Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Tell me about money when you were a kid.

I remember the first person who ever gave me a ₦500 note. A guest spent the night with my family and gifted two notes to me when he was leaving the morning after.

Shout out to visitors that roll out cash.

Haha! I’ll say we were comfortable. Bills were paid on time, new stuff for school every session, we travelled abroad for summer vacation. We weren’t wealthy, but we had enough. We had the new consoles, the latest sneakers, the newest phones.

Sweet.

That was before my dad retired sha. After he did, my mum kept up the good work, but it wasn’t like before.

What did your dad do for a living, and what did your mum do?

My dad was a medical doctor working as an expat in another country – he did that for 20 years. He had to work across cities in the country, even in a village. My mum was a teacher, but she moved to live with my dad for about 9 years and I lived with both of them for a while before coming back to Nigeria. She came back to Nigeria and became the principal of a school.

Now she’s a businesswoman.

What’s the first thing you ever did to ‘earn’ money?

In secondary school, I would write poems and sell them for Valentine’s Day. So I would write like 5 poems, you select the one you want, pay, then my best friend would use her beautiful handwriting to write inside your card. If you want a custom poem, you pay extra. My best friend and I shared the money 50-50. I was in SS2/SS3 at the time.

*Love letter for ₦100*

We were in a boarding school so it was extra money to buy snacks and food during breaktime. I was known for my literary work once upon a time.

Young bestseller. Inside Life!

Inside Naira Life, hahaha.

After that, did you do anything to earn money?

I just had to be someone’s child, hahaha. Allowances basically – all through uni. There was really no need to look for extra income then. And medicine is a jealous profession. It’s not easy to combine it with something else.

So naturally, House Job after actual school?

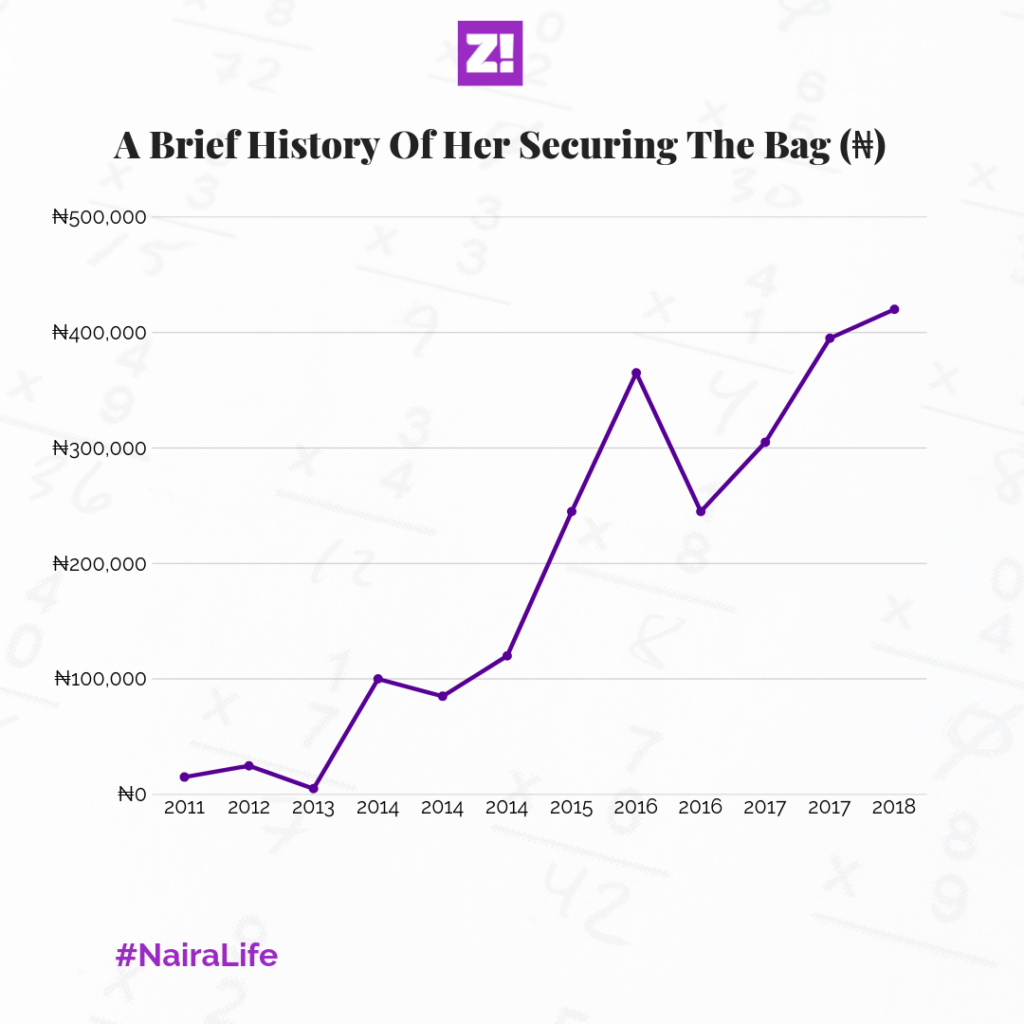

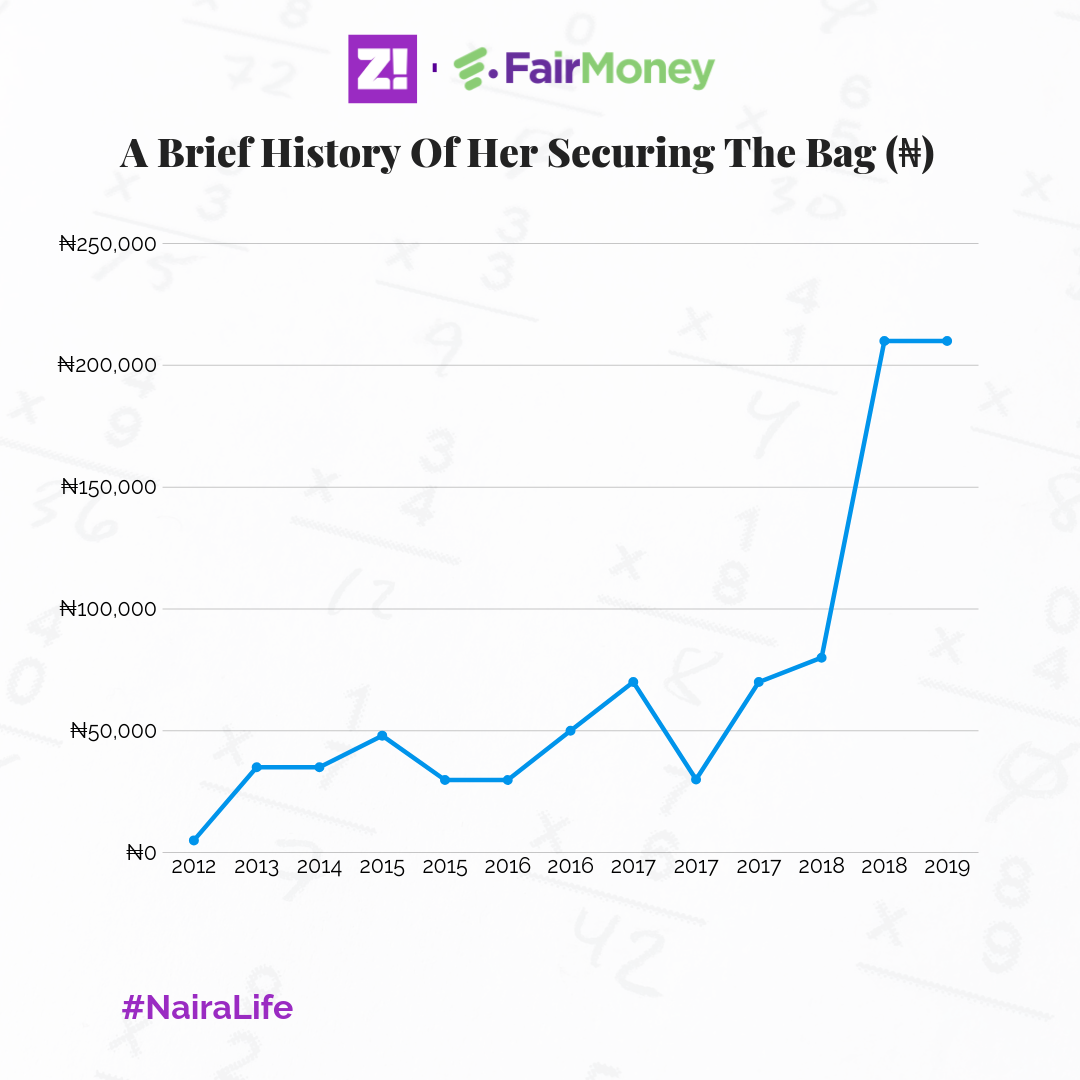

Yeah, I moved to Lagos for that. Got a job with the Lagos State Government and we were paid about ₦157k. Now the money was different almost every month, and the payslips never really explained what was going on but ₦157k was the average. I turned 25 during this, and I did the house job from 2015 till 2016. I got a job almost immediately after – barely a week – at a private clinic in Ikoyi and I was paid ₦80k monthly. 8 am to 4 pm, 5 days a week and alternate Saturdays.

However, just before getting this job, I started a fabrics business with a capital of ₦30k – buying and selling.

Smooth.

I worked in the clinic for a few months before NYSC. During NYSC, I was paid ₦43k by the state and after plenty gbas-gbos, ₦75k plus allowee of ₦19,800.

After NYSC, I had the option of going back to Lagos State or the private clinic but I wanted something else so I was home for six months. My husband noticed how much of a struggle it was during those months.

Wow. What did you want so badly that you were willing to wait for 6 months?

Something around Advertising, Marketing communications or Business consultancy. During that period, my business was my major source of income and fortunately, it was doing well.

So so sorry about that.

Anyway, after months of not getting any job in the field I wanted because “what is a doctor looking for in this field” and other unreplied applications, I went back to the private clinic. But when I went back, I told my boss that I wanted to do social media marketing also and I wasn’t going to work 5 days a week.

Wait, you mentioned husband earlier.

I got married during NYSC.

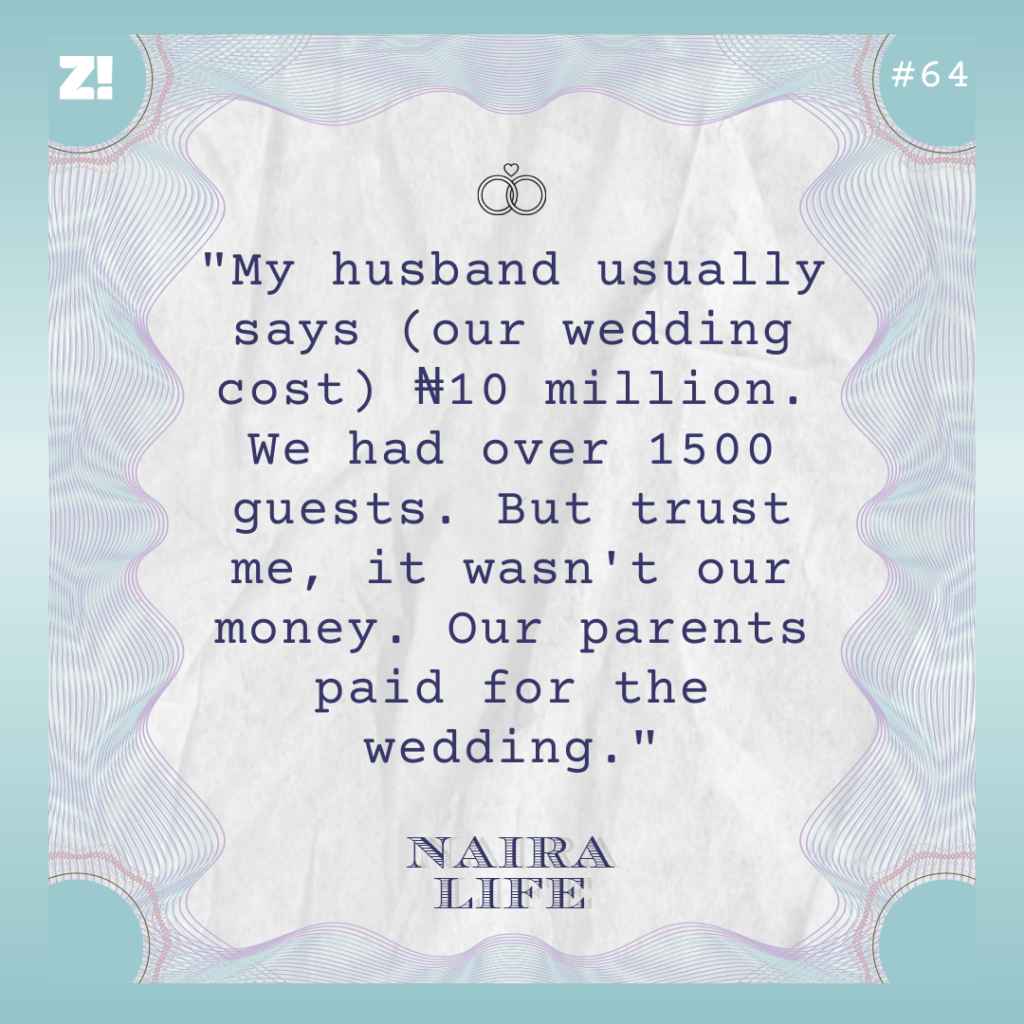

Ballpark number. How much did your wedding cost?

Hahahaha. My husband usually says ₦10 million. We had over 1500 guests. But trust me, it wasn’t our money. Our parents paid for the wedding. The money we saved up was used to get an apartment and set it up – I saved ₦300k. We had a list of things we needed for the house so when people asked what we wanted for the wedding, we sent the list.

How much will you say your gifts saved you, in cash?

Over ₦500k – fridge, microwave, washing machine, gas cooker, blender, water dispenser, and other things I can’t even remember. We could have bought those things eventually but we would have bought cheaper ones. My husband is a doctor too and when we got married, he was working in a private clinic while I was a Corper. So we had to be penny-wise.

You fed an army.

The parents did. We just had fun.

Do you ever imagine a scenario where they just handed you the cash instead?

I tried to convince the parties involved. I was told how impossible it was for me to have a small wedding. I’m the first grandchild of my mum’s family with 6 aunts and an uncle. They consider me their baby. Everybody came from across the globe.

Okay okay, back to getting back to being a doctor

And social media marketer. Surprisingly, she agreed. Anyway, I started working 3 days a week and alternate weekends. I handled social media also. I was paid ₦1.5 million/annum, and I used the other two days to run my business.

So, you worked there as a doctor and managed their social media? Awesome!

Yes. And surprisingly, when I calculated my salary, it was higher than what a lot of my friends were earning as doctors.

That’s interesting.

Medicine doesn’t pay well in Nigeria and it’s really sad. I have many many friends who have relocated and are planning to relocate soon.

In fact, the whole medical journey can be a struggle. They sold us the medical dream but didn’t show us the full picture.

My dad once told me that if I wanted to be rich, I shouldn’t be a doctor. Didn’t make much sense to me then but I get now.

Doctors are some of the smartest people but many don’t know anything outside medicine. I know many people who would like to try something else but they don’t even know what else to do. So they stick with what they know.

Society doesn’t even make it easy. The pressure is ridiculous.

In all, the real ballers are the owners of big hospitals. Especially those who have registered HMOs. Then consultants who studied abroad and then come back to Nigeria and consult for big big clinics, or hospitals. Just consulting for big hospitals is enough. That’s a lot of reading and investment.

Ah, that’s brave.

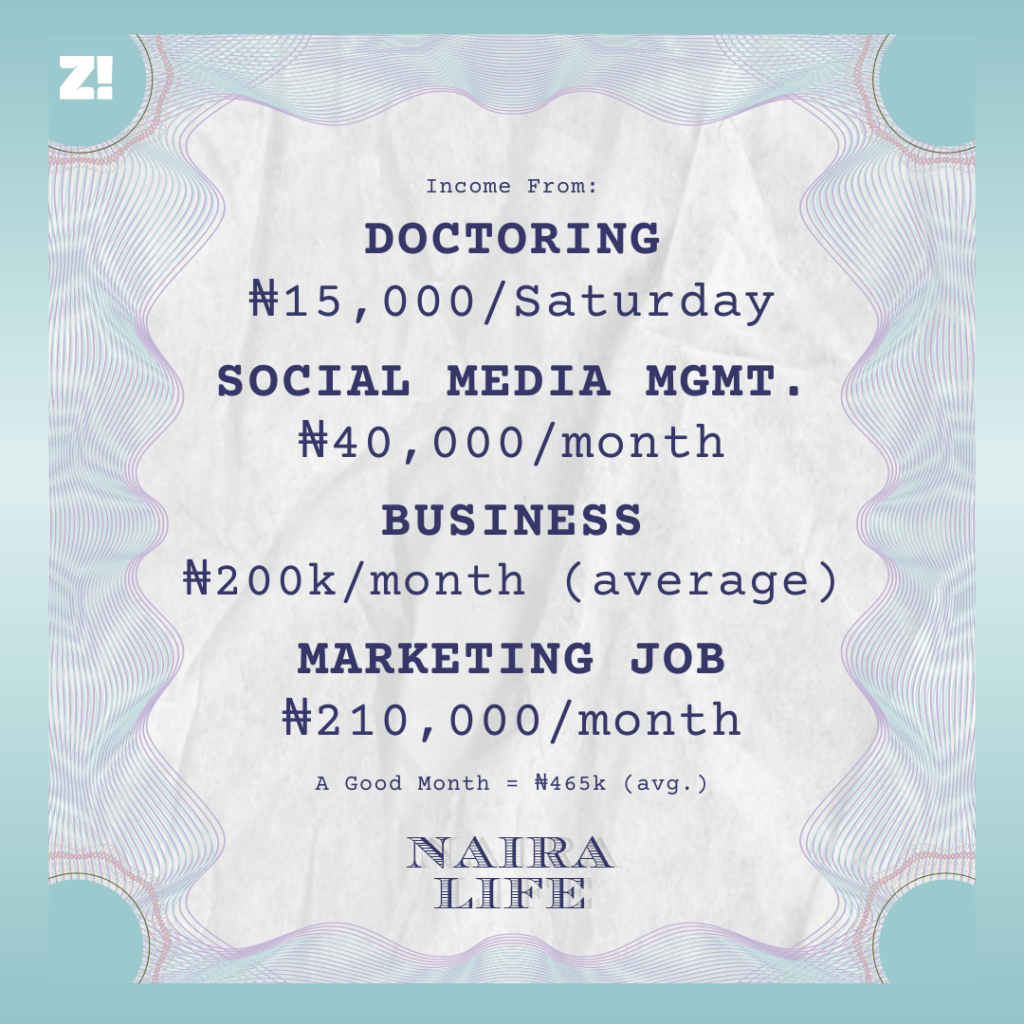

Yep. In fact, I got a job in 2019 at a marketing company. I still work as a doctor but only on alternate Saturdays and I still handle their social media. And I still run my business.

Let me tell you a funny story.

I’m listening.

When I was going to switch, I was scared – leaving the known for unknown. I had wanted this for a long time and I was really getting boredat the clinic. Then I got my job offer and saw how much they were offering.

How much?

₦3.6 million/annum. My friend and colleague at the clinic made me drop my resignation letter that day. My husband was out of town, I sent the offer letter to him and he sent back a draft of my resignation letter

Hahaha.

When I resumed, I experienced culture shock. I was coming from a place where we waited till the last day of the month or the first day of the next month for salary to getting several credit alerts for different things in the course of the month.

Mad o.

A few weeks after I resumed, the MD announced that everyone was getting a raise. I remember sitting there thinking:

Is this how you people used to do it? That was the day I knew I wasn’t going back to full-time medicine. I had seen the light.

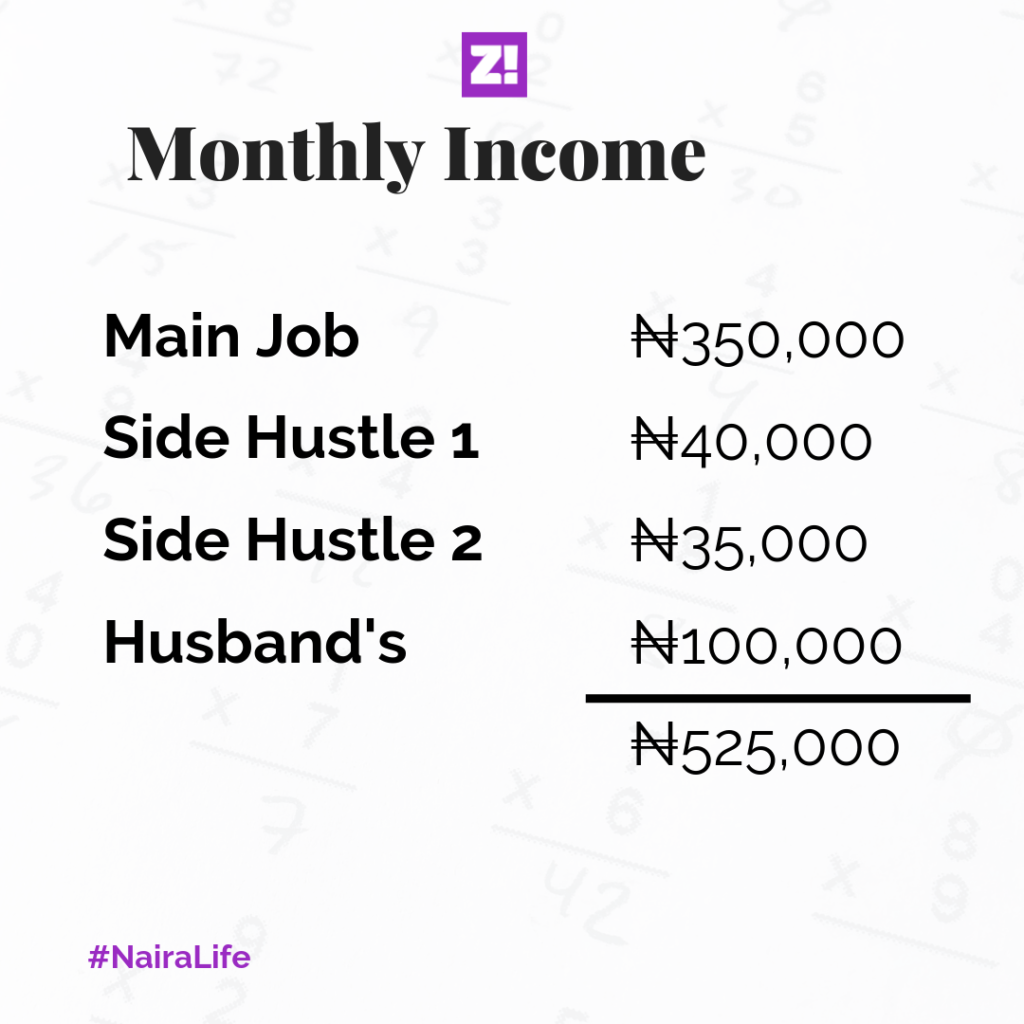

Well done! So, business plus clinic side gig, plus main job, what’s that looking like?

When my business started, I used to do a lot of running around and it was quite stressful. But these days, I pray and focus on large orders – less stress, more profit. And everyone is happy. Pre-COVID, I tried to do one batch a month.

Ah, and now covid has paused it?

For individuals, yes, but I supply fabrics to businesses too so I still got some of those during this period.

What’s something you want but can’t afford?

I was dreading this question. Because I don’t think I have an answer. Probably to spoil my husband and parents the way I would love to. My reason is because I hardly ever drop lump sums for anything. I prefer to pay in installments or save up for something. I plan my money.

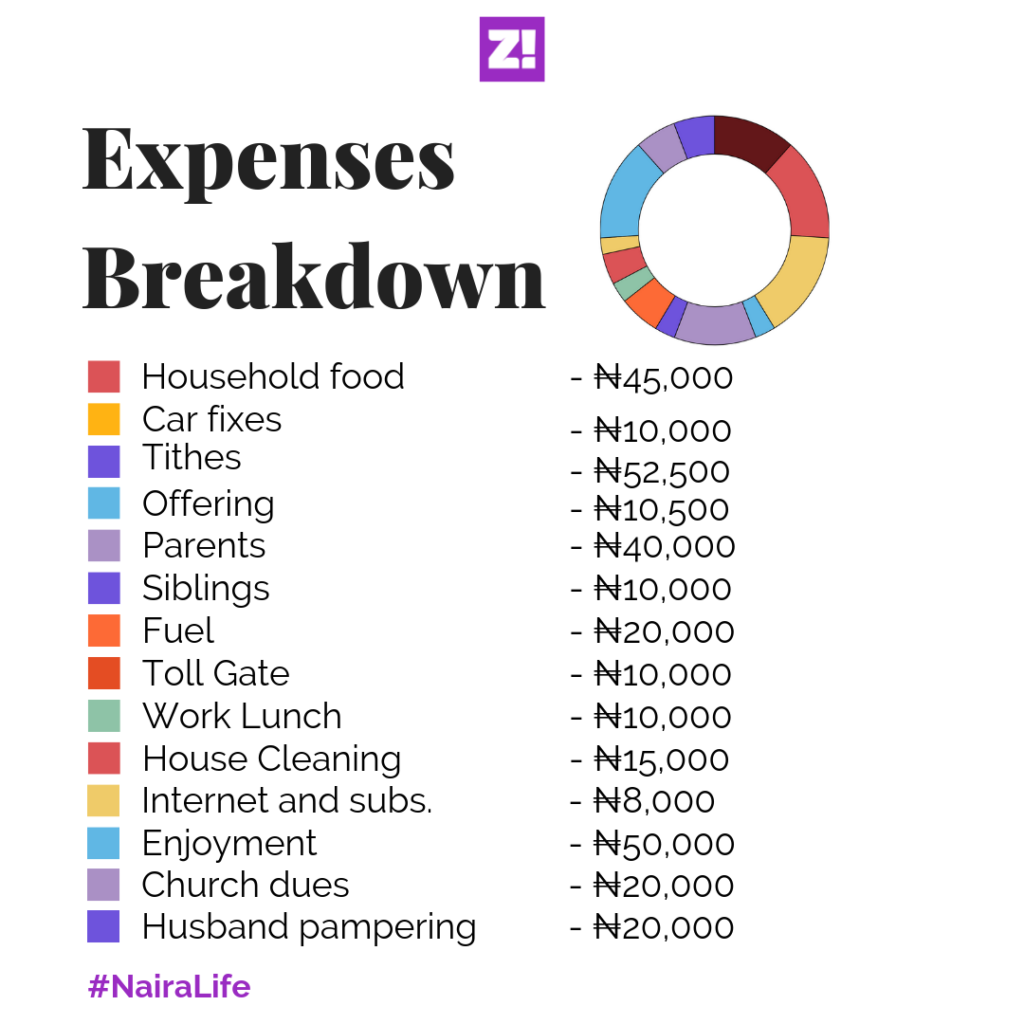

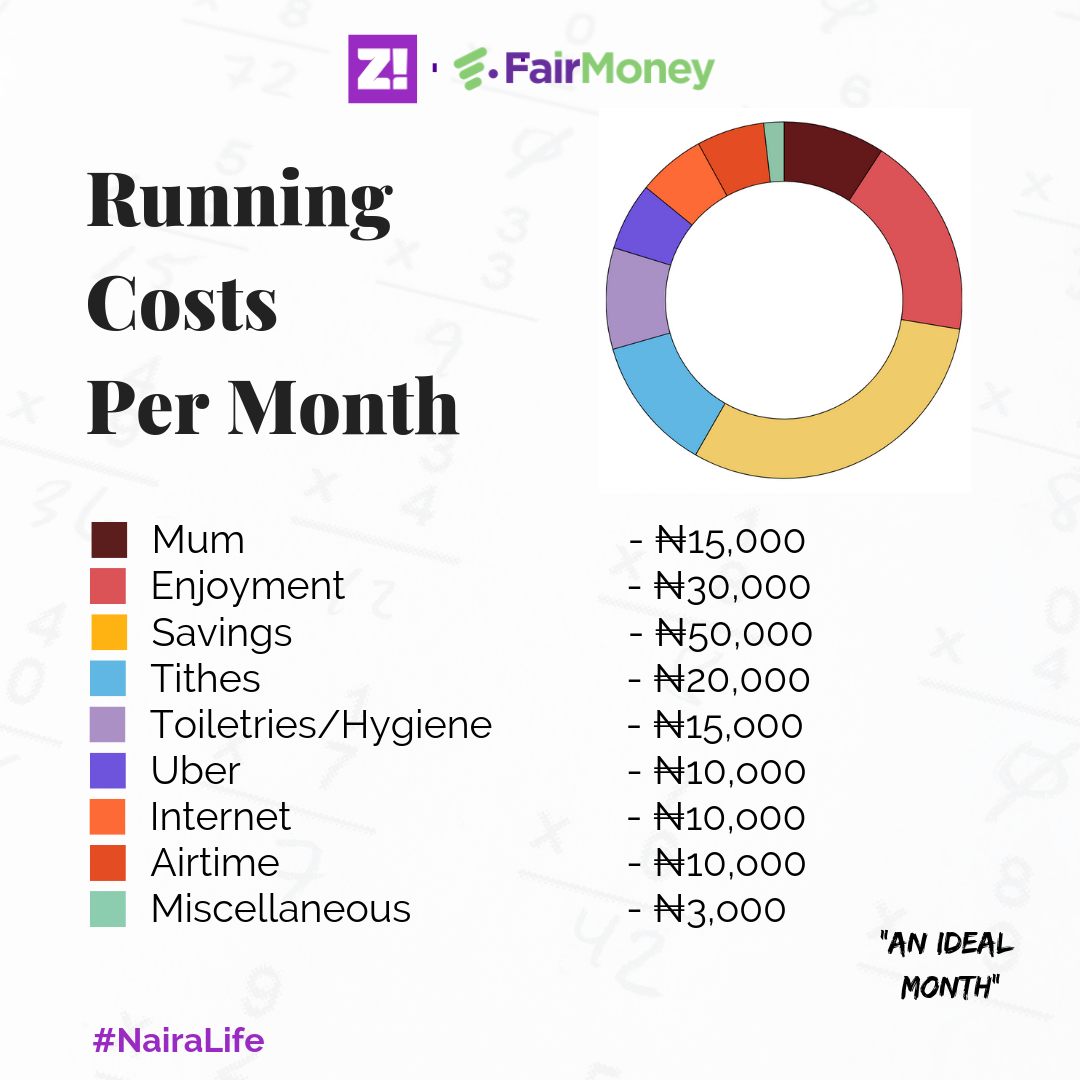

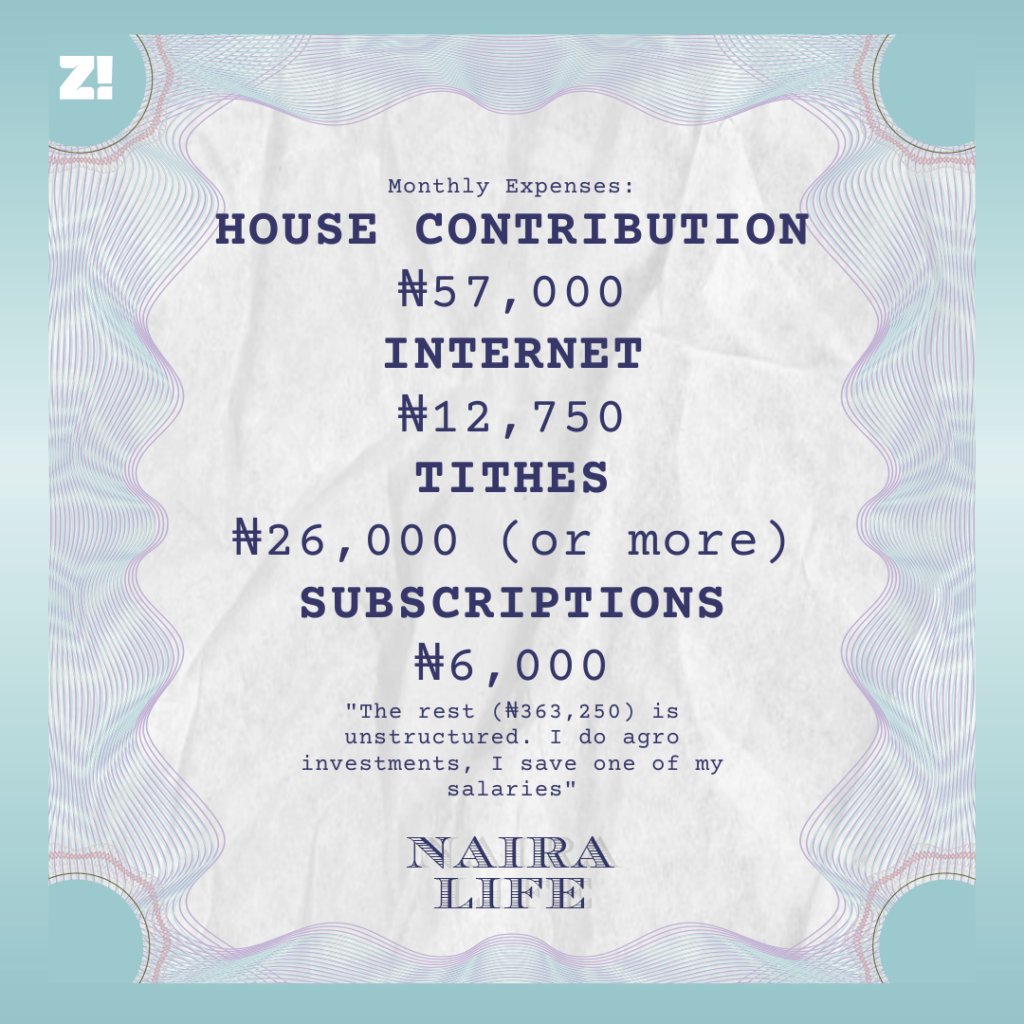

Talking about planning your money, what’s your monthly expense sheet like?

Anything that’s not here doesn’t have structure. I do agro investments, I save one of my salaries in Dollar vest on Piggyvest. I just started getting into stocks and Eurobond etc – one of my salaries, the clinic gig. I send money to my parents sometimes.

I have a shopping addiction – shoes and clothes. I am trying to slow down now.

Tell me about your wildest splurge

I think December 2019, a store was doing sales and I was just buying shoes and clothes. Bought Christmas presents for people. Dropped money for church and some other money gifts. I don’t know how much I spent but roughly ₦200k to ₦250k.

Woah.

You’ve heard worse jo.

Hahaha. Yes I have.

I’m not really one to splurge. If it’s above my budget, I don’t think about it. It’s not even an option. I wait for sales or a better deal. If it’s essential, I save or pay in installments. The only thing I splurge at once are agro investments.

What’s the most annoying miscellaneous you’ve had to pay for?

MDCN annual fees. I hate that I have to pay for it year after year and nobody is actually checking to see if I am doing the right thing.

I know you plan all your money, but what’s the last thing you paid for that required serious planning?

We moved houses. From a rented flat to one that is almost free (₦12k a month with electricity and water and other perks) but we had to renovate. So we needed to plan that. However, because we had been saving our rent monthly, it made it easier so we just used the rent money for renovation and added extra. Stretched finances a bit but we are good.

₦12k a month? Is there still space?

Hahaha, it’s hospital quarters o. I was doing shakara before but after doing the maths, nobody begged me. They are supposed to be taking it straight from my husband’s salary.

Lit lit lit lit o. Do you have a sense of how much renovation cost?

About ₦600k. We bought a few things too.

Tell me a financial regret you have.

I wish I had gotten more savvy about investments earlier, probably during housejob. I started taking it seriously last January and I have seen great improvement. But also, one needs to earn more to be able to save and invest more.

My financial decision I don’t regret though, is starting my business.

On a scale of 1 to 10, how will you rate your financial happiness? And why?

7. I’m content with my life to be honest. I can’t think of anything I really need that I don’t have. I have things that I want but no hurry, everything good will come. The remaining 3 is for the potential money I can make if I take the right steps. There’s always room for improvement.

One last thing.

I’m listening.

If your 13-year-old came to you and said, “Daddy, I have met the man/woman I want to spend the rest of my life with,” would you approve?

I am guessing you wouldn’t let the child make such a decision. So why do we make kids choose what career paths they want to follow at that age?

Some will know, but many of us are on a journey of self-discovery. And I’m still on that journey. I don’t have a 5-year plan. I have an idea of who I want to be but I take each day as it comes and enjoy the experience.

I enjoy being a doctor, but I know there’s so much more that I can be and I’m not afraid to find out.

Grand closing. Thank you very much for taking the time.

This story was edited for clarity. Some details have been changed to protect the identity of the subject.