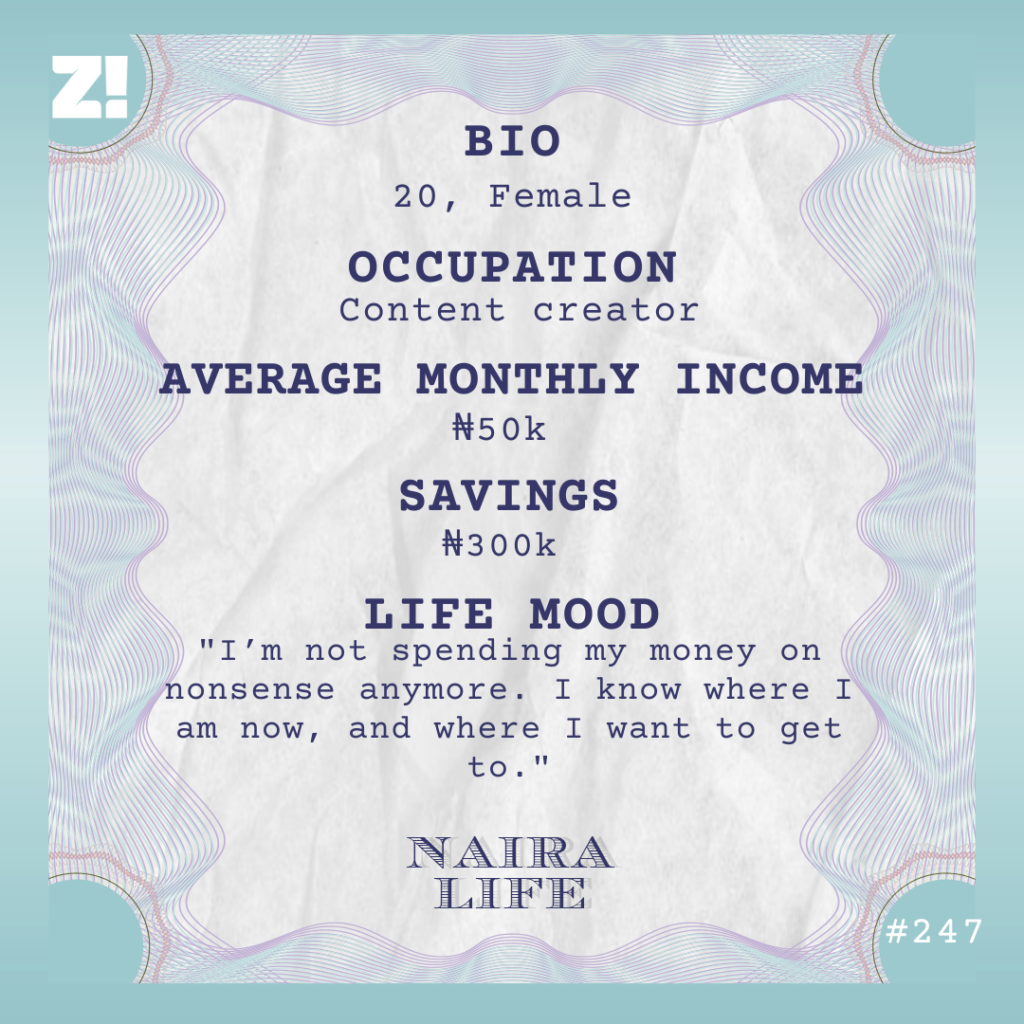

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

Five-year-old me thought money used to multiply. Some context: When I was in kindergarten, I noticed people would walk up to my class teacher with one ₦50 note, and she’d give them two sachets of water and two ₦20 notes as change. In my head, I concluded one single money could give you “two money.”

LOL. Didn’t we all?

I decided to multiply my own money too. So, I took ₦50 from my mum’s purse and used it to buy water from my teacher. When she gave me the “two money”, I proudly took it home to show my mum. She was like, “So, you’ve started stealing at this age?” Good times.

Now that you mention your parents, what did they do for money?

My dad is a lecturer, and my mum has a small business.

Before secondary school, I thought we had money. Maybe it’s because I didn’t pay attention to the finances, and I had mostly all I needed. But I was definitely shocked when I started asking for money in secondary school, and my parents would always respond with, “There’s no money.”

That’s when I started realising the small things like how we never had a family outing. Even on the odd occasion when my mum bought outside food, she’d buy just two plates, and the five of us would have to manage it.

What did this realisation change?

It led to my “I need to make money” phase at 15 years old. I was in SS 3 in boarding school when I started painting my schoolmates’ nails, charging between ₦50 and ₦100. It was illegal, but I’d walk around the hostel with my nail file and nail polish, announcing, “Do your nails!” It was my trademark.

I used to make an average of ₦300 daily and lived large. I spent all my money at the tuck shop.

Did you continue after secondary school?

I wanted to, but my dad thought starting a side business would affect my studies. So, I dropped it.

I started uni in January 2020, but had to return home after a couple of weeks due to a combination of the COVID pandemic and an ASUU strike. In June, I decided to learn a skill, so I picked make-up. My mum paid ₦200k for the three-month training and the make-up box I needed. But I only practised on a few people before abandoning it.

Why?

I felt I couldn’t make people look pretty. Luckily, school resumed in 2021, and I went back to focusing on my studies.

Did you try any other thing for money?

I went to classes from home (I still do), and my dad wanted me to focus, so I couldn’t do any business.

I don’t have an allowance because he gives me transport money to school every day. The man doesn’t even know I have a bank account.

But I was on social media a lot. In 2022, I decided to give content creation a try. I thought it might be fun, and I’d also heard that creators make a lot of money.

How did that go?

I wanted to create content relatable to people like me who weren’t rich kids, so I challenged myself to live on ₦1k daily and share my results. People definitely found it relatable because my accounts grew quite quickly, and I started making money from it in 2023.

How do you make money as a content creator?

Mainly through influencing gigs. Brands reach out for custom content, and others send free gifts so I can talk about them on my channels. My first client reached out to me in January and paid ₦20k for three videos. I was ecstatic. I’d initially charged ₦25k, but I didn’t even mind. It was the motivation I needed to take creating content seriously.

The only downside is, the money is not constant, and brands sometimes owe me too. There was this brand I worked with for three months. In that time, I made 16 videos for them, and my total pay was ₦300k. They paid 40% before the campaign started, and were supposed to pay a percentage every month. But they paid another 20% in the third month, and 40% months after the campaign ended. I’ve worked with them a couple of times, and they always pay late.

Is this your regular experience with brands?

Thankfully, it’s not regular. I guess I’ve been pretty lucky. The wildest influencing gig I’ve ever gotten was from someone who paid me ₦100k just to play their song in the background of one of my videos. It was easy money.

What’s your monthly income from influencing like?

On average, ₦50k per month. Some months are better than others, though. The ₦100k gig was just last month.

What about your expenses?

Pretty moderate. I still try to live on ₦1k daily because of my content, but the way the economy is going these days means I often overshoot my budget. But I still live at home, so food and transportation to school are taken care of.

But I should confess. This moderate lifestyle is just a few months old. When I first started making money online in January, I went on a spending spree for months.

What were you spending on?

Everything I was interested in at the moment. You know how you start getting strange ideas when you have money you don’t need? That was how it was for me.

First, I decided I wanted to get into those coffee girl aesthetics. So I bought an icemaker for ₦90k and a coffee maker for ₦25k. I’ve not used them for even one day; the icemaker is still inside the carton.

Another time, I became obsessed with BookTok — the readers section of TikTok — and thought reading books would help me escape the reality of living at home. I started with fantasy and dystopian books. When I grew tired of those because the plots started to look the same, I moved to deeper self-help books. I quickly got tired of reading those as well, but I just kept buying them, telling myself I’d read them one day.

The last bulk purchase I made was in June — I bought nine books which cost almost ₦100k, plus delivery. From January to June, I spent ₦400k on over 60 books. Most of them are unread and are just sitting on my shelf. I console myself with the fact that I can still sell them someday.

Now, I’ve moved past all that and just save my money.

Do you have a savings goal?

I’m saving to get my own place. My family home is nice, but it gets tiring. Since July, I’ve tried to save 80% of every amount I get from influencing. It’s currently around ₦300k. But I’m still debating whether to stick it out till I graduate and invest my savings in a piece of land instead, so I can resell it for a profit later.

The remaining 20% of my income is the vex money I use for the odd outing, or when I need data to create content.

Can you break down your typical expenses in a month?

Data – ₦15,000

Eating out – ₦30,000

Miscellaneous – ₦10,000

I don’t spend a lot, even when creating content. I just use my phone and a tiny influencer light I bought for ₦10k on AliExpress.

Do you plan to continue creating content after uni?

Yes. It’s my backup career plan. There’s money in content creation o. I know people who don’t have a degree but make millions from it.

Plus, I did a two-month unpaid internship as part of school requirements in April, and I realised there’s no money in the course I’m studying at school. But I’m still studying hard to graduate with good grades so I can have both my degree and content creation. Then, I can stick to whatever pays more.

How would you describe your relationship with money?

I feel like I’ve been playing since, but I’m now focused on making my money work for me. I save better, and I’m deliberate about spending and managing my money. I’m active on social media, and I’m familiar with the urge to live a fake life, but I make do with what I have.

You guys recently did a video where you asked people how long it’d take them to spend ₦500k. It’d probably take me two years with how deliberate I am now.

My mindset now is, I need to make money for my future, and no one will make it for me.

How much money qualifies as “good money” to you?

I honestly can’t pick a specific figure. More money will come with more responsibilities, so I don’t think there’s a point where I’ll be satisfied. It’s always on to the next thing.

Is there anything you want right now but can’t afford?

Definitely land. It’s part of my savings goals, but I want to get land in an already developed area to get better returns on investment. I’d need ₦3m – ₦4m for that.

On a scale of 1-10, how would you rate your financial happiness?

10. I’m not spending my money on nonsense anymore. I know where I am now, and where I want to get to. I’ve also learned to limit impulse decisions and not do more than myself.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.