Every week, we ask anonymous people to give us a window into their relationship with the Naira – some will be struggle-ish, others boujee–but all the time, it’ll be revealing.

Here: a lady who cares deeply about fresh food, tells us how she keeps her finances on a leash.

Age: 26

Occupation: Works in Finance

Location: Lagos

Relationship Status: Single

Gross income: ₦8.6 million/year (₦416,000/month, net)

Rent: ₦250,000/year

The first salary.

I have many first salaries. The first money I made was Uni in 2011; 300-level and I just sold something that made me ₦2,500. I remember sending part of the money to my siblings. I think I bought them airtime.

“Are you sure you have to send me this money? You need it o.” That’s what my brother said.

But anyway, my next first salary was my NYSC salary, and it wasn’t just the usual ₦19,800. My Place of Primary Assignment also paid me ₦65k.

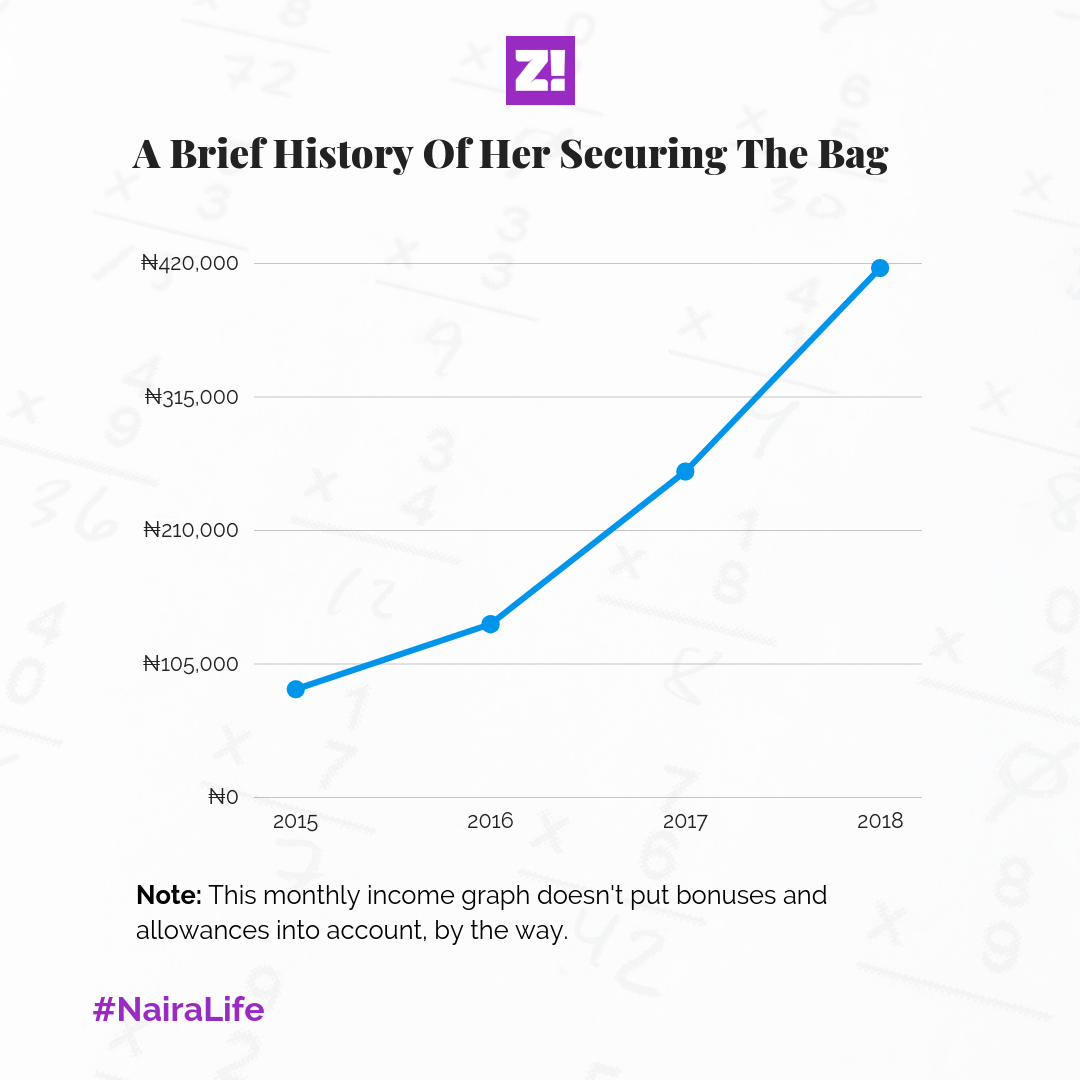

Then to my first post-NYSC salary, my take-home was ₦136k. The annual package was about ₦3.15 mil. (Annual package is the total income earned that year, and they’ll include the money that gets taxed, paid to the pension manager and bonuses).

Where does your money go?

So first, I’m always saving. When my salary enters, my personal rule is to not touch it, until I’ve first of all looked at my budget. I have a budget on lock till December because I have projects, travel plans. So I have to know at what point I need to pay for what, and when I’ll be able to afford it.

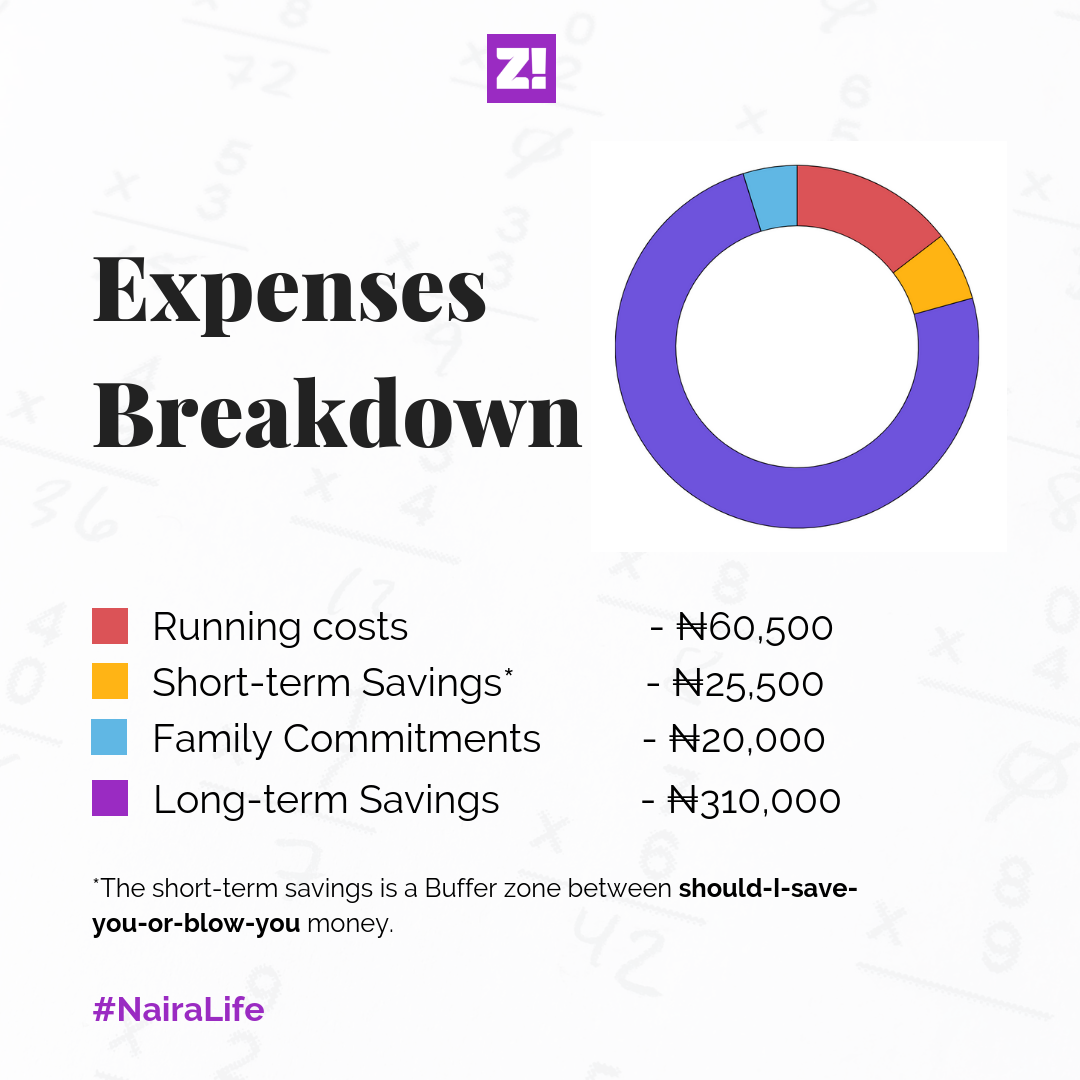

I like to think about my savings in two brackets; short term and long term. My long-term savings is about ₦310k, and it’s for the more tangible things, like investments. My short term is around ₦25k every month.

I also have to say that it’s very rare for me to save the whole long-term savings every month. It happens somewhere around once in 3 months.

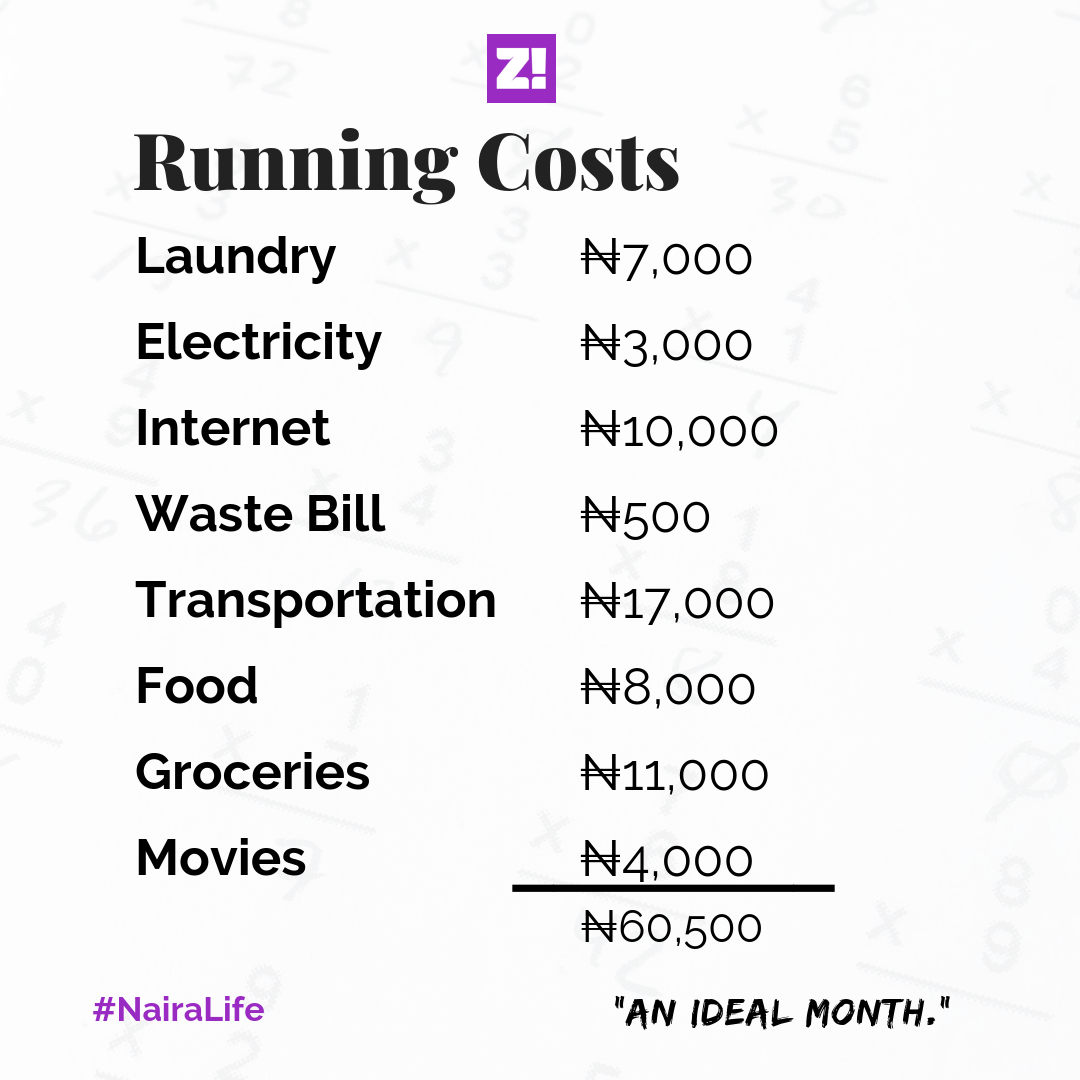

For my running costs, I don’t have a lot of expenses so I always budget about ₦60k.

This isn’t always realistic though. Sometimes, all it takes is one day of reckless grocery shopping.

When it’s looking like I’m going to be in trouble, I just pause–check my account, wallet, everything. Then I check my remaining commitments and bills for the rest of the month. I may have to adjust some things or borrow.

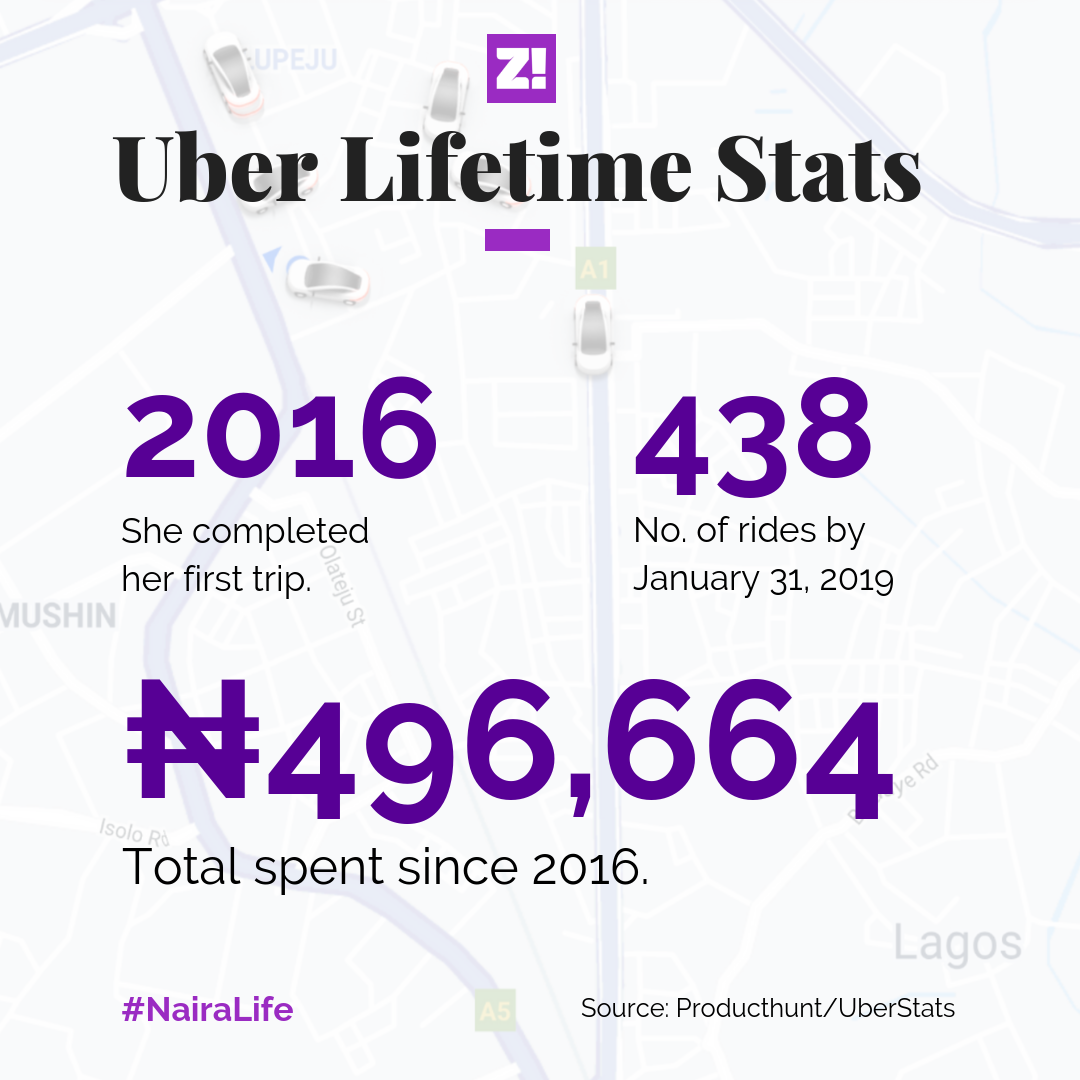

But as long as I’m not taking Ubers, or spending too much on food, staying super-conscious, I’m good.

What do you spend the short-term savings on?

Small things tend to pop up–like bridal showers and the occasional Aso-Ebi – like once in 3 years. I tend to be selective about the Aso-Ebi I indulge in, and it’s not even about the money. I think it’s an imposition, and it’s cancelled in my books.

But to be honest, what tends to take the bulk of my money is fresh food. Every other weekend, I might just blow like 4k. I used to have a groceries budget. Used to.

My Uber budget has almost disappeared because I have a car now. My ₦6,500 full tank lasts me for 2 and a half weeks.

I still Uber every now and then. Public transport to work used to cost me ₦400 a day, to and fro. It was actually ₦300–the extra ₦100 is for the occasional fruits I buy en route.

What do you think about what you currently earn?

I dunno, really. I never realise how little I was earning, just until I’m earning more. But I’m content with it.

What was the old job like?

It was quite prestigious. You walk into a room–any room–tell them where you work, and everyone falls in line. But it was also die-on-the-job work. It trains you to become a soldier. After 2 years, I quit mostly because I was looking for a better quality of life.

Now, I’m lucky to be at a job where I have a good quality of life and I earn good money.

Realistically, what is great money for you?

First of all, it can’t even be in Naira.

How much money are we talking here?

Bastard money. Just leave it like that.

What’s something you can’t afford but totally want now?

Property. It’s not even a want. You should always be looking to own property because you can’t be paying rent in this Lagos. But for how long will I save to buy a property of ₦30 million really?

What does your ₦250k/year rent currently fetch you?

Oh a studio apartment–one room, a kitchen and a bathroom. You know, my leave allowance used to be my rent money. My former job used to pay my leave allowance in the month rent was due.

Do you ever think about retirement?

I really haven’t thought about it, but maybe I’ll go to where rich people are, find someone to marry me, then start doing rich people things.

…

Okay on a serious note, I know the goal is to find something I enjoy doing to the point that I don’t have to retire. Currently, I’m not there yet, I’m just winging my whole career.

Once in a while, I just remember “oh, we have this pension thing!” and then I check. It was a little over ₦1.6 million at my last check.

What’s the last thing you paid for that required serious planning?

My car. All of my long term savings last year went into my car. I copped it for ₦2.9 million. My agent gave me a pretty good deal.

Tell me the most stressful miscellaneous you’ve had to pay for?

Definitely car trouble. ₦25k or so. Or when I have to fix something in the house, like the annoying plumbing that spoils overnight.

I’m constantly over-planning, so big expenses hardly catch me unawares.

So, you have an emergency fund?

Remember that 20-something-thousand? That’s supposed to be my emergency fund–in fact, I named it “Contingency” in my spreadsheet. So by the end of the month, I’m like “wait, no emergency. Oh, nice. Spend that money girl.”

Another bad habit I have is that, say I budget ₦40k for something and it comes at ₦20k, I just go yayyyyy, and then I blow the rest on food.

This financial satisfaction thing, where will you say you are at right now?

Between ₦136k to ₦416k, I think there’s a point you get to where you’re just okay. You don’t have to worry about some basic stuff–a comfort zone. So about life satisfaction, I’m content.

When did you hit the comfort zone?

I’m not sure, but the move that gave me peace of mind also gave me good money. My previous take-home when I quit was ₦256k, so it was both.

About that annoying 5-year question;

I’ve always failed this. People ask me, and they’re never satisfied with my answer. They find this hard to believe, but I’m not the most ambitious. I’m not big on ambition, but I can’t compromise on competence. I believe in cultivating competence, even if all that’s required of you is washing plate at The Place.

Career-wise, I’m totally winging it.

Let’s try this question again, but short-term.

One of my goals this year is to actively seek out investment opportunities. I did a 7-year Sukuk bond in 2017 that will give me a 16% profit. I also invested in an Online Agric investment platform in October 2018. You pay like ₦250k in stages and you get an estimated ₦100k profit.

Also, there’s the ₦50k Ajo I just do with the money I don’t really need with part of my long term savings.

When it comes, I’m balling.

You do pretty well with money.

To be honest, I think knowing where you are with money gives you power. I know what I can’t afford for the rest of the year. When I get paid, I don’t touch my money until I look at my budget. Like, I’m always rushing to my laptop to check my spreadsheet before I touch it. I also have a separate account for my running costs.

Any side hustles?

I have this one where I’ve put in a total of about ₦200k. I started last year, selling stuff online with a friend. We split the damage 50/50. We’re on our third inventory cycle, and for the first time, we don’t have to put any money into it.

3rd inventory?

Yeah, the stuff we sell. The first inventory, we put in money of course. The 2nd cycle, we put in a little less money. Then the 3rd cycle, the only reason we put in money was to increase our inventory.

How’s that going?

We sell on Jumia, and that one is pretty easy. But the Instagram part? If selling on Instagram will not teach you patience, nothing will. Constant engagement is exhausting.

I’m thinking about what you said earlier about ‘quality of life’

Quality of life for me means quiet in my head. I just want to be able to slow down, and think clearly. Not necessarily money. I remember this one night at my last job:

I’m working overnight with two other superiors. Between them is a total of 25 years of work experience. I totally respect their commitment to the work, but I know right there that I don’t want to live like that for long.

That moment was my trigger.

Check back every Monday at 9 am for peeks into the Naira Life of everyday people.

If you’d love to share your Naira Life with us, tell us here. You’ll be anon, of course 🙂