Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

“Do crypto with Quidax and win from a $60K QDX prize pool!” Bayo, a 28-year-old Lagosian tells Jide, his Ibadan friend seeking the most secure way to trade crypto in Nigeria after a major exchange he trades with announced its plans to leave the country. Find out more here.

What’s your earliest memory of money?

I must’ve been around three years old when my elder brother was resuming Nursery 3. He was reluctant to start the new class because everyone thought the class teacher was mean. So, my cousin promised to give him 50 kobo if he went to the class without making a fuss. It worked; my brother stopped complaining.

It was my first time realising money could insulate someone from certain experiences. Or at least, make the experience better. I became more convinced of that when I got into primary school.

How so?

My mum never gave me lunch money; I went to school with home-cooked meals. Other kids had money to buy stuff during break. They looked like they were balling, and I wanted that lifestyle. I knew I needed money to make that happen. So, I started a mini-rental business in Primary 3.

My elder brother was good at sketching storybooks. Whenever he made new ones, I’d lease them out to my classmates for ₦5 or ₦10. What I made went into sweets, sugar cane and snacks. I was finally balling like my mates, and I loved it.

What was the financial situation at home like?

It mostly depended on my dad’s job. He was a geologist who did several stints at private oil companies throughout my childhood. When he worked at a good place, there was money. But when he didn’t, we struggled. My mum’s tailor income couldn’t do much for five children.

One of the times we really struggled was when my dad lost a job as I was about to start SS 1. I had to stay home for weeks because he couldn’t pay my fees.

He got a new job a few months later, and things returned to normal. I never forgot that period, though. I noticed how trying to hold the family finances together stretched my mum. That’s when I started associating having good money with having a job. But interestingly, my parents didn’t allow us to work while in university — they were against whatever business my siblings tried their hands at. It was always, “Go to school and get a certificate”.

Did you try a business in uni too?

There was no point. I lived on allowances. I got into university in 2013 and was on a ₦40k monthly allowance right from the first year. In 2016 — my third year at uni — my allowance increased to ₦80k, then there was the extra ₦15k – ₦20k from my mum.

My dad lost his job that same year, thanks to Buhari. That man came and introduced policies that affected oil prospecting companies, and the whole sector became unstable. Even when my dad found another job, he had to take a nasty pay cut. I think he went from earning about ₦600k in allowances alone to an ₦100k salary. Of course, it meant he could no longer fund my lifestyle.

What were some of the changes you had to make?

I was a baller before my dad lost his job. I lived in a two-bedroom apartment my dad paid for and used to host house parties once a month. I also regularly bought food for my friends and splurged on gadgets and expensive shoes. In 2016, you could get good Nike shoes for like ₦20k.

However, when my dad lost his job, I became totally broke. In fact, the right word is poverty. I didn’t have any savings, and my allowance dropped from ₦80k to ₦12k to anything I got. I moved into a self-contained apartment and started missing meals. Obviously, the parties stopped. I suddenly became the “I don’t have money” friend.

Thankfully, this was close to a compulsory six-month internship period, so I left school for another town where the internship was.

Were you paid a stipend at the internship?

Nope. It was unpaid. I stayed with an uncle, so feeding and accommodation were sorted. But I wasn’t comfortable with not having money.

About three months into the internship, I was with a photographer friend’s phone when a ₦100k credit notification popped up. He saw the message and was like, “Oh, this person has paid their balance”. I asked what the balance was for, and he said a photoshoot. I was shocked. How much was the full amount if the “balance” was ₦100k? I decided there and then I could take pictures too.

LMAO

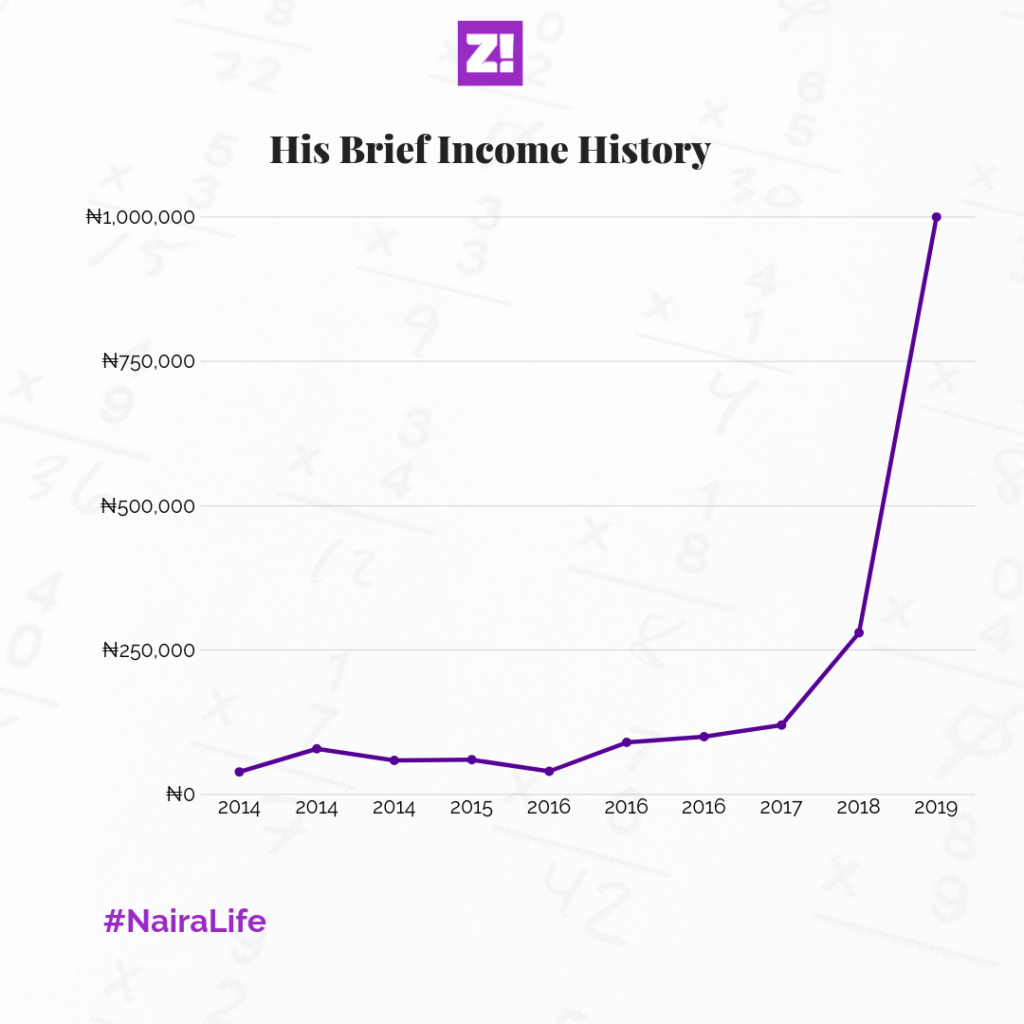

This was in 2017. My friend hooked me up with someone who owned a studio, and I started hanging around him to learn the photography business. After a month, I ditched my internship to focus on photography. I got a job at a studio — after forming like I knew what I was doing — and got paid ₦28k/month. I started as a photography assistant, but I was pretty much a full-time photographer.

At this point, I’d stopped calling home for money because the answer was always the same — there was no money. I was fully in hustle mode. I worked Sunday to Sunday — it was stressful as hell — but it felt good to earn my own money. I also made extra money on the side assisting other photographers and taking pictures on my own. These, plus my salary, usually brought my income to ₦50k monthly on average.

I should mention that I didn’t tell my boss I was still in school. I thought it’d spoil my chances. I only told him when I had to return to school in February 2018. I’d worked for about seven months in total and saved most of my income, so I used it to sort my school fees and the ₦90k rent for my self-contained apartment.

Did you continue with photography in school?

Yes. The friend who introduced me to photography was in my university too, and he had a studio in a nearby town. I’d gotten a number of clients from my time assisting photographers, so I still got gigs.

It was that time when everyone was doing model shoots and polaroids. Whenever I got clients, I’d use my friend’s studio and fuel his generator as appreciation for using his space. I usually made like ₦20k – ₦30k per shoot. I also set up an Instagram page for my pictures and became a mini-celebrity in school. I had photography jobs almost every weekend.

How much did that bring you in a month?

Between ₦30k – ₦50k.

I graduated uni in October 2018 and returned to the studio I worked at during IT. This time, my pay was ₦35k, and I worked for five months before I went for NYSC.

I chose a photography studio for my PPA, and they paid me ₦50k/month in addition to NYSC’s ₦19,800 allowance. I also joined the media department of a church and had access to their camera, which was useful for my side gigs, bringing in an extra ₦20k here and ₦30k there. During my NYSC year, I was averaging around ₦120k/month.

Not bad.

In January 2020, I got a ₦150k product shoot gig for someone’s website. Until that time, it was the most money I’d ever made from a single photography job, and I felt like I’d finally made it. It also sparked my interest in documentary photography. I love telling stories and had even written briefly at one point. I figured documentaries would let me combine storytelling with photography. I didn’t know many documentary photographers, but if I could learn it, I would stop taking portraits and covering events — I’ve always found the latter stressful.

Then, COVID lockdown happened immediately after I finished NYSC, and I couldn’t even find the events jobs I didn’t like. The studio I worked at also closed down, and they never reopened even after the lockdown was lifted.

Damn. So, no gigs and no salary

It was brutal. Thankfully, I went back to living with my uncle after university, so I wasn’t homeless. I didn’t have any savings, though. When people started coming out again after lockdown, I decided to focus on freelance photography rather than keeping a studio job. I realised I could make more money that way.

So, I started taking on a few jobs here and there, including corporate headshots for organisations. One thing I did was make sure to charge well — my rates were from ₦100k. I knew I did great work, and I wasn’t afraid to call money. At least, if I did only one job a month, it’d be something. Of course, there were months I didn’t see anything.

I also had a two-month stint teaching students at an academy. The organisers paid me ₦20k/month per student, and there were 10 students, making ₦400k for the two months.

Did you still pursue documentary photography?

Oh, yes. I applied to quite a number of brands, offering to make documentaries for them, but nothing came out of that.

Towards the end of 2020, I decided I’d lived with my uncle long enough. So, I moved into a two-bedroom apartment with a friend from school. The cost was ₦800k, and I contributed half of the bill.

In 2021, I partnered with a photographer friend who had an abandoned studio, and he allowed me to run it. There was equipment there and everything— I just had to sit down there. I even had an office like a proper big boy. It didn’t come with additional income sha. My clients were still mostly from my freelancing gigs, and I averaged around ₦200k – ₦400k monthly.

Then, in 2022, I got a job with an international NGO.

How did that happen?

A friend randomly shared the vacancy with me and asked if I was interested. It was a communications intern role, and I thought, “Well, let me try”. It was my first 9-5 job, and it paid ₦130k/month.

I didn’t stop photography, though. A few months into the job, a colleague noticed I took really good pictures for my reports and introduced me to a one-time project that involved covering photography for an NGO event. That paid ₦400k.

My job also involved a lot of travel, which translated to additional per diem allowances. That usually brought in an additional ₦100k every other month. There was also health insurance and other small benefits. I kept thinking, so this is what 9-5 people have been enjoying?

What was having two incomes like?

It was great. I was finally able to save up to buy my own camera. I’d been using my church’s camera and borrowing from friends until that point. It was a Sony Alpha 7 III, and it cost me ₦1.3m. I still use that camera today.

My roommate moved out at a point, and he owned most of the appliances. But I was able to re-furnish my apartment with a new TV, couch, air conditioner and a few other things. Generally, I felt like I was finally setting up my life. I hadn’t called home for money in forever, and I was living well.

I also finally landed a documentary gig in December 2020. An organisation I’d previously worked with said they wanted to produce infographic video content in five different languages. I randomly charged ₦1.8 million for a three-minute video, and they agreed. I bought myself a Macbook Pro after the project ended because why not?

[ad]

How was the internship at the NGO going?

It was initially for six months, but it got extended to a year. After the year ended, there was an opportunity for me to apply to become a regular communications officer, but I didn’t get the role. I could’ve renewed my internship, but I was angry that I didn’t get the regular role, so I left in March 2023.

Back to freelance photography?

Yes. However, I also became a subcontractor for the NGO. I’d left some projects unfinished and some decision-makers thought I should be the one to do it. I even made more money that way. I did about five gigs for them within seven months, and each paid between ₦100k and ₦200k.

However, I still wanted a 9-5. I’d tasted how the other side lived, and I liked it. So, I applied and got a communications officer role with another NGO in September 2023. My salary was ₦469k/month. I was back to balling levels.

Love to hear it.

It also involved a lot of travel. I could be on the road for three weeks in a month, and with per diem allowances, my monthly income came to around ₦800k. The only downside was I no longer had so much time for photography side gigs.

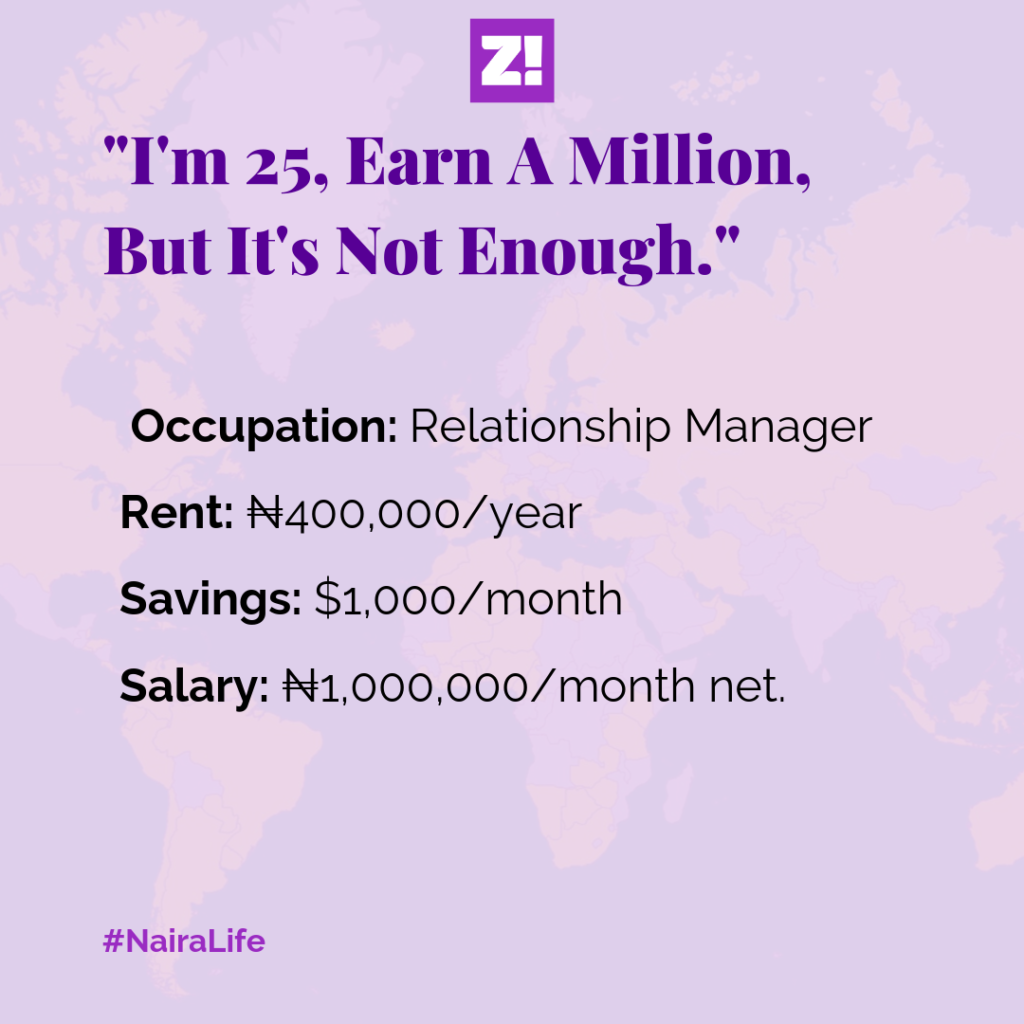

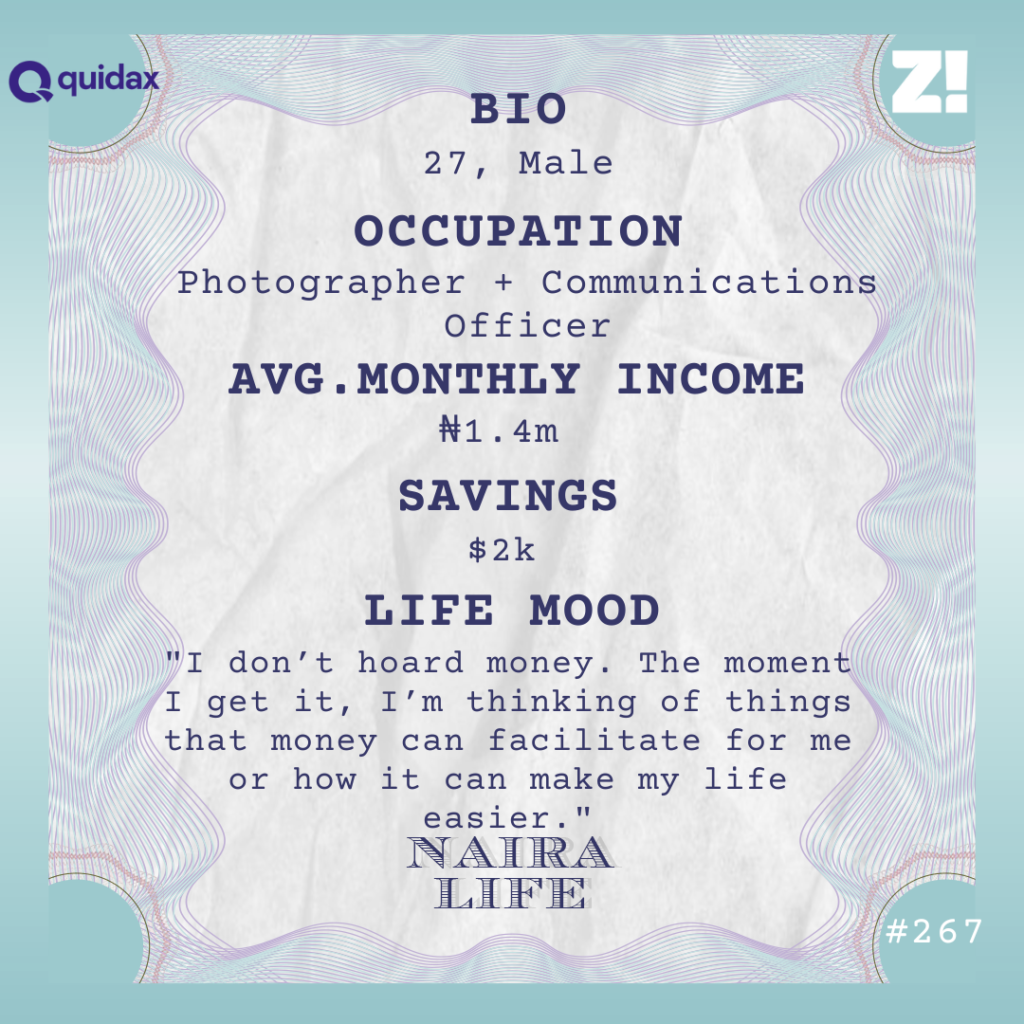

Interestingly, I found out after about four months of working at the NGO that I was like the least-paid person there. Someone else on my level was earning ₦1.4m.

AH. How did that happen?

I asked HR, and it turns out I wasn’t supposed to accept the first offer I was given. I had no idea I could negotiate. It really affected my morale, but shit happens. My salary was slightly reviewed to ₦600k, and I had to take it like that.

I’m still at the NGO. With travel allowances running into ₦350k – ₦400k, my income from my 9-5 runs into ₦1m monthly. Then, an added ₦350k – ₦400k approximately from photography — mostly portraits and documentaries.

I’m actively on the job market, sha. I’m hoping to land a managerial role and make more money.

What’s an ideal amount you think you should be earning?

If I were to change jobs now, I’d hope to earn nothing less than ₦1.6m – ₦1.8m/month. But comfortable money for me right now would be $9k – $10k/month, and I think I should be able to achieve that within three to four years if I stay on my current career course or expand my photography clientele.

How would you describe your relationship with money?

Money is a means to an end. I want to live a life without stress, and I know money is what can give me that lifestyle. So, I don’t hoard money. The moment I get it, I’m thinking of things that money can facilitate for me or how it can make my life easier.

I hardly save these days. I once put about $2k in a cryptocurrency just to have something somewhere. But I lost $1,500 out of it earlier this year when I took someone’s idea to trade it. I just removed my remaining $500 and left it in a dollar account. I recently added $1,500 to it, so it’s back to $2k now.

I’m also not into investing because I think there’s a gap between what I’m earning now and what I want to earn, so I prefer to focus on that.

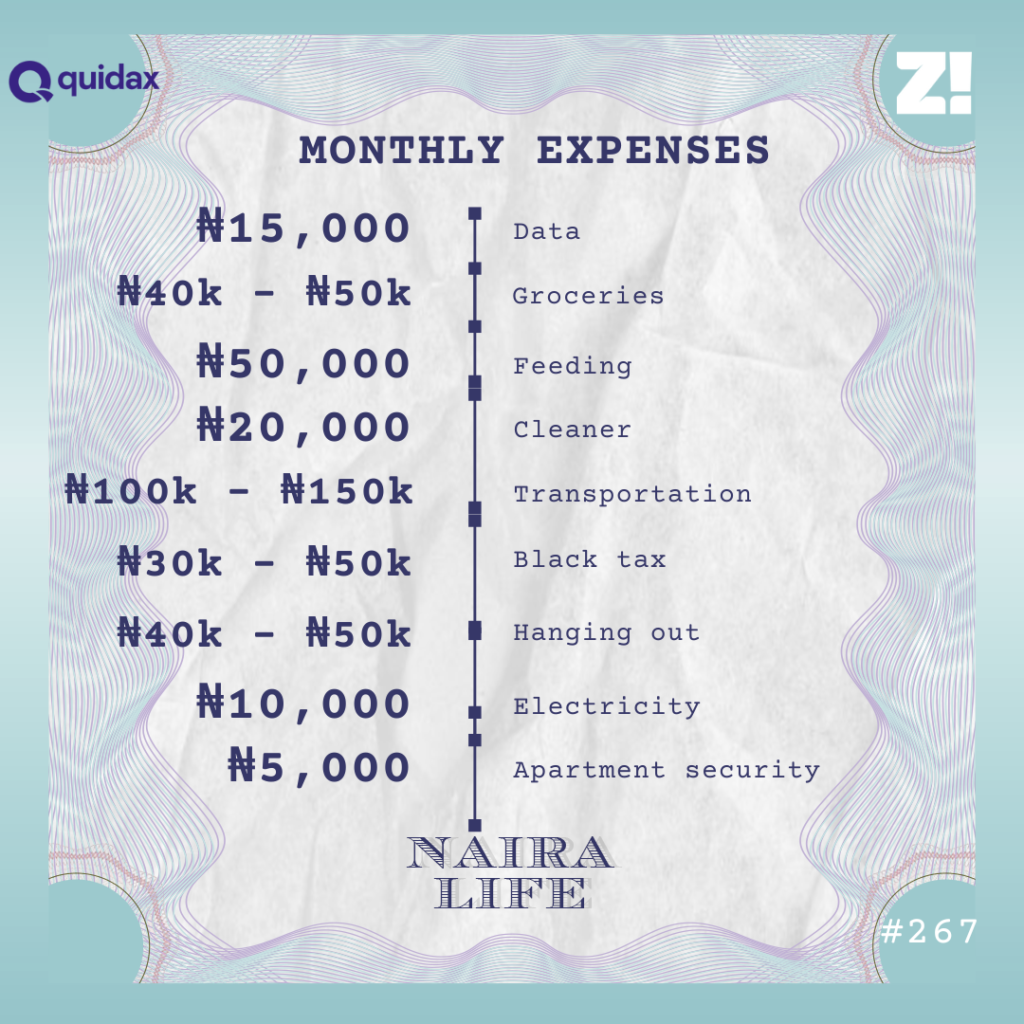

Let’s break down your typical monthly expenses

Tell me about a recent unplanned expense you made

Reebok sneakers. I move around different communities for my job regularly, and the sneakers are so comfy. I can walk around in those things all day. It cost ₦45k, and I still think it’s worth it.

I’m curious. Do you see yourself juggling a 9-5 and photography for much longer?

I even have construction in mind. That’s what I studied in school, and I might pivot into that when I’m around 40 years old. But I definitely plan to set up my own media organisation so I can do media and communication consultancies and work on more documentaries. That’ll probably cost around $15k.

For now, I like working in the development sector because it makes me feel like I’m making an impact. So, I’ll probably stick to it for a while. I also hope to japa soon, so I’m deliberately applying to foreign-based jobs.

Is there anything you want right now but can’t afford?

Maybe a car. But it’s more of something I have to wait for, rather than can’t afford. I have about ₦4.5m saved for it, but prices have increased, and the car I want now costs around ₦9m, so I have to gather money for that.

How would you rate your financial happiness on a scale of 1 – 10?

6. I’m not really happy with my finances, and I think I can do a lot better. My income seems like a lot of money because of where Nigeria is right now, but it’s really not. I’m not where I want to be financially. Maybe if I can bridge that gap and develop better money habits, that number could grow to an 8 or 9.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.