What comes to mind when you hear “Ponzi”? You’re probably thinking about the Mavrodi Mundial Moneybox, known as MMM. This infamous fraudulent scheme, which Sergei Mavrodi ran until he died in 2018, had a presence in over 100 countries, including Nigeria, before its inevitable crash in December 2016.

Many Nigerians lost their life savings in a scheme that promised quick and eye-popping returns on investment. Nigerians learned the hard way that there’s no free lunch. However, it seems the Nigerian government learned a different lesson from the whole affair and entered into a sovereign Ponzi finance scheme. What is this, and why does this spell serious trouble for Nigerians?

Ponzi schemes: An explainer

The name Ponzi comes from Charles Ponzi, an Italian con artist born in the 19th century. His scams were simple enough and were aptly described as “Robbing Peter to pay Paul”. He ran a scheme where he promised investors great returns on investment in a short time.

The scheme depends on getting as many people as possible to buy into it so that as new entrants come in, their contributions fund the payouts of older members. This is why Ponzi schemes are also described as pyramid schemes.

Pyramid schemes are mathematically doomed to failure because they eventually become unsustainable. There’d be way too many people waiting for new entrants to fund them, and when that doesn’t materialise, it becomes clear their investments are gone with the wind. This is when the scheme crashes.

The FG’s Ponzi financing scheme

So here’s what the Nigerian government did. Imagine a giant financial scam where the government tricks investors into buying bonds with promises of juicy returns on their investment. Sounds good, right? But here’s the catch: the government doesn’t use that money to invest in anything that could make a profit. Instead, they use it to cover everyday expenses like salaries and pensions.

When it’s time to pay back those investors, the government doesn’t have the money, so they issue new bonds to pay off the old ones. It’s like a never-ending cycle of debt that keeps getting bigger and bigger. Eventually, the government’s debt grows so large that it becomes impossible to pay back, leading to a catastrophic financial meltdown. That’s what’s called a sovereign Ponzi scheme, and it’s not pretty.

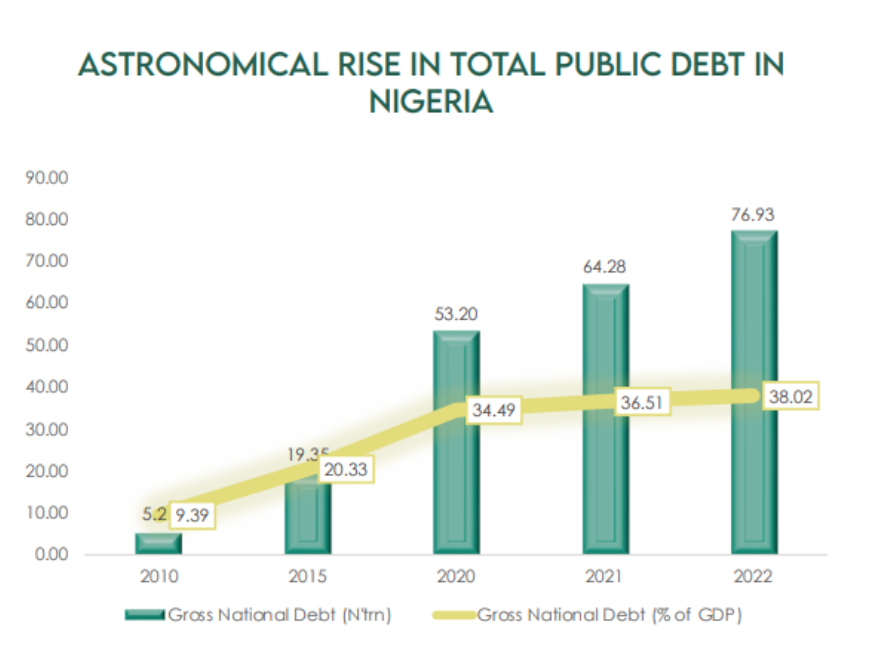

According to Proshare, Nigeria’s debt profile rose again after the Paris Club debt was cleared in 2005. However, debt up until 2014 was at least sustainable. In 2015, the national debt rose 22% to ₦19.4 trillion from ₦15.8 trillion in 2014. By 2020, the debt had spiked by 175% to ₦53.3 trillion.

[Source: Proshare]

ALSO READ: Nigeria May Be Moonwalking Into a Debt Trap

Nigeria kept up the borrowing, and by the end of 2022, our debt had risen to ₦76 trillion. What makes matters worse is the borrowing didn’t translate to economic growth for us. The World Bank predicts slow growth for Nigeria and projects that 13 million more Nigerians will fall into poverty by 2025. As we said earlier, there’s no free lunch.

What’s the way out?

A few other countries have adopted the Ponzi financing model, leading to disastrous outcomes.

A cautionary example is Lebanon which, for many years, accumulated debt recklessly. Today, the country is fighting crippling inflation and has fallen into depression.

One way out, according to Proshare, involves approaching the International Monetary Fund (IMF) for a policy support instrument (PSI). In simpler terms, it refers to policy advice on issues like market reform, subsidy and the exchange rate. Regardless, it will involve some pain in the short term, but this is preferable to the looming crash ahead if we continue down this path.

Another option is debt restructuring. This is a process in which a borrower and a lender agree to modify the terms of a debt agreement. This is usually done when the borrower has trouble repaying the debt and needs to change the payment plan.

Improving efficiency in government spending is also necessary. No more white elephant projects and inflated budgets. The new administration must demonstrate to Nigerians its seriousness in reviving the economy and saving us from falling into a debt trap. Nigeria has a fighting chance of escaping the looming crash if it can implement these reforms.