|

-

I’d just published this story about an apprenticeship gone wrong when Tunrayo* reached out, saying she’d had a similar experience with a Nigerian politician who’d been her role model since she was 9.

She talks about finally getting the opportunity to work with this politician, abandoning her family, enduring abuse, and almost losing her identity and life to her work.

As told to Boluwatife

Image designed by Freepik

I became fascinated with a particular Nigerian politician at 9 years old. Fascination doesn’t even begin to cover it. I was obsessed. I even had pictures of the woman in my room.

Let me tell you how it started. I decided I wanted to be a journalist pretty early in life. I loved watching the news and following political stories. Though a businessman, my dad knew a lot about the political happenings in my home state. That’s how I got to know this politician. Biodun* was a prominent political figure in my state at a time when it was almost impossible to see women at the forefront of politics. She was 20 years older, but I wanted to be like her.

I admired and wanted to be like Biodun so much I’d write short notes about my admiration and paste them on the noticeboard at the mosque. Biodun was partly the reason I didn’t study in the UK. I graduated from secondary school around 2010 and had already secured admission to the UK — not for journalism, though. My dad thought studying law was better.

Just before I was meant to travel, my dad changed his mind and decided I’d better go to school in Nigeria instead. His reason? Biodun also studied in the UK and was a chain smoker. He knew how much I idolised her and feared I was ready to imitate this woman in everything, including smoking. He was right because I did get into smoking years later because of her, but we’ll get to that.

Eventually, I got admitted to study law at one of the universities in my state. Ironically, that brought me closer to Biodun — it was the same state she worked in. By then, my obsession had grown to commenting on all her social media posts and fighting everyone with anything negative to say in the comments. I followed every single thing she did. I started calling myself a “Biodunist” and made her picture my wallpaper on everything I owned. She was also my display picture on all my social media accounts — the love was that deep.

It was politics that finally brought me the opportunity to meet her. My penchant for writing led me to work for several media houses as a student, and I regularly wrote articles criticising the state government in power. This made me well-known to some members of the opposing political party in the state, and I became friends with many of them. I also became active in student union politics and championed several causes to ensure female involvement in school politics.

In 2014, I organised a female conference and magazine launch to highlight women doing great work in their fields. Of course, Biodun had to be the face of the magazine. I repeatedly sent several invitations to her via Facebook, but I didn’t get any headway until someone I knew from my political activities gave me her contact. Surprisingly, Biodun responded, and we started chatting on BlackBerry Messenger.

I couldn’t believe my luck. It was my chance to impress her, and I tried my hardest. She loves rap music — BBM had a thing where you could see what people were listening to, so I started listening to Nicki Minaj and Drake because she did, too. One time, we were chatting about Game of Thrones during exam season, and I’d literally leave my books to watch new episodes so that I could respond if she talked about the series.

Biodun wasn’t in office at this point, but she planned to run again in 2015, and I somehow became involved in her campaign. She knew I was her staunch supporter and that I knew my way around politics. So, she sent me a data modem and tasked me with creating social media accounts for her campaign.

I should note that we hadn’t met at this point, and I wasn’t being paid, but it felt like I was part of something great. I bragged about my work with her to everyone who cared to listen. I went for Hajj that year, and instead of praying for myself or my family, I stood in front of the Kabba praying for Biodun to win the election. I cried like a baby when she lost the party’s primary elections.

Remember that conference I organised? She didn’t come, even though she promised she would. She sent a representative instead, but I couldn’t stay angry with her for long. Especially since she came through for me some months later when I got into trouble with the police because of my outside-school political activities. She promised to send lawyers if I wasn’t released. It didn’t get to that, but I took that assurance as her reciprocating my love for her. And my loyalty tripled.

We still kept in touch when I went on to law school. She’d always tell me how stressful work was for her since she didn’t have a personal assistant, and I’d respond by saying I wished I was there to help her. I moved into her house immediately after my final exams in 2017 and resumed work unofficially that same night. I say “unofficially” because no one gave me an appointment letter. I was supposed to go home — my mum had even booked a flight for me, but I refused to leave her side.

Biodun was planning to run for governor in 2023, and I was tasked with building a roadmap for her to get there through humanitarian initiatives, charity, and the like. That became my life’s work. In my head, I was going to help make a difference in the state.

My daily schedule involved waking up around 11 a.m., going to Biodun’s study, and working with her until 3 a.m. I lived in the same room with her maid and slept on a bunk bed. They also had a dog in the maid’s room who peed everywhere, which meant I couldn’t observe my daily prayers regularly.

I ate once a day in Biodun’s house — only breakfast, and that was typically bread and eggs. I rarely ate more than once a day, and that happens if the maid brings food to her study and Biodun tells me to come and eat. That wasn’t often because she did a lot of diet fasting. I also wasn’t being paid, so I sometimes called home for money so I could buy food. Looking back at it now, it was a far cry from my privileged background, but I didn’t see it at the time. I was working with my idol, and that was all that mattered.

It also didn’t matter that I took monthly flights with my own money during NYSC year for monthly clearance just so I could keep living with Biodun even though I was posted to a different state.

Our schedule got a lot tighter in 2018 because of the preparations for the general elections the following year. Biodun wasn’t contesting, but she needed to ingratiate herself with the party, and she handled many campaign efforts and empowerment projects in our state on behalf of the presidential candidate.

We flew together everywhere. I was always in the car with her, never more than a few feet away. No jokes; I followed her into the toilet several times and even helped her dress up. I was the one carrying campaign money and following her up and down. People began calling me her PA, and it thrilled me.

If you know anything about politics in Nigeria, you know there’s never a shortage of enemies. Biodun’s house was always full, with different people going in and out. That crowd got bigger with the campaigns, and we began killing a cow daily to cook for people. I was the one handling money, and sometimes, when she directed me to give someone money to buy something, I’d naively exclaim that the item shouldn’t cost that much. That brought me a lot of enemies.

There was also a lot of backbiting and passive-aggressiveness going around, and I soon started feeling unsafe. I had to bring some friends to come live with me because I worried about even eating food at the house. I’m honestly not sure if I was attacked because I was found unconscious one day with my three cats dead beside me and three random scars on my back. This was just before the elections in 2019, and I’d briefly returned to my family home. I was hospitalised for a week, and after I was discharged, I still returned to Biodun’s house despite pushback from my family.

2019 was also the year my eyes started to “clear”. Biodun landed a ministerial appointment and got an actual PA. I didn’t mind it because I thought there was a way personal assistants were supposed to dress or look, and I didn’t fit that position. Where did I even want to see money to buy good clothes? I was literally dressing like a maid back then. But that wasn’t the only thing that changed.

I’d always known Biodun had temper issues — she was known for screaming at people and throwing objects, but I always knew to avoid her when she was in a mood, so I was hardly the focus of her outbursts. But the night before a dinner to celebrate her appointment, she called me a stupid person and threw a remote at me because I couldn’t find golden spoons to rent for the dinner.

ALSO READ: Nigerian Women Talk About Navigating Harassment in “Safe” Spaces

We also went from working closely together to hardly speaking to each other. We were still living in the same house, but there was now a PA and several DSS officers around her and I couldn’t just approach her.

Those first few weeks after her appointment, I felt like I was just floating around—going to the office and returning to the house with no sense of direction. After a while, I was officially given a title as research and policy assistant and a ₦150k salary, but I didn’t feel like part of the team.

I’d thought the ministerial position would provide an opportunity to work on the projects Biodun and I had discussed as her roadmap to governorship, but she was no longer interested. We’d planned to start a recycling project, but that got abandoned. She’d also placed someone on a scholarship but suddenly stopped paying the fees and ignored prompts about it.

Around the same time, she bought aso-ebi for everyone in the office for someone’s wedding. People would reach out for help, and we’d ignore them, but if the person died, we’d send cows and visit for optics. I didn’t recognise who she’d become, and I felt betrayed. What happened to the visions and the people we used to go see back to back during the campaigns?

It suddenly became like I didn’t know how to do anything anymore. Biodun would scream at me and insult me in full view of everyone for the slightest thing. I wasn’t allowed to leave the house or office without permission. One time, I went to the mosque, and when she didn’t see me in my seat, it became an issue. I was also working long hours. I had to get to the office before 9 a.m. and only leave after she had left. Sometimes, I’d return home by 9 p.m. only to continue working till well past midnight.

The office politics was even worse. People who work in government offices have the opportunity to go on training programs with an estacode allowance (or travel allowance) to cover any expenses. Biodun’s chief of staff made sure he was the only one who went for those programs. He actually didn’t even go for most of them; it was the allowance he wanted.

In 2020, I summoned the courage to leave Biodun’s house. I rented an apartment but had to lie to her that it was my friend’s place, and I just wanted to visit her during the weekends. That was how I packed my things small small till I moved into that apartment.

Moving out was a lifesaver. I really began to see how I’d grown into a shadow of myself. I could cook and eat without worrying about going out to buy food and having to explain where I went. I should mention that my mum had been worried about me for a long time. My dad had passed away at this point, and she expected me to return home to manage his business, but I couldn’t even visit. I was also constantly taking money from my trust to survive. She didn’t understand why I just couldn’t leave.

The final push I needed to leave came during the EndSARS protests. I wasn’t allowed to join because I worked for the ruling government, but it was a cause that affected me. My younger brother was a victim of these SARS officers, and it was personal to me. So, I’d sneak out of the office to attend protests. I could do that because the presidency had directed most officials to return to their states to try to diffuse the tension.

On social media, Biodun formed solidarity with the youths, even helping project the #5for5 demands. But on a WhatsApp group with other party members, she was inciting people to throw curses on the youths for protesting and claiming a political opponent sponsored them. I was appalled by it all and even got into a public argument about it on the WhatsApp group until some people reached me privately and called me to order. I was so disappointed and ashamed. This wasn’t the Biodun I knew and admired.

The presidency also called for stakeholders to present reports about the protests, and I attended one to get pointers on how to prepare Biodun’s report. You won’t believe no one talked about the lives lost at the Lekki toll gate or the damaged properties. The “stakeholders” were rather discussing contract approvals.

I think that was the point I became disillusioned with the whole thing and decided I was leaving for good. I did leave sometime later during a meeting with Biodun and some other staff. They were complaining about something I supposedly did wrong, and I just stood up, plugged in my headphones and walked out.

Four years later, I’m still glad I left when I did. I can finally breathe. Since then, I’ve grown in the political space and have done important work that I care about. I also manage my dad’s business now.

I can make friends with whomever I want. I couldn’t do this while working with Biodun because I wasn’t allowed to talk to anyone connected with other politicians. She also made me write damaging and insulting articles about other people, and I regret being used to do so much of her dirty work, but I’m moving on from that.

Most importantly, I’ve grown, and I now know my worth. I wasted so many years of my life following someone mindlessly, but I know better now, and no one can make me go through that again. I don’t have any political leader because I can’t do that running up and down for someone else anymore. I’m grateful for my family and appreciate how much they stood by me while I figured things out. I’m in a better place now, and my experience has taught me to treat people with respect. I know how it feels to be treated like shit, and I have a responsibility to make sure I don’t pass that on.

For every young person aspiring to get into politics, it’s important to develop yourself first before putting yourself under someone else because reaching your full potential will be difficult that way. Also, don’t trust any politician. They change.

*Names have been changed for anonymity.

NEXT READ: The #NairaLife of an Apprentice Who Wants Out of the System

[ad]

-

We’ve established that bridesmaiding is an expensive venture for Nigerian ladies, as they shell out as high as ₦800k to be a part of the intending bride’s bridal train. But what does it look like for their counterparts, the groomsmen?

Considering that men don’t have to spend extra money on glamming up their faces or sewing expensive owambe styles, one might assume that their expenses should be significantly lesser and budget friendly. But to confirm, we asked six groomsmen about the costs of being a groomsman and their stories are proof that “weddings” are expensive for everyone involved.

Taiwo, 30

Highest spend: ₦280k

The most recent wedding I was a groomsman at was in April. A friend of over 10 years was getting married. He was also my groomsman when I got married, it was only right that I returned the goodwill. The wedding was outside Lagos, so we had to sort out accommodation. We got a shared apartment for ₦150k per night, and it was shared among five occupants. I paid ₦60k for me and my wife. Apart from my outfit material , my wife also had to wear the theme cloth of the day, so that was about ₦90k on materials and another ₦50k on tailoring. Another ₦50k went into getting new shoes for me and my wife, and I contributed ₦30k for the couple’s gift.

For me, I always ask myself some questions before I commit to the financial burden of being a groomsman.

“How close are we? Can the person do the same for me?” Once I have my answers, I make a decision. I’ve politely turned down several requests in the past.

Deji*, 30

Highest spend: ₦1.25 million.

I spent this much because I wasn’t just part of the groomsmen, I was the best man. The groom had come through for me in so many ways too —he’s my guy, but also like a mentor and older brother.

The wedding was in Benin, so I spent ₦80k on flights — this was in 2022. We wore two traditional outfits and one suit, and I paid ₦125k for all three. ₦40k went into accommodation, and another ₦150k for spraying the couple at the party. As groomsmen, we also had to chip in ₦250k for gifts for the couple. The bulk of my spend — ₦600k — was a personal cash gift to the couple.

To be honest, my finances took a hit, but I wouldn’t have had it any other way;he’d have done the same or more for me.. Right now, a friend’s impact on my life and my current earning power will determine how far I’m willing to go for them.

Feranmi*, 31

Highest spend: ₦125k

As a groomsman, I had to pay ₦50k each for suits. The groomsmen were also required to wear white agbada for the traditional ceremony. I didn’t have one, so ₦22k went into that. The wedding was in Ibadan, and I had to make a trip down from Lagos. Thankfully train tickets were quite cheap at the time,so I only spent about ₦4k on transportation.

When I got to Ibadan, I realised that the groom didn’t make plans for accommodation so ₦30k went into paying for a -2day hotel stay.

As a groomsman, you also want to spray the groom on the dance floor. I think I withdrew about ₦20k for that. The whole expense came down to over ₦125k which was a huge sum to me in 2022. I literally spent a third of my house rent on groomsman duties. But the groom was my guy guy, so I didn’t bat an eye going all out like that.

Although my finances have significantly picked up these days, you have to be a very close friend before I agree to be one of your groomsmen. Otherwise, I’ll just send in a cash gift of ₦15-₦20k, which is a fraction of whatever I’d have spent as a groomsman.

Hammed*, 25

Highest spend: ₦200k

The wedding was outside of Lagos and I travelled by road to Osun. I spent about ₦200k on sewing the different clothes to be worn. This was a significant amount for me at the time as I had barely started working and didn’t have a huge savings.

When I got to Osun, I barely had money left to spend on anything. Thankfully, I didn’t have to worry about accommodation. We all slept in a large hotel room, courtesy of the groom.

I wouldn’t say the costs had a huge effect on my finances as I was able to make any money spent back, . However, I didn’t envisage that I’d have to be part of so many activities before and during the ceremony. I anticipated a fun experience, but it was hard work all through. I don’t regret it. And while I can’t even confirm the groom would do the same for me, I’m sure he is a valuable friend in several other ways.

[ad]

Ayo, 30

Highest spend: ₦230k

I was a groomsman and best man for the wedding. The groom and myself are good friends. I escorted him to buy his ring, and even planned his engagement, so at that point it was settled I was going to be the best man. The whole time I wasn’t thinking about the financial implication of things. I just wanted to make sure my friend had the best day he could.

Majority of the expense went into our clothes. I spent ₦70k on a three-piece tux, and another ₦30k went into a new pair of shoes. We also had to wear white for the traditional ceremony, but thankfully I had one and didn’t have to incur extra cost. The wedding was in Akure, so travel expenses by road came to about ₦30k. There was also ₦100k that went into spraying money.

I still approach groomsmen requests with graciousness. I look at the relationship I have with the groom;I don’t take it for granted that someone finds me worthy to play a special role in their day. If it’s beyond my budget, I politely decline and offer a modest cash gift to support the groom.

Jaiye*, 28

Highest spend: ₦180k

A friend got married last year and he needed me to be a part of his “agbada men”. I’m not sure if agbada men and groomsmen are the same thing, but we didn’t have to pay for suits. It was just one outfit for the wedding and that seemed fair enough. The material was ₦50k and it came with a custom-made beaded velvet cap for ₦15k. I spent another ₦15k on sewing and ₦20k on shoes. The agbada men also planned a surprise bachelor’s eve for the groom so we had to contribute ₦30k each to make that happen.

The wedding was in Badagry, so I made plans with a neighbour who offers private cab services. ₦50k went into the transport expense because the man had to wait to take me back. The whole expense came to around ₦180k and I wasn’t proud of my financial decision because the guy wasn’t even a close friend like that.

Now, once I get an inkling that your groomsmen ask is nearing a ₦50k budget, I politely decline and send a monetary gift. Maybe ₦10-20k.

Read this next: How To Plan a Wedding in Tinubu’s Economy, According to Wedding Planners

-

As a chronic, unapologetic onigbese, does shame not visit you?

We’ve told everyone, your partner and debtees, what to do when you refuse to pay back your debts. Obviously, that hasn’t worked, so sit down and let us advise YOU on what to do when you’ve been stung by the bug of onigbese-ism.

Break coconut on your head

You’ve refused to pay back the money you owe, so obviously, you have a coconut head. We suggest you go head to head with an actual coconut and hope the impact will reset your brain and nerve endings, and you’ll do what’s right.

PS: If you land in the hospital and you call our name, we’ll deny you like newly elected politicians deny their wicked godfathers.

Wash your head with coconut water

After the much-needed factory reset, this’ll cleanse you of all rubbish behaviour, like holding on to people’s hard-earned money simply because you can.

Print “onigbese” on a t-shirt and make it your uniform

Since you can’t stop kidnapping people’s money, buy a plain T-shirt, print “I’m an onigbese” on it, and wear it around town. That way, people already know you can’t be trusted, and the next time people want to get into business with you or you ask for a loan, they’ll know what they’re getting into and flee.

Find shame

It’s public knowledge that you can’t shame the shameless, and there’s no one as shameless as an onigbese. But please, find shame so when people start dragging your name and everything you hold dear through the mud, you can feel it and finally pay them.

Beg for forgiveness

Make a list of all the people you owe and how much you owe them, and go on an apology tour. Just make sure you take their money with you before they drag you to Kirikiri for wasting their time.

Beg the police to arrest you

Take yourself to the nearest police station and beg them to put you in handcuffs and drag you into a cell. If you’re in the cell, you won’t see the people you’re currently owing money or anyone new to owe. And hopefully, when you come out, the fear of all you endured in the cell will lead you down the right path, one that isn’t filled with debt, shame and embarrassment.

Disappear

We know you. You’re probably not going to do anything we’ve said. Just pack your bags, leave the country, make sure you lay low for the rest of your life and tell your children to get ready to break generational curses. This is because the people you’re owing will swear for you, and at least one will work.

-

Get a free ticket to Strings Attached and enjoy a feel-good evening of music, dancing and games at Muri Okunola Park, Lagos on May 11, 2024.

-

The Nigerian authorities can try all they want, but they can’t kill the vibes at owambes But since spraying money is now a crime that can potentially land you in jail for six months, we’ve found some ways to get around it.

Do transfer

The downside of this is that you can’t spray your ₦2000 broken into ₦100 notes in peace. You’ll probably have to send as much as ₦5k so that the celebrant can see that you rate them.

Envelope it

Let’s bring back how our parents gave out cash gifts before this money spraying wokeness. Find the celebrant before you leave the party and press the envelope into their hands.

Collection basket

If you’re throwing a party soon, a collection basket is one more thing you need to make plans for at your event. Make sure it’s stationed right on the dance floor where people can easily spot it.

Money box

If there’s anything Valentine and birthday gift vendors have taught us, it’s all the creative shit you can do with money.

Spend bundles

Think about it, the money won’t litter the dance floor or get trampled upon if it’s in a huge ass bundle. However, this method is only advisable if you’re an odogwu spender.

[ad]

Money vouchers

Event planners now make arrangements for money vouchers at parties. How does it work? Buy a voucher equivalent to the amount you intend to ‘spray’, transfer to the event planner and handover the voucher to the celebrant. The event planner will in turn transfer the money to the celebrant.

Or just stay at home

You won’t have to spray anyone or think of ways to avoid EFCC’s wahala if you’re not at the party.

READ ALSO: I Avoid Getting Sprayed With Money at Events

-

The typical Nigerian “owambe” is barely a complete experience if guests haven’t rained money on the celebrant in an almost excessive display of wealth. While most people look forward to this highlight, I was shocked to find out that there are others who’d rather skip the entire show.

Amid EFCC’s recent clampdown on socialites for spraying money at events, Segun* shares how his mum’s experience with a diabolic relative shaped his interaction with money at social functions.

As Told To Adeyinka

My earliest memory of my mum getting furious and creating a scene in public was at my 10th birthday party. 20 years later, I still have a vivid picture of what happened.

While dancing on the stage, an aunt from my father’s side came to press ₦50 notes against my forehead. I’m not sure if it was a deliberate attempt on her part, but she wouldn’t put the money anywhere else but my forehead. I remember my mum yanking me off almost immediately and walking off the stage. My aunt was furious, and they both got into a loud argument that almost disrupted the party. My aunt argued that my mum’s action implied she had ill intent against me. My mum, on the other, hand wasn’t willing to take chances.

Years later, I learnt that what happened on my birthday was a traumatic response to my mum’s experience at her wedding. The gist is, an older relative who came from the village pressed money against her head the same way my aunt did at my birthday. My mum fell sick for weeks after her wedding and was hospitalised. The doctors couldn’t say exactly what was wrong and all the treatment did nothing to improve her condition.

The biggest women-only festival in Lagos is BACK.

Get your tickets here for a day of fun, networking and partayyyyyThings only got better after my granny involved an Islamic cleric who revealed they had to find and discard “bad money” from a close relative sprayed on her wedding day. Many relatives attended the wedding and since my mum was barely conscious, she couldn’t tell the family members whom she suspected. Remember, she was hospitalised almost immediately after her wedding, so all the money from the wedding was still in a bag. It was hard to identify which money was from whom so the cleric suggested giving everything to charity. She was discharged about a week later and the doctors described her recovery as “miraculous”.

That experience shook my mum’s core, and it shaped her interaction with money at social events. If the money isn’t in an envelope or sprayed into a collection bag or basket, my mum doesn’t want it. This has also rubbed off on me and my siblings over the years. We might not be as extreme as our mum, but if someone aims for our head or forehead while spraying money, we find ways to dodge it or remove ourselves from that situation.

In my case, I also avoid doing the same to people. I’d rather put the money in a brown envelope and give it to the celebrant, spray it in the collection bag or just ignore it entirely.

[ad]

READ ALSO: Zikoko’s Guide to Avoid Spraying Money at Parties

-

You know how you see something you like at the market, but then you hear an outrageous price and realise you don’t like it like that?

That’s how adulting has changed how these Nigerians think about self-care and their guilty pleasures.

Image designed by Freepik

Joseph, 31

I used to take myself to a high-end restaurant immediately salary entered. It started when I got my first job in 2013 with bukas. Then I moved to fast-food spots and proper restaurants as my money grew.

I started living alone in 2018, and increased responsibilities shook this tradition, but I kept at it. My breaking point was when my rent increased from ₦800k/year to ₦1.6m in 2023. No one told me to budget first before anything else. I still spoil myself sometimes, but I do it with sense. High-end restaurants are now once in a blue moon.

Charles, 35

I love taking road trips. Since 2019, my idea of unwinding has been driving four to five hours from Ado-Ekiti to Lokoja to spend the weekend at least twice a month. Sometimes, I spend my time in Lokoja with relatives. Other times, I stay in a hotel and only come out in the evenings.

Since the fuel subsidy removal in 2023, I’ve only been to Lokoja once. A trip that typically cost me ₦15k – ₦20k fuel to and fro now costs ₦25k just to get to Lokoja. It’s not sustainable. I encourage myself by reasoning that the kidnapping situation has worsened, so I shouldn’t do road trips anyway.

Anu, 31

For a long time, my idea of self-care was trying out continental recipes I found online. It’s my way of travelling the world without actually travelling. But I’ve hardly cooked anything new since I started having kids in 2018. My children are picky eaters, and I hardly have time between taking care of them and working to even consider making extra meals. I only get to satisfy myself when they’re away on holiday.

Jen, 28

Food was once my go-to when I was stressed, bored, or sad; it made me feel better. But my metabolism is no longer what it was. At university, people always wondered how I could eat so much but stay skinny. Now, I can’t even breathe near shawarma if I don’t want to add 2kg.

My new form of self-care is exercising. I’ve been a regular gym goer since 2022, but my gym just increased their fee to ₦70k/month from ₦50k, and I’m considering doing my exercises at home instead.

Ima, 24

Ekpang Nkukwo is my favourite meal, and my mum made it almost every week when I was growing up. She’d also make it when she noticed I was unhappy, and I associated the meal with feeling better. Anytime I was on holiday from school, I’d call her on my way home and ask her to prepare it.

I started living alone in a different town because of work in 2023, and I thought I’d make the meal every weekend to congratulate myself for surviving the week. I’ve only made it once since then. The preparation stress no be here. Sleep is now my way of making up for a stressful week.

Jesse, 33

Since I started earning reasonably well in 2020, I’ve taken one full month’s salary a year to splurge on something I really want — mostly electronic gadgets. But I couldn’t do that in 2023 because of wedding preparations and my MBA studies. It doesn’t look like it’ll be possible this year too because I now have a family to consider. I’ll probably have to settle for splurging a small percentage rather than the full salary.

Ella, 26

Sleeping in during the weekends was my way of spoiling myself until I had a child in 2023. I make up for it by bingeing old movies to de-stress. And I try to squeeze in power naps as often as possible. Hopefully, I can resume sleeping in when my child gets older. Sleep is life.

The biggest women-only festival in Lagos is BACK.

Get your tickets here for a day of fun, networking and partayyyyyNEXT READ: “We Make Do With Our Imagination” — 7 Nigerians on How Inflation Affects Their Relationships

[ad]

-

I don’t know who concluded that all women do is backbite and gossip about each other, but genuine female friendships can be the sweetest relationships ever. I asked seven Nigerian women to share the most thoughtful gift they’ve received from a female friend, and their responses were so sweet.

Image designed by Freepik

Amara, 27

I launched my online business in 2023, and my best friend made sure she was the first person to patronise me. She bought something worth ₦50k and paid ₦100k for it. I cried so much. She was planning for her mother’s burial at the time and shouldn’t have been in a position to even offer emotional support, talk more of financial. But that’s just who she is. I’m so grateful for her.

Tobi, 26

I’d only known my closest friend for six months when I got married in 2022. But this babe went all out for me. She wasn’t the chief bridesmaid (my sister was), but she organised a surprise bridal shower, came to stay with me three days prior so I wouldn’t stress, got me a blender as a wedding gift and even distributed souvenirs at the wedding reception. We’ve been friends for two years now, and she’s still the same caring human being. We’ve even passed friendship. We’re sisters now.

Jola*, 30

I was in an emotionally abusive relationship for two years, and my childhood friend never hid her disapproval. But she always welcomed me with open arms when I’d come crying about yet another thing my ex had said or done to me. Sometimes, he’d block me everywhere for a couple of days then come back to beg me.

When the last incident left me crying for three days, my friend paid for a therapist appointment and took me there without telling me where we were going. I got back with my ex a few days later, but I saw the therapist for about two months, and the appointments eventually gave me the morale to end the relationship for good. I have my friend to thank for that.

Debbie, 24

I was travelling from Abuja to Lagos in 2022, but our bus kept having issues on the road. It stopped again around Ogun state at 1 a.m., and the driver was suggesting we’d have to sleep there so he could call a mechanic in the morning. I’d been keeping my friend (who lived in Ogun) updated about my movement, and when she heard that, she convinced her dad to come pick me up. When I got to her house, she had a meal waiting for me. It wasn’t exactly a material gift, but she probably saved my life that night. What gift tops that?

Detola*, 25

My two closest friends and I have a tradition of surprising each other for our birthdays. When one person is celebrating, the other two gather money and plan the surprise.

I was really broke in 2023 and couldn’t contribute to one of the birthdays. My other friend took it up without issues. She got a bracelet and had it engraved to say it came from both of us. Our other friend never even knew what happened.

RELATED: 10 Ways to Make Sure You Never Receive a Bad Birthday Gift

Joy, 20

When I broke my juicer, I nearly lost my mind because juicing was the one thing I constantly did for my late dad when he was ill. I told my friend how my family thought I was overreacting over such a small thing, and she didn’t say much. Only for her to show up at my house the next week with a new juicer. I cried.

Chisom, 35

Pregnancy and childbirth did a number on me. I had my baby in 2017 and was so depressed after. To make it worse, I started losing my hair. It felt like the whole world was against me. I felt ugly, bloated and tired, and I told my best friend about it. The next time she came to see me, she brought a pair of scissors and a brand-new wig. She hyped me up to cut off my whole hair and start afresh. In her words, I had nothing to lose. I could own my bald head or wear a wig and look good either way because I had the face to pull it off. I’m not sure why, but it greatly improved my confidence. I felt seen.

*Some names have been changed for anonymity.

NEXT, READ: 7 Nigerian Women Share The Worst Thing A Friend Has Done To Them

[ad]

-

There are many reasons to have constant headaches in Nigeria right now. But do you know a group of people who have it easy? Those with super reliable USD cards that come through any time for international payments.

Let’s get into the things they enjoy and why you should be like them.

International shopping

There’s nothing as therapeutic as clearing your cart on Shein, Ali Express, Amazon, Asos, and other stores and taking delivery of all your fire fits. Of course, this dream can only turn into reality when you have a reliable USD card that won’t embarrass you.

Money from the abroad

Imagine your friends abroad wanting to send you small hard currency for these tough times, or you need to get paid for your freelance work, and you have to run helter-skelter for someone’s account. God, abeg.

Can never be anyone with a USD Chipper card. Input your card details on platforms that accept Visa direct and you’ll get that sweet dollars.

Seamless tuition and online course payments

At some point, it gets embarrassing to disturb friends and neighbours anytime you have to pay for an online course or tuition fees. But surely, this doesn’t apply to someone who has a USD card that makes it seamless to pay on platforms like Udemy, Coursera and many more.

Ease of running business

Nigerian business owners and complaints are like 5&6, but one group of people you’ll hardly catch in this mix? The ones who can easily pay for social media ads and drive more awareness for their business. Let us tell you now, their not-so-secret joy-giver is a USD card.

[ad]

Seamless subscription

People with USD cards might have their kettle of problems in Nigeria right now, but they don’t have to worry about paying for subscription services that help them escape from the shege. With a Chipper USD card, you don’t have to blink twice before your Apple Music, Canva, etc bills are sorted.

Travelling

The planning and logistics that go into travelling is stressful enough. So, the last thing anyone should struggle with is payment for plane tickets, hotel accommodations, visa fees, cab rides, etc. We’ll tell you one thing, Nigerians with USD cards can’t relate to these struggles even if they try.

USD Chipper Card

In case you’ve not gotten what the gist is about, let’s use this moment to tell you that the people who enjoy these super cool things are USD Chipper Card users.

With your USD Chipper card, you get a fast and reliable means to make international payments without breaking a sweat.

So, will you join the over one million Nigerians who’ve gotten the 411 or do you need more convincing to enjoy your life?

READ NEXT: Interview With Dollar: “I’m Too Sexy for This World”

-

You might think your love language is gifting the people you love, but what happens when they suddenly japa and you have to show love in other ways? Because while you may want to be intentional, the exchange rate, distance and logistics will collectively ask you:

To make it worse, it’s much easier for abroad people to send money and gifts back once they get there, making the guilt even worse. We spoke with seven Nigerians who have friends and family abroad, and they talked about the struggle to send them gifts on meaningful days.

Dora*, 21

My Canada-based brother regularly sends me money for school fees, and I hate that I can’t send him gifts to show my appreciation. He doesn’t expect anything from me, but I don’t want to be someone who just “takes” all the time.

For his last birthday, I thought of sending him foodstuff from here because he’d complained about how expensive things were in the African market over there. But when I calculated the cost of the items and shipping fee, it was running into ₦200k. I didn’t have that type of money, and I couldn’t bill him and then use the money to gift him. I had to settle with sending him prayers.

Tobore, 30

I love giving thoughtful gifts, and all my friends know. You can innocently tweet about needing something and find the item delivered to you weeks later. It’s why I’m really bummed I can’t do much for my friends who have relocated. Most of them are in the UK.

Between 2022 and 2023, I could still send £20 or £50 gift cards, or pay for birthday cakes. But I have to adjust with the current exchange rate. I mostly fund their naira accounts now, so they have something when they visit. But I feel like I’m not putting as much thought into gifting as I usually do. The exchange rate is killing my creativity.

Lizzy, 25

My best friend moved to the UK two years ago, and we don’t talk as often as we used to — a deliberate decision on my part.

Talking every day meant I kept sharing my many problems, then she’d send me random money. But I can’t send her money like she does. I can’t say I want to send ₦20k because that’s just £10. What will that buy? And it’s shameful to just be collecting.

ALSO READ: 7 Nigerian Millennials Share Hacks for Living Through Inflation

Joan*, 27

For two years in a row, I’ve celebrated my US-based bestie’s birthday by gathering all our families and friends for a surprise conference call. I don’t even know if the element of surprise is still there. I occasionally send her $10 through our other US-based friends with naira accounts, but I feel that’s too small for a birthday gift.

I tried to get a proper gift from a US store last year — again through a mutual friend — but I was hearing $300. Omo. Conference call had to come to the rescue. At least, she loves the calls.

Anita*, 24

I feel guilty that I can’t surprise my boyfriend on special occasions. One time, I tried to send him shoes, but he realised I was planning something when I asked for his address. He insisted I send him the money so he could buy it himself and cut out the shipping fee bit.

I make up for being unable to go all out by sending money to his naira account. I can’t wait for him to visit so I can properly spoil him.

Richard*, 28

I haven’t bought my friend a birthday gift in the two years since he relocated because it’s either virtual dollar cards don’t work when it’s time to buy things online, or the exchange rate means I can only buy the barest minimum for him.

Thankfully, he understands and just tells me to send prayers. I add a dash of words of affirmation here and there.

Ola, 24

I’ve resorted to asking my Dubai-based big sister to tell me the things I can do to show my appreciation because I can’t afford to do anything else. She has an online business, and I manage it for free. It works out for both of us.

*Some names have been changed for anonymity.

NEXT READ: Nigerians Share Their Funniest Visa Rejection Stories

We interviewed three couples five years after we first spoke with them in 2019. How have their relationships evolved over time? Watch the final episode here:

[ad]

-

I have a hot take: There’s nothing wrong with being a gold digger now that the naira is dancing to the beat of Lagbaja’s ‘Konko Below,’ and everyone has to play survival of the fittest.

So if you really want

to survive this economythat bag and are willing to frolic a little with someone that has plenty of it, then these tips will definitely help you.Tell them why you’re with them

Times are harder than the last time we said ‘times are hard’, so tell them you’re only with them for the money. If they decide to still form heartbroken when the relationship ends, then that’s their business.

Bill them small small

Believe it or not, this economy might also be affecting your goldmine. So, while you’re asking them to move and shake things for you, do it with a conscience before they take their gold and run away from you.

Make sure they always have time for their partner

Don’t be greedy; they’re already giving you their money, so the least you could do is make sure they remember their actual partner and share the time between you and them.

Don’t post them

Always remember they might have a partner. Do you really want them to see the love of their life doing TikTok challenges and cuddling up with you on your Instagram page? We thought as much

Be thankful for your goldmine

Please, have you seen the state of our economy? The fact you found someone willing to share their money with you is a miracle. And you should be eternally thankful for them..

Find other options

What if the gold finishes? What if see finish enters? What if someone else has more money than they do? These are the questions you should o ask yourself before you decide to stick to one gold mine.

Give them good advice

This is important if they are currently in government. Advise them to do the right thing and tell their friends to act right. If you don’t, the thunder the citizens have sent their direction might mistake you for their real partner and meet you where you lay.

-

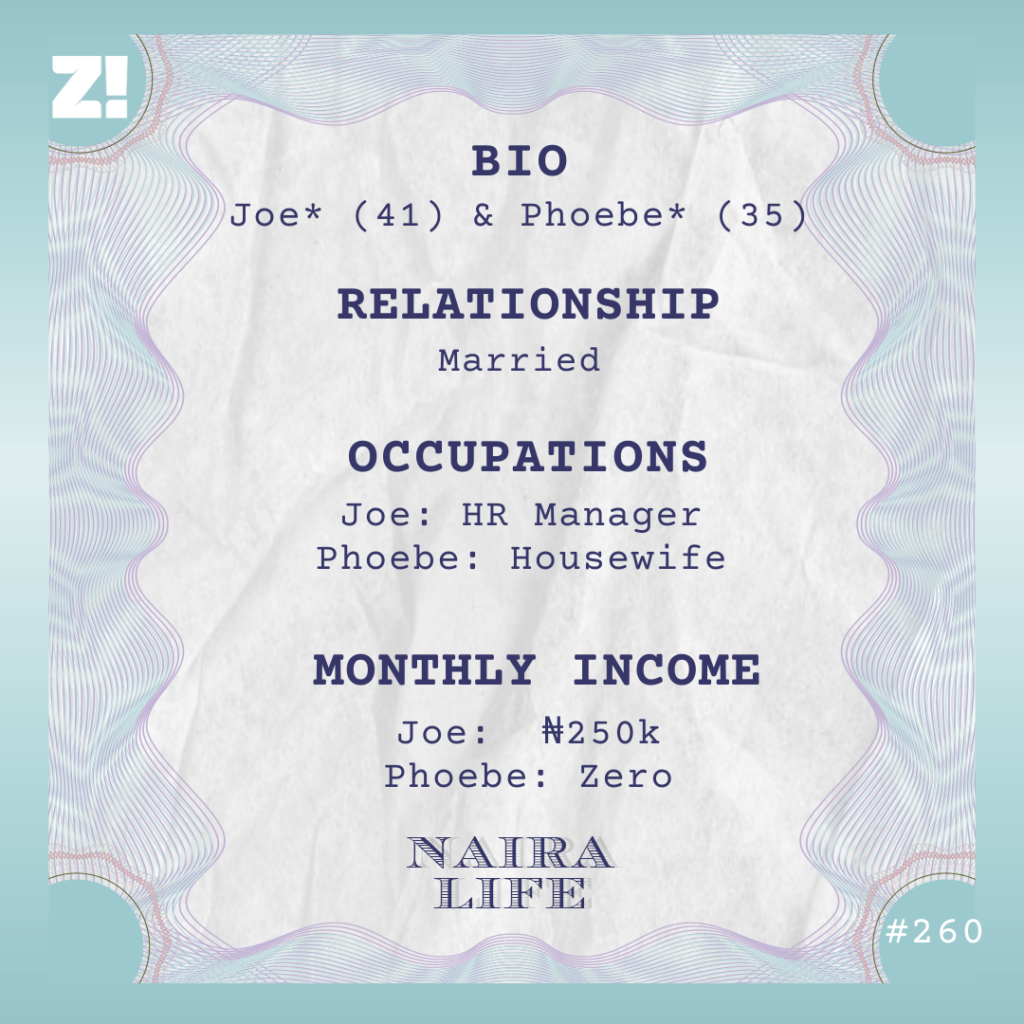

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was the first money conversation you both had?

Phoebe: Three months after we started dating in 2011, he asked me to come over to cook coconut rice and chicken for four friends he was hosting that weekend. He’d boasted about my coconut rice. When he asked how much I needed for the foodstuff, I said ₦20k, and he got angry.

Joe: Yes na. When it wasn’t like I was throwing a party. I immediately started having second thoughts about her — ₦20k was a big chunk of my ₦70k office manager salary, and spending it on that small amount of food seemed wasteful to me. We had a big disagreement and didn’t talk to each other for two days. Of course, the cooking didn’t happen again.

How did you get past that?

Phoebe: He came and begged me when I didn’t reach out. We talked through it, and he understood that I wasn’t just calling one amount for the sake of it. I’d planned to cook one more dish so the food could carry him into the following week. Plus, I don’t like to manage things. If I’m doing something, I want to do it well.

Joe: You should be able to tell that she was the child of a rich man already. Not like us who were born with wooden spoons.

Were you really a rich kid, Phoebe?

Phoebe: I won’t say rich. We were comfortable, though. My dad worked with Nigeria Airways when it was still in operation, and we lived in our own house and had some cars. My mum didn’t even have to work.

I had an allowance in secondary school, although I can’t remember how much it was now. It increased to ₦15k/month when I entered uni in 2005. The money didn’t see the end of the month, sha. I constantly spent it on food, clothes and make-up.

I guess growing up was different for you, Joe?

Joe: It was. We struggled a lot financially due to my dad’s poor financial habits. He was a furniture maker who loved gambling. Whenever he gambled away his money — which was often — he’d collect money from my mum’s provisions business. She had to close the business to take up a cleaning job when I was 10 because the business wasn’t going anywhere.

I’m the first child, so I had front-row access to the whole thing — the days when my mum had to hide money under my bed so we could afford food the next day. Or when she’d beg a neighbour to allow their kid “lap” me on the bus to school, so I wouldn’t have to pay for transport.

I think seeing that taught me financial responsibility, even though I didn’t see it like that then. I just always thought, “Why must this man always spend money like this?” I didn’t want to be like him, so I subconsciously learnt to keep any little money that came my way right from childhood.

Let’s talk about you guys. Where were you financially when you met?

Phoebe: I’d just left a toxic HR intern job and was very broke. It’s not like the ₦50k/month salary they paid did anything, but it was nice to have something at the end of the month. Thankfully, my family and siblings were always there to support me financially. I think it was even the money that one of them sent me I went to withdraw the day I met Joe at the ATM.

Joe: It was an instant attraction, at least on my part. I had to drop all the “toasting” lyrics in my arsenal that day before she gave me her number. I was at the ₦70k job at the time, and I felt I’d gotten to the point where I could afford a relationship.

What do you mean by “afford”?

Joe: I believe finances play a big role in relationships, especially as a man. I should be able to take care of my woman to a reasonable degree. My mum wouldn’t have had to go through all that if my dad had done his duty. It’s why I didn’t really pursue long-term relationships when I was in uni. I had the boldness to pursue Phoebe because I had a fairly good job and lived in a modest ₦150k/year apartment. I wasn’t doing too badly.

So only one of you had an income. What was that like?

Phoebe: We had some clashes in the beginning. He always insisted on paying during dates and encouraged me to come to him when I needed money, but then he’d complain that I was spending too much or getting too much of everything on dates.

Joe: We didn’t see eye to eye on money matters. Every other aspect of the relationship was fine, except that. I was torn between wanting to provide and this madam trying to choke me with expenses.

Did you both have conversations about this?

Phoebe: We did, several times. But I only started to fully understand his issues with my spending when we moved in together in 2012.

What changed?

Phoebe: Living together made our financial situation more transparent — I knew what he had in his account. Since that was essentially what we lived on, I learnt to manage my expectations and spending.

We also started a system where he had to approve financial decisions. We agreed that he was better with money, so it made sense for him to manage it. I couldn’t just use the money he gave me to cook to buy bags. Plus, he’d even see it sef.

Joe: As if that always stopped you.

Screaming. Did this approval dynamic continue after marriage?

Joe: Yes. We dated for two years and got married in 2013. Our alignment on money matters helped make the decision to start a family much easier, so we just continued that way.

Phoebe: I worked as a school administrator for two years after we got married. During that time, we agreed that I’d be sending my ₦75k salary to his account for transparency. I resigned from the job when I got pregnant because I kept falling sick. I haven’t worked at a 9-5 since then. We have two kids now, and I take care of them full-time.

What’s a one-income household like?

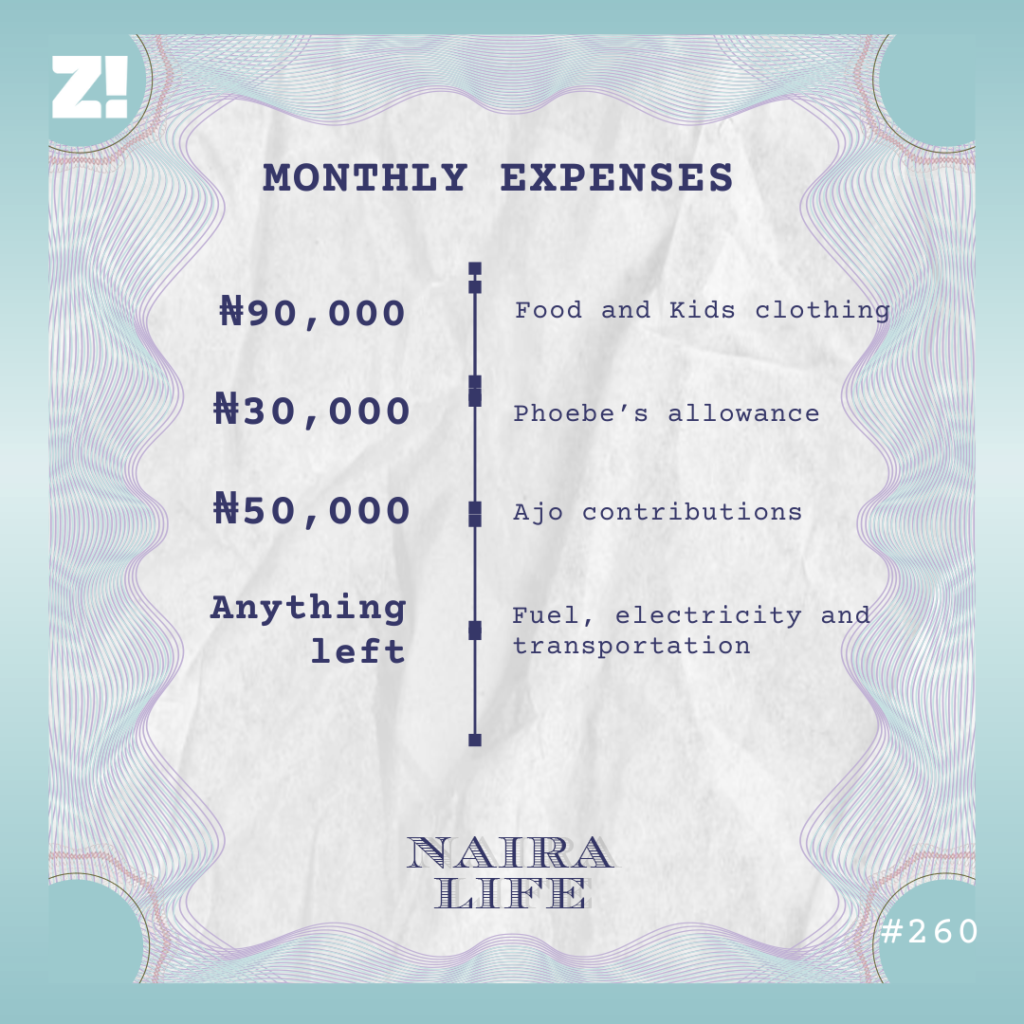

Joe: It is a lot of planning and transparency. She knows what I earn, and she also helps me to manage it. I currently earn ₦250k, and 90% of that goes into the home. I give her a ₦90k monthly allowance that covers feeding, the kids’ clothing and any home emergencies and ₦30k for her personal needs. Then I pay for things like fuel and electricity and save ₦50k monthly with ajo contributions to cover the children’s school fees and our ₦300k/year rent.

Phoebe: I almost always go back to him for feeding money before month’s end because of how expensive things have gotten. It usually lasts three weeks max. Can you imagine that the feeding allowance was ₦50k in 2019, and I hardly spent it all in a month? If you think about it too much, you’ll just start crying.

I feel you. What’s the most difficult thing about a one-income household?

Joe: Definitely the flow of money. It won’t hurt to have extra income. We’ve been considering business ideas for her that could help but also not take her attention away from the home too much.

Phoebe: We’ve actually agreed on wholesaling and retailing bags online, but I’ll need like ₦150k to start. We don’t have that kind of disposable income right now, so we’re just making do with what we have.

Joe, you mentioned you’re a first child. What’s black tax like?

Joe: Phoebe, oya answer. You’re the one always promising money to our family members.

Phoebe: Fortunately, our families don’t ask for money like that, and there’s no monthly obligation. But I think it’s our responsibility to also offer financial help sometimes, especially during joint events which don’t even happen often. The only other expenses are random ₦10ks here and there. Do you want them to think I’m the only one spending your money?

How would you describe each other’s relationship with money?

Joe: She’s clearly the spender, but it’s interesting how she’s evolved from almost reckless spending to weighing the importance of things before spending on them. She also allows me to lead in everything, especially money, and I appreciate that.

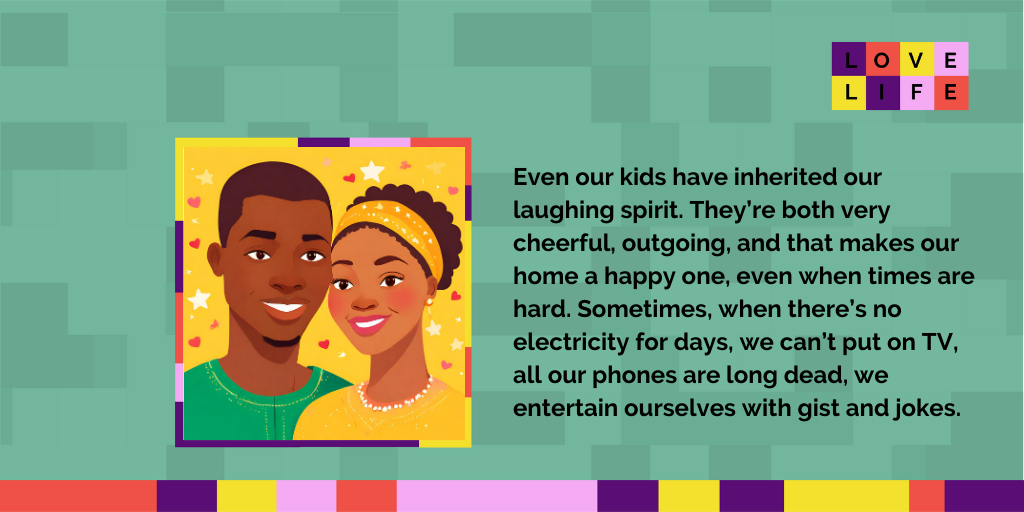

Phoebe: I owe my improved spending habits to his insistence on transparency. He’s very open and analytical about his finances, and I have no choice but to be the same. He’s also very big on providing. I can’t relate to all those Facebook and Twitter discussions that keep asking what women bring to the table. My man doesn’t care. He’s thinking about how to fill the table.

Energy. What’s one thing you want that’d make your relationship even better?

Joe: A house and a better job. If I had a ₦500k/month salary and didn’t have to think about rent, we’d have some extra income to do some of the things she likes. She’s been complaining about how we never go on dates anymore. Plus, our children will enter secondary school in the next three years. So, even more school fees to think about.

Phoebe: Money to start a business. If not for anything, but to have some cash to surprise him once in a while. It’s difficult to surprise him with gifts because he knows how much I have at every point, and if the money reduces, he can immediately tell I’m planning something.

Out of interest, would you ever go back to the 9-5 life?

Phoebe: I want to say maybe when my kids are older, but let’s face it. Young graduates hardly get jobs. What chances would a mother with more than a decade-long career gap have?

Joe: Honestly, I don’t want her to have to worry about that. Let her just be chopping my money.

God, when? Is there anything you wish you could be better at financially?

Joe: Side hustles. Nigeria is too expensive to have one income source. I’m already into real estate on the side — I work as a part-time agent, facilitating land sales with a family friend’s real estate company — but I haven’t made much in commissions from it because I haven’t had time to go for site visits and network with potential clients. But I plan to be more intentional this year.

Phoebe: I think I just want to be better at contributing something to our income. Anything.

How would you rate your financial happiness on a scale of 1-10?

Joe: 5. We can only afford the necessities right now. I dread the day an emergency comes and wipes out everything we have.

Phoebe: God forbid, please. Mine is also 5. We aren’t begging, but we need to earn more to be able to afford a reasonably good life for our kids.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]

-

Navigating loss is never easy. No matter how old our parents get, we’re never really ready for when they’ll leave the earth. I was discussing this with a friend when they revealed their grandmother’s rather strange request: She didn’t want anyone to spend on medical bills if she ever became seriously ill.

Intrigued, I got on the phone with mama’s carer, and with her help, got mama (75) to share her reasons.

As told to Boluwatife

Image designed by Freepik

My children think old age has affected some parts of my brain, so I make sure to repeat the same statement at least once a month: You people should let me die if I ever fall terminally ill.

I’m 75 years old, and in my lifetime, I’ve seen friends and family members battle sicknesses for years. They pile up huge medical bills for their family, and eventually still die. The death that strengthened my resolve not to go the same route was my husband’s.

He died in 2018 at 71, and he was in and out of the hospital for four years before that.

His health battle started with a mini-stroke in 2014. He was admitted, and doctors said, “Oh. Thank God, it’s nothing serious.” That was until they found cancer in his chest during routine scans. Again, they said it wasn’t too serious because it hadn’t advanced much yet.

A year and several chemotherapy sessions later, the doctors had changed mouth. Something about the tumours moving to other body parts. My children gathered money and took him overseas for better treatment. No one told me how much it cost, but I could see in their eyes that they were stretched thin financially and emotionally.

About three years after the initial diagnosis, my husband was declared cancer-free. We did thanksgiving at church and even gave away food items to less privileged people in gratitude.

Six months later, my husband slumped. The cancer was back, and it caused his kidneys to fail. He had to include dialysis to his long list of medical procedures. This time, my children came to ask me if their father had any money saved up somewhere.

He passed away soon after. I was heartbroken. After all we went through, it seemed like we only delayed the inevitable. I don’t want to put my children through the same thing again.

So, I’ve decided I’ll die at home. I take blood pressure medication and pain relievers for my arthritis, but if I ever develop a terminal illness or a sickness that requires long-term treatment, I’ve told them not to take me to the hospital and just care for me at home. I’ve lived long enough already. I’d rather die than become a financial burden. If they go into debt and sell their properties to keep me alive, but I still die due to old age, what use would it have been? Instead of going through surgery or chemotherapy, isn’t it better for me to cross over peacefully?

I think my children still don’t take me seriously even though I’ve been saying this since their father died, but I won’t stop reminding them. Maybe the next step should be to tell them that my spirit won’t let them rest if they make me suffer my last days in a hospital.

I’m not scared of death, and they shouldn’t be too. Everyone has to go at one point, and I prefer to go in a way that won’t burden anyone. I’ve had the privilege of seeing my children marry and become successful, with their own children. What more does anyone want?

LIKE THIS STORY? YOU SHOULD READ THIS NEXT: My Grandkids Are My Second Shot at Parenting the Right Way

[ad][/ad]

-

If you think it’s stressful to ask unwilling friends and family to pay back money they owe, wait till you experience a Nigerian employer from hell who defaults on salary payments. It’s a daunting situation that will take a toll on your mental, emotional and financial wellbeing.

I asked some Nigerians who’ve been owed money by their employers how they navigated the experience, and they shared these tips.

Avoid wasting time

“My former employer was a serial defaulter. I learnt from her that the longer you wait to get your money, the less likely the debtor will make that payment. So, it’s important you start taking proactive measures right after they make that first default on payment.”

A polite reminder

“No serious employer should ever forget your salaries, but there have been cases where all I needed to do was send a reminder. Before you assume that they don’t want to pay and do something rash, it’s sometimes useful to give them the benefit of the doubt and send a polite reminder”

Be proactive with reminders

“If you’ve got a boss with an established pattern of owing or forgetting about salaries, your best bet is to send a reminder a week or two ahead. That way, there’d be no excuse or opportunity to default.”

Reduce your productivity

“Everyone I’ve worked with knows I give my 100% on the job, but the moment my money is threatened, it drops to 50%. When the employer asks why, I’ll simply tell them I don’t have money to cater for basic needs that keep me productive. They might be pissed and want to gaslight you, but it does the trick.”

[ad]

Involve a third party

“I always make it a point to research an employer before taking a job. I must have an idea of the people they roll with. This way, I’ll know who to turn to if there are issues where I need to involve a third party.

One time, I only got paid when I told an ex-boss’s sibling about the money my boss owed me. That said, you should only do this when you’ve exhausted other options.”

Document everything

“Corporate culture taught me the importance of documenting everything. Once I notice I have a boss who acts funny with money, I put my guard up and keep receipts. People like that will make deductions out of thin air from your salary and if you don’t have the evidence to counter them, o ti lor.”

Use social media

“I once had an employer who refused to pay me for months. His excuse was that the company was struggling and there was no money. I eventually resigned and didn’t get paid. Weeks after, I saw this man post pictures of a new Range Rover. My subsequent reminders were ignored.

Eventually, I quoted his car announcement with a thread about how he’s owing me money and tagged some blogs and other popular influencers on Twitter. This man paid my money that same day.

I hate social media drama but I’ve realised that when it comes to debt, it’s one of the most effective ways to get your money.”

Still confused about how to ask your employer for money? You should read this: 10 Memes To Send To Your Shameless Debtor

-

2023 might have been the trickiest year for the naira yet. The currency went through more ups and downs than our constantly embattled national grid and affected Nigerians’ relationship with money in more ways than before.

Per usual, NairaLife had one goal this year: Finding answers to how Nigerians are making, spending — and even losing — their money. How has money (or the lack of it) affected the quality of lives?

The stories we told sparked conversations, offered insights into subjects people seldom think about and caused some “God, when?”s.

Here are ten stories you couldn’t stop talking about, and which deserve a second read.

These are the stories that did the most numbers:

1. How do people in the seats of power live?

This story broke the internet and received mixed reactions when it was published. Some were pissed to read about the extravagant life this politician’s daughter lives, and others weren’t too surprised.

But one thing is clear: it’s important we have these difficult conversations about money. As Ruka, our editor-in-chief, explained in this thread, these conversations are a stark reminder of the country we live in.2. She has over $150k in savings but is only 50% happy

I had to physically stop myself from converting $150k to naira when I read this story the first time. This lawyer should hold a savings masterclass. She has three savings buckets in dollars. When asked why she put her financial happiness at just 5/10, she said, “I need more money. I want to be able to travel and do more for myself without having to touch any of my savings buckets.”

Fair enough.

3. There are side gigs, and there ARE side gigs

I’m not sure if “side gig” is an accurate description of the other jobs this finance guy does. I mean, if your main salary pays ₦1.2m/month and a side gig pays as much as ₦8m, which one deserves the tag of “main income source”?

Anyway, you’ll definitely learn a thing or two from his story.

4. How do you own real estate worth over ₦40m on a civil servant salary?

The answer is years of planning, relationships and access to loans. This NairaLife is one of the most insightful ones I’ve read so far. I’ve never found civil services appealing, but after reading this, it’s not looking so bad.

5. The writer making bank in crypto’s volatile market

If peer pressure ever pushes you to crypto, consider what the content writer in this story said first: “I feel the best way to make money in crypto is to get a job in crypto. So, while I hold some coins and try my best to avoid trading, I watch out for job opportunities in the crypto market. It’s the perfect blend of stability and risk.”

That said, he’s raking in a cool $1200/month following his own advice.

These are the stories you absolutely need to read:

6. A Nairalife sponsored entirely by faith in God

This was the first Nairalife story I wrote, so it has a special place in my heart. He’s a full-time missionary who should be earning ₦49k/month, but he hardly gets paid because his pay depends on donations.

I’ll never forget the confidence with which this missionary said, “I move with this confidence that I have God and can never be stranded.” Literal chills.

7. He made 100x his salary in three years, and it started from a bet

You know that proverb, “What an elder sees sitting down, a child can’t see even if they climb the tallest tree”? It’s a good thing the data engineer in this #NairaLife didn’t follow that. His dad wanted him to join the military, but he chose computers. We can agree that decision paid off, because he now makes ₦3.5m/month.

8. From almost-yahoo boy to POS agent

I don’t think I’ve rooted for someone as much as I do the 23-year-old in this story. He’s been hustling since he was very young and left home when he was 16. No, his parents weren’t dead. They just weren’t present.

At his lowest, he almost turned to a life of crime. But a chance encounter changed the course of his life.

9. The stay-at-home dad who’s choosing his family over money

It’s unusual to find a dad who chooses to do a “woman’s job” by becoming their children’s primary caregiver in Nigeria’s heavily patriarchal society, so I knew I had to tell this story.

Fun fact: This interview was interrupted several times when his kids cried, and he had to attend to them. I thought it was the cutest thing ever.

10. Navigating a finance-threatening mental disorder

I first heard of the term “dyscalculia” during the interview for this story. This 25-year-old subject has struggled with numbers for as long as she can remember, and as an adult, it’s progressed into an inability to handle money and poor financial decision-making.

On top of that, she was diagnosed with Borderline personality disorder in 2022, which explains her constant struggle to keep jobs. Her story really gives individuals’ relationship with money a whole new perspective.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad][/ad]

-

Whether you believe it or not, you can’t live by money alone.

In my observation, while looking out for you and other fellow Nigerians, here are some essentials you probably need more than money this holiday.

Romance

Romance is sweeter with money but sweetest when you have nothing else to hold on to. Grab your partner and dream of a future where you can finally afford Detty December.

Good health

You shouldn’t have to be told this, but here we are. There’s no Christmas balling without sound health. Watch what you consume, look twice before you cross the road, spend quality time with family if you like them, and for Lagosians: stay indoors if you’re not ready to spend hours in traffic and looking for cabs.

Direct supply of original products

We’ve apparently been buying counterfeit soy sauce, drugs, drinks, canned food, etc. You need to eat and use original products to keep good health. If you find out where to get these products, please inform us.

Time with loved ones

My dear brother and sister, a lonely Christmas and holiday benefits no one. Get yourself some company and loving, and make lasting memories money can never buy.

Work promotion

Think about it, promotion at work may come with bigger responsibilities, but your money goes up too. If you ask me, it’s better than a money gift that’ll finish in less than a week.

Job referrals

When people speak highly of your work and recommend you to your potential clients and employers, that’s something money can’t buy.

A personal ride

Specifically for Lagosians because your road network problems need divine intervention. In this surging transport fare issue, a personal ride is what you need most this December and beyond. Skateboard, bicycle, scooter, tricycle, motorcycle, motor car, trailer, whichever works for your budget. Work according to your budget. I wish you a safe ride.

An appointment on Tinubu’s cabinet

Tinubu’s government and friends are the only ones balling in Nigeria currently. What’s better than joining the ballers? Though the curses of agitated Nigerians won’t miss you too.

Relocation

An escape from this ghetto and being able to catch your breath from the wahala of corrupt government, insecurity, fake products, harsh economy and many other stressful things. Even though their currency is now better than ours, you can start with Benin Republic.

-

Every year, the naira fights valiantly for its life with little success, and 2023 has been no different. The year started on a hopeful note. With the 2023 general elections scheduled for the first quarter, many young Nigerians were optimistic about a government change that would mean a long-overdue improvement in the economy and other sectors.

The elections ended with one of the most keenly contested results in Nigeria’s history and the results have contributed in no small way to the many ups and downs (mostly downs) Nigerians have experienced money-wise since.

This is a timeline of 2023’s most important money events and conversations.

New fuel prices (Part 1)

Image: Punch Newspapers Nigerians aren’t strangers to fuel scarcity, but the 2022 floods and reports of adulterated fuel brought us the worst version we’d seen at that point. Unstable fuel prices followed us into January 2023, with fuel stations selling at between ₦200 – 250 per litre against the standard ₦167. The Federal Government officially standardised fuel prices at ₦185 per litre on January 19, 2023, and sent a memo to petroleum marketers informing them of the same. Lagos State even created a timetable for filling stations to further beat the scarcity. By April, fuel sold at ₦254 per litre.

THE STORY: Nigeria has Standardised Fuel Prices. But Our Problems Are Not Over

The cash scarcity saga

Image: Channels Television Godwin Emefiele first announced the redesign of the ₦200, ₦500 and ₦1000 notes on October 26, 2022, with a January 31, 2023, deadline to phase out the old notes. What followed was a series of events fit for a telenovela. The Minister of Finance, Zainab Ahmed, claimed she wasn’t informed. The naira soon fell sharply in the foreign exchange market — selling at ₦1,000 to £1 and ₦800 to $1. By January 2023, the new notes still weren’t in circulation.

The CBN moved the deadline to February 10, but two days before the new deadline, the Supreme Court gave a temporary order to halt the expiration of the old notes. In response, President Muhammadu announced that only the old ₦200 notes could remain in circulation beyond February 10. While experts debated on whether the president could overturn the Supreme Court’s ruling, Nigerians suffered the brunt of widespread cash scarcity and bank transaction failure.

The ATMs were either empty or limited to ₦5k daily withdrawals. Bank queues were longer than a Fela album. This led to protests across the country — several banks and ATM points were set ablaze. Most institutions were ill-equipped to accept cashless payments. Patients were left untreated as family members went on the hunt for cash. People were left stranded in supermarkets after botched POS or bank transfer transactions. A pregnant woman in Kaduna reportedly died because her husband couldn’t get cash in time for her to be admitted to a health centre. Pure chaos.

THE STORY: What Has the Naira Scarcity Cost Nigerians?

The rise of POS agents

Image: Zikoko Memes POS agents quickly became major players in the scarcity as Nigerians turned to them for urgent cash needs. But the agents had to brave the long ATM queues or buy the scarce new notes at high rates, which reflected in their transaction charges. In Ekiti, POS charges increased from ₦20 per ₦1k withdrawal to ₦300 per ₦1k. In Lagos, POS agents charged as much as ₦2k – ₦3k to give ₦10k cash.

While all this was happening, the Nigerian government was focused on the February 2023 elections. It wasn’t until March that the Supreme Court and CBN confirmed all old notes would remain legal tender till December 31, 2023. In November 2023, the Federal Government asked the Supreme Court to extend this deadline yet again for an indefinite period. And one is forced to ask: Why all the wahala in the first place?

THE STORY: The #NairaLife of a POS Agent Forced to Plot New Business Moves

“Fuel subsidy is gone”

Image: The Ideal Those were President Bola Tinubu’s famous words in his inaugural speech on May 29, 2023. Right away, fuel stations started hoarding fuel, leading to another scarcity within months of the last one, panic buying and transportation hikes across the nation. The few open fuel stations sold at ₦500 – ₦700 per litre even before the new prices were announced.

The official prices ended up going as high as ₦557 per litre. By July 2023, it had climbed to ₦617 per litre. Fuel rationing led to a decline in fuel consumption nationwide, fewer cars on the streets as people took to trekking, increased cost of goods and services hinged on transportation and general hardship. E-hailing cab drivers even went on a nationwide strike, requesting an increase in fares as they could no longer work with the new fuel prices.

President Tinubu claims that fuel subsidy removal saved Nigeria over ₦1 trillion in two months, which “will now be used more directly and more beneficially for you and your families.” What this means exactly and how it will be done isn’t clear right now.

THE STORY: Fuel Subsidy: Tinubu Went off Script, and Nigerians Are Facing the Brunt

Student loans with a jail-time caveat

President Tinubu signed the Student Loan Bill into law on June 12, 2023. The bill, which should provide interest-free loans to indigent Nigerian students, was received with mixed reactions. Nigerians expressed concern over the loan requirements and two-year imprisonment punishment for defaulting on repayment. The Student Loan Scheme is expected to kick off in January 2024.

THE STORY: The ABC of Nigeria’s New Student Loan Bill

Foreign exchange goes south

Image: Forbes Africa On June 14, 2023, the CBN released a press release announcing its decision to allow the naira to “float” in the foreign exchange market, with hopes that it’d bring our currency to a unified exchange rate. This came after Tinubu suspended former CBN Governor Emefiele on “financing terrorism” charges. The policy change meant the CBN would no longer determine the exchange rate, and the rate at which the naira gets exchanged for any foreign currency is dependent on the agreed price reached by the buyer and the seller.

[ad]

The naira fell by 36% against the dollar on the official market and sold at ₦750 to a dollar from the previous ₦477 to a dollar. Some experts commended the float, expecting the rate to stabilise over time and positively impact investor confidence. Others, like Femi Falana SAN, criticised it as illegal.

THE STORY: Losers and Winners from CBN’s Unified Exchange Rate Policy

School fees 200% hike

What’s really going on? In July 2023, the Federal Ministry of Education (FME) announced a school fees hike from ₦45,000 to ₦100,000 for new students of Federal Government Colleges. This came despite appeals by the Nigerian Parents Forum in June 2023. Federal universities like the University of Lagos (UNILAG), the University of Nigeria (UNN) and the University of Maiduguri (UNIMAID) also announced hikes by as much as 200%, to the dismay of students and parents alike. While the presidency argued that tuition is still free, the schools increased their miscellaneous levies, citing prevailing economic realities and the high cost of living.

Mass business closure and layoffs

Image: Zikoko Memes In August 2023, Pharmaceutical company GlaxoSmithKline (GSK) announced its decision to exit the Nigerian market after 51 years of operation, due to foreign exchange scarcity and volatility, rising business costs and a shrinking consumer base. Procter & Gamble, Unilever, Sanofi, Jumia Food and Bolt Food, joined the exodus, contributing to mass unemployment in a country with 71 million citizens already living in extreme poverty. Nigerian-based companies and small businesses weren’t spared either. 20 out of the 175 textile companies in Nigeria were forced to shut down. Due to the rising cost of maize, poultry farms followed. Tech companies like Bolt, Alerzo and Jumia, conducted mass lay-offs to stay afloat.

Nigeria’s new $1.95 billion loan