

How to develop the necessary qualities and gain knowledge?

You can develop the traits of a successful trader by communicating with experienced market participants. You will receive valuable advice from them and be able to adopt profitable trading methods. Joint trading on a demo account contributes to:

- Strengthening self-control;

- Increased confidence;

- A better understanding of market mechanisms;

- Getting the necessary practice.

After completing training practice, you will be able to move on to real trading. As you gain experience, income will increase, and the number of losing trades will decrease. We also strongly recommend keeping a trader’s journal and statistics. Then you will be able to assess the dynamics, react quickly, correct the strategy and promptly seek advice.If necessary, an individual risk manager can be assigned to you, accompanying you at the stage of learning and gaining experience. Select a broker that offers this kind of service to its clients.

Final Words

Trading is a business. And any business does not standstill. You cannot find a formula for success and use it all your life. You will need to track trends and constantly look for new successful solutions. Your commitment and readiness for hard work will lead you to high profits!

-

5 Reasons Why You Should Consider A Loan from Page Financials

Personal loans are good for a variety of purposes—from consolidating debt to solving a myriad of pressing issues. They are personal, which means your reasons are yours.

Do you remember the first time you needed more money than you had? Borrowing money then was not as easy as it is now. You probably would have run to family members or friends which usually meant nothing was certain, or apply for a bank loan, which was a very tedious process, hard to get – especially if you do not have an enviable collateral in choice locations, or know someone in top management position in the banks to stand as a guarantor.

The situation is completely different now. There are financial services providers like Page Financials who have changed the game entirely, they have not only disrupted the borrowing and lending ecosystem but have also shaped how even the banks respond to providing these services today.

With the intervention of Page Financials, a leading financial services provider, anybody with a verifiable and consistent income, that meets a few other criteria – like having a good credit history – can now easily get a personal loan from the comfort of their home.

If you are still thinking about whether or not to consider a personal loan, we have highlighted 5 reasons why customers usually resort to getting a personal loan.

1. Cash emergencies

If you need money right away to cover bills, an emergency cost or something else that needs immediate attention, you can take out a personal loan. Page Financials provide online applications that allow you to complete application conveniently in minutes. You could receive funding immediately as well, depending on your past credit history and the information you have provided.

You can use a personal loan to cover emergencies like:

- Paying past-due home payments and utilities

- Medical bills

- Funeral expenses

- An unexpected car repair or purchase

What you can do with a personal loan is limitless, and as established earlier, it is personal to you.

2. Debt consolidation

One of the popular reasons to get a personal loan from Page is for debt consolidation. If you have existing facilities with different lenders, you’d agree that managing multiple loans from several lenders can prove to be challenging. Missing on payments can result in negatively impacting your credit score. Availing a personal loan in such a situation can save you from financial distress. All you require to do is approach Page and state that you have some other loans elsewhere and would like to consolidate different payments into one debt with the help of a loan. This method offers several benefits that include enjoying an overall lower rate of interest which can help in reducing the timeframe required to pay-off your loan.

3. Rent, home improvement and repairs

Whether you want to renew your rent or looking to move to a more befitting neighborhood, or simply looking to upgrade your apartment and fix some repairs, a personal loan is a great way to cover the costs conveniently. The urgencies that come with meeting these needs are usually unprecedented which is why a personal loan may be your surest way to meet up with the deadline. Failure to meet up with rent on time for example will lead to series of embarrassments from your landlord, and…you don’t what that. In the same vein, if you see a new apartment that you love and fail to make payment on time, the house goes to someone else that has cash at hand. This is why speed and convenience are of essence when it comes to personal loans and part of the USPs at Page Financials, you can access a loan and get support anytime whether it’s 2 am or 2 pm so you don’t have to miss any opportunity again.

4. Vehicle financing

Auto loans are available if you’re looking to buy or lease a car, but personal loans are also available to finance any need you may have – including a vehicle financing. Another great reason why you should consider a personal loan rather than going for an Auto loans are secured loans and use your vehicle as collateral. If you’re worried about missing payments and your car getting repossessed, a personal loan might be a better option for you.

5. Starting/expanding your business

Side hustles are very popular these days, and are a great way to test the entrepreneurial waters. If you have one, or you are thinking of starting one, you are going to need some funds to run or expand it. Channeling extra funds into your side hustle can help you take it to the next level. But if you don’t have the money you need now, taking out a personal loan for your side business may help. Getting an outright business loan would normally require some sort of security or collateral – which most startups don’t have, which is why taking a personal loan as a salary earner – to fund your side business, would be a smart thing to do. Personal loans may be well-suited for side hustles because they are often smaller than typical business loans and don’t require a high level of collateral or profitability. All you need is a proven source of income — and that can come from your current day job.

What to consider when considering a personal loan

Applying for a Page Loan is super easy, everything happens online and you don’t need to visit their office.

To begin the application, click here to visit the website as a private sector employee or click here to visit the application page for public sector employee.

The application process is in stages, at each stage, you’ll supply relevant information that helps make a decision to approve your loan. (See requirements for each category below).

You can upload all the documents online while filling the form so you do not have to worry about carrying files from one office(er) to another.

The first stage you will encounter while filling the application form is the BVN and IPPIS verification phase. You will be required to provide these details to help us to verify your identity and financial standing.

Loan requirements for private sector employees

To be considered eligible for a loan as a private sector employee, it is required that:

- You earn a monthly salary (minimum 150k monthly)

- You have up to 6-months’ salary account statement

- You live/work in Lagos or Ibadan (bankers nationwide can apply)

- You have a valid work ID from where you work or an evidence of employment or promotion

- You have a BVN that is actively connected to your working mobile number

Some of the items above will be retrieved automatically when you begin the application, it usually takes customers less than 3 minutes to complete the application if they have the requirements ready. To apply as a private sector employee click here.

Loan requirements for public sector employees:

To be considered eligible for a loan as a Federal Government Civil Servant, it is required that:

- You have your work ID

- You have a valid Government issued ID

- You have at least 3 months’ payslips

- You will present a signed letter of authority to debit (the letter is available for download on our website).

To apply as a public sector employee, click here.

Reasons to avoid a personal loan