If you think you’re going to be like Chimamanda and work with Dior, you’re wrong oo! Take this quiz and find out the designer you’re going to be working with this year

-

If you’ve been reading this every Monday, you know the drill at this point. If you haven’t, now you know that Zikoko talks to anonymous people every week about their relationship with the Naira.

Sometimes, it will be boujee, other times, it will be struggle-ish. But all the time–it’ll be revealing.

When do you first feel like you truly understood money?

It was actually recently. Someone hired me to do a job and he hasn’t paid me. This guy has money oh, but somehow it clocked for me that money is money, but value is subjective. Like, money and value are not always equal. Most importantly, there’s the part where I realised that for your account to increase, someone’s account balance has to reduce.

That’s an interesting start.

Even if I remember the first time I made money, I’m sure it wasn’t hard. I always used to be like, “if you deliver value, the money will come.” It’s not that straightforward anymore.

I had opportunities when I was in school, but I enjoyed doing those things so much that I did them for free.

Then NYSC started, and I was getting broke too easily. That’s when I told my friend, “yo, I can do anything. Just holler if you need anybody to do anything.”

Just around that time, a bunch of guys were building a business, and they needed someone to do motion graphics. My guy hooked me up with them.

They were like, “can you do it?” and I’m like, “sure why not?”

Bruh, I’d never done that shit before. I had no experience in design or Motion Graphics. We had that conversation on a Monday, and I sent it in on a Friday.

They loved it so much that they invited me over, and gave me the full gist. Someone had actually hired them to do a job, and they had outsourced that part of it.

So now, all three of us went to meet this person, as partners, and he paid us 60k. It really was a big deal. Bruh, we actually took a photo with the cheque.

It’s also how I learned design, someone needed something done, so i just winged it and learned till I delivered.

How did that business go?

We had a good run, but there were too many forces pulling me away, so I succumbed, and I had to leave.

Forces?

Yes. We weren’t in a major city where all the action was happening. Plus, other forces like family and friends were pulling me back home. I vaguely remember, but we didn’t make a lot of money with that business in the short time we worked together–maybe 400k? But we had a good time while we were at it.

So you mostly survived on NYSC salary?

See, the best way I can explain my financial life is this; I don’t have money o. But I always have money.

Also, this might sound weird, but there was this beggar who had a baby. When I think about it now, if I had only 200 naira, I always made sure to give her 100 naira. As long as I see her. I was probably giving her out of selfishness, to be honest. Because weird thing, but every time I gave her money, someone always calls me to dash me money or pay me for something. I swear.

But anyway, where were we?

What happened after NYSC?

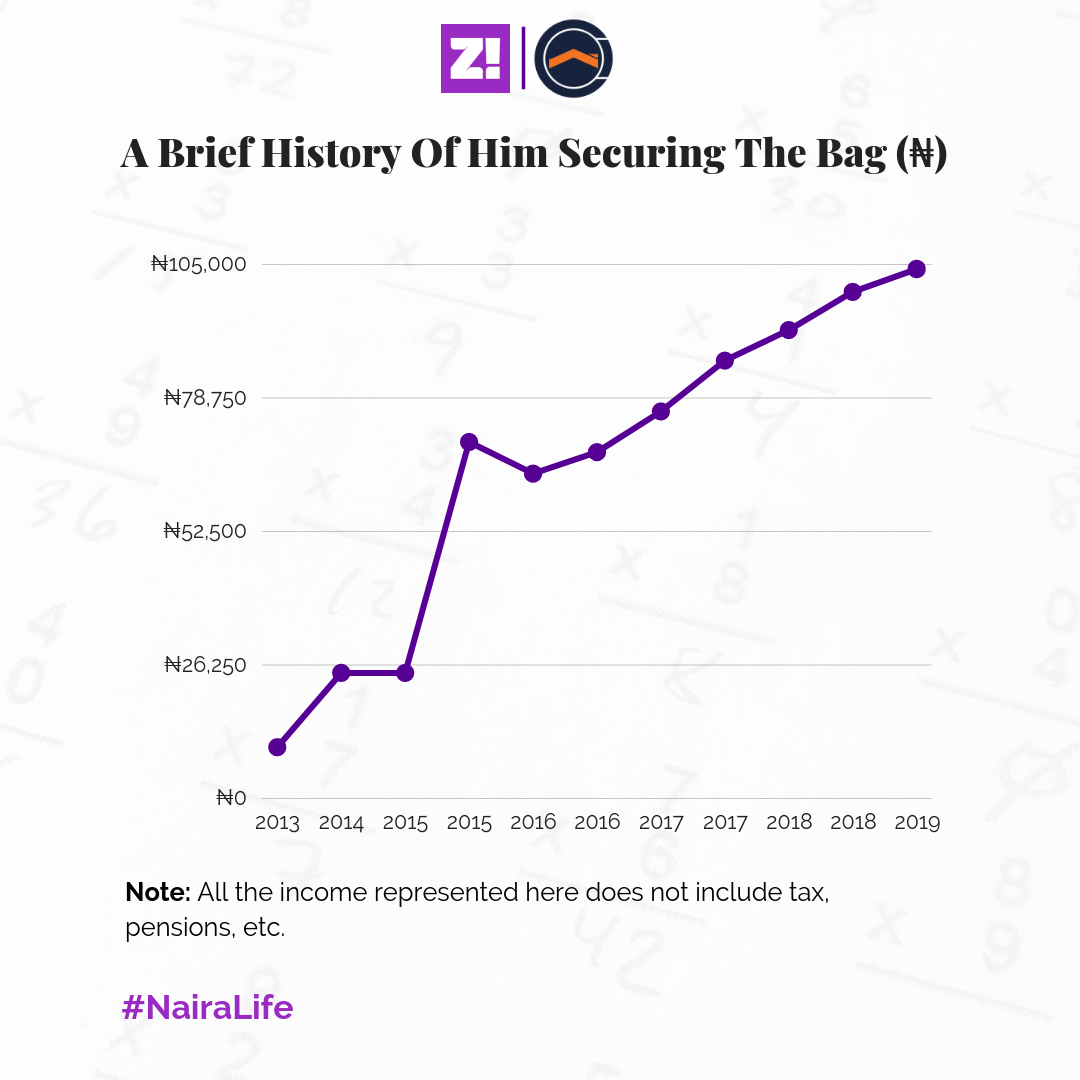

I stayed behind about six months, then I left and returned to Lagos. I got a job almost immediately. This was at the end of 2015. I started at 80k – net was 73k. I joined in November and I didn’t have a lot of needs, so it was a lot of money at the time. But next month? That was the real hit.

What happened in December?

One of the friends I’d already made in the company told me something, “Guy, go and borrow money you know you can’t afford to pay back.” And I’m like, what’s the guy saying? And he was like, “you go soon find out.”

The next week, I got an “end of the year” bonus–500k. After working for only two months. Bruh. I remember sitting inside keke, in the middle of two people, looking at them left and right, and saying in my head, DO YOU PEOPLE KNOW HOW MUCH I HAVE? ARE YOU JOKING?

Of course, I was super chill outwardly, but I was ecstatic. I saved it though, because I didn’t have any need for it.

It was also a time that my work required a lot from me that didn’t make side interests easy, so I shut them out.

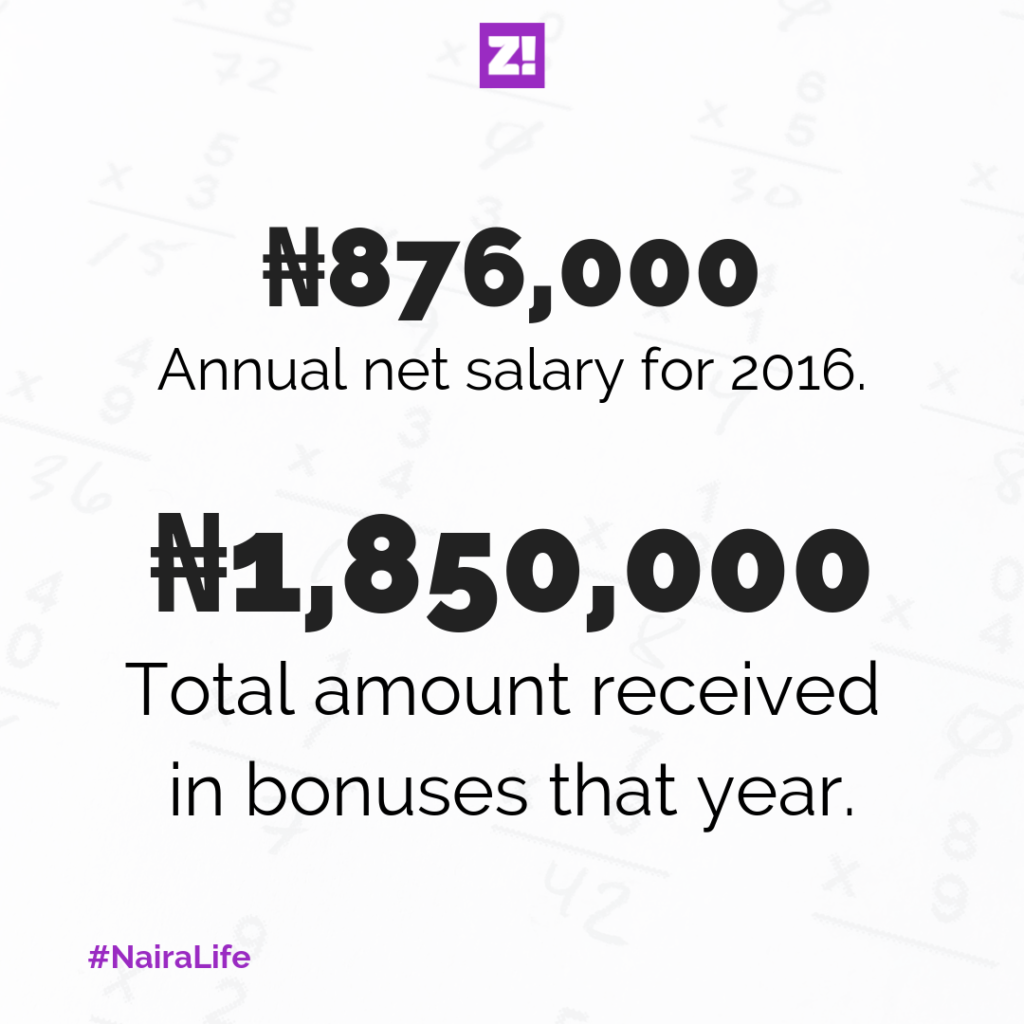

So, 2016?

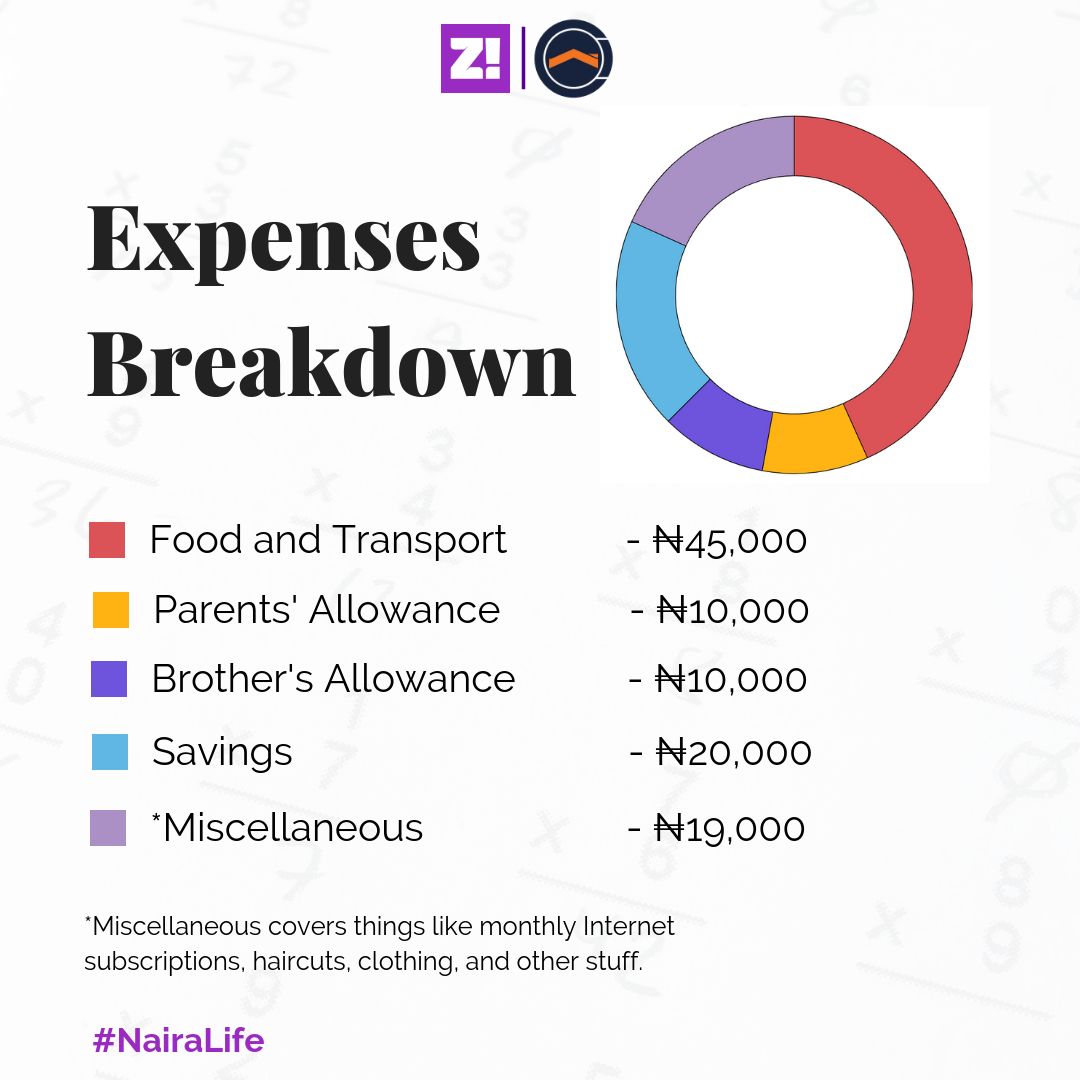

I was collecting my 73k, but now that I remember, it’s like most of it was going to Amazon. I liked to buy fancy stuff for my girlfriend at the time, like scented body wash and stuff like that. I’d just buy and ship.

Smack in the middle of the year, I got another bonus and gbas; 650k.

Is there a structure to these bonuses?

We thought there was, turns out there wasn’t. I was saving most of it anyway, so I was good. It was a quiet year, doing my work and minding my business, but by the end of the year, another bonus gbos; 1.2 million. I wasn’t expecting it. Them no dey expect that kain thing. This was in December 2016.

This was also the time I thought it’d be great to do something with all that money. So I convinced my mum to buy a car from someone–cost about 1 million. Then I bought it off her and had to pay in instalments. The goal was to use it for Uber. Do you know what’s mad? That car actually cost me 1.4 million, instead of 1 million. That extra money came from getting the car to the best condition possible.

I think this was when my downturn with money started.

I think I made only 180k from Uber. It was on and off the road–terrible investment. So by December 2017, I sold the car to someone that I sometimes feel guilty about selling to, even though he was aware of the car’s condition.

That was also the time I decided to move out of my parents’ house.

Ah, that.

The place I got was 650k. But you the Landlord wanted me to pay 2 years, so it actually cost me 1.4 million. And that was the first time in a very long time I felt like, “oh shit, I’m burning through all my cash.”

Still, I went for Umrah that December. I just felt like I needed it. This one cost 800k.

How did you fund your December?

Oh, I got another bonus – 2 million – so it made all of it easy.

Also – I wish I tracked this but – I spent close to 600k to get my house to living conditions. I bought my TV for 360k – it was a Black Friday sale – then I spent the rest on painting for the house, bed, fittings and other stuff.

Sha, at the end of that period, it felt like I was back to zero. At the turn of 2018, the office decided to increase my net salary from 70-something-k to 90-something-k, which is ridiculous, but okay.

It really does feel like your real salary comes twice a year.

The reality of this started setting in at the beginning of 2018. I’m like, how can I be collecting 90k a month? It’s been three years, and that was when I started to think properly about my growth within the company.

I mean, there were occasional bonuses that still came here and there. They’d come like twice a year and bring another 200k. The problem with all of it was that you couldn’t plan around it.

Wait, what company was this?

It’s a services company running a very lucrative business by Nigerian standards. The company has cash, there just doesn’t seem to be a proper structure. Can’t tell you the name 🙂

Anyway, I got 650k again, middle of the year. At this point, it was boring. There was already a shortfall for me that when the 650 came, the money felt like “are you joking” money.

To be honest, I want to quit, but I haven’t garnered enough courage to quit. I just need a financial justification to do so, like when my side hustle can sustain me without my 9-5 salary. I feel generally disenchanted with the whole 9-5 system at this point.

Did I mention that I bought a car? That made me completely wrecked. Only reason I could even survive paying for that car was paying instalmentally.

Anyway–

–End of the year bonus, 2018.

2.5 million. I pushed like 1 million into a project. Another 1 million went to the balance of my car. The remaining 500 went into tiny holes, like debts. Sha, the money on top of the 2 million completely disappeared.

What project?

A lifetime project – marriage. I mean, I know 1 million isn’t going to be enough, but it’s a start. You blink and 6 months will pass and next thing you know, I don’t have any money for my wedding.

What are the numbers looking like?

Argh. In total now, I’ve put in about 2.25 million. My parents have put in like 5 million. I’m sure my bride and her family have in well over 5 million.

So let’s say it has already crossed 10 million.

Wow. I’m shocked hearing that out loud. Like, it doesn’t feel like it, but then the numbers don’t lie. We’re actually planning for 500 guests, but realistically, 600.

What’s your financial future looking like inside marriage?

I’m screwed. While my job gives me a bad salary, it’s not exactly bad money. Also, there’s the part where my fiancée is doing fantastically well.

So even though I need to pull my own weight, I’m not under as much pressure as you’d expect.

So side hustles will go a long way, because my job actually gives me time.

We have big goals, so I’m going to have to step up. I don’t have it entirely figured out right now, but I’m in good company.

Let’s talk about your monthly income

I’m winging this money shit every month. My only luck is that I’m not that much a heavy spender, so I only spend when I need to. Also, I have a reflexive saving habit. Money comes and I just save, and it’s not accessible short term.

Also, I invested in something once; Sukuk. I can’t even remember how much I put in it, I just gave my babe to sort it out.

For health emergencies, I have my office HMO. They also sort out pension too by the way. Imagine how much pension you’ll be getting from a 100k gross salary.

How much money do you honestly feel like you should be earning every month?

800k to 1 million. And this is an educated figure. My skillsets across my side projects say I should be earning that much.

Something you want but can’t afford?

Nothing. I have everything I want. There’s a part of me that will say material stuff, but right now I think I’m fine. I think I’m just extremely lucky for everything I have, for the people in my life. For my fiancée.

These material things are mostly random shit, like a GoPro, or a drone.

Grad school would have been on my list, but I like where I’m headed. But if I had to go back to school, it’d be to study Sustainable Energy Futures. I’m enthusiastic about energy solutions for our part of the world.

When was the last you felt genuinely broke?

Yesterday. I almost cried. I was looking at my account balance and the list of things I have to do. And when I thought of the fact that at the end of the month, I’ll get 92k, it started driving me nuts. Funny thing is, I feel this way every month.

There’s something about my growth at work that depresses me. The closest people around me make me feel like I should be doing more.

And it’s not like they’re saying it or anything, I look at them and I just know I should be doing more. I’m not poor, but I could be doing way better.

Most of them are doing between 500k and 1 million a month. My existence is not threatened, financially. But I’m not happy with my financial performance, so far.

I feel you.

In the middle of this madness, my friends and I started a company in 2017.

I think we’re up to something, and I can see money or other success in my future. I care very much about building digital products–systems, apps, etc. It’s super interesting and lucrative. It’s still a tough sell at large, but we’ve been lucky a few times.

The most I’ve made from a gig – argh I don’t keep track of these things – I think it’s 200k and that’s minus the company revenue. This was a personal gig. To be honest, it was only for a few hours of work.

Despite everything, it always feels like I don’t have money. But I just always have money and I never lack.

Someone always tells me the best things that have happened to me were the ones I didn’t really plan for. I’m honestly grateful and optimistic about the future.

Random, but what is your Nigerian dream?

Building something that blows. Blowing in Nigeria is selling something to the government, then relocating your family Abroad.

Then join them later after you’ve hustled well here. And then live happily ever after; The Abroad Nigerian Dream.

Check back every Monday at 9 am (WAT) for a peek into the Naira Life of everyday people.

But, if you want to get the next story before everyone else, with extra sauce and ‘deleted scenes’ just subscribe here. It only takes a minute.

-

You’d think a struggle as common as finances would be easy to understand. It’s not. Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish–others will be bougie. All the time, it’ll be revealing.

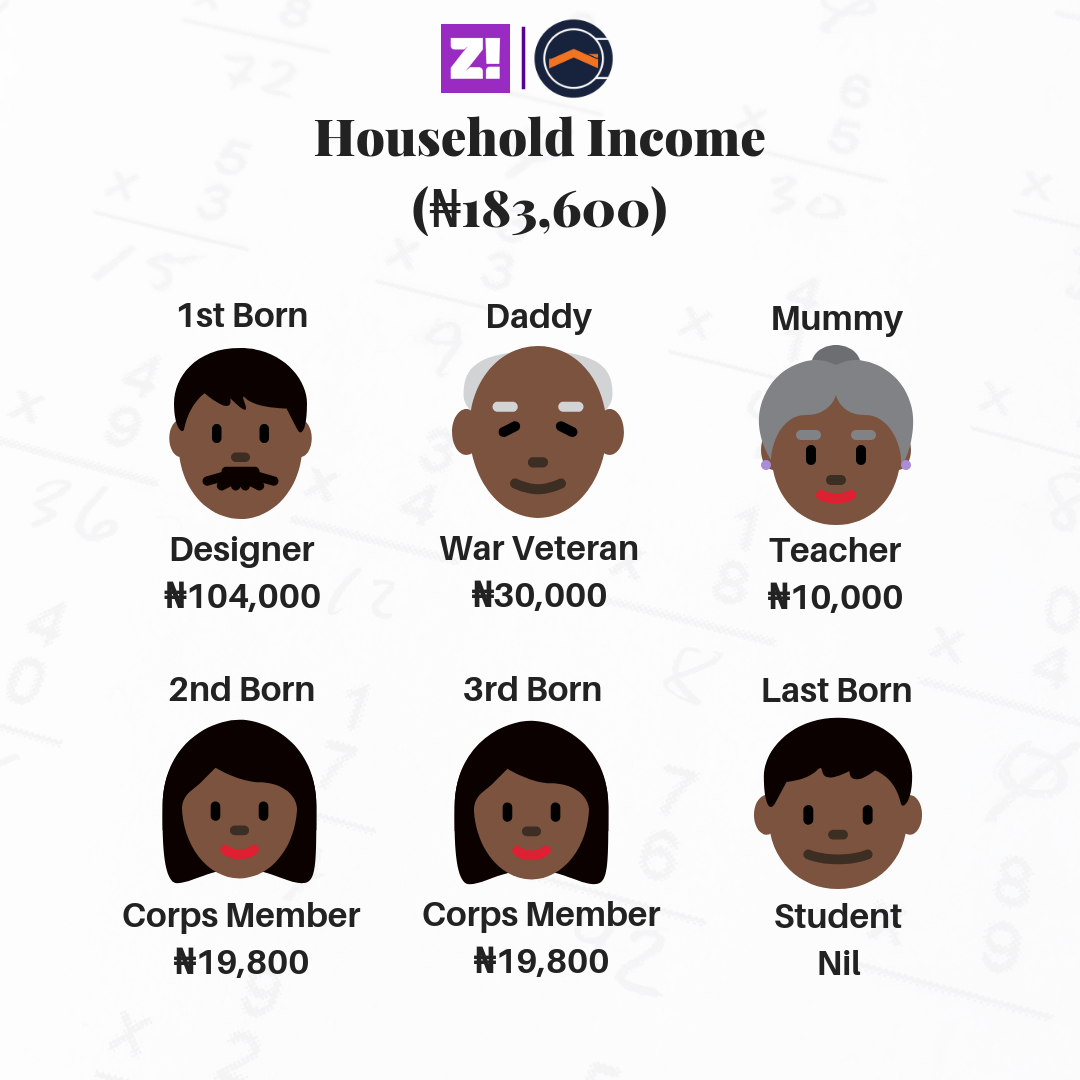

The guy in this story lives for one purpose; making sure all is well at home.

Age: 29

Occupation: Designer

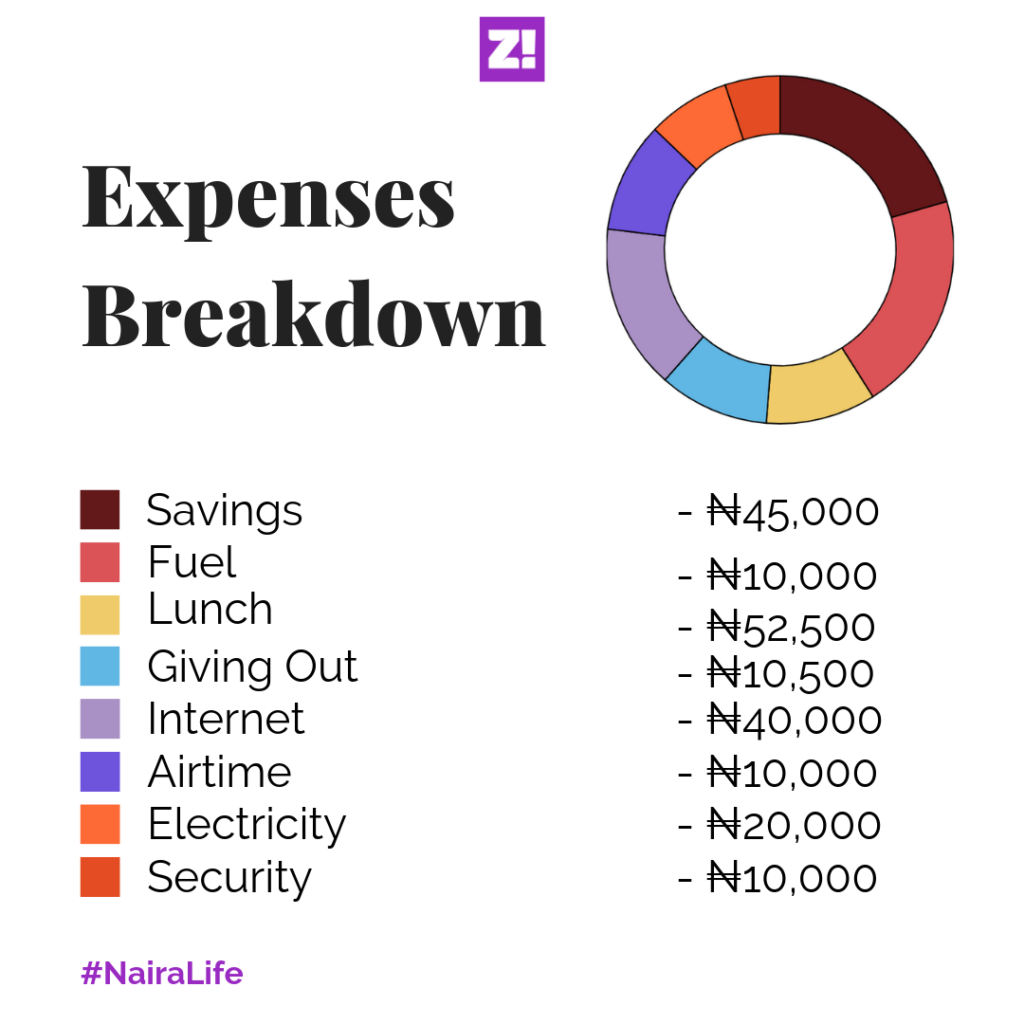

Net Income: ₦104,000/month

When did the hustle start?

My first teaching salary came during the 8 months ASUU strike in my final year. I spent the first four months waiting for ASUU to “call off the strike next week”. Then by the end of the fourth month, I just went looking for a job, and I found a teaching job.

I got paid ₦10k per month to teach Maths, Further Maths, and Physics.

When did you start to learn to design proper?

There was this moment of realisation that came in 400-level second semester. I had one more year in Uni and I knew I wasn’t going to graduate with a 2-1. So I started looking for how to complement my drawing skills.

Interestingly, 2 years earlier, one of these organisations came to school saying they were going to teach us graphic design and all of that. Some of us were going to take a test, and those who passed would get a 50% scholarship.

I passed, but that scholarship still meant I was going to pay ₦36k, but I couldn’t even afford that. So I fashied it.

Back to 400-level again, I met this guy who already knew how to design. And one day he goes, “you sketch really well, you know you can colour that in Photoshop, right?”

He taught me, free of charge.

To be honest, I had already lost hope of becoming a graphic designer at some point. I mean, the oldest prayer I can remember from when I was in SS3 was how I want to make a living with my pencils. So I wanted to study Computer Science, you know, to see how it can aid my art. The school gave me Physics to study instead.

So, this person teaching me made all the difference.

Okay, back to making a living.

Let’s not forget that I spent 7 years in school for a 5-year course because of ASUU. Okay, so the next time I earned after that teaching job was during NYSC. I dunno the ₦19,800 NYSC was paying other people, but I was collecting ₦19,600 sha. Bank charges and all that. There was one month that ₦19,500 entered sef.

I served at a Parish House in a village, and the Reverend paid in cash and kind. Cash at ₦5,000 a month. Kind in loads of free food and chicken.

30 days after NYSC in 2015, I got my first job as a designer. It was a perfect 26th birthday. Got a message on that Sunday–my birthday–telling me to resume on Monday. My first post-NYSC salary was 70k. I was on probation, so no tax, pension and all of that. But by the time I collected my 7th salary, the money go cut down.

Ah, the taxes.

Yep, all of that came in and I started to earn ₦63,800. Currently, my take-home is at ₦104k.

Let’s break that money down.

First of all, as the first born child of a not-financially-gallant family, I get to actually spend less than 50% on myself.

What’s the current household income back home?

40k monthly. 30k from my dad’s pension. 10k from my mum’s teaching job–she teaches at a primary school. Then my two sisters are currently serving. I guess we can count their own 19,800 at least.

When did you start paying the ‘Black Tax’?

See, immediately my first salary entered, most of it went straight to my family, and it wasn’t because of all that first salary ritual. My brother had just gained admission into University, and I had to collabo with my dad to pay his fees.

Since then, it has been making sure no one stays sick for long or goes hungry.

What’s the hardest part?

It’s knowing that there’s always something waiting for the salary to come. It’s an endless loop, but that’s not all. Also hoping that nothing happens back at home that will now touch the sacred ₦45k that feeds me and transports me to and from work. On the tough months, I don’t even get to save up to ₦15k.

What are some things that can go wrong?

One time, I fell sick and it cost me ₦15k to get back on my feet. Another time, my dad called that his brother had been arrested. Apparently, my uncle ran into someone he was owing. In the bid to “get him to pay back”, a fight started and he hit his creditor. That cost me 30k, One day, my dad’s vehicle was impounded. The fine was ₦80k, I raised ₦50k.

Have you ever reached a breaking point?

There was a time I had ₦60k in my account. My brother called me like “ASUU has called off the strike o.” They’ve increased our school fees to ₦120k. Do you know how much he used to pay before the strike? ₦40k. It knocked me out. Took me three days to get my senses back. But I survived it sha. Borrowed here and there for the fees, and to survive that month.

Do you ever enter “I can’t kill myself” mode?

Ah yes, when I don’t find any solutions. But it never really fixes anything. It mostly turns into a fight between my dad and me.

Another thing is, my dad has a drinking problem. I sent money home once, and my mum called me to say they’d run out of money for food. I went mad, because I know he spent part of that money drinking. It ended up in my dad and I shouting at each other, and my mum watching, helpless.

You and your dad seem to have an interesting relationship.

I used to hate him a lot, argh. He retired from the Army as a Corporal. I was a stubborn kid, and his methods felt too rigid. I thought he was a demon. Like, you put your leg in the wrong place, and you get a slap. There were no second chances with him. My mum, on the other hand, was kind and never hit us. That dynamic used to confuse me a lot.

It’s weird, but I kind of appreciate my father now. Growing up in the barracks, I’m not sure I want to live like most of the people I grew up with. Something he said once that I can’t ever forget; “I can’t let my children grow up in the barracks. Barracks children don’t prosper.” So it’s like he thought the only way he could make sure of this was to beat the barracks out of our psyche.

Mad.

As soon as he came back from his peace-keeping mission Sierra Leone, 2002, he retired. He was 42 at the time. This was also about three months after that Ikeja Bomb Blast. So we moved out of the Barracks and he started working as a driver for a flour distribution company. His military pension was also coming in at the time, ₦27k. That money increased to ₦30k in 2013, and he’s been collecting 30 since then.

What did your parents think about you wanting to become a designer?

Once, my teacher beat me for tearing my books and using it to draw comics. My mum came to school the next day to fight the teacher. “For your life, no beat am again! Na you buy the book for am?” Special woman; born of a soldier, married to a soldier.

It’s interesting, but they’ve always supported my talent and dream. At every stage.

Let’s talk about now. How much do you feel like you should be earning?

See, I shouldn’t be earning less than ₦200k. My workload is crazy. I know people earning twice my current income, who don’t have half my skillset. I tried speaking to my boss about a raise once, but he said I have to wait till it’s ‘increment season’ because the company has a salary structure.

Okay, what will be great money for you right now?

₦300k. I’ve thought deeply about this and analysed it. With 300, I’ll marry, put my children through school and build a house in 10 years. It’s not like I have a shayo budget that will drain my money or anything. I really don’t live beyond work and going back home.

Interesting.

I’ll pull this off easy in Ibadan, which is where I know I’m going back to full time when this Lagos hustle is over.

What’s something you want but can’t afford right now?

An apartment. A better apartment. ₦400-450k will get me the apartment I need now, but I can’t afford it. I’d have said a car too, but even if I had a car and all I had to do was maintain it, I still won’t be able to afford it, not to talk of buying one.

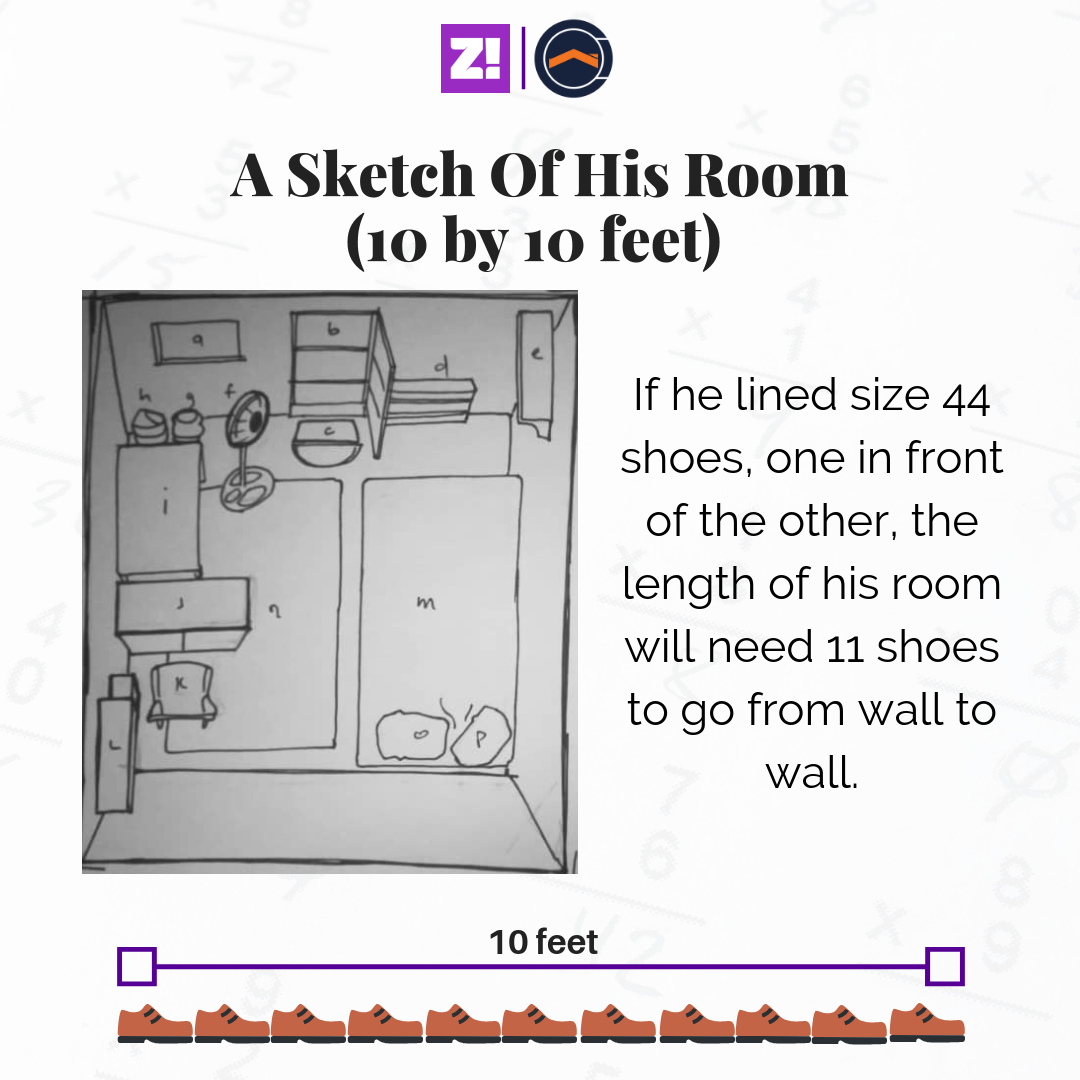

What type of apartment do you currently have?

It’s a single room in the boys quarters of a compound of many single rooms–with about six families. It’s a pretty small room and my rent is about ₦36k a year. When I first came to Lagos and was going to get a place, I told myself that I needed one that won’t be difficult to pay from my ₦70k salary. So I got a room. It was a win for me.

I have a bed, shoe rack, cloth hanger, shelf, table, and a cabinet. Then I share a bathroom with the compound. I don’t cook, so I don’t even need a kitchen.

Let’s talk about saving.

My saving is my emergency fund. I save for eventualities of all kinds, but to be honest, my brother’s school bills is what literally takes my savings. That’s why I lost my mind when the issue of my brother’s school fees came. It’s the major thing I constantly have to plan for the long term.

It’s also why I can’t invest, even though I’d love to. If I had earned more, I’d definitely be investing. It’s the only way to immortalise money.

Tell me something that’s currently on your mind?

“When will you marry?” It has started ringing in my head. I have a plan too and in fact, I’m already famzing my girlfriend’s mum.

You know – my ex-girlfriend – she’s married with a kid now, and it didn’t end because we didn’t like each other. But I couldn’t keep up – we were the same age. Our struggles were also at the same stage. Within one year after NYSC, she married. My current girlfriend is at a less advanced stage – she’s still in school. So I’m looking to marry within the next two years, she’ll be done by then. The babe makes me happy.

Awwn. Let’s talk about happiness, generally now.

To be honest, I think it’s a blessing to get to a point where I can actually come through for my family. My mum’s prayer is always “God bless the person that led you to the person who hired you.” When the twins got admission, there was no one to pay for their admission. That was when I got the teaching job to hustle. My brother won’t have even gone to Uni at all. It’s quite fulfilling, and I believe things will fall into place.

Most of all, I have an interesting job and amazing colleagues.

But my salary? That one is just annoying.

Click here to go straight MyCashEstate.

Check back every Monday at 9 am (WAT) for a peek into the Naira Life of everyday people. If you’d love to share your Naira Life with us, tell us here. You’ll be anon of course 🙂

-

1. When someone recommends a new tailor to you and you have hope.

2. But as usual, they are just prepping you before they start their madness.

3. When you hear these words “I can sew it ma”…

4. … Just know that your tailor is going to use your fabric to practice.

5. When you choose your own style and the tailor just decides to remix it.

6. When the tailor takes your measurements but then decides not to use them.

7. When your tailor promises you an outfit on a certain day, just add 3 months for peace of mind.

8. When you’re annoyed and shouting your tailor, she just stares at you, like:

9. When your tailor starts hanging out with bad gang and decides to start charging foolishly.

10. When you have to start chasing your tailor for your own clothes.

11. When you finally abandon a useless tailor and he/she starts calling you to ask where you are.

-

1. We were just minding our own business when we saw these slaying pictures of Madam Aisha Buhari on Twitter.

2. The First Lady, who was on her way to a global security conference in Brussels, was spotted in this beautiful Salvatore Ferragamo zig zig cape.

3. Madam Aisha will give the opening remark at the ‘Women’s Role in Global Security’ forum. But we’re just here for this outfit though.

4. Let’s all admit it, even this model did not do the dress justice like our slaying Mummy Aisha!

5. Please, join us in appreciating this beauty.