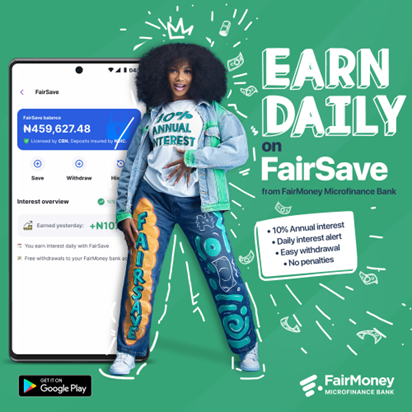

In the ever-changing world of finance, having a reliable financial partner is critical to achieving financial security and peace of mind. FairMoney, a leading digital financial service provider in Nigeria, is committed to being the ultimate financial guy you can count on. Here are five times when you need a financial friend, and why FairMoney is the perfect solution:

- When You Need Emergency Funds: Unexpected financial emergencies can happen to anyone, anytime. FairMoney offers quick access to loans without collateral, making it the perfect financial friend to turn to in times of urgent financial needs.

- When You Need to Navigate Economic Hardship: Economic hardship can be tough to navigate, especially when it comes to finances. FairMoney offers flexible repayment terms and interest rates that are relatively low compared to other banks. This makes it easier to manage your finances during tough times.

- When You Need to Start a Business: Starting a business requires capital, and not everyone has the financial means to start one. FairMoney offers loans that are tailored to your business needs, allowing you to kick-start your entrepreneurial journey. If you’re already a business owner, you know how important it is to have inventory to sell. But sometimes, you may not have the cash to restock your store. FairMoney offers loans for business owners, so you can get the capital you need to keep your business running smoothly.

- When You Need to Pay Medical Bills: Medical expenses can be overwhelming, and not everyone has insurance to cover these costs. FairMoney can help you cover these expenses with its hassle-free loan application process.

- When You Need to Pay School Fees: Education is essential, but not everyone can afford to pay for it upfront. As parents or students, we know how stressful it can be when school fees are due. FairMoney offers loans of up to 3 million naira without unnecessary paperwork, making it easy for you to get the money you need to pay for tuition and other school-related expenses.

FairMoney is the ultimate financial friend that you can count on in times of need. With its flexible repayment terms, and hassle-free loan application process, FairMoney has established itself as a reliable provider of digital financial services in Nigeria. Whether you need emergency funds, help navigating economic hardship, or assistance paying for medical bills, rent or school fees, FairMoney is here to help. So, next time you need a financial friend, think of FairMoney – the guy you can count on.

For more information, visit www.fairmoney.io