Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

The recurring theme in this #Nairalife is safety nets. The 32-year-old project manager in the story saved up ~₦21m in about five years. Now he lives in a country with free healthcare and earns $90k/year. He may have 101 problems right now, but being broke isn’t one.

Here’s how he got there.

What’s your oldest memory of money?

When I was six or seven, my allowance was ₦20. Every morning, I found the money on the table without fail. One day, I found two ₦20 notes and took both to school without thinking much about where the second note came from.

When I got home, my mum asked me why I took more than I usually did, and I had no good answer. It was at that moment I realised that I didn’t confirm if the extra money was meant for me. I’ll never forget the punishment I served. But it was a lesson in contentment and accountability. This event taught me not to touch any money that doesn’t belong to me.

What was it like growing up?

My dad was an insurance executive and my mum was a nurse. Both of them had thriving careers, so we were very comfortable. We were the typical working-class, upwardly mobile Nigerian family of the late-90s and early 2000s. My dad changed cars every three years because of where he worked. We had two drivers, and I was dropped off and picked up from school every day. I was pretty much a “get-inside” kid.

So when did you actively start thinking about money?

When I was 15 or 16. I’m the last of my parent’s four kids, and there’s a 12-year age gap between me and my eldest brother. Somehow, my brother convinced my parents to pay me for house chores and I was getting ₦500 – ₦1000 for this. However, it wasn’t set in stone. This was the first time I earned money.

Things changed at home around the same time.

What do you mean?

In 2007, my dad decided to run for political office. The people around him made him feel like he stood a chance, so he sunk his savings into his campaign.

He lost the election, and there was nothing to return to post-election. He’d resign from his job to focus on his campaign, even though his company’s board advised him not to.

Omo.

My mum retired from work in 2003, so she didn’t have a regular stream of income either. Things became a little shaky. The drivers were the first to go, followed by small adjustments.

What sort of adjustments?

The plan was for me to go to university in the UK. But when this happened, the plan changed to a private university in Nigeria.

In hindsight, things weren’t entirely rough – my parents had some financial structure we fell back on. We had houses, so we didn’t have to worry about rent. My parents also had some investments in stocks, which gave us some financial cushion. It was the first time I saw how safety nets worked. That event spurred my interest in keeping resources aside for rainy days.

How did that manifest?

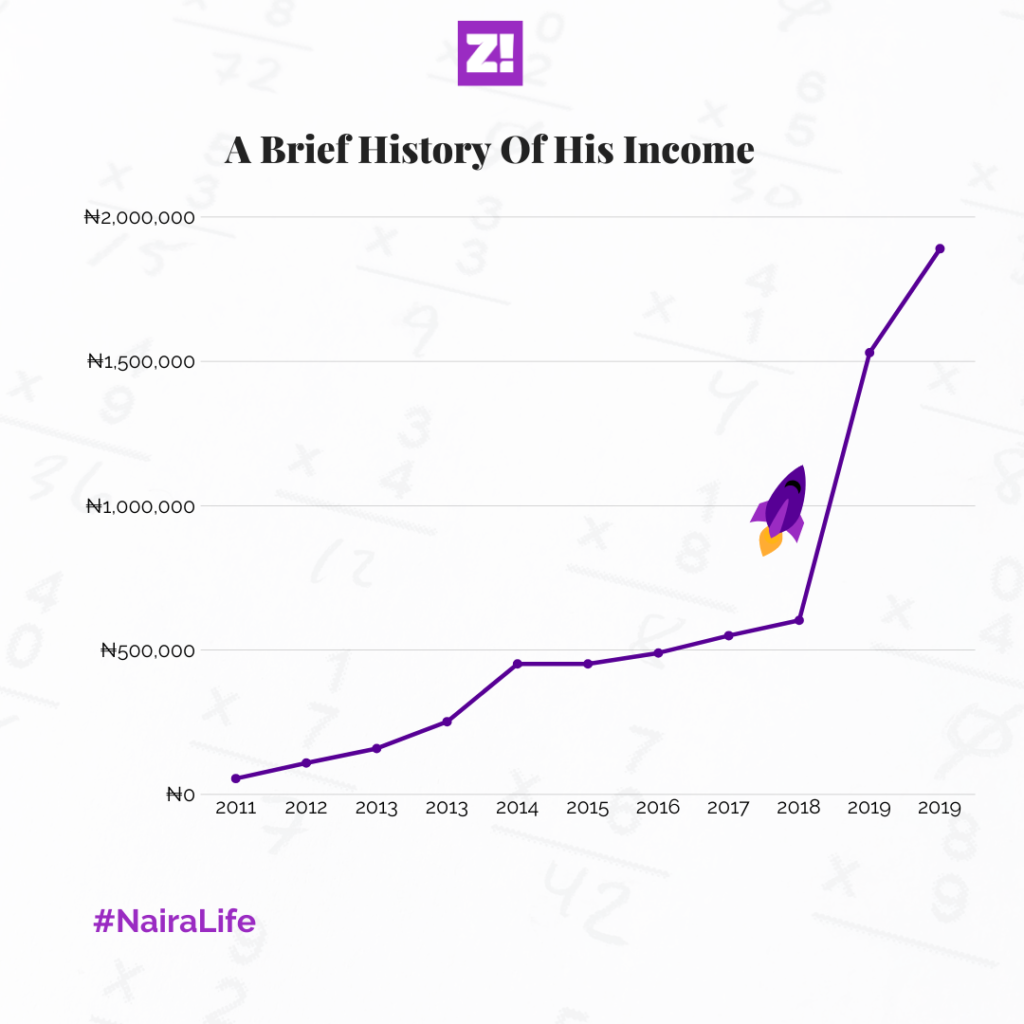

When I got into university in 2007, my allowance was ₦15k. By the time I left in 2011, it’d increased to ₦20k. During my time in school, I made sure to save every month – ₦2k here, ₦3k there. It helped me build my savings muscle.

What happened after uni?

NYSC. I served in the south-south and worked at an architecture firm as a site supervisor. The pay was ₦10k/month and the federal government also paid ₦19800, which brought my monthly total to ₦29,800. My boss also tipped me between ₦1k and ₦2k every weekend.

The cost of living in the state was low and I could live comfortably on ₦500 per day. There were barely any additional expenses. I lived on my salary at the firm and saved most of my government allowance for the whole year. At the end of my service year, I had about ₦180k in savings.

Sweet.

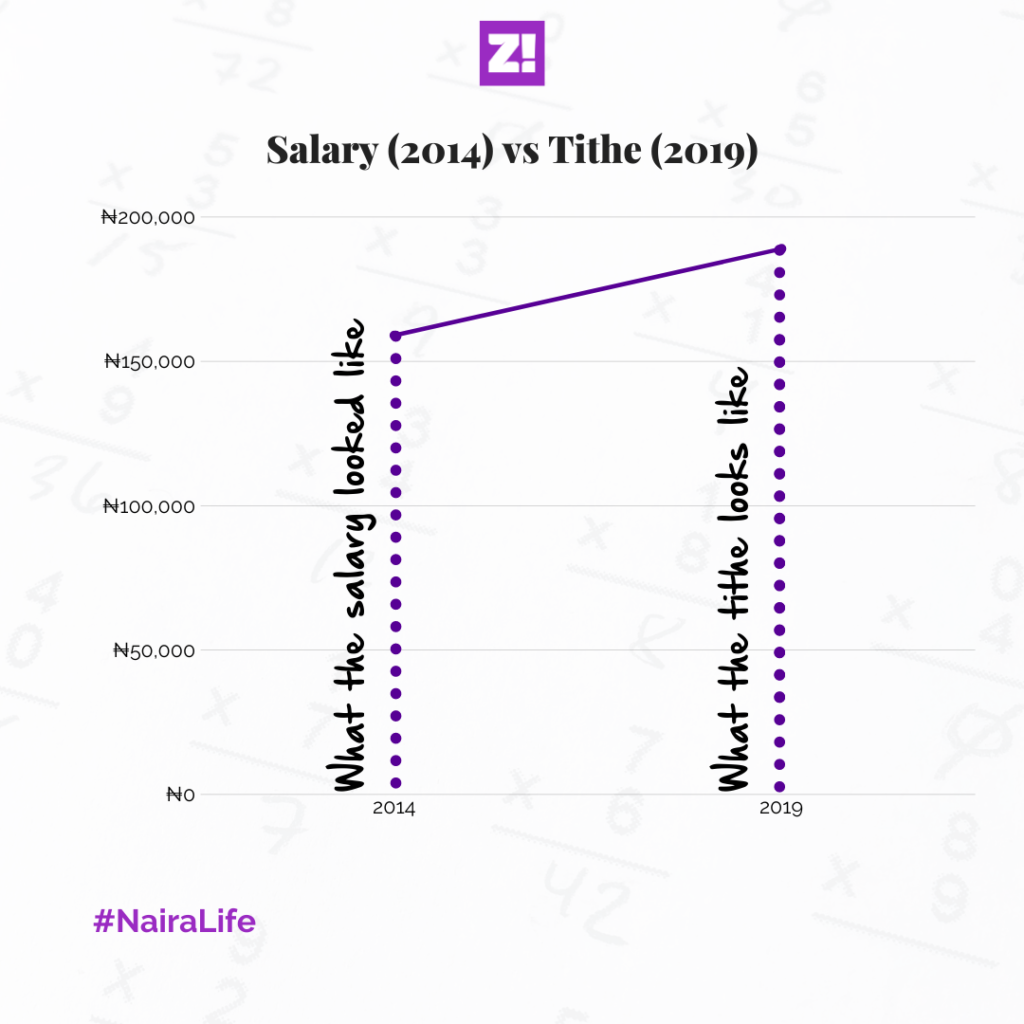

I returned home, moved in with one of my siblings and started job hunting. Three months later, I got a job in a telecom serving firm. My salary was ₦60k.

However, the people that ran the place were unserious. Three months into the job, I hadn’t received an offer letter, which was a red flag for me. Fortunately, I found another job at a furniture company.

How much did they offer you?

₦60k. When I told the people at the telecoms servicing firm I was leaving, they finally sent me a proper offer letter, bumping my salary to ₦130k. But my heart wasn’t in the job anymore, so I did the next best thing.

You used their offer letter as leverage, didn’t you?

I did and renegotiated my salary with the furniture company. We settled for ₦90k, and I resumed work in July 2013. The most interesting thing about the job was the high-network individuals I met. It was eye-opening.

Tell me more.

The furniture company helped HNIs set up their homes. I could be called into a meeting to give a presentation and the client would be this wealthy person I’d seen on TV. It was a thrill watching them listen carefully to what I had to say about our plans for their spaces. Like, they were genuinely interested and asked questions. For a 22-year-old, this was a massive confidence booster.

I guess I also started thinking of how to unlock an extra means of income. A few months into the job, I found it.

What did you find?

I always cleaned up nicely and looked good. I usually wore trad outfits to work on Fridays, and people always asked me who made the outfits for me. Although I didn’t know how to sew clothes, I had relationships with the guys who did.

So, I started telling people that I could make attires for them if they wanted. Like that, I was in business. I’d take their measurements, and give them fabric samples to select from and a three-week timeline to deliver the clothes.

My 9-5 definitely helped pick things up. I was close to how the business ran, so I knew how sales were closed, and how to interact and manage people’s expectations. I took these lessons, scaled them down, and applied them to this fashion business I started.

What were the margins like?

They were pretty good. A yard of fabric was about ₦500, and I needed between three and four yards for each order. That was ₦2k. Then I paid the tailors between ₦2k and ₦2500.

When it was ready, I sold the trad for ₦12k to ₦13k. Sometimes, as high as ₦15k.

Man. You were making at least ₦8k in profit from each order

Yes. On average, my profit ran into ₦40l – ₦60k every month. By this time, my salary had also increased to ₦100k. That was pretty good money for me.

How good?

I didn’t need to spend what I earned from my 9-5. I saved my salary for the next three years without touching it and ran my life with whatever I made from my business.

Fascinating

In 2015, I was just turning 25 and was thinking about what to do next. My boss’s wife kind of gave me the clarity I needed.

She’d joined the business and was firing and hiring people at will. Then at one point, she queried me for taking two days off work. She claimed it wasn’t approved even though we had a conversation about it. The penalty was a salary deduction for that month.

I wasn’t even bothered.

Why not?

While I was away from work, I got an order and made about ₦200k in profit. I made 2x my salary in one day. It was enlightening, and I realised that the 9-5 might be taking too much of my time.

Ah. That point of no return.

I started looking for an exit, which came when I found another means of income — interior design. A friend referred me for my first job because of my experience at the furniture company. I made about ₦600k on that job alone. The following month, I got another project. Then the third one came. In a few months, I made about ₦1.3m doing what I did at my 9-5 for ₦100k.

I was like, mad o.

LMAO.

By the end of 2016, I quit my job. But I didn’t go straight into starting a business. I needed a break to map out my next steps. So I returned to school for my Masters. I spent the next two years there.

Did you do anything for money during this time?

Nah. I focused on school. It helped that I didn’t have to. My parents chipped in for my school fees, but I was in charge of my upkeep and accommodation. I had ₦3.5m in core savings and about ₦1m from my recent side gigs. I lived on this throughout my time in school.

Safety nets, eh?

Absolutely. I graduated in August 2018. A few days after my convocation, I got a call from someone I’d been referred to. They had a ₦375k project for me, and I got right to work. However, I didn’t use my usual guys for some reason. I went for cheaper labour, and it cost me. The guys messed up the job. Naturally, I wasn’t paid my ₦175k balance.

That wasn’t even the most painful part.

It wasn’t?

A few months later, I found out the guy I did the job for was a nephew of the state governor. I couldn’t help but think that I lost a plug there.

I took the lessons and moved on.

Sorry, man. But how easy was it to get jobs when you got out of school?

My referral network made sure I had projects to do — ₦80k here, ₦100k there. Then a big one came in November 2018. The first person I designed for in 2015 was expanding their space and commissioned me for the interior design. Because of my background in architecture, they also made me a project manager. The scope of the project ran into ₦6m. I executed the project and got paid.

Baller.

My payments were spread over a few months, which worked because I wasn’t sure when the next job would come. That said, I was now certain that I could make the business work.

What happened next?

Growth. In 2019, I was busy from one project to another. I did some work for some good brands that paid well. I moved into a mini-flat in March and the rent was ₦500k. I bought a Nigerian-used car in April for ₦750k and spent ₦400k on early mechanic work. By the end of the year, I had saved about ₦6m. It was a good year.

Also, I got into a new talking stage with an ex-girlfriend in the same year. She lived in Canada and we hung out when she came home for Detty December in 2018. That kicked things off again and we wanted to give the relationship another shot. However, she didn’t want to do long distance. This put japa on the table for me. In December 2019, I wrote IELTS and officially began plans to join her in Canada.

What did this mean for your business?

On some level, I stopped consciously trying to grow it. I thought it’d be selfish to grow the brand, hire people and let them go in the end. I just kept to the level I was.

Fair. What was your planned relocation route to Canada?

It was originally going to be via Express Entry. But Covid happened, and they stopped the draw. My girlfriend and I decided that I’d come in on a visitor’s visa and apply for permanent residency when we got married. I was set to leave in December 2021, but a new wave of Covid hit. As a result, flights were grounded and borders were closed. I didn’t leave until May 2022.

The months must have dragged slowly

Not really. In August 2021, I got a huge project and the cost came to about ₦53m. Since I’d planned to leave at the end of the year, I brought someone on board and agreed to a 60/40 split. My profit from the job was going to be ₦8m.

When I couldn’t leave in December, I focused on the job. However, the guys I was working for didn’t stick to their timelines. We were supposed to complete the project in January 2022, but it went on and on because they wouldn’t tidy up things on their end. Gradually, the relationship turned sour and they terminated the contract right after I left in May 2022. My business partner and I cut our losses and moved on. In the end, I made ₦6m from the project.

I’d started a new life in Canada anyway.

True. How’s it been going?

Pretty good. I got married in mid-2022, and my wife and I filed for Permanent Residency afterwards.

I became a permanent resident in January 2023.

Congratulations. What were the first few months in Canada like, financially?

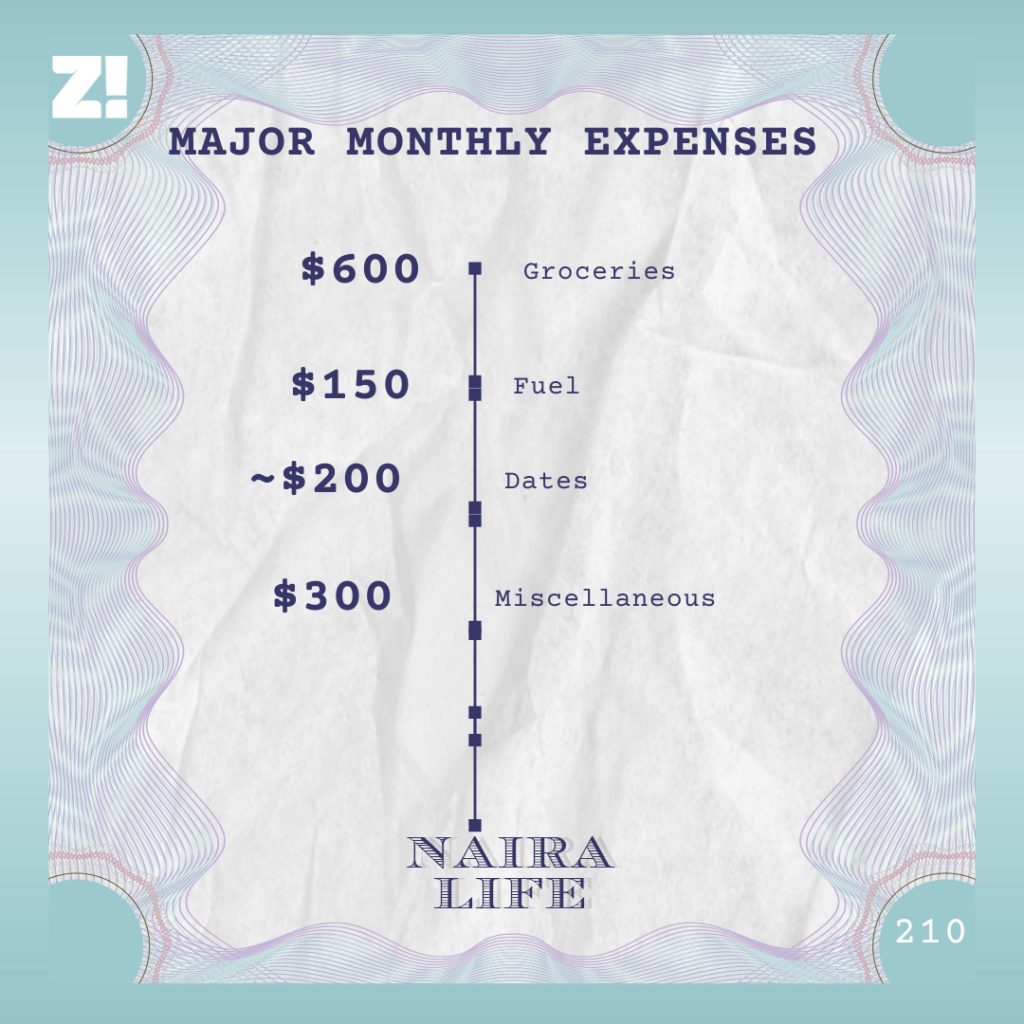

I came to Canada with about ₦21m saved up from my efforts in the past few years. This was about C$40K, and it helped me settle in. My wife took care of the rent and I picked up groceries and other miscellaneous. My average spend was C$1200 – C$1300/month.

Also, I still got some jobs in Nigeria. But since I wasn’t on the ground, I found someone to execute and I supervised them from here. At the end of each project, we split the profits. This brought in a few million naira.

Once my permanent residency was approved in January 2023, it was time to transition back into construction and project management. I’d taken a course on project management the previous year. So I started job hunting.

How did that go?

A few rejections here and there, but I got a job in February.

In construction?

Yes. I’m not a project manager at a construction company. The pay is C$90k per annum. That’s C$7500/month.

This is my first salary job since 2016. Mostly, it’s to provide some financial security while I settle in here. In a few years, I’m hoping to start up my own thing. Fingers crossed.

Fingers crossed. What’s your current mindset about money?

Since 2018, I’ve been saving at least 70% of my income because I felt Nigeria could happen anytime. Now I feel like I’ve saved fairly enough, and I’m confident about my safety nets. Also, the possibility of things going awfully wrong is low because of where I now live. The government of Canada has our back. In addition, there is my pay, which is a miracle considering I don’t have any Canadian work experience.

The bottom line is that I’m in a safe space and can afford to take a foot off the pedal. Money is for spending right now. At least until I start thinking about starting my own business here. It’s why I’m excited about our wedding ceremony in Nigeria later this year.

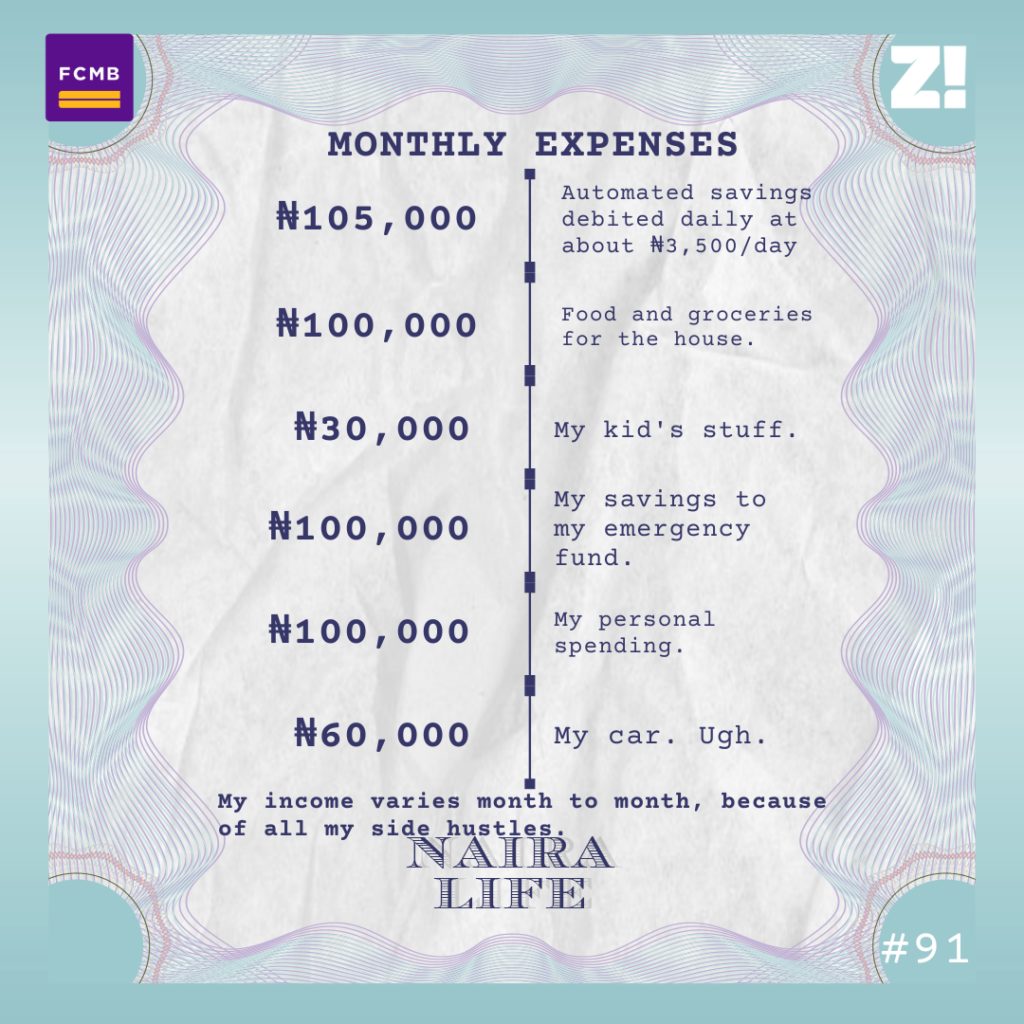

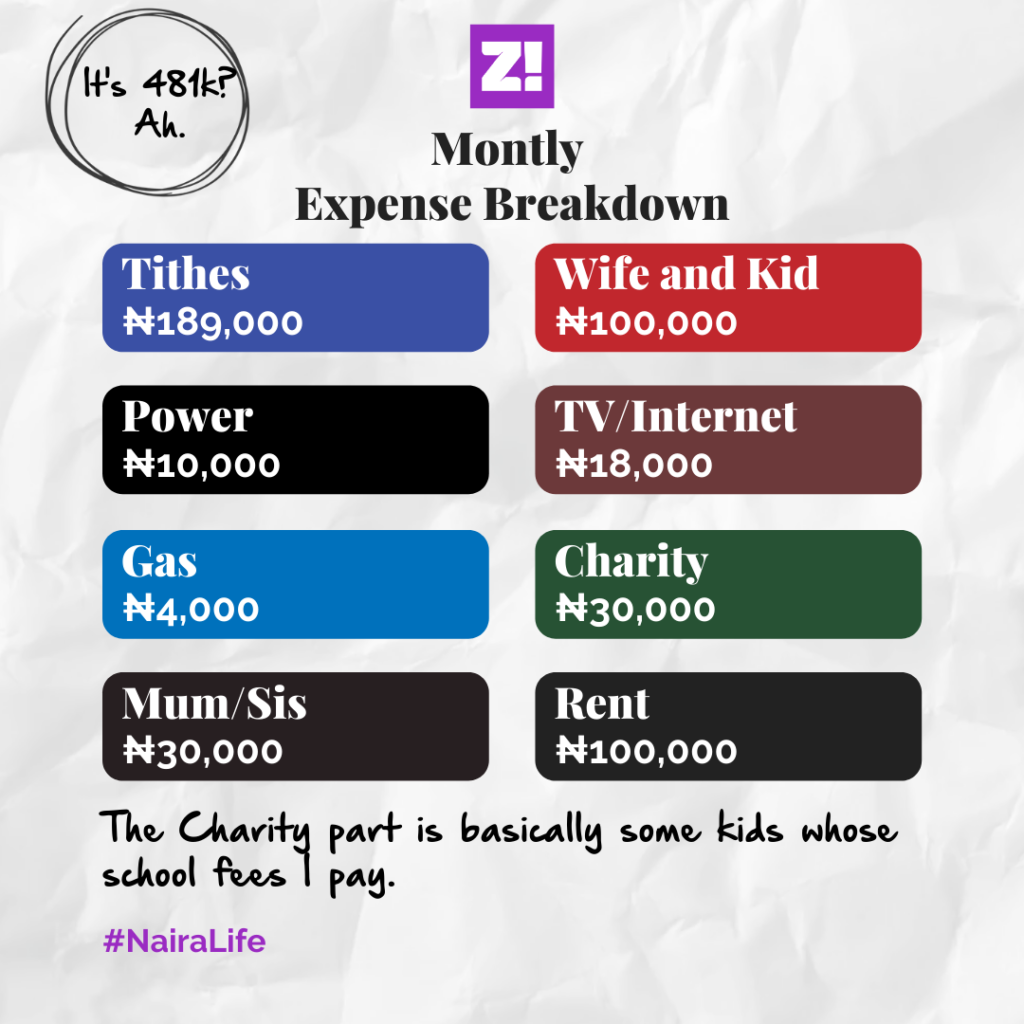

Exciting. Speaking of spending, what do your monthly expenses look like?

What about your savings?

It’s distributed across Canadian Dollars, US dollars and Naira.

Canadian Dollars – ~ C$13K

U.S Dollars – $4k

Nigerian Naira – >₦2m

Love it for you. Is there anything you want but can’t afford?

To be fair, nothing at the moment. I’d have said a second passport but I’m already on the path to getting that. No rush.

God when. I have to ask, when was the last time you felt really broke?

Not since my adult life started. I started building a secure chest as soon as I could. And as the years progressed, I delayed instant gratification of giving in to it would put me in a vulnerable financial situation. I really don’t remember the last time I was broke.

Energy. Is there a part of your finances you wish you could have been better at though?

Maybe I should have started actively investing. Not just save money but get it to work. A primary goal in the next three years is to build an investment portfolio.

Let’s circle back in three years and see how that goes.

Haha. No worries. What’s your financial happiness on a scale of 0-10?

It’s a 7 or an 8. I’m just happy about where I am, man. I’m planning my wedding, and I have the finances for it. I have some travel plans in the works and I can afford them. Most of all, I have the safety net to cover my immediate needs. There’s definitely room for improvement, but am I doing badly? Nah.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.