Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

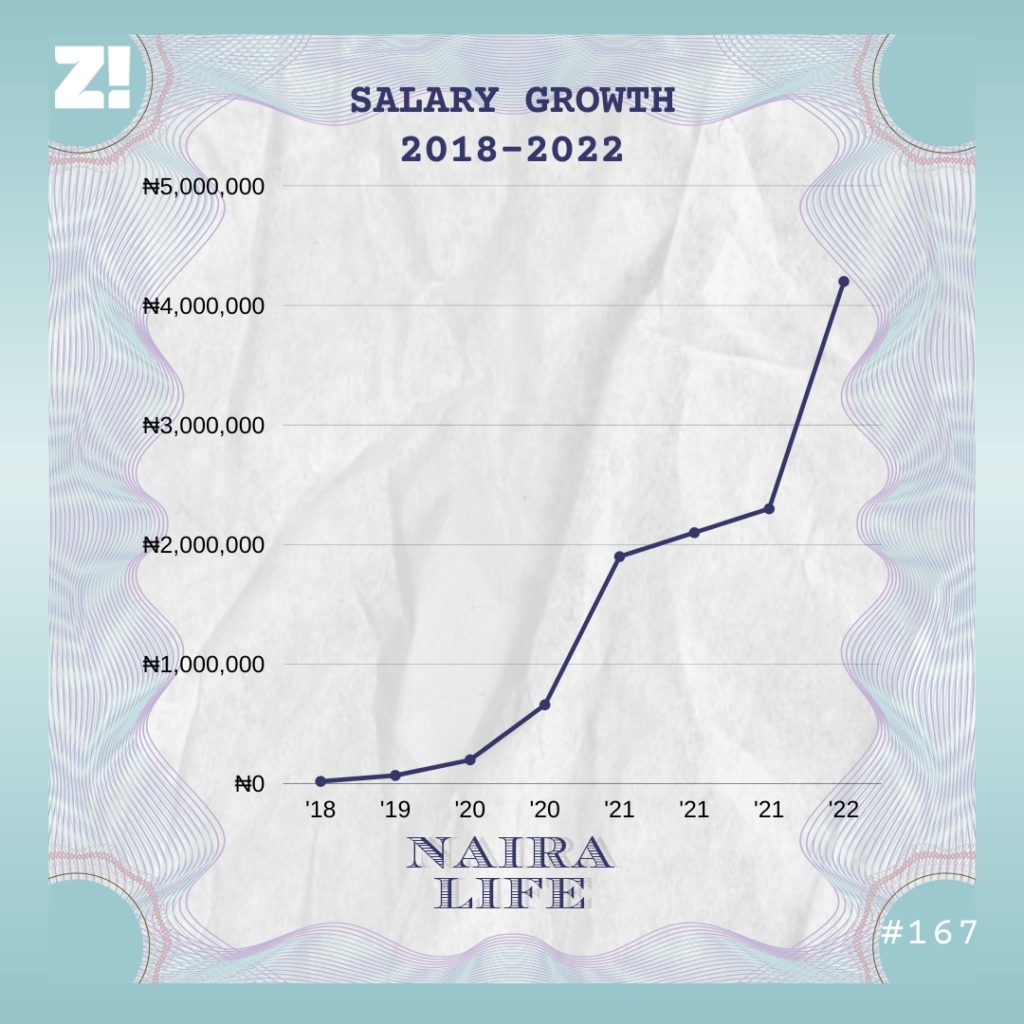

After today’s subject on #NairaLife was fired from her ₦200k/month job in 2020, she found remote work and hasn’t looked back since. Since then, she’s gone from $50k to $93k a year, and she’s only 24.

What’s your earliest memory of money?

As a child, I was hell-bent on making my own money. Even today, my dad talks about how much I loved money. I never had a “baby of the house” phase. I’m the firstborn, and my brother was born shortly after me. I had to learn to share from a young age, so it was just natural to want my own stuff.

From my pocket money in primary school, I bought soft drinks and sold them to my parents and neighbours for twice the price. They patronised me because I was a child. My dad was always excited to see me try to make money. He encouraged me by having conversations about career with me and giving me books to read. I read Rich Dad, Poor Dad when I was nine.

But were things good at home?

I’d say we were a lower-middle-class family for the early stages of my life. My dad was a government contractor and my mum was a civil servant. In 2008, when I was 10, our luck changed. My dad got a super contract that single-handedly moved us to being rich rich. We started travelling abroad for holidays, shopping in malls, getting cars, drivers, etc.

This continued until 2015 when my dad invested a ton of money in an infrastructure-based contract that turned bad. Because it was a government contract, people advised him to withdraw and just leave his money if he didn’t want to risk his life.

Ah.

By this time, I was in my second year in university, getting a ₦50k allowance monthly. Thankfully, I saved about ₦30k of it because I didn’t need to spend so much. As things got worse, my dad had to sell assets and borrow money to pay our school fees. On some months, he couldn’t give us allowances, so I had to survive on my savings from both my allowance and the internships I was doing since I was 14.

You were doing internships at 14?

People have always told me I’m ambitious, but really, I just hate being idle. Internships, when I was younger, were just me trying to figure out what I wanted to do in the future.

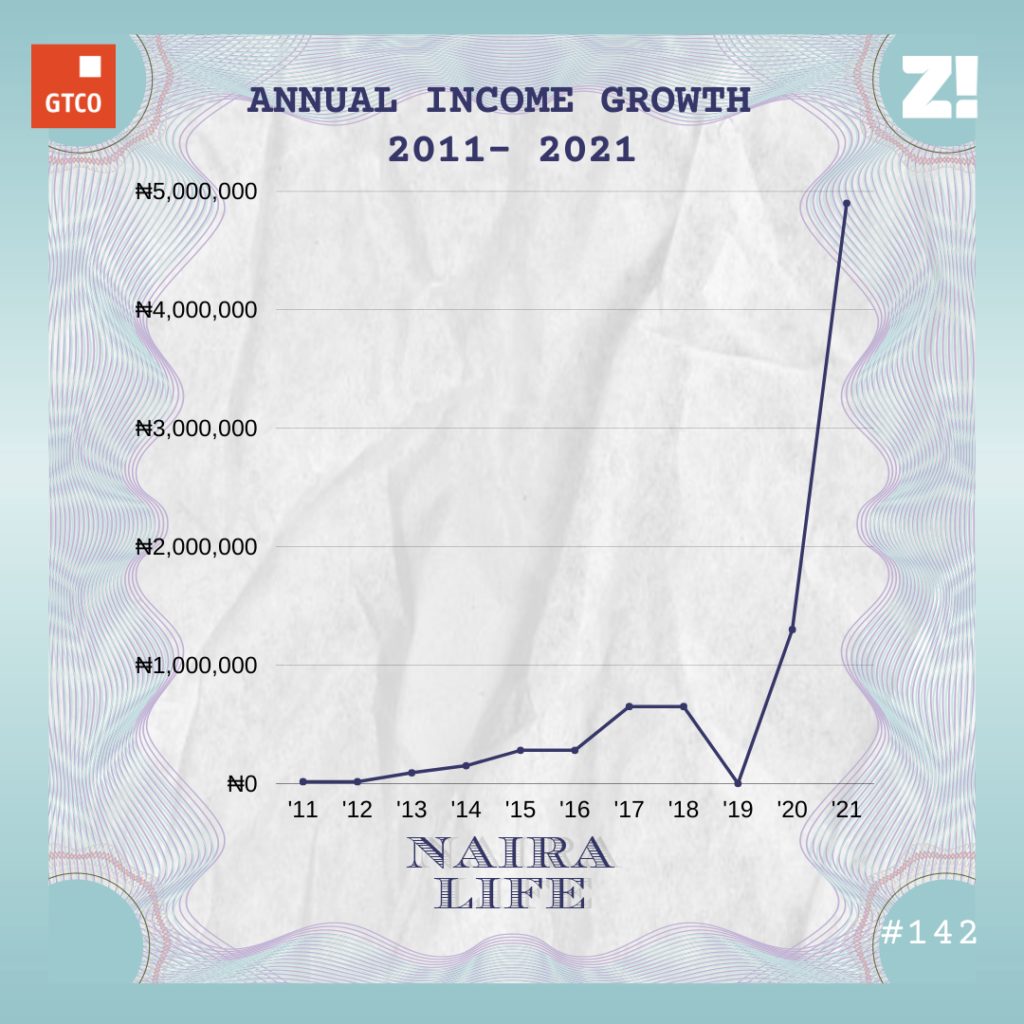

I wanted to become a journalist, so I worked at a magazine publishing company owned by my dad’s friend. This was in 2012. It paid ₦5k per week for the four weeks I worked there. I basically sat and watched movies all day every day, except the one time I followed the crew out to take celebrity pictures. It was too stressful running around trying to get pictures. That experience and someone telling me journalists didn’t make much money made me cross journalism off my career to-do list.

In 2013, I got an internship at an airline through another of my dad’s friends. It paid ₦10k for the one month I was there. I got to the office and read a book every day. On some days, I was sent on errands. But in that period, I learnt how organisations work and how people communicate in workplaces.

Then you started university in 2014.

And I was still doing internships. This time, it was with an advertising agency. I picked calls and sat in on different teams’ meetings. That’s where I first learnt about content marketing and strategy. In 2015, I went back to intern there again.

So, back to my family wahala. I didn’t notice the shift from being lower-middle-class to being rich like I noticed the shift from being rich back to being lower-middle-class. I was older and much more aware, and seeing my family suffer made me desire to have money even more.

You’ve been working since you were 14. How are you not burnt out?

Oh, I’ve burnt out a few times. The first time was in 2017. A friend passed away towards the end of my internship and all the work stress I’d been carrying just broke like a dam, so I wasn’t focusing during those last few weeks. I also burnt out quite a bit as time went on. Even last year.

Interesting. Let’s go back to your many jobs.

In 2016/2017, I worked at an experiential marketing agency for my school IT. I absolutely hated it. The stress was too much. Experiential marketing means you have to run around to make the campaign work out. Thankfully, my allowance was still coming in trickles, so I could survive.

Before I graduated in 2018, I spoke at a school career fair, and a man from some big company approached me to hire me. He liked my speech and they were looking for an intern. It was April, and I thought it was going to be a summer internship, so I said I was interested. A few days later, some people from the company called me to interview me and ask when I could resume. That’s how I started working while I was in my final year. I went to the office only on Fridays and my salary was ₦20k.

Let me guess, it was stressful.

Stressful as hell. The salary was only enough for transportation and maybe some food. Many times, I got back to school after they’d locked the school gates because of traffic. I had to make friends with the security guards so I wouldn’t get in trouble.

I eventually stopped working there in October. I went for NYSC camp in November, and a content agency that had also heard me speak at the career fair reached out to hire me for the year of NYSC. I accepted the job and started working there in December, two days after my convocation.

Best in working.

LMAO! By January 2019, my monthly income became at least ₦69,800 per month. NYSC paid ₦19,800, and the job paid ₦50k. My lecturers from my old school also started recommending me to final year and master’s students to proofread their projects. This didn’t happen every month, but I charged ₦25k whenever I got a gig. Sometimes, I got three gigs in a month. Other times, people didn’t pay up. I still have like three people owing me from freelance jobs.

I also moved out of my parents’ house in 2019 because work was far from home. I lived with family. The summary of my 2019 until September was that I was broke. My monthly earnings couldn’t sustain me.

What happened in September 2019?

I finished NYSC and got a raise to ₦200k for the same role. Omo, it was amazing. I started taking Ubers to work and was able to save small amounts from time to time. Things were looking good until March 2020 when I was laid off.

Ouch. COVID?

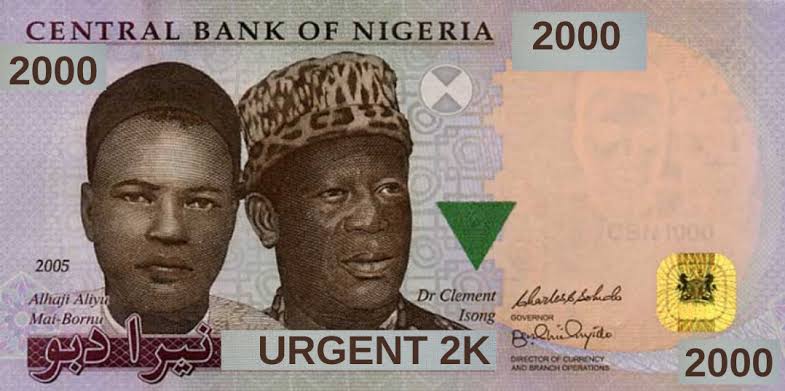

COVID. The company was losing money, so they laid a bunch of us off. That period was extra depressing for me because I had another job offer from a bank that was going to pay ₦300k. When COVID hit, they stopped replying. I got a ₦300k severance package from my job, and my dad asked me to save it in dollars since I wasn’t doing anything with the money.

I moved back home and moped around for a bit. I had zero savings except for the dollars, no job, and nobody was hiring. By June, I decided to go online to look for freelance work.

What did you find?

Between June and August, I helped a couple of people revamp their LinkedIn pages. I made about $250 in total from all my jobs. But freelance was stressful. I had to pander to impress people and didn’t like it. I wanted an actual job, so I started researching how I could find one.

My goal was to find a content marketing job, but I didn’t even know so much about content marketing. I knew more about content strategy. All the jobs I applied for rejected me. By August, I joined online communities of content marketers through LinkedIn and Slack and took it as a job to participate in conversations very actively. What this helped me do was understand better how to present myself as a content marketer.

Another key thing I learned in this period — which I think anyone looking for remote work should learn — was how to present myself as someone looking for a job, and not as a Nigerian looking for a remote job. All those fancy Canva CVs were thrown out of the window. I focused instead on making my LinkedIn look as professional as possible.

When did you find your first remote job?

September 2020. It paid $400 a week. It was a content marketing role for the sister company of a company that didn’t hire me because they suddenly didn’t have a budget for my role. I was in a one-man team writing, creating images, doing social media, and everything else content-related. It wasn’t ideal, but at least it helped me build a strong portfolio in content marketing.

By November, a content marketing agency reached out to me via LinkedIn. They were looking for a content marketing manager. Their offer was $50k a year. That’s $4,187 a month.

ALSO READ: “I’m Losing Friends as I Earn More” — What’s Your Biggest Fear About Money?

Whoa.

I couldn’t sleep the day the offer came. I’d just gone from earning nothing to earning millions in naira. I hadn’t just secured my first million, I was going to be getting millions every month. I had to adjust my thinking to accommodate the fact that I was making that much money. When I got my first salary, I didn’t even spend from it at first. I was just looking at it in my account.

I left the other company in January 2021 because the stress of working two jobs was too much for me.

Did your parents know how much you were earning?

They’ve known all my salaries. They’d always been there, so there’s no point hiding it from them now that it had increased. Thankfully, they’re not the type of people to overburden me with requests. By 2020, my dad had gotten another nice contract that was steadying the family, and my mum had gotten a promotion and a raise too. So things were good.

Back to your plenty money.

By August, I got a promotion that increased my salary to $55k a year. That’s $4,583 monthly. It wasn’t too much of an increase, but it was something. At this point, I’d gotten used to the money, so I decided to spend it. I converted a part of my parents’ house into a mini apartment for myself. I bought everything — new furniture, a new laptop, a desktop, a new phone, fridge, freezer, everything. By the time I was done, I’d spent about ₦10m. I have zero regrets. It’s super comfortable for me.

My taste also went up. I bought only expensive things — plates, furniture, high-end clothing, etc.

By October, I got another promotion and raise. This time, to $60k a year. $5k a month. When I got that raise, I started feeling super dissatisfied. I knew I could earn so much more elsewhere. These raises were too small to keep me in one place.

Back to LinkedIn?

The next thing was to find a job at an organisation that did their content marketing in-house and not work with an agency. At agencies, you have to work with different clients who have different needs. But on an in-house marketing team, you can focus on the company and avoid the stress of talking to too many people. That same October, I started applying for in-house agency jobs.

One that I applied to got back to me, and by February 2022, I started working with them.

How much do they pay?

$93k a year.

Interesting.

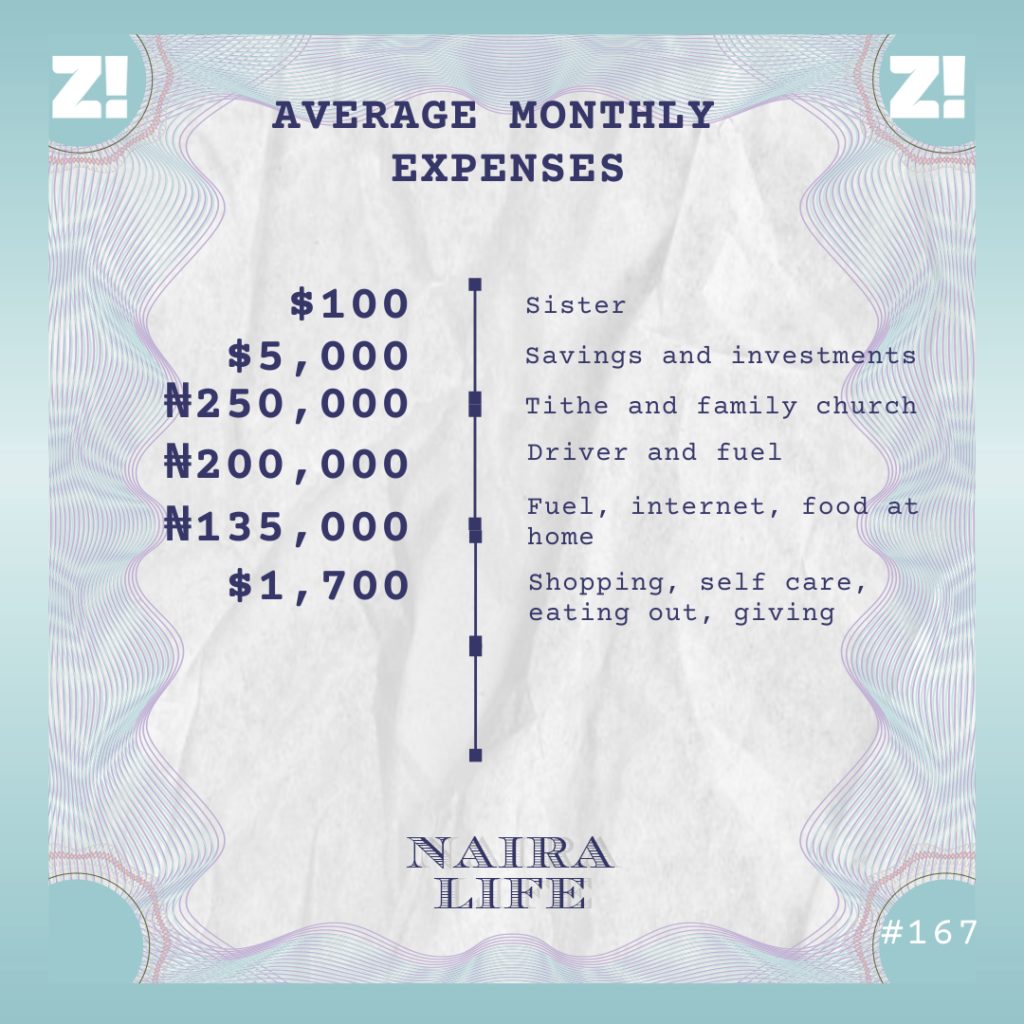

I’m not used to the massive jump yet. In three months, I went from earning $5,000 a month to saving $5,000 a month. Right now, my monthly income is $7,746. $5k goes into investments and savings, and the other $2,746 is spent.

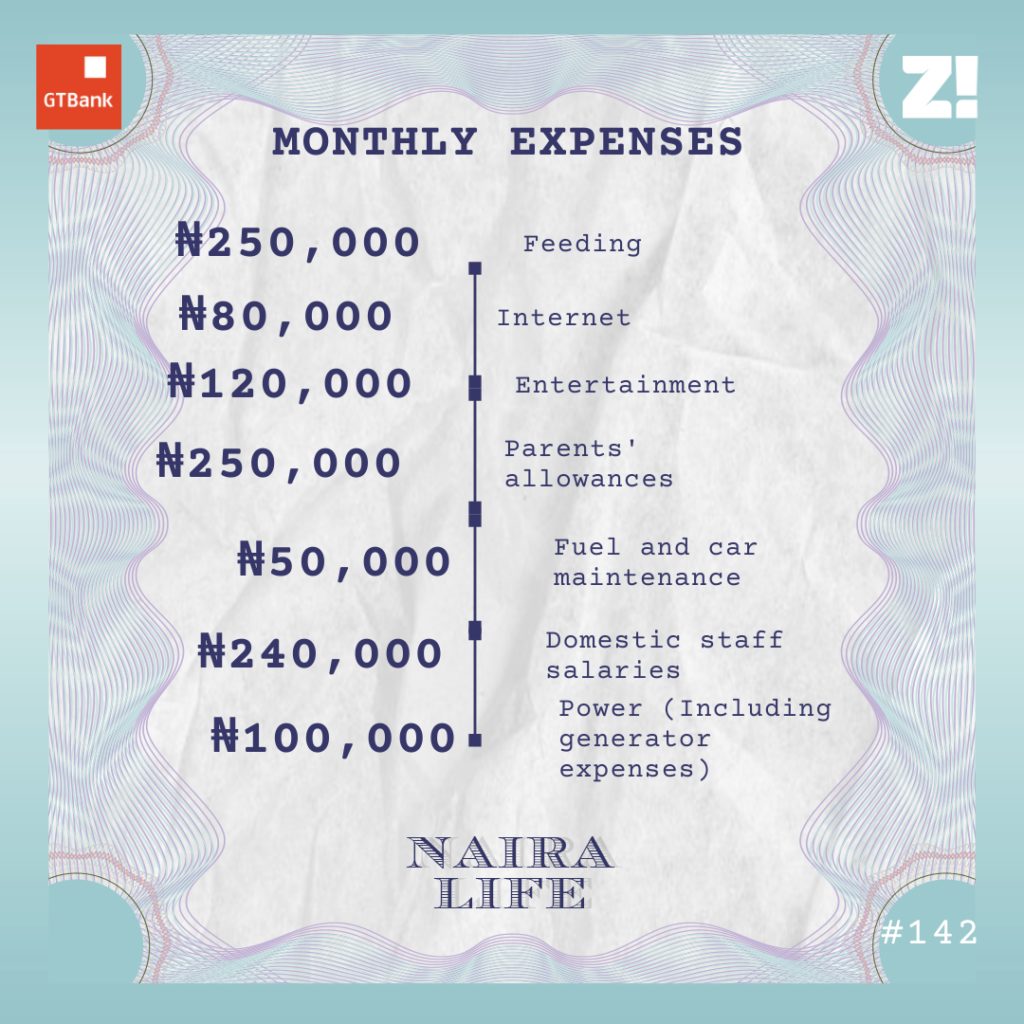

What do you spend your money on?

Let’s also look at your investment portfolio.

I’ve always gravitated towards non-traditional investments like crypto, so I have a lot of that. However, the downturn in the crypto markets made me reevaluate my investment strategy and redirect to more traditional instruments like property and mutual funds. Right now, I have $26,000 in crypto assets, $4,500 in an investment account I’ve just opened, $5,000 in my savings and emergency funds, and land worth ₦2 million. I also now use a financial management company to manage my finances better.

Where do you see yourself in the near future?

My immediate goal is to be making $10k per month in the next year. As I climb higher up the ladder, it’s going to be more difficult to make massive jumps. My dream is to make $150k a year by the time I’m 30, but I’ve realised I dream too small, and my reality always blows my expectations out of the park. So let me keep my hopes at $150k, maybe I’ll be making more than that soon.

What do you want right now but can’t afford?

Hmmm. Nothing. Wait, maybe citizenship to a different country. Maybe my own house. Maybe to move to a better, bigger rented apartment. I’ve seen one in Lagos that I like that’s ₦10m a year, but I don’t want to take it yet. I want to focus on investing and building wealth.

And your financial happiness on a scale of 1-10?

8.5. It could be a 9. It can’t be a 10 because there’s always room to earn more.

ALSO READ: #NairaLife: How Did This Agric Economist Go from Earning ₦40k to $5,500 in Four Years?

/focused-black-student-working-on-his-laptop-computer-1051420210-0ae622102e474ea4a09025d1f319e6f4.jpg)