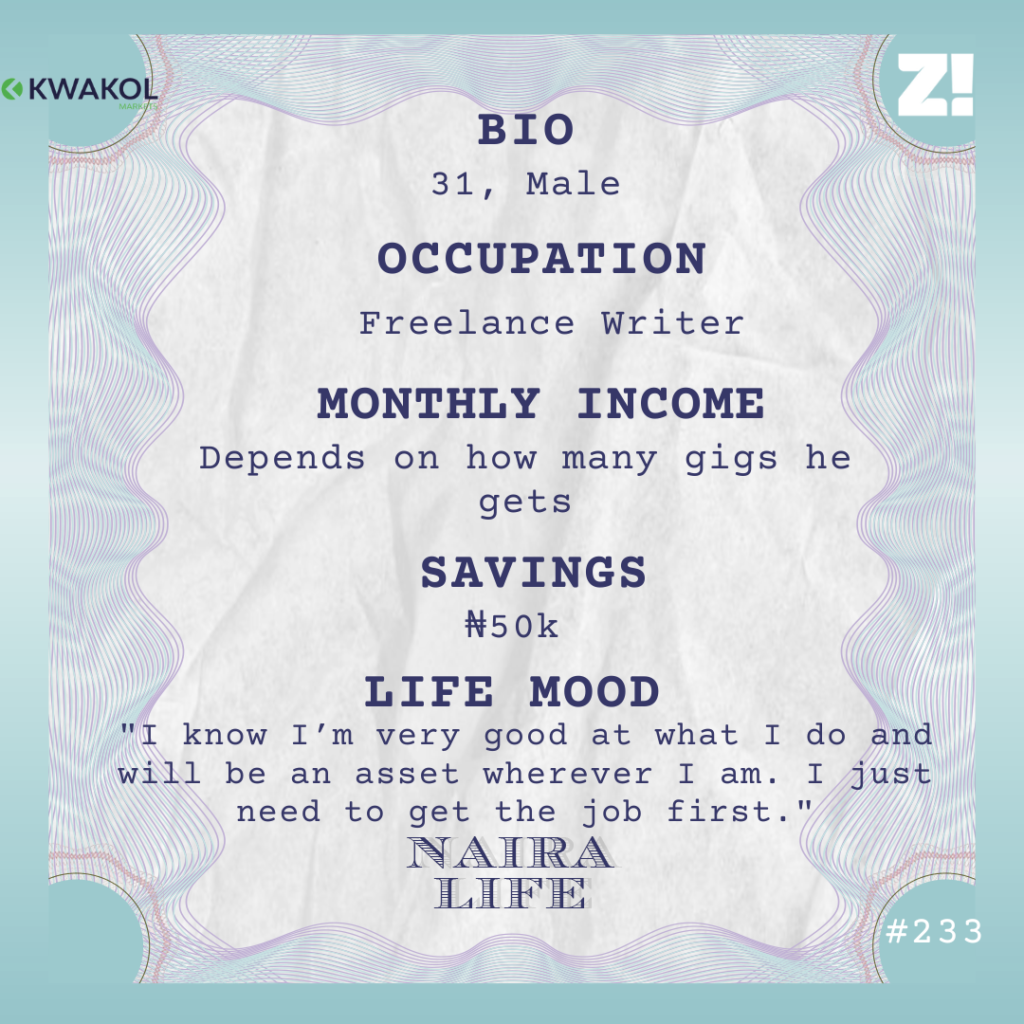

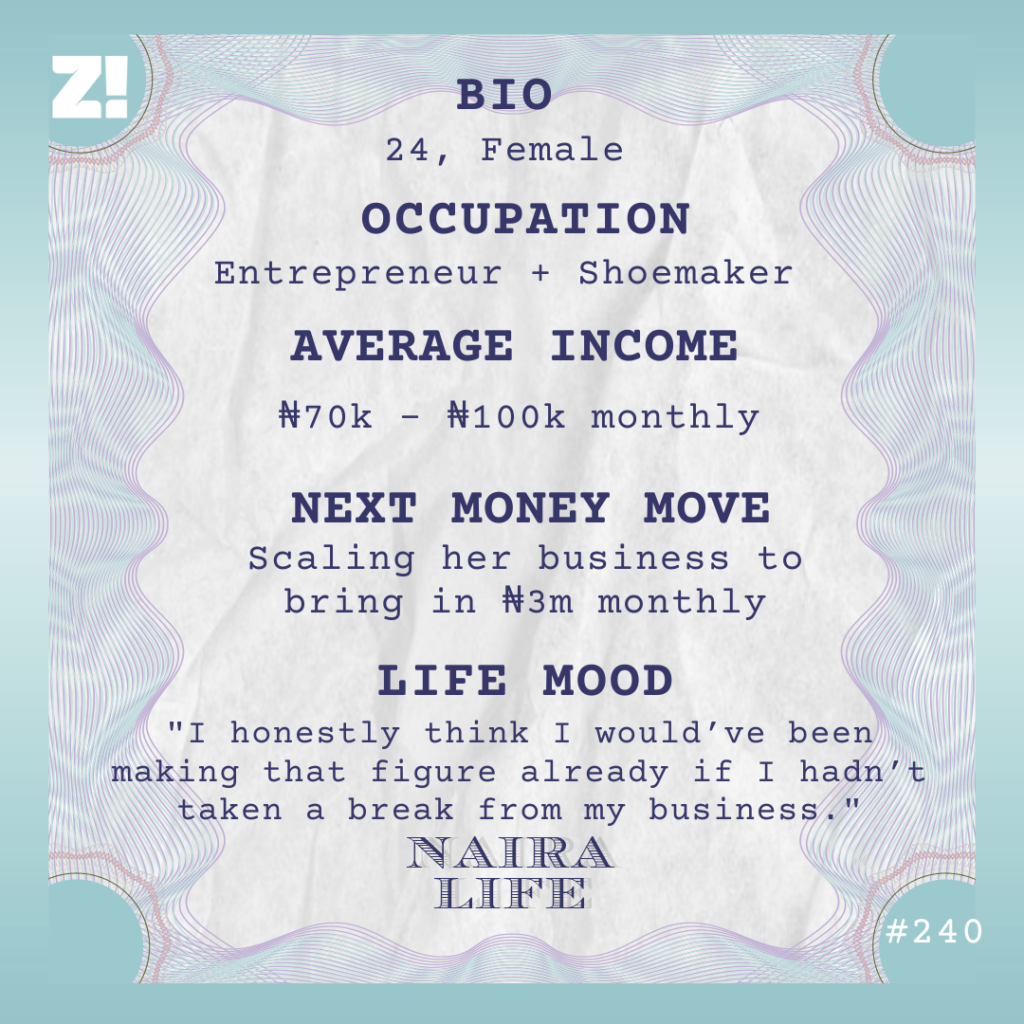

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

My mum made sure all our holidays — right from primary school— involved me and my four sisters learning a handicraft to keep us busy. When I was about to enter JSS one, we learnt how to make beads, and I sold some beaded bags I made for ₦150 – ₦300 at a church’s Children’s Day display.

Did that spin off into a proper business?

Not really. My siblings and I made those bags from the spare beads left over from what we used to learn. We just brought them to the display and ended up selling them.

We also learned how to make beaded flower vases and sold a few at church for around ₦800 each. We spent nothing on procuring the materials; my mum got them for us, so we just shared what we made among ourselves and used it to buy wara, suya or ice cream at school. My mum didn’t like that because we always got lunch boxes, but you know what they say about outside things being sweeter.

Talking about your parents. What was growing up like financially?

Both my parents are medical professionals, so we didn’t lack anything. We even had a driver who took us to school.

Plus, we lived in Maiduguri where things were affordable. Thinking about it now, growing up in the North was one of the best times of my life.

How so?

It was quiet and secluded. The people were also good with crafts. It wasn’t strange to find a four-year-old braiding her hair.

Fun fact: my siblings and I first heard about stuff like the Home Alone movies and Boney M Christmas songs after we relocated to the North Central in 2012 —years after the rest of the world had seen them. That’s how secluded it was up north.

Why did you relocate?

The Boko Haram crisis had started to gain ground, then my dad got another job. So we used the opportunity to move. I remember my sisters and I had to be picked up from school to leave in a hurry because everyone was just running helter-skelter.

That must’ve been terrible. Were you still making stuff?

Before we moved, I had a stint making beaded yarn crochet mini purses, and I sold about four of them to classmates for ₦100 each. I also made some crochet tops for my siblings.

After we moved, my mum paid ₦15k for a one-week training at a baking school so my siblings and I could learn how to bake cakes and snacks. Of course, that meant I had to monetise my skill somehow.

Let me guess. Another business?

Yes, also a stint. I baked a cake for a neighbour’s wedding but was only paid for the ingredients. I didn’t try to bake for money again after that.

The next one-off gig I did was play the piano for a Valentine’s Day program in 2013. I was paid ₦2k for it.

How did you even get the gig?

I learned how to play the piano when I was seven years old — thanks to my mum for getting someone to train us. I got the gig through some of my secondary school friends who also played instruments. Some of them were playing the drums and guitar, so they just told me to join them and play the piano, and the organisers paid me afterwards.

It looks like you’ve always had an entrepreneurial calling

Tell that to Nigerian parents. Now, everyone knows you can make money from business or on social media without a certificate. But medicine was what my parents knew. To them, it was: Study medicine, enter the labour market, and you’ll get money.

I was confused when it was time for uni because I knew how to do a lot of things. For example, I was good at graphic design from practising on our home computer. But I was also considering biomedical engineering. Eventually, I followed my parents’ advice and got into uni to study dentistry in 2017. I’m in my final year now.

Do I even need to ask if you’ve tried your hand at any business since you’ve been in school?

LOL. I currently run a shoe-making business I started a few weeks before starting uni.

How did it happen?

During the waiting period between getting provisional admission to the university and resuming the new session, my cousin was supposed to visit from the U.S, and I decided to gift them something unique.

I didn’t want to crochet a blouse because it was too basic. So I thought, “Why not crochet sandals?” I had a design in mind and wanted to use the stronger cobbler threads instead of typical yarn, so I bought some for about ₦300 each and started work. I had to change the design several times because it wasn’t working.

I finally designed the top of the sandals, then I found a shoemaker to help cobble the sole. He gave me a list of materials to buy, which cost me about ₦1,500 and in three days, he taught me all I needed to know, and we produced the sandals. Unfortunately, my cousin didn’t visit Nigeria that year, but I was so proud of my production.

What did you later do with it?

I carried myself to a studio and paid ₦100 for professional pictures of the sandals on my crusty feet for Facebook.

LOL

The Facebook post helped. Two coursemates saw it and asked me to bring one each for them when school resumed. It cost me ₦700 to produce one, and I sold it for ₦2k.

When we resumed, I made a couple more shoes and sandals for my personal use. Then, my hostel roommates started asking me to make one for them too. My bestseller was a crochet beaded gladiator sandal that I sold for ₦1,500 each.

Subsequently, I started advertising to students outside my hostel. I even got someone who bought fifteen pieces at once to retail. In my first year, I averaged ₦20k in monthly profits.

What was it like just starting school and getting thrown into a successful business?

It was crazy. I’d be at lectures all day and return home in the evening to work all night so I could meet up with orders. I was also running around different shoemaker shops to borrow their filing machines to finish the shoes because I didn’t have one.

Now, I realise I was underselling myself. Because how was I spending seven hours making one sandal only to make ₦1k as profit?

It was big money to me then because I had no responsibilities and still got a ₦25k/month allowance from my parents.

When did you start charging more for your skills?

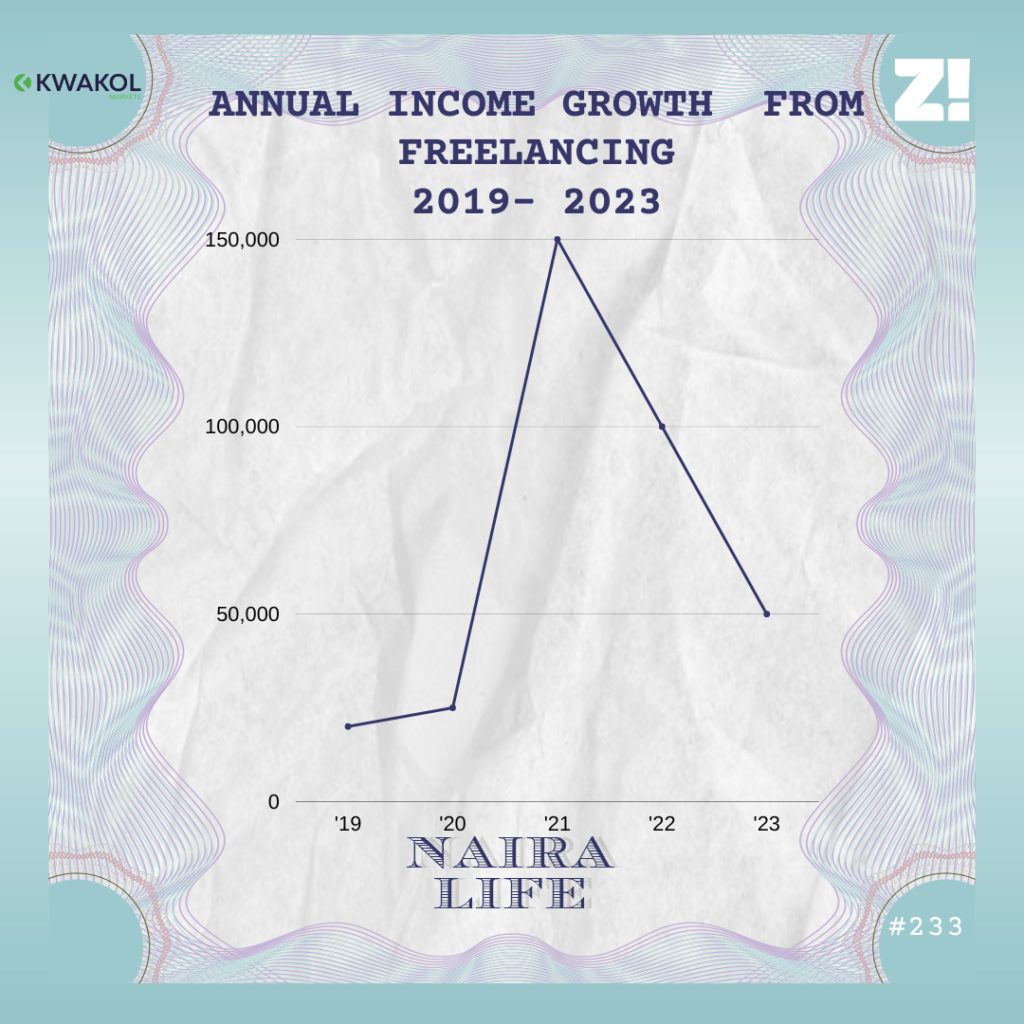

2019. Word-of-mouth advertising wasn’t working again, so I stepped up and became intentional about advertising on social media. After one tweet blew up my business and helped me sell about 50 sandals, Twitter quickly became my major channel. I sold each sandal at ₦4,500, making ₦3k in profit on each. I used the money I made to buy most of the machines I needed.

Several people also reached out to support me, and the goodwill meant I could get a generator and register my business with the CAC. Someone even gave me a filing machine for free. I still use it till now.

So, 2019 was the year your business blew

2020 and 2021 were even better. I got part-time staff to assist me with the shoemaking, running deliveries and taking pictures for content. At some point, I had six people working with me and paid them based on how much work they did per week. But it usually ranged from ₦10k to ₦50k weekly for each of them.

How much were you making yourself?

Between ₦500k – ₦800k monthly. I usually had to set aside about ₦250k to settle my staff. By 2022, I was making ₦800k in a good month after paying salaries and other business expenses.

That’s serious balling figures. What were you spending on?

I was barely spending anything I made from my business because my mum sent me foodstuff in addition to my ₦35k monthly allowance.

I only touched it when I wanted to pay rent for my off-campus accommodation, which was ₦400k. The other thing I constantly spent money on was fuel for the generator I used for the business — the rest I just saved.

I should add that I hardly spend on unnecessary things. I’d rather take a keke than spend money hailing a cab. Besides, I can’t take a car to the market where I go to buy shoe materials. I only use cabs when absolutely necessary. I’ve been using the same phone since 2019. It’s doing its work, so why change it?

[ad][/ad]

You mentioned saving most of your income

Yes. I used most of it to rent a two-bedroom apartment for my workshop in 2022. It cost me about ₦6m to settle rent, set up the space, and get more machines for work. To be honest, I initially wanted to buy a car, but I thought about it and decided to invest in my business.

How are you still juggling everything with medical school, though?

I’m not juggling —it’s been very tough doing both full-time. One aspect always suffers; if I’m not having logistics issues, my staff will come with their own. I’ve failed a lot of tests, and reading is a hassle. I don’t have a social life because school and business take up all my time. I even had to pause my business at the beginning of this year and only resumed a few weeks ago.

What happened?

I had a mental breakdown in 2018 due to some personal issues, which kept me out of school for roughly six months, and I had to repeat a year. So, this year came with many back-to-back exams and the backlog from that year. I also had to move back to the hostel since I wasn’t really making money anymore.

You weren’t making sales at all?

My shop was still there, and we still had a few walk-ins and repeat customers. But I wasn’t advertising on social media, so sales slowed to about ₦70k – ₦100k monthly.

I laid off some staff when I started running at a loss. Since I was busy with exams, I couldn’t monitor what my staff were doing, and they’d typically deliver poorly finished jobs to customers who’d complain and ask for a refund. Sometimes, I’d remake the shoe and send it again at my own cost. I often had to dip into my personal allowance to fill those gaps.

Some other staff stopped coming because I couldn’t afford to pay them. At the moment, I work with only three people.

Omo. How’s it going now?

I just resumed advertising again, so I’m still trying to find my feet, but making sales isn’t difficult for me, and I know I’ll get back to 2022 figures soon. I’ve had to become even more prudent with money. I’ve only braided my hair once this year; the rest of the time, it’s been in twists.

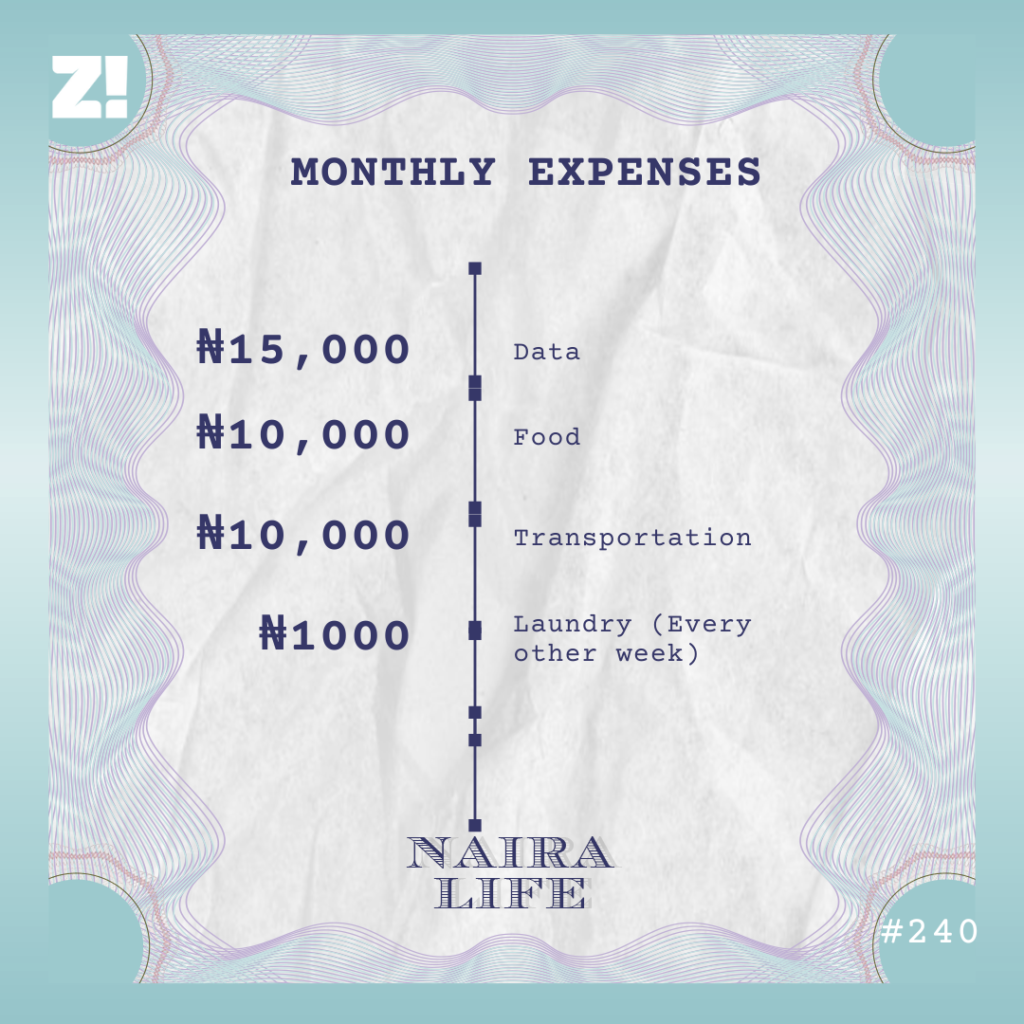

I even switched to an old 3G sim one time because I knew data wouldn’t finish as fast as it would on 4G. I also sometimes turn off data mode on most of my apps and avoid Instagram and TikTok. But I still have to be online because of my business, so data is a necessary expense.

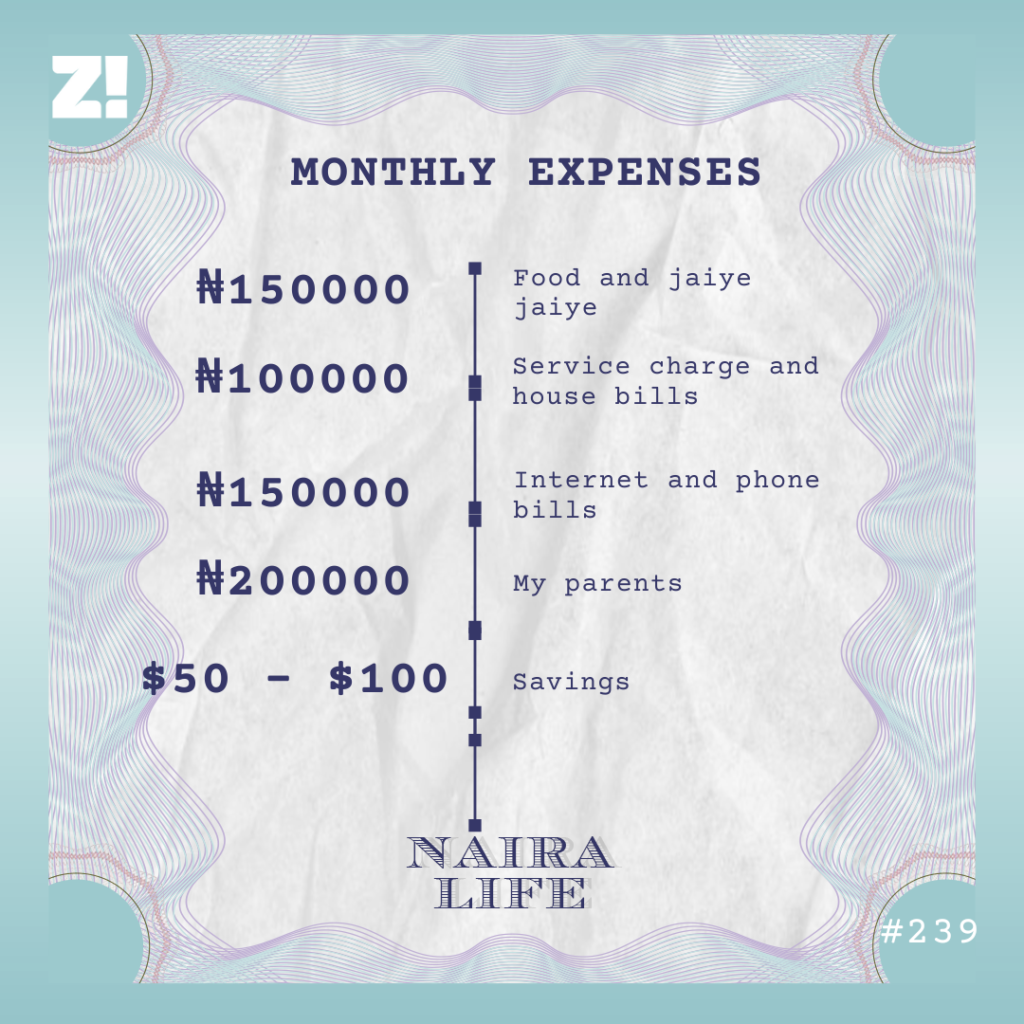

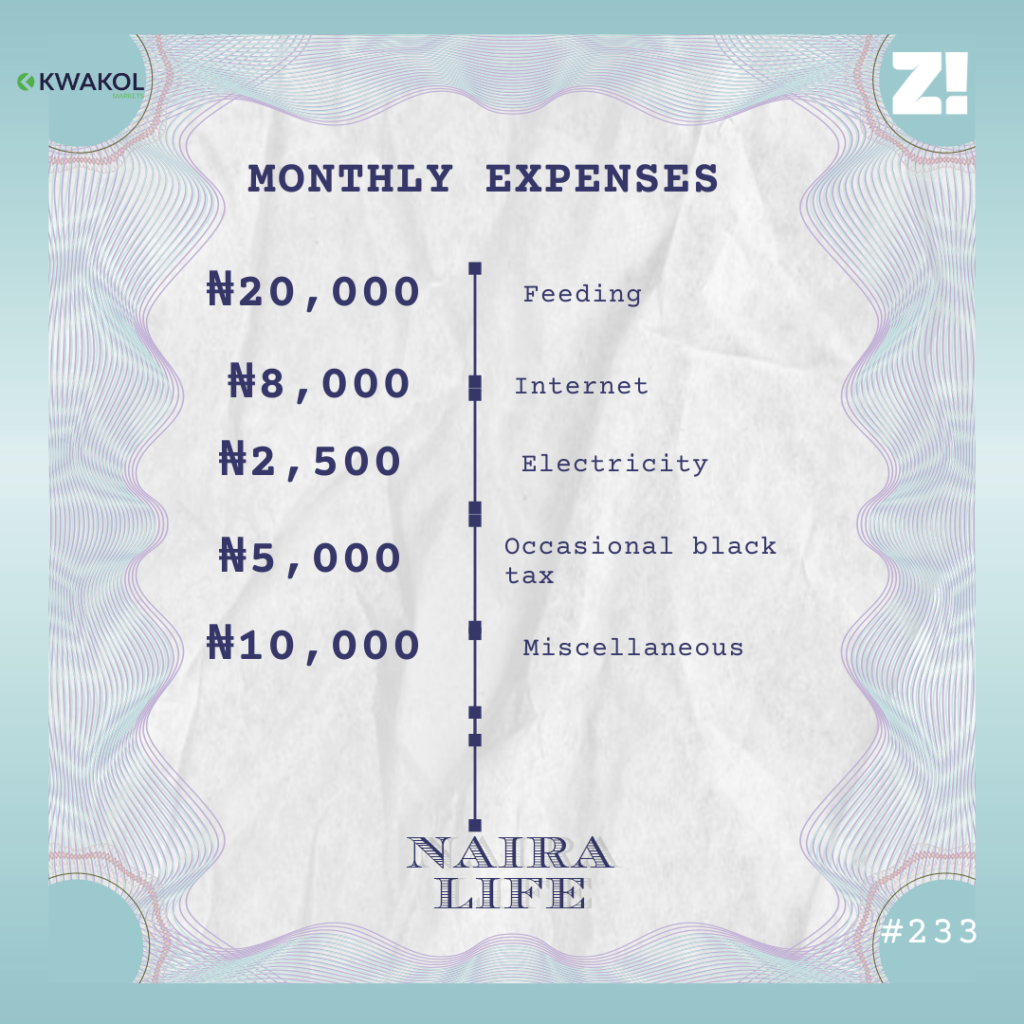

Let’s break down the expenses in a month

My mum still sends most of the foodstuff I need, so my food expense only includes perishable items.

What would you say is the toughest part of being a business owner?

Apart from the obvious challenge of doing it as a student, managing staff is really tough. When they don’t do the work properly, we end up remaking the product multiple times, which comes at a cost. It’s difficult getting people who actually care about the work; they’re just interested in the money.

That part is confusing for me because it also affects them when we run at a loss. So, why misbehave?

You’ve been at this for six years. What are some things you’ve learnt?

I now know how to better determine my price point, based on how my competitors are pricing, the rising cost of materials and how much effort I put into a piece of footwear. On average, one piece costs ₦30k now. Some people still tell me I should charge more, but I can’t do that. Is it until I get 500% ROI on one item?

On the other hand, I noticed that there were some people who never patronised me until I increased my prices. It’s a Nigerian mindset. People think the more expensive, the better it must be.

So, you’re in your final year. What does the future look like for you?

I’m still unsure about whether I’d practise after medical school, but I know I’m going to take a full year to give all my attention to my business. The business is here to stay, no doubt about that.

I also want to get an MBA, partly to add a title to my name, and also to get actual business insights. I may also go back to study biomedical engineering like I wanted before listening to my parents and studying dentistry.

Is there anything you want right now but can’t afford?

I’ve always wanted to go into bag-making, and there’s this tagging machine I’ve been eyeing. I’d also like to get a better phone and filming gadgets to make shoemaking tutorials on YouTube and take better pictures for content. Everything should cost about ₦900k.

How much do you think you should be making from your business now?

₦3m/month. I honestly think I would’ve gotten there already if I hadn’t taken a break.

Rooting for you. How would you rate your financial happiness?

Currently a 4, but I’m hopeful that once I settle into pushing my business again, it’ll be a 7 by the end of the month.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

We’re cooking THE biggest meat festival in Nigeria, and we’re assembling all food lovers. Sign up HERE.