Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

There was a time when my mum would throw money on the floor to keep me busy, and I’d pick them up and arrange them. I was a toddler, so I don’t remember much. The first money memory that stuck happened when I was 13 years old.

What happened?

My mum gave me ₦200k cash to deposit at the bank, and the bank staff took me to an inner room to sort out the transaction. They even asked if I wasn’t too young to handle that kind of money.

I was just about to ask that, too

It was normal for me. My parents started sending me on similar errands early. With my mum‘s egg depot business and my dad’s lecturing job, they had very little time and these errands fell to me as the firstborn.

What was the financial situation like growing up?

Money wasn’t a problem. By that, I mean, my siblings and I went to good schools — not like we were travelling abroad for vacation every year.

Haha. Do you remember the first time you made money?

I sold recharge cards in JSS 1 because I wanted to make my own money. My mum gave me the ₦3k capital, and I sold them at her shop after school. But I didn’t realise I wasn’t supposed to eat both the revenue and profit. So after selling off the first set of cards and using the money to buy snacks, there was nothing left to buy more cards. The business lasted two weeks.

The next thing I tried to sell was zobo in JSS 2; I’d use ₦1k to make 30 bottles of zobo and sell each bottle for ₦50. My customers were on my street and I used all my profit to buy Lemon Plus sweets, Nutri-C and Noreos biscuits.

How long did this business last?

I can’t remember now. I think I just got tired after I made enough money. That’s one thing about me: I start businesses on a whim when I’m broke and stop following through when my finances are better. I had a few other zobo-selling stints across the six years I spent in secondary school. My mum is a businesswoman, so she was happy to provide the capital whenever I wanted to start again.

I got admitted into the university in 2018 and stopped thinking about business for a while because I had a ₦50k /allowance. Unfortunately, my allowance progressively reduced by at least ₦5k every new semester in school.

Why did it reduce?

Buhari happened and my parents’ finances took a hit. I began looking for ways to make extra money again. In 200 level, I took a receptionist job at an import/export firm during a three-month school break. I also did some proposal writing and co-anchored radio programs on behalf of the firm.

My employer was supposed to pay me ₦10k/month, but I thought it was too small. We eventually agreed on ₦50k spread out over a couple of months. He completed the payments in 10 months after I left the job to resume school.

Did you try to make extra money in school?

COVID and ASUU struck, and I had to return home for most of my 400 level. My bank account had ₦10k in it when I returned home, but it didn’t take long to hit zero. One day, I wanted to buy a bottle of coca-cola, and I didn’t have ₦70 to buy one. It felt like I had hit rock bottom. How come I didn’t have ₦70?

On the same day, my dad returned home with a 5-litre keg of liquid soap. I liked how it smelled and asked him where he got it; I was already thinking about how to make it too. I got the person’s number — she was a church member — from his phone and she graciously offered to teach me at home. That was how I started a business making soap.

How did that work?

I spent ₦2,500 on chemicals to make 25 litres of soap. That quantity gave me about 13 kegs of soap, which I then sold to my neighbours at ₦1k each. I usually made a profit of almost ₦13k on each 25-litre batch.

The batches sold quickly because of how intentional I was with distribution. I’d take my kegs to every door in our quarters, introduce myself and talk about my product. I was quite persistent. Once someone bought from me, they became repeat customers because the soap was good quality. By August 2020, I’d saved about ₦65k.

Nice

Around that time, I stumbled on essential oils at the shops where I bought chemicals for my soap. They were quite popular — people began talking about tea tree oil to treat pimples — and I assumed they were expensive. Imagine my surprise when I found out you could buy a small bottle between ₦500 and ₦800. Just like that, I saw another business opportunity.

Haha

I have a reasonably good following on Twitter, so I took my business online. I started creating content and advertising my products. The business took off. I’d buy the oil for ₦550 and resell it for ₦1,500 or ₦2k.

However, the liquid soap sales had begun to slow down. My customers could only buy a new bottle after running out of the old one, and I noticed I had more and more bottles of liquid soap tying down my money. I abandoned it when I resumed school in 2021.

Oh, wait. I did something else before school resumed.

What was that?

My dad connected me to an edtech company that produced past questions for JAMB, WAEC and other examinations. My job was to type the questions into their application, and the payment was based on how much I worked. I think it was ₦50 per question I input into the application. The faster you type, the more you make. I got paid ₦35k after the first project, then another paid me ₦50k. The last one I did before returning to school paid me ₦20k.

By this time, I’d also abandoned the essential oils business. It wasn’t moving again. If I’m being honest though, I stopped putting in as much effort because I was getting money elsewhere.

So you resumed school as a rich kid

Somewhat. I had ₦150k saved up, but I bought a new Samsung phone for ₦86,500.

I still had some money, so I wasn’t in a hurry to make more. I also had access to my dad’s friends and occasionally called them for money, using my project as a reason. My dad already gave me ₦90k for my project, but I still needed money for other school things.

After I graduated in 2021, I returned to the edtech company to see if they had anything for me while I waited for NYSC. It took a while because it wasn’t JAMB season and it was a downtime for the business, but I finally got an admin/receptionist role at their office. The salary was ₦60k/month.

I was going to work there for three months before NYSC, but I was there for a year. I had clearance issues at school and ASUU went on strike before they fixed it.

Did this bother you?

I wasn’t bothered about the delay because I was making money. For example, in April 2022, I got a lump bonus payment of ₦150k plus my salary.

I finally left after I got my NYSC call-up a few months later. My PPA was at a tech company and I was paid ₦50k/month. My role was project management associate, but I did everything there — from project management to graphic design.

With NYSC’s ₦33k allowance, my monthly income came to ₦83k. I saved about ₦22k of that monthly.

What were your expenses like?

Mostly transportation and personal needs. I didn’t pay rent because I lived with a friend. At one point though, I was almost homeless when my friend moved houses. But luckily, my aunt lived in the same city, so I moved in with her. She left the city shortly after and left me alone in her three-bedroom apartment.

The city I served in was quite expensive, though. Between trying to save money and transportation costs, I got broke again.

Time for another business?

Yep. But I wasn’t motivated until my birthday in 2023. I got an influx of money, and I thought, “Omo. Having money is nice o”. I didn’t want to go back to living hand-to-mouth.

So, I felt it was time to start selling zobo again. I’d been taking a bottle to work to curb my coca-cola addiction and my colleagues always complimented the drinks. I discussed my idea with some bosses at work — who were like mentors — and they helped me do a cost analysis. I bought bottles, branded them and made 50 bottles of zobo, fruit juice and tigernut drink. Everything cost me about ₦10k to produce.

Just ₦10k?

I even had ₦700 change left. I bought one mudu (bowl) of zobo for ₦500, five pineapples at ₦300 each and two watermelons for about ₦1k. The 50 bottles cost ₦3k. I can’t remember how much I printed the stickers for branding, but I didn’t spend more than ₦10k for everything.

I sold each zobo bottle for ₦500, and the other drinks for ₦700. The first batch finished in two days, and I made a profit of ₦30k. Subsequently, I was making about ₦60k in profits weekly. I also took the drinks to my CDS meetings, so that increased my customer base.

After a while, I started selling at trade fairs too. My colleague introduced me to the first one I sold at. I paid ₦30k for the stall and made about ₦77k in total. My profit was only about ₦25k, but it was a good start. The second time I sold at a fair, I sold all 150 bottles I went with — easy ₦150k. I was so excited.

Love it for you

My next plan was to buy a heavy-duty blender or a freezer for the business. My aunt’s house had a fridge, but it could only take 50 bottles at once. But in June, I stumbled on a post that promised to give ₦250k to a struggling business owner. I just had to comment and make sure I got the highest number of likes. Ah. I sent that post to everybody.

I gave up after I got 450 likes because others were getting up to 2000 likes. However, I found out that they were buying likes after the organisers reached out to me to tell me I had the highest organic likes. It was so unexpected.

That wasn’t all. Someone on Twitter had seen my post asking for likes, so they DM’ed me and said God told them to send me money. They also sent me ₦250k.

Mad

I screamed so much that day. I took ₦26k to register my business with the CAC. I called my aunt and told her I’d won some money and wanted to buy a freezer in the house. Remember I said I was staying alone in her apartment, right? Well, she told me to hold on because she wasn’t sure when she’d return to the city.

Apparently, the rent had expired and her husband had been paying it just because I was there. She didn’t want me to buy the freezer and then get stranded if it turned out that I had to move out.

Did you?

Not immediately, but this was the beginning of my business’ problems. I was getting a lot of drink orders, but I couldn’t store them.

In October 2023, my aunt and her family returned to the city. A cockroach infestation happened around the same time, and I had to move production to the boys’ quarters. It was a smaller space and it meant my production was reduced drastically.

Plus, they’d also started using the fridge so I had almost nowhere to store the drinks. I was down to making 30 bottles weekly and about ₦17k in profits.

Did you have another income source?

I’d finished NYSC earlier and was retained at the tech company. My salary was increased to ₦140k, so at least, I had a 9-5 to fall back on.

However, I became tired of the job in January 2024. I felt I should be doing better. So, I started sending out applications. It felt like I was sending my CV out into the air because I didn’t get any word back for a long time. The one time I got an invitation for a bank’s assessment, I didn’t see the email until the date had passed.

Ouch. Sorry about that

It was a beacon of hope — at least someone saw my CV. I got another bank’s assessment and passed the first stage. To celebrate, I walked into a mall to buy myself some snacks. That’s when I noticed a flower store. It was close to Valentine’s Day, and it was the period when Nigerian Twitter was dragging someone for selling a bouquet for ₦350k.

I asked the store assistants how much a mini stem of rose cost, and they said it was ₦1,100. I saw another business opportunity there. I put a flyer together and told people around me I was selling flowers. My cheapest bouquet was ₦25k — which originally cost me ₦11,500 to assemble. I got 12 orders for Valentine’s Day.

The amazing thing was that I didn’t even need capital. Once my clients paid, I just had to go to the mall on Valentine’s Day and assemble the flowers there. I was just the middle-man. Although the price of the stem had increased to ₦2k, I still made ₦150k in profit.

Sweet

I also took flower orders for Mother’s Day in March. I think I made about ₦70k from three orders. Then there was one time my boss at work bought a ₦250k bouquet. I made about ₦145k profit from that sale alone. It’s a seasonal business, but there’s a lot of profit there.

How’s the drink business going these days?

Quite slowly. There are weeks I don’t make them at all. But it’s a situation where I know I can make the drinks if I’m ever broke and need to make quick money. That’s the point I am at right now. I might not have money in my account at some point, but I have the skills to make sure I’m not entirely broke.

So, right now, you have two businesses and a 9-5?

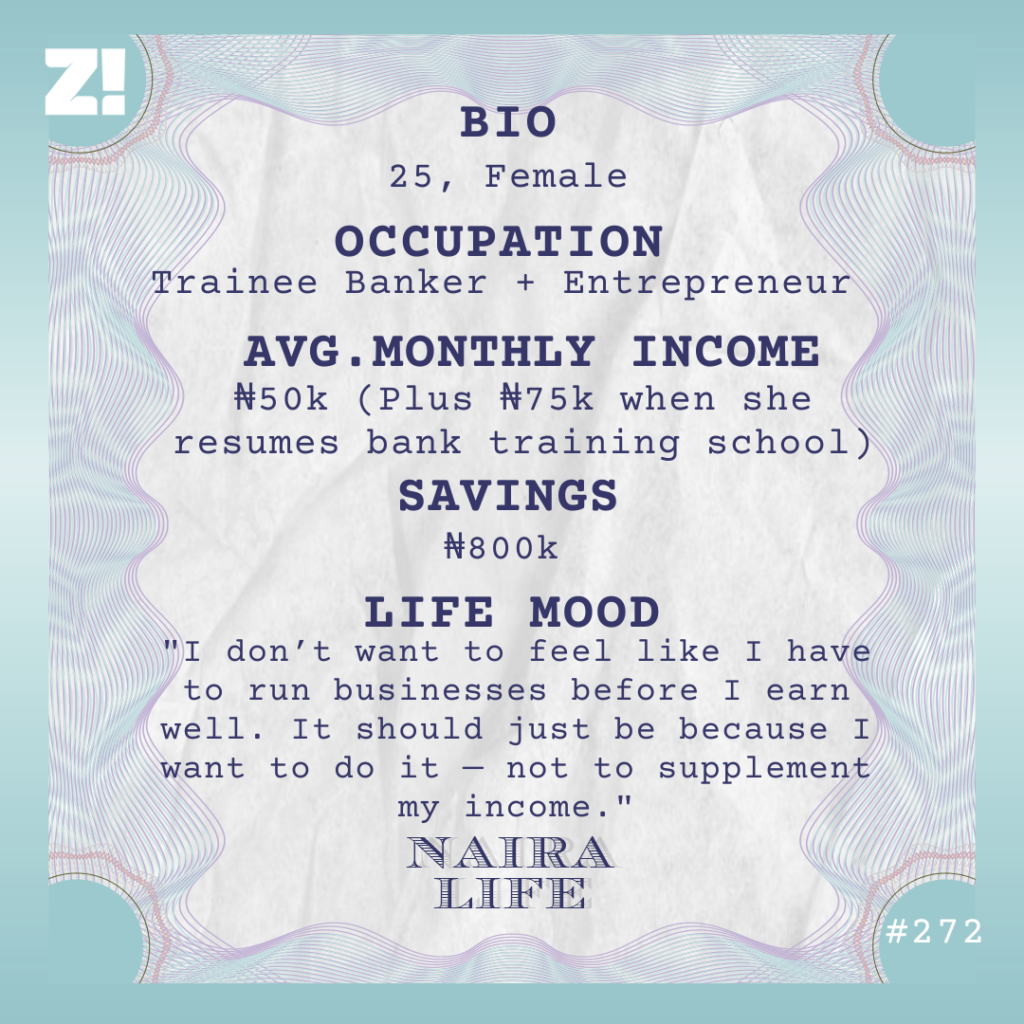

One, actually. I’ve paused the drinks business because I recently landed a bank job. I should be going to training school in a few weeks. I heard I’d be paid ₦75k/month for the three-month training, then about ₦285k after confirmation. I’m still actively pursuing other offers, though.

The flower business is off-season right now, but I get approximately ₦50k/month from it. I have about ₦800k saved up just for savings’ sake — I like knowing I have money somewhere.

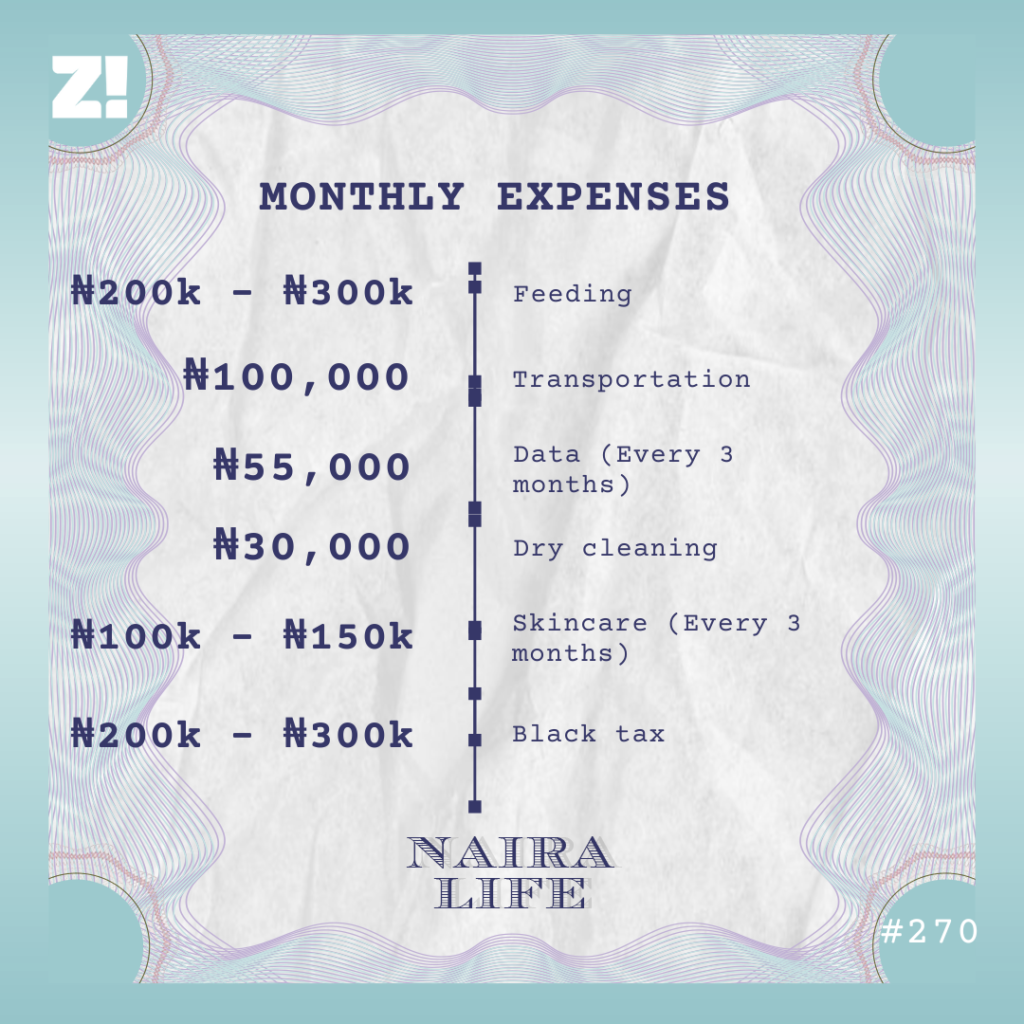

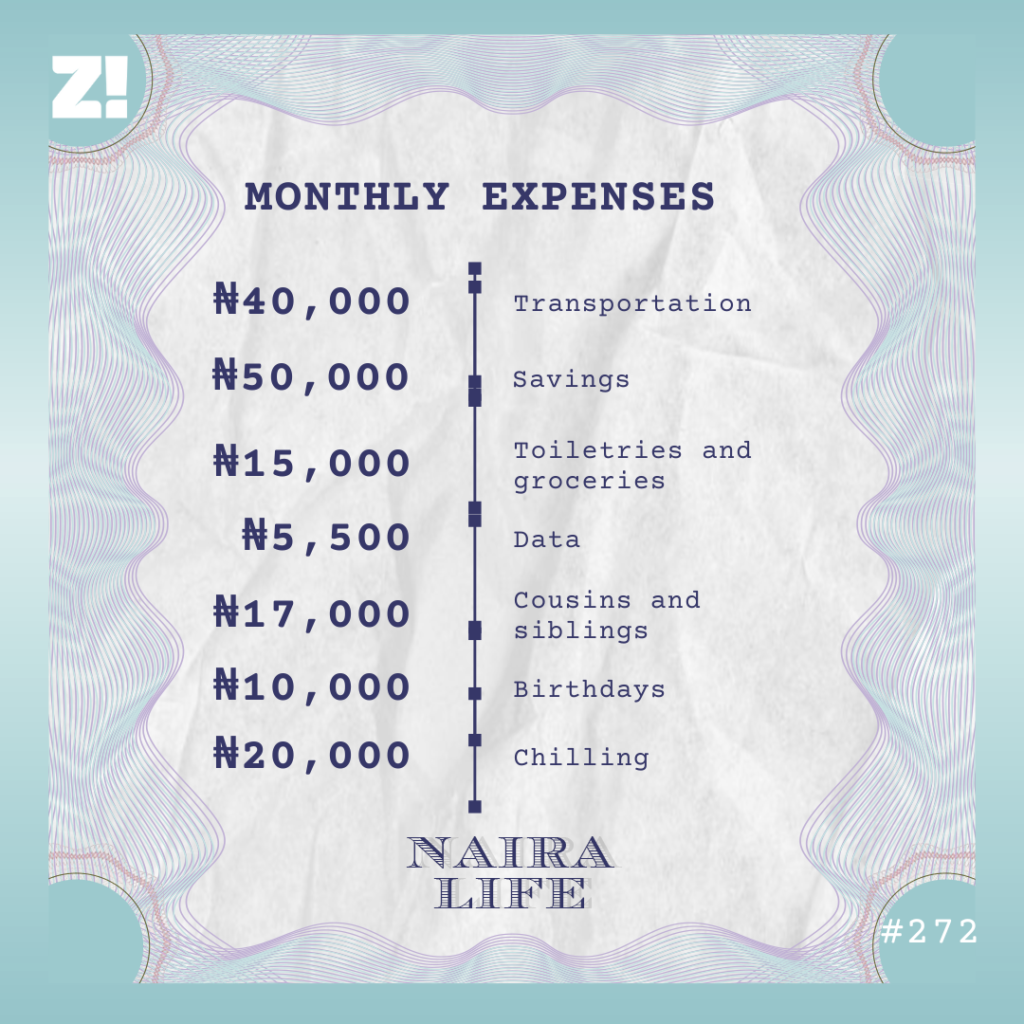

Let’s talk about your monthly expenses

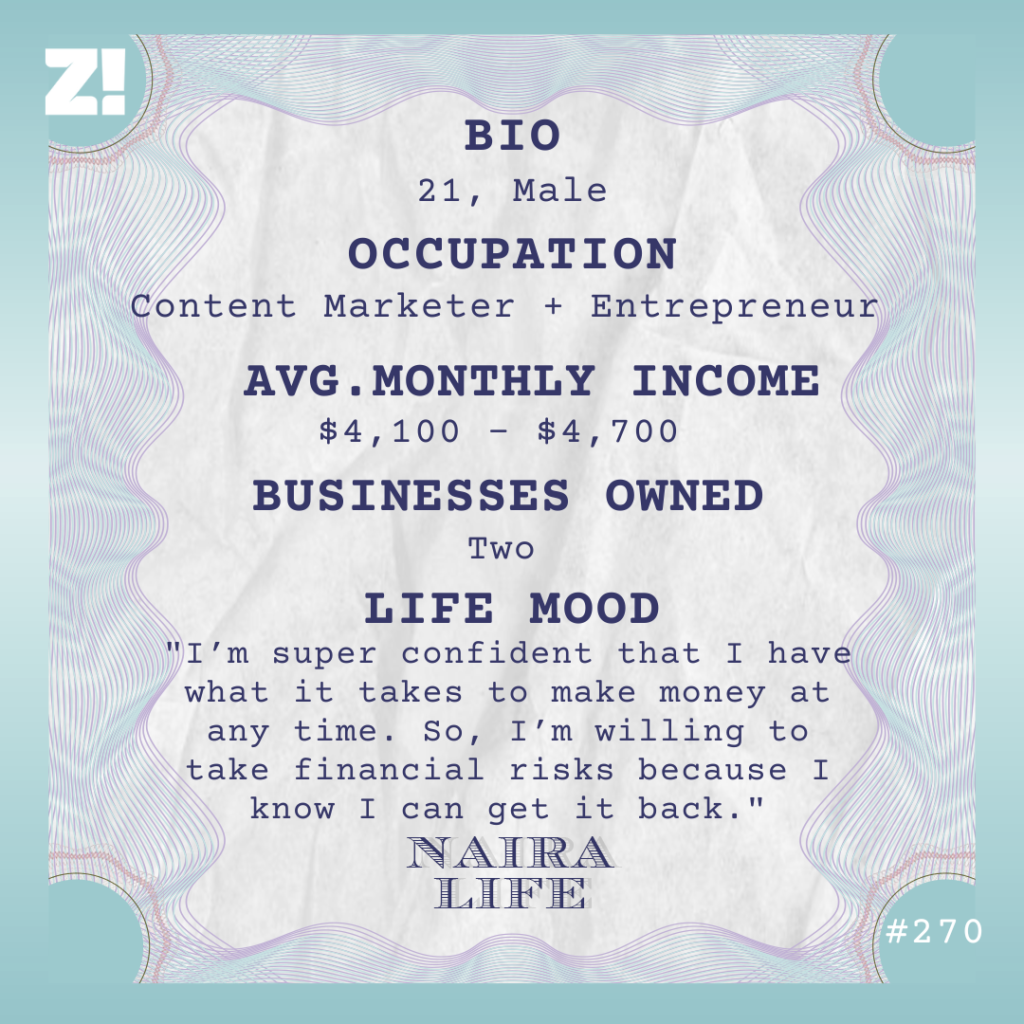

How would you describe your relationship with money?

I think I chased money a lot before, which is the reason I tried so many things. But I think I’m comfortable in my own skin now. I don’t have to pursue money. When I need it, I can always do something or offer a service that’ll bring it my way.

Is there anything you want right now but can’t afford?

I’d like to go to Lebanon on vacation — I like that it snows there. But I don’t want to wipe out all my savings on one trip. It costs about ₦2m to go on vacation there. I may just start small and visit Benin Republic first. Last I checked, ₦500k – ₦600k can take me there.

Is there an ideal amount you think you should be earning?

I’d like to earn ₦500k/month from a 9-5. I’m not counting business money because I think it should support my primary earnings. I don’t want to feel like I have to run businesses before I earn well. It should just be because I want to do it. Not because I want to supplement my income.

Is there anything you wish you could be better at financially?

Yes. Investments. The only thing I do right now is save in savings apps. But I feel I should be doing better.

I also have this bad habit of depriving myself of things for a while. Then I break and spend so much money at once.

A recent example happened when I was interviewing for jobs. One interview was in a different state, and I decided to use the opportunity to visit my parents. It was a long series of trips and I went by road to save money. But when I had to return, I was tired and just spent ₦105k on a flight back. My plan to save money just scattered like that.

How would you rate your financial happiness on a scale of 1-10?

5. I’m comfortable now, but I feel in my bones that I’m going to be a rich person. I still have a lot to do to get there.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]