Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I didn’t pay much attention to money until I graduated from secondary school and got my first job as a teacher. Prior to that, my parents provided everything I needed. It’s not like we were rich. My dad was a civil servant, and my mum was a petty trader, so things were average at best. But they did their best to make sure my siblings and I were comfortable in school. If we didn’t take homemade lunch with us, they’d give us lunch money. So thinking about where money came from wasn’t top of mind until I got that job.

Let’s talk about your first teaching job

I finished secondary school in 2009 and decided to do something while waiting for university admission. So, I got a job teaching primary four students all subjects for ₦4,500/month. My salary was increased to ₦5,500 three months later.

The first thing I did when I started earning a salary was to save up for a Nokia torchlight phone, which cost about ₦10k – ₦11k. Then, my dad took me to the bank to open an account so I could save my money there.

I didn’t save sha. When salary landed, I’d buy clothes and recharge cards for my phone and even my secondary school teachers. Sometimes, I’d give my mum money. I was quite generous because I had no expenses or responsibilities, so I gave it out freely.

I left the job after a year to teach at my former primary school because they were going to pay more.

How much?

₦7,500/month. But I only worked there for one month during summer lessons. The principal didn’t want to hire me when school resumed because he knew I was going to go to uni soon. So, I returned home until uni resumed in November 2010.

Did you do anything for money while in uni?

If you count scholarships, yes. I’d been hearing about them since my first year, but I didn’t pay any attention until my second year. I topped my class and was automatically shortlisted with one other person from my department. I did the assessment and got a full scholarship till my final year.

How much did the scholarship come with?

They paid ₦150k into my account every year. My tuition was only ₦50k, so I had ₦100k to do whatever I wanted. I had to maintain a particular CGPA yearly to remain on the scholarship, though. Another rule was that I couldn’t take another scholarship, but I did anyway.

The second scholarship was from an oil company and was worth ₦100k every year till graduation.

Baller

I only enjoyed the second scholarship twice before I was caught. Actually, I confessed. The people from the first scholarship had come for the usual review, and the person in charge was like, “I heard one of you is on another scholarship”. I think they just said that to scare us, but when they started asking us one by one, I said, “I am”, when it got to my turn.

They made sure I discontinued the other one. I had to write to the oil company asking them to stop the payments.

So, I was left with just ₦150k. After paying my tuition, I’d usually spend the rest carelessly on my girlfriend, food, friends and my parents. I got a laptop too.

At the end of my third year, I got another ₦50k scholarship.

What happened to not taking on more scholarships?

Technically, I didn’t process the scholarship myself. I wrote the exam on behalf of a friend. We agreed to use my name and some of his own details — his year and department — and if I got in, I’d give him some percentage of the money.

I gave him half of the first payment, but I didn’t give him a cut in the subsequent two payments.

Was he okay with that?

He complained, but the money was entering my account directly, and I basically did all the work, so he dropped it. I was now in my fourth year and needed money for my project and other off-campus accommodation expenses, so the extra income came in handy.

Final year came, and the scholarships ended. I failed one of my final exams and had an extra year.

Yikes. So sorry about that

Thanks. I didn’t want to take any risks, so I started going for night classes regularly. That was how I stumbled into a business opportunity. I noticed there were no snack or drink vendors at night in the building we studied in, so I started setting water and snacks on my table whenever I came to read. People would come to buy, and the demand became so high that I stopped reading for my class and focused on the business.

I moved my “stand” to the entrance of the hall. I’d regularly sell ten bags of pure water and several cartons of biscuits in one night. I even had to employ two part-time students to stand at my spot while I moved around to market my goods. I paid my staff in free biscuits and, sometimes, ₦1k per day. I made close to ₦30k daily, but I usually put most of it back into the business.

How long were you at it?

About two years. I started in 2015 and continued even after I sorted the extra year because I was still in school processing my NYSC and project.

By this time, some other people had noticed I was making money and decided to start their own night snacks and water business too. Then the school management became aware. Normally, businesses in school had to register through the authorities, but since I sold at night, they didn’t quickly catch on. I eventually stopped in 2017 because of the school’s wahala.

I really made money within those two years. At one point, I was sponsoring my younger sister at the polytechnic and regularly sending money home to my parents.

What did you do after?

I went for service in 2018 and taught maths and other science subjects at a government school. They didn’t pay an extra allowance, and I had just the NYSC ₦19,800 monthly stipend. So, I started looking for other income opportunities. I first tried after-school tutorial lessons for ₦100 daily, but it didn’t quite take off. I was serving in the north, where students hardly came to school during the normal hours. So, I just made the lessons free as a form of community service.

Six months later, I got a secondary place of assignment from NYSC. It was at a private school in town that paid ₦15k/month, bringing my total income to ₦34,800.

I also decided to try the tutorial business in town — that one worked better. Though, the parents always negotiated payment to the extreme. It was ₦5k per child, but they’d bring two other siblings and say the ₦5k should cover them too. I sha accepted it. I just wanted to make money.

What were your expenses like during this period?

It was mostly feeding and transportation. The school I worked at gave me a two-bedroom apartment, so I wasn’t spending on accommodation.

Remember the students I was giving free lessons? I also paid some of their school fees and bought books and math sets for some of them to encourage them to come to school and keep participating in my class.

Apart from these, I also sent money home and occasionally financially supported my pastor. I didn’t have any savings.

Interesting. What happened after NYSC?

Job applications. There was one that had five interview stages. I passed three and failed the fourth one. I was still in the north and was travelling down to Lagos for each of these interview stages. When it didn’t pull through, I decided to move to Lagos to focus on job hunting. This was late 2019.

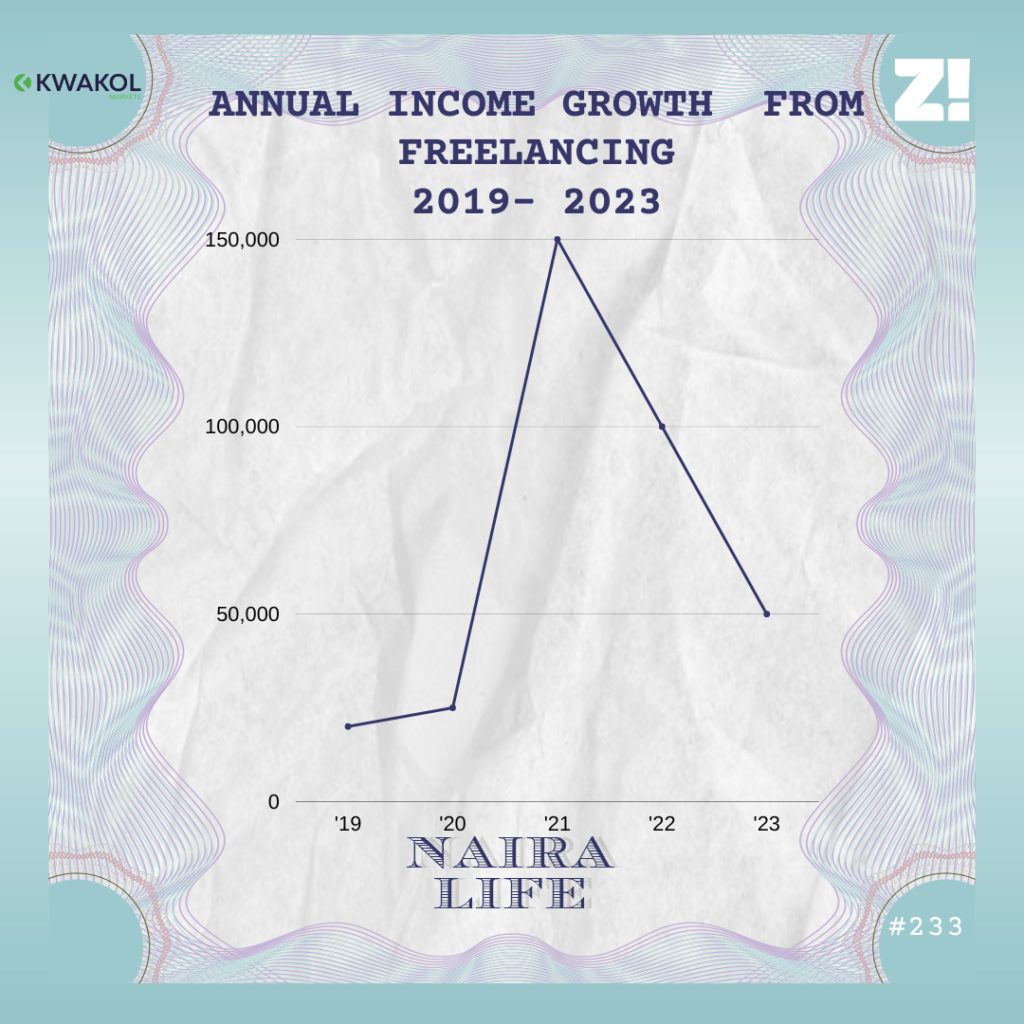

But when nothing came after two months, I returned to teaching for ₦15k – ₦20k per month. When COVID lockdown happened in 2020, I used the opportunity to learn copywriting and social media marketing. All the money I made from teaching paid for my digital marketing classes. It was like a new world. I started offering services as a freelancer, even though I did a lot of free work in the beginning. Once in a while, I got social media management and digital marketing gigs and made the odd ₦10k – ₦20k.

In October 2021, I landed my first full-time job as a content writer and social media manager at a real estate company. My salary was ₦40k/month, and I got free accommodation in Ikeja.

I was also freelancing on the side: CV writing, LinkedIn optimisation, personal statements, social media management, and everything else that came. My goal was to save ₦100k per month, and I planned to do that with the side gigs.

How did you manage the side gigs with a full-time job?

My job required me to be online, and I had access to the office Wi-Fi and electricity, so I used the resources to work on my freelance gigs.

I didn’t keep a record of how much I made, but I met the ₦100k/month savings goal a couple of times. Then around the end of 2021, the office headquarters moved to Banana Island. The long commute from Ikeja was so expensive, and I couldn’t keep up, so I resigned in January 2022.

Did you have another job lined up?

I freelanced for a bit, taking up social media management gigs to stay afloat. But in March 2022, I got a digital marketing role at an agribusiness company in Abuja, so I had to move. My salary was ₦100k/month.

This one didn’t come with accommodation, and I initially squatted with a friend. But his place was far from the office, so I started living in the office to save transportation costs. There was always light and data, so I didn’t have to pay for those. It also meant I could save more. With my freelance gigs, I saved ₦150k in some months; other times, I saved ₦100k.

Was there a particular savings goal?

I wanted a new apartment in January 2023, so I was just locking the money — like fixed deposits — in a savings app until the new year.

But my savings plan derailed a bit when I left the job after four months. They could no longer afford to pay me, so they discontinued my contract, and I returned to Lagos.

Back to social media freelancing?

I decided to focus more on CV writing and LinkedIn optimisation training. I realised the demand for social media managers was far lower than the supply. Anyone can wake up and start managing pages for ₦50k. I’d rather train someone in social media management than manage their page.

Going freelance meant my monthly savings had to stop. I was living in a single room that my elder brother left after getting married, and my younger brother came to stay with me, increasing my monthly expenses. The fixed savings I had couldn’t mature faster.

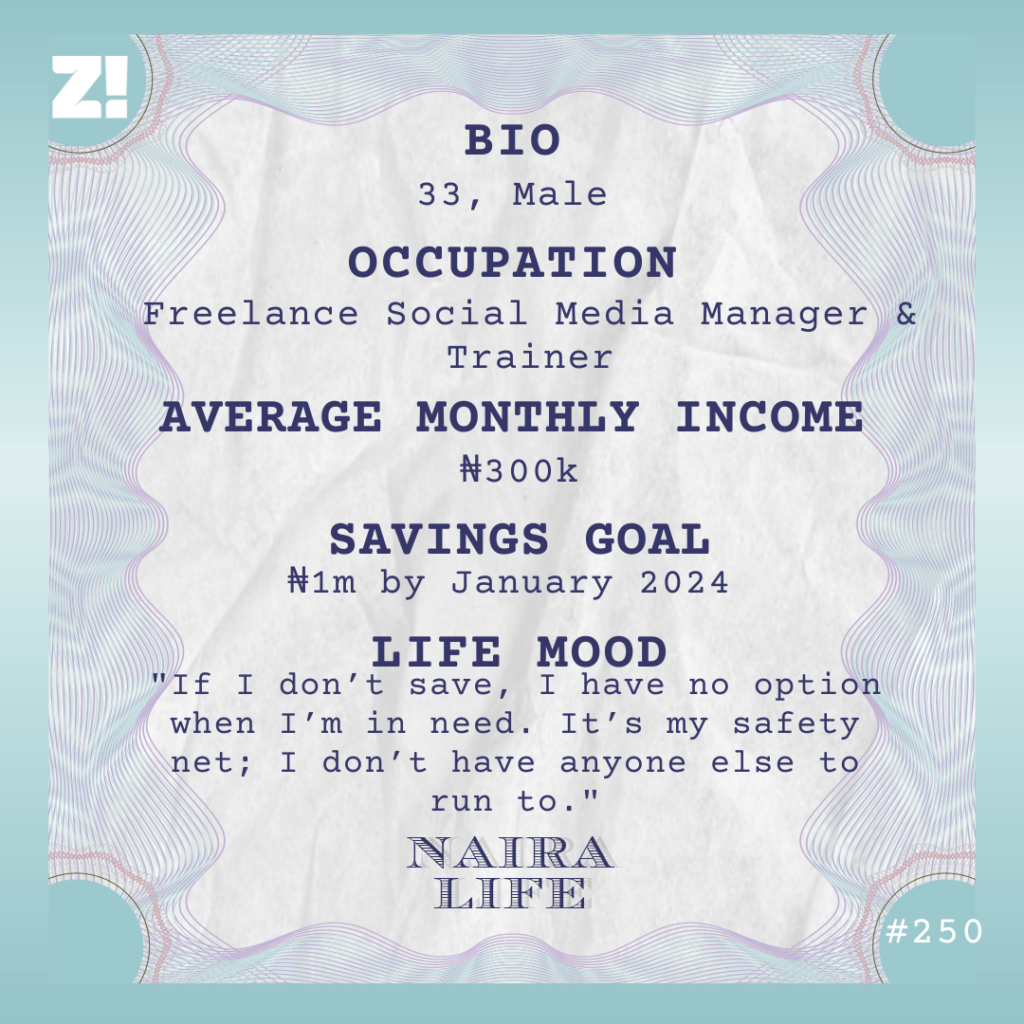

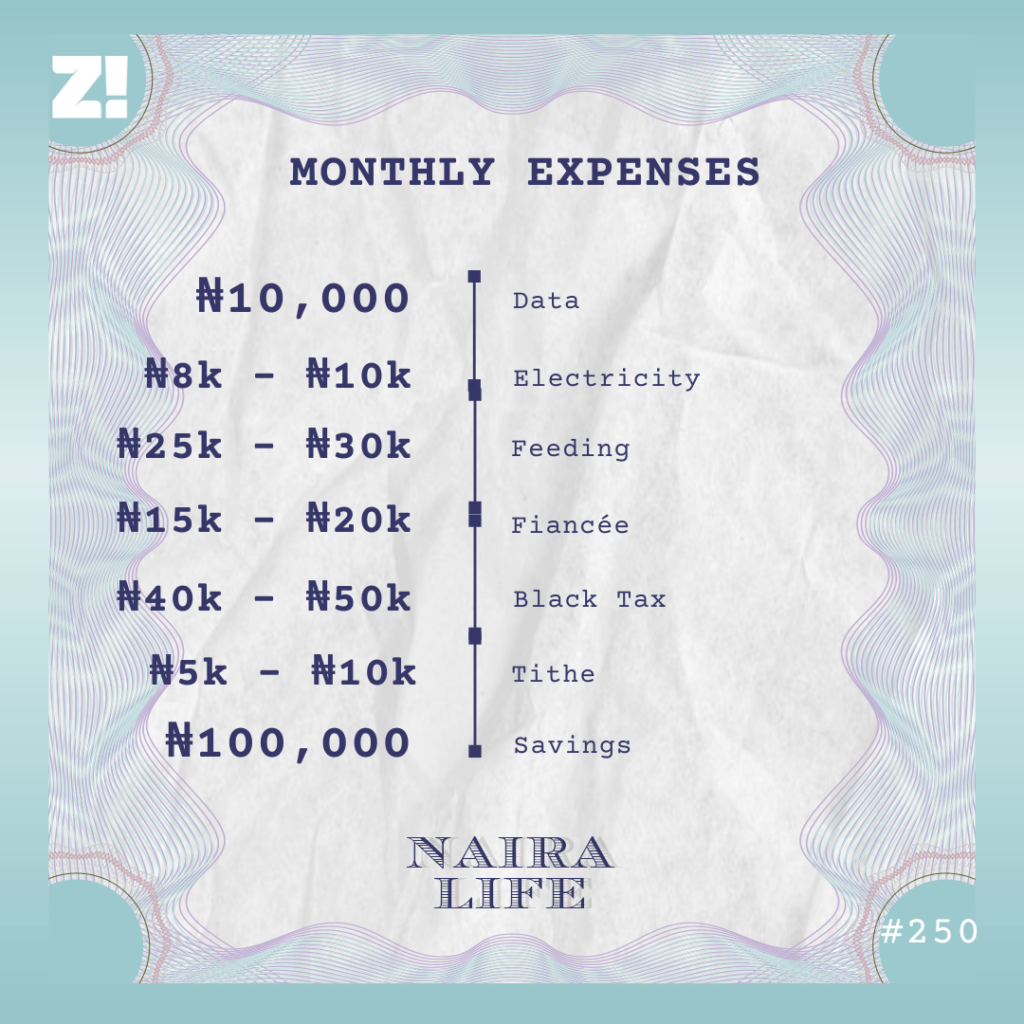

When it matured in January 2023, I got paid ₦500k+, which went into renting and furnishing my one-bedroom apartment. I still freelance full-time, but my income has gotten better. Since January, I’ve been getting more gigs. I resumed my ₦100k monthly savings, and I’m now locking it till next year. My new goal is ₦1m by 2024.

How much do you make from freelancing in an average month?

I’m terrible at keeping track of my income. But I notice an inflow of at least ₦300k/month on my bank app, and I religiously save ₦100k.

You seem to take saving very seriously

If I don’t save, I have no option when I’m in need. It’s my safety net; I don’t have anyone else to run to. I even feel I should be saving more than I currently do. I’m not as prudent with my expenses as I want to be. I plan to take financial courses soon and explore long-term investment options like stocks and real estate.

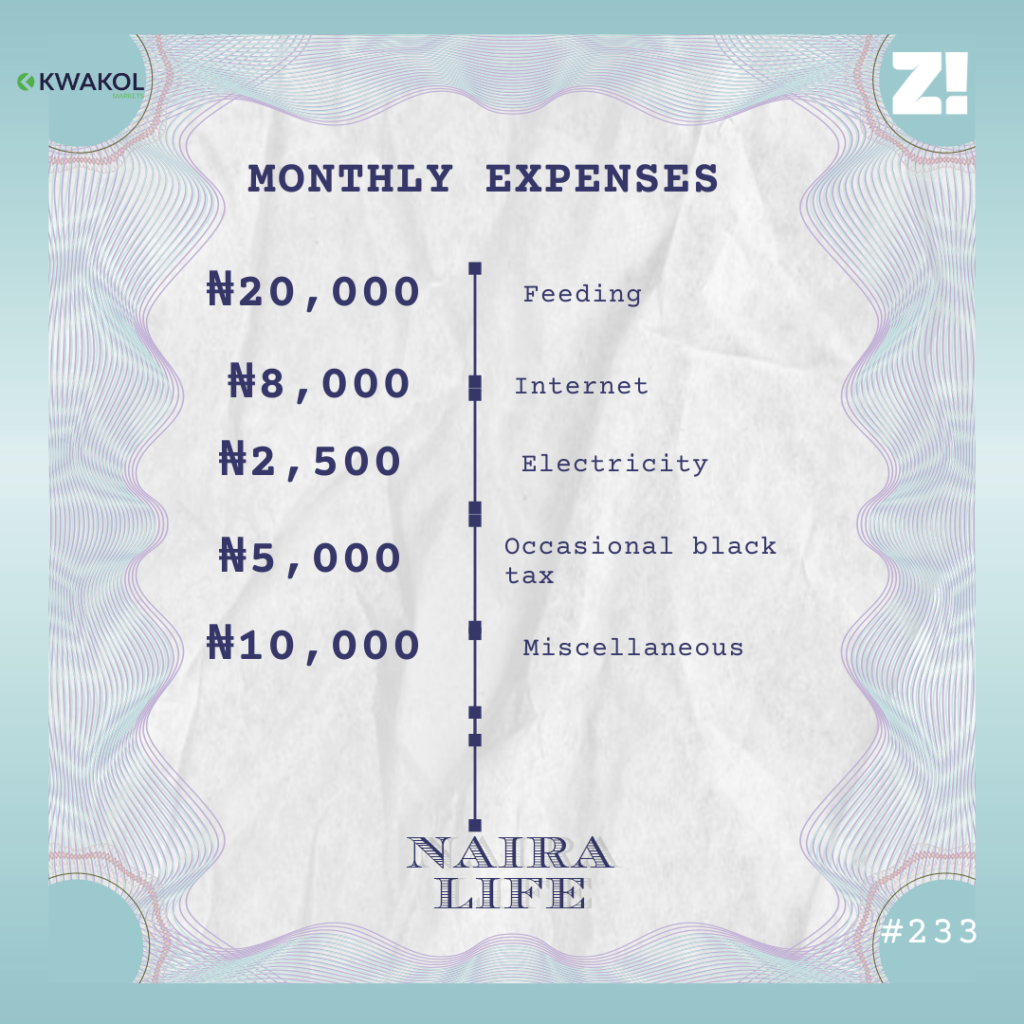

Can you break down your monthly expenses?

Sometimes, I look at my income inflow on my bank app and wonder where all the money goes. The thing is, when I’m broke, I go on social media and aggressively market my services. When I get clients, and they pay, the money goes to solve any urgent need at that moment. I think that’s why it’s so difficult to track.

Do you ever worry about the unpredictability of freelancing?

All the time. If I see a community management role in a decent company willing to pay ₦350k – ₦400k/month now, I’ll take it.

I’m still actively job-hunting, but recruiters have just been ghosting me. I’ve gone through several interview stages with major companies. After creating three-month content strategy plans or visibility case studies as the final test, they go, “Unfortunately, you’re not qualified”. I’m not even interested in doing any case study again. It’s like free work.

Is there a backup plan in case both freelancing and the job search don’t work?

I’m currently taking a six-month software engineering program I started three weeks ago. A politician sponsored it, so I didn’t have to pay anything. There’s also the possibility of job placement at the end, so that’s my long-term career goal for now. At least, they say tech is where the money is.

Is there anything you wish you could be better at financially?

Definitely financial record-keeping. Maybe I’ll go and withdraw all my money so I can watch it physically leave my hand because, right now, I don’t know exactly how it moves.

How would you rate your financial happiness on a scale of 1-10?

5. I’m earning reasonably well, but it’s not stable. A full-time job would help me plan my finances better, and I’d then use my freelance income to augment it.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad][/ad]