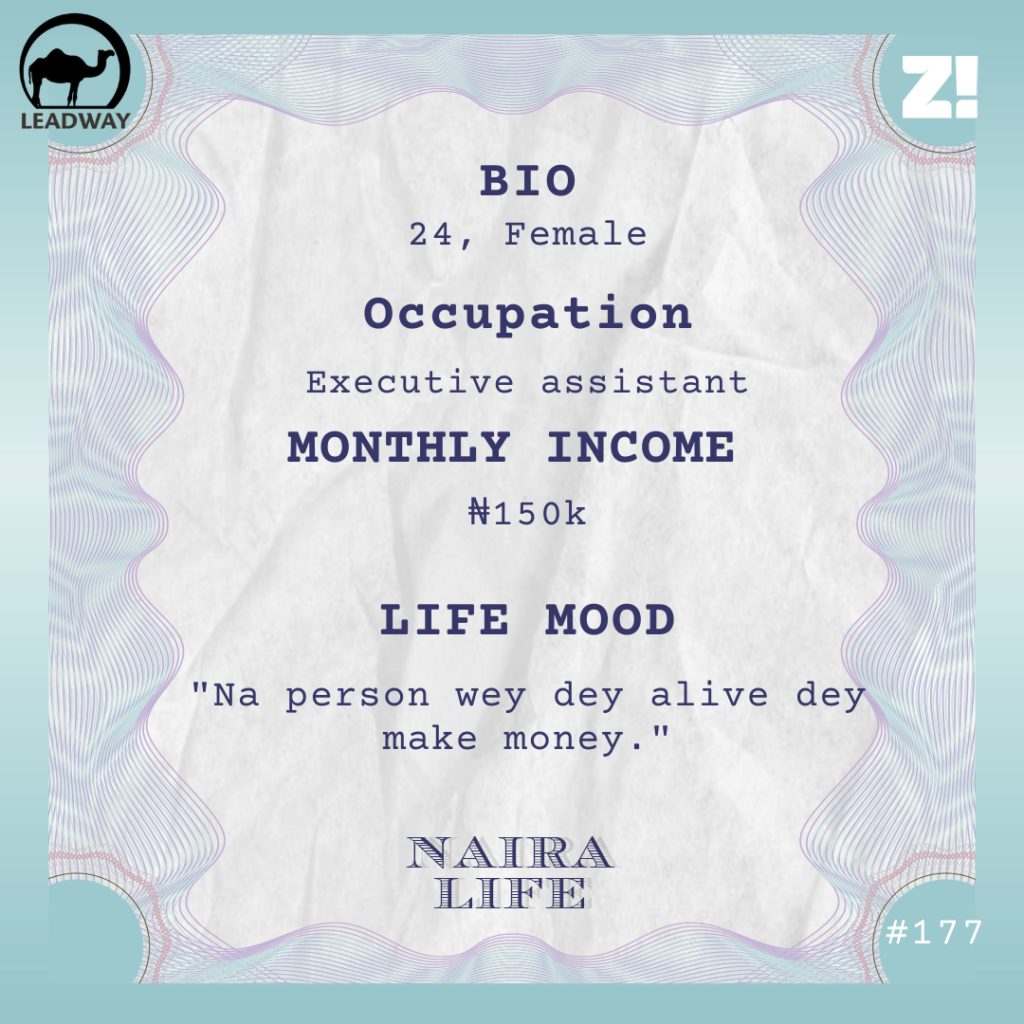

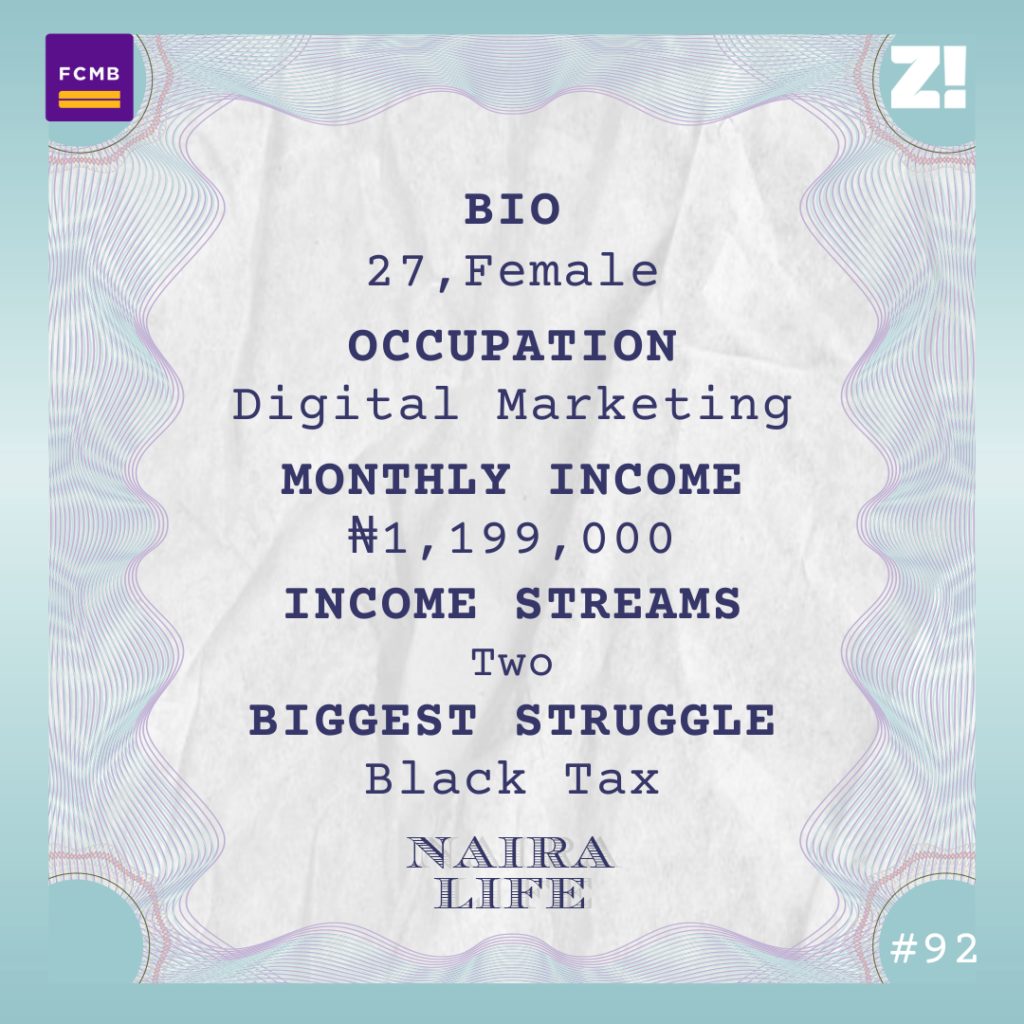

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

When I was in primary six, there was this woman who regularly sold snacks in my class during break time. I’d heard that her doughnuts were really good, but they cost around ₦10 – ₦20, which I couldn’t afford with my ₦5 lunch money, so my friends — who also brought ₦5 to school — and I never bought her snacks.

One day, she came into the class as usual. Then, some of my classmates formed a queue, and she gave each of them a snack — even my fellow ₦5-lunch-money classmates. I thought she was giving the snacks away, so I also queued and collected doughnuts and meat pie without asking questions. When I finished eating, the woman started asking me for money.

LOL. What did you do?

I told her I thought it was free, and she changed it for me. She made a scene and my classmates laughed at me. Apparently, the “giveaway” was meant for some pupils as directed by a teacher, and I wasn’t among them.

I couldn’t tell my parents, so I had to pay for the ₦30 worth of snacks I ate using my lunch money for the next six days. I didn’t eat anything during break time for those six days.

Why couldn’t you tell your parents?

My parents were disciplinarians, so I didn’t know what to expect. They’d either flog me silly or pay for it.

Plus, money wasn’t always great at home. My dad worked in construction and had frequent periods when there were no projects.

My mum, a nurse, helped out during those dry spells by working double shifts and treating people in the neighbourhood for extra cash. But there were still times when I got sent home from school for not paying fees on time.

Those experiences sort of made me grow up early. By the time I turned 9 years old, I’d realised my mum couldn’t always be home because of work. I started cooking at that age, too. I’m the third of four children, but the cooking responsibility fell on me because my elder brothers were in boarding school.

How early did you start making money?

Not until I finished secondary school in 2003. I hit a delay with university because I wanted to study medicine, but JAMB kept jamming me. So I started typing at cyber cafes. It was still the early days of the internet, and I was curious about it. I stole ₦100 from my mum to pay for 30 minutes on the computer and tinker around. That’s how I stumbled on the Mavis Beacon typing tutorial and got good at it really fast.

The other guys at the cafe noticed and began asking me to help them send emails and stuff so they could buy less time on the computers, and I charged each person ₦50.

I had a regular customer who was trying to travel abroad and so was in constant communication with embassies. He usually paid me ₦200 per day. He’d come to pick me up from my house at 6 a.m. because browsing was cheaper till 9 a.m. at a particular cyber cafe.

I saved most of what I made from the typing gigs — My mum was big on saving and made sure we all did it. I think most of the money went into Christmas clothes.

How long did the typing gigs last?

About three years. I wrote JAMB every year during those three years, but I didn’t get medicine. I also learnt graphic design during that time — it was called desktop publishing then — at a computer school. The graphic design lessons lasted three months, but the cafe kept me around to help them type when they noticed I learned fast. I left after six months when I noticed they had no plans of paying me.

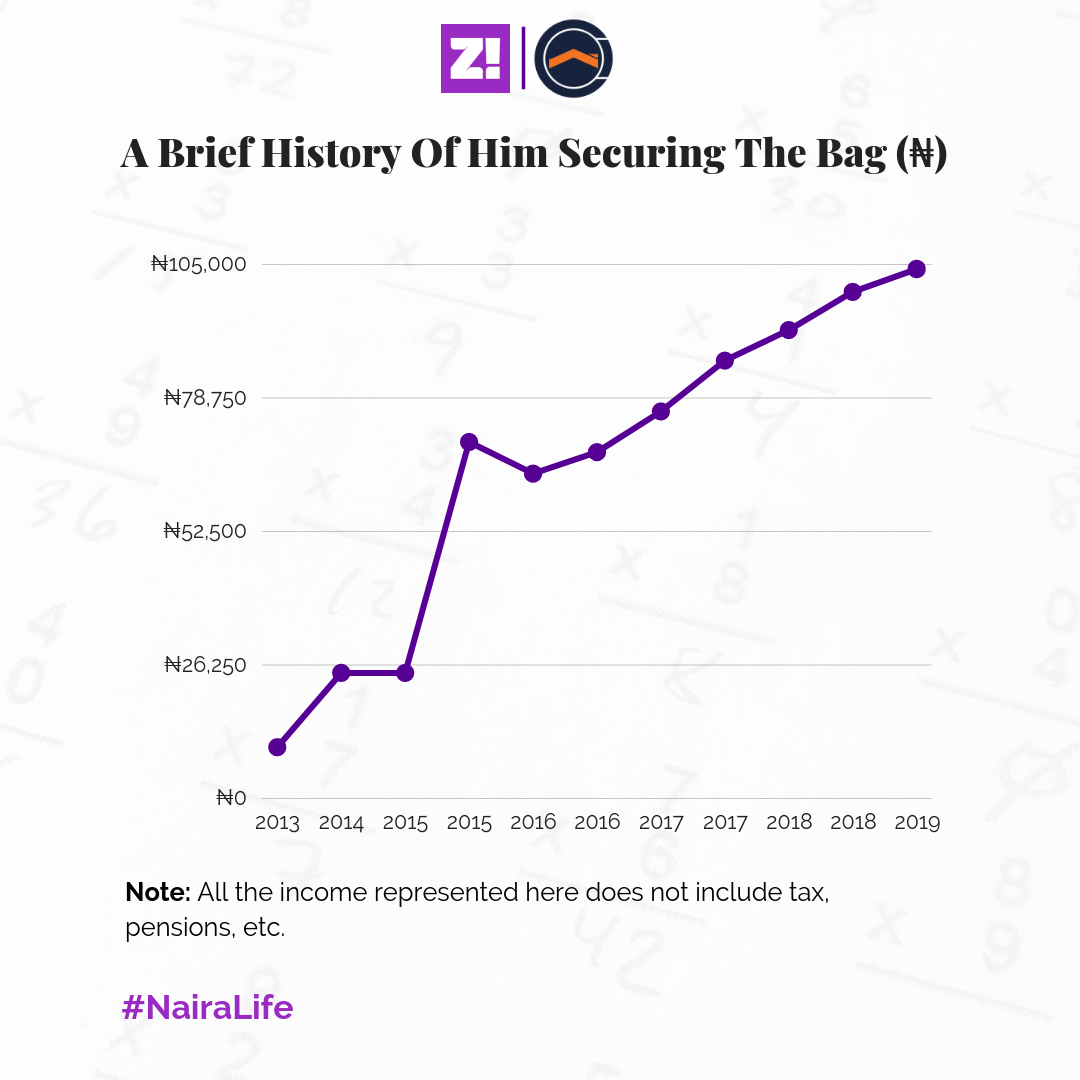

I applied to another computer school and got a job as an instructor for ₦2,500/month. This was in 2005. I’d also taken a break from seeking university admission because I was tired.

So you were fully working class

Yes. In 2006, I became curious about how publishers get books and magazines to look so much better and glossier, and I took an interest in printing. I found a printing school and applied for a two-year programme. It was subsidised because I applied through a Christian fellowship and paid ₦20k for the full programme.

I was juggling the programme with work. The classes were held in a training centre, so I used their computers to take on typing, design and any other gigs I got. All of this was bringing in around ₦10k- ₦15k in monthly income.

Then, in 2008, an uncle advised me to apply for a university’s distance learning program. I did, and got an admission offer to study Psychology.

I didn’t work for my first two years in school and relied solely on my parents because I wanted to make a first class. But in 300 level, I found a job opportunity and decided to let first class rest small.

What job opportunity was that?

Art director — what you’d call a graphic designer — at an advertising agency in Lagos. The salary offer was ₦65k/month.

The only thing was school was in Ibadan, and I’d have to go to Lagos for the job. But I had a hunch that the job could be my big break, so I took it. It was my introduction to advertising, and I don’t regret taking the job even though it was stressful shuttling between both cities. My grades suffered, but I graduated with a 2-1, so nothing spoil.

In 2015, I moved to another agency for a ₦100k/month salary. At this point, I was largely responsible for myself, even though I lived with an uncle in Lagos. Nine months after joining the agency, I was promoted to head the creative department because of my printing knowledge, and my salary jumped to ₦150k. I moved out of my uncle’s place to a ₦350k/year mini flat to start my life as a semi-big Lagos boy.

What was that like?

Things were good. The economy wasn’t as terrible as it is now, and I could easily provide for myself. In 2017, I became bored of agency life. Also, tech startups were beginning to gain ground, and I decided a tech job was going to be my next challenge. I applied and got a brand lead role with a tech startup and took a salary cut to ₦120k/month. As expected with startups, I did more than branding. My role quickly morphed into product and digital marketing.

Sadly, the startup went belly up after a year because the founders couldn’t raise funding. By the time I left in 2018, they were owing me three months’ salary. Fortunately for me, I had a steady stream of side gigs — from printing to graphic design and even taking small small gigs from my previous agency — which brought my income to between ₦150k – ₦400k monthly, so I didn’t go broke while unemployed.

[ad]

How many months did you spend unemployed?

Two months. My previous agency offered me ₦250k/month to return to lead the creative department. One thing about me, I don’t skimp on accommodation. I know a lot of my productivity and even job opportunities are tied to how close I am to the commercial parts of Lagos.

So, I got a bigger two-bedroom apartment at ₦800k/year — which was just one quick Uber away from work. I should mention I regularly had friends staying with me at different points, so it made sense to get a bigger place. But I didn’t last long at the job.

Why?

The higher salary came with more responsibilities than I thought. The CEO took a backseat, and I was acting as the COO, even managing the agency’s profit and loss statements. I was also designing and managing designers. It was too much, so I left towards the end of 2018. I didn’t have another job lined up, but I had my side gigs to fall back on.

What did you do next?

I became interested in brand and marketing strategy, so I used the free time to take online courses. I decided I wanted to transition to that, so I started joining Strategy communities and connecting with people on LinkedIn.

Meanwhile, I was also applying to several jobs. I got a couple of offers, but I was either unhappy about the proposed salary or the distance from my house. This went on for about a year.

How were you surviving?

I had about ₦2m saved up from my side gigs in a money market account with an asset management company. It’s like a savings account that gives between 14% – 17% interest yearly, so I just left all my savings there.

Plus, my brother introduced me to a business opportunity. We went around Lagos secondary schools printing yearbooks for them. We made as much as ₦1.5m in profits per yearbook project. We put back half of our earnings into our running costs and split the rest.

In 2019, I finally got a strategy job that paid ₦300k/month. It was an agency job, but I enjoyed speaking to several brands to proffer solutions — I wasn’t just a designer.

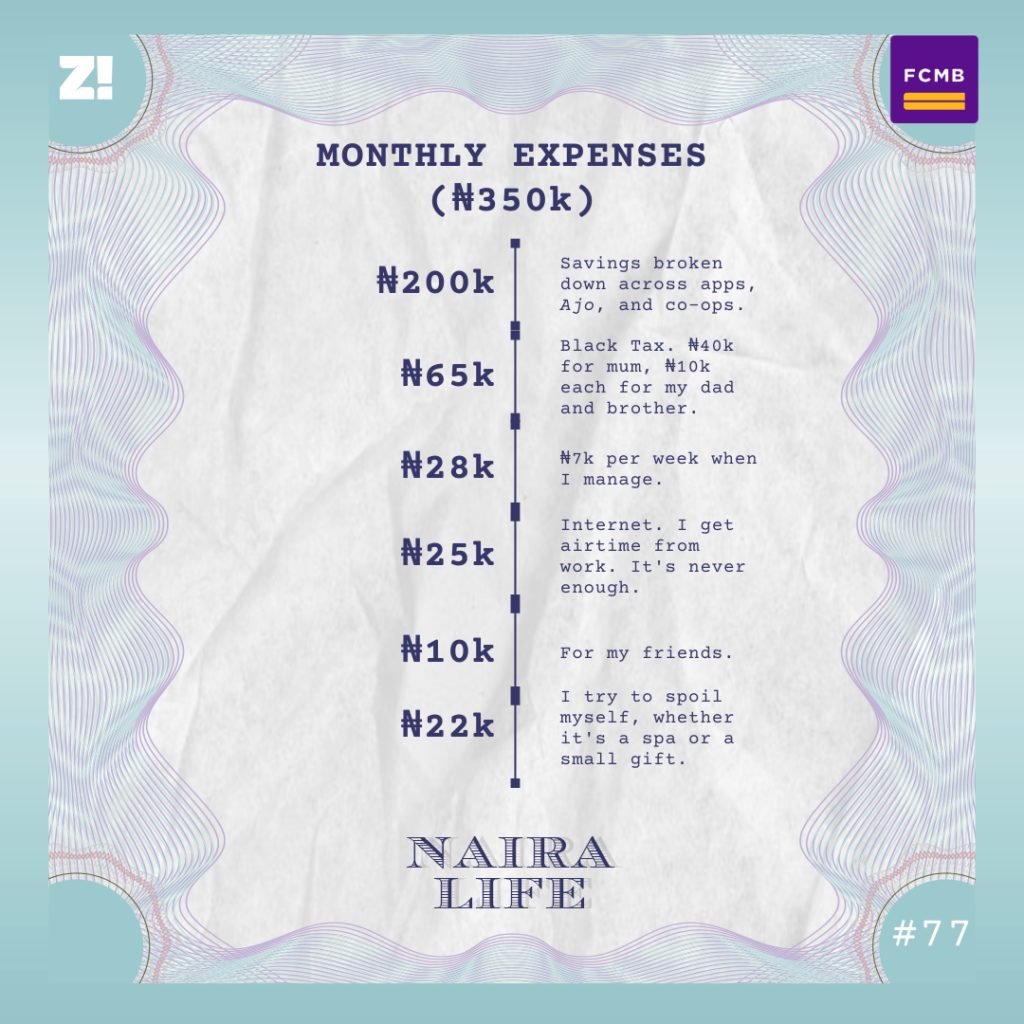

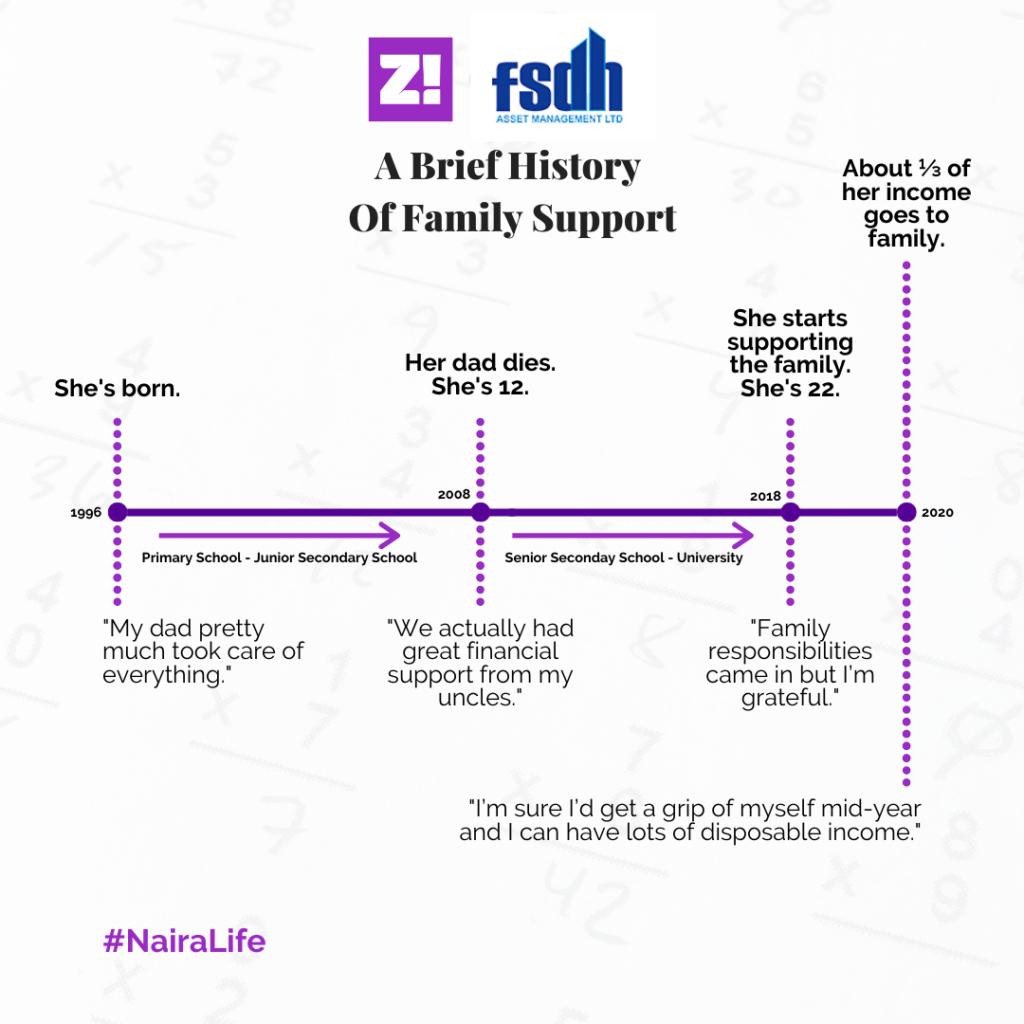

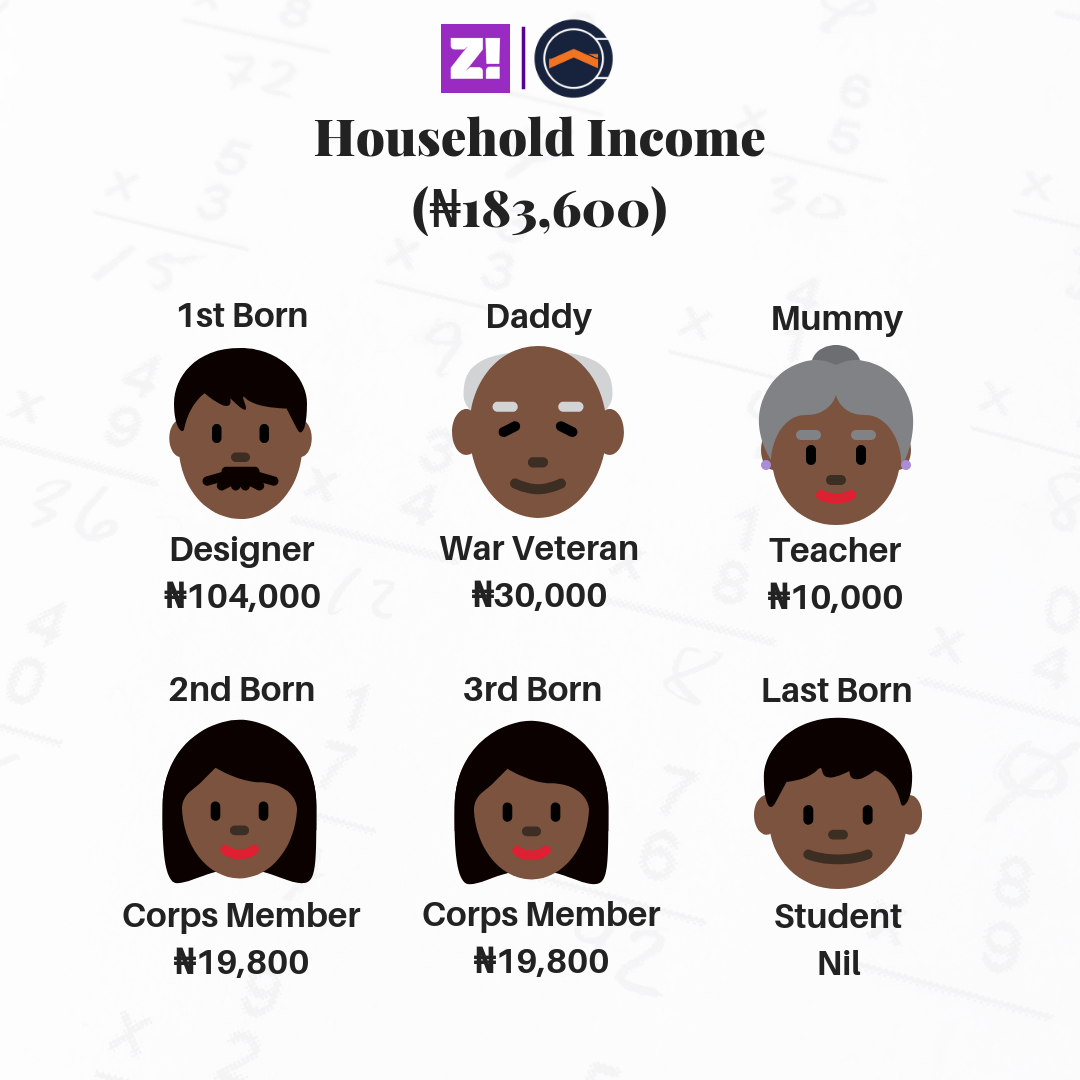

During this time, I was the only one in my family with a stable income. My dad had passed, my elder brothers were struggling with their careers, and my younger brother was in uni, so black tax fell on me.

Tell me more about that

I was 100% responsible for my younger brother, who was in 300 level, paying his university tuition and hostel accommodation fees. I also started sending my mum ₦40k monthly and regularly loaned my elder brothers money to get by.

I can look back and say now that I was looking out for my family and building them up because I was in the position to do so, but it was crazy. I was working, but I couldn’t see any evidence of my hard work. All my colleagues had cars, but I couldn’t afford one because of black tax.

In a way, it taught me delayed gratification. But in the moment, I lowkey resented it. There were times I’d call my mum or siblings, and we’d scream at each other, but at the end of the day, I had to provide for them. At one point in 2021, I took a ₦1.5m loan from a microfinance bank for my brother, but he defaulted on repayment. I had to complete it with my salary.

Damn

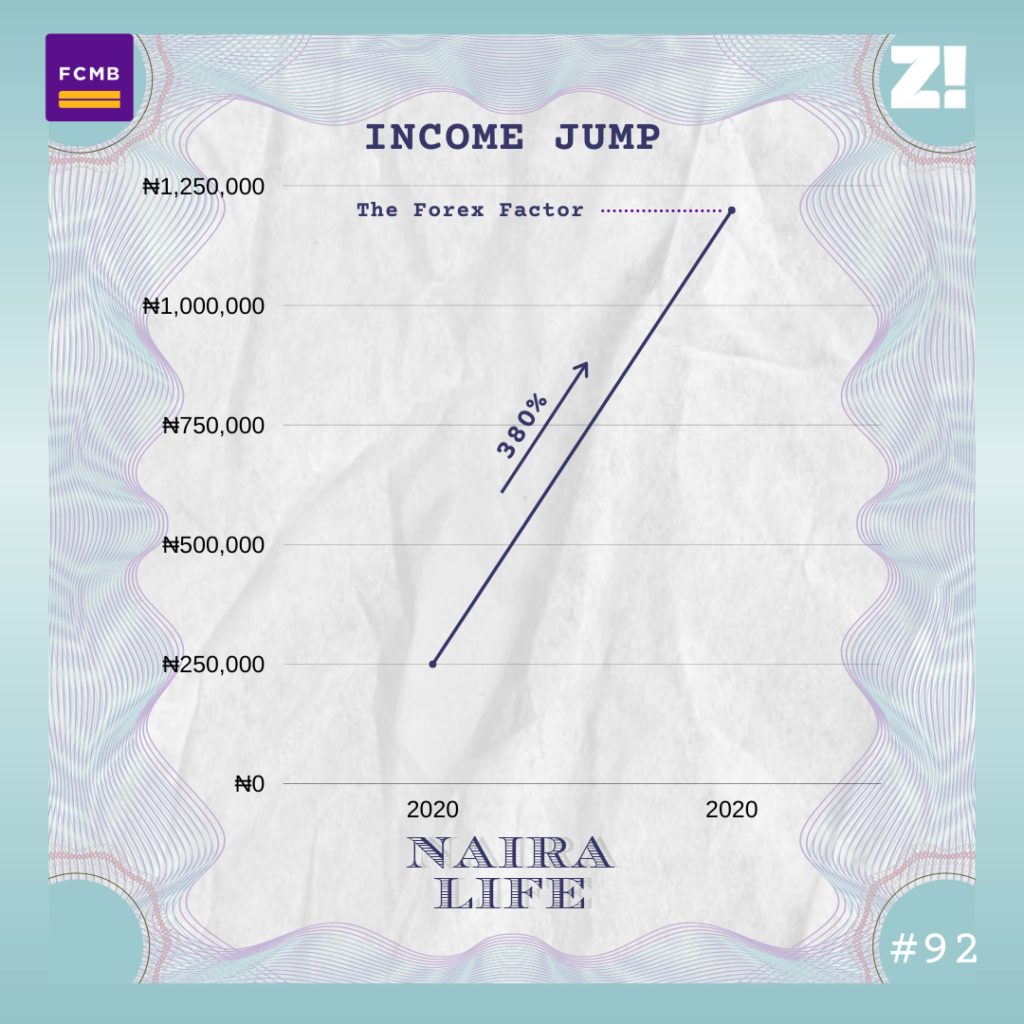

Thankfully, I also got a better-paying job in 2021. It paid ₦400k/month, and things started looking up from there. I moved to a senior management role at another agency the following year, and my income increased to ₦700k/month. The job also came with an official car.

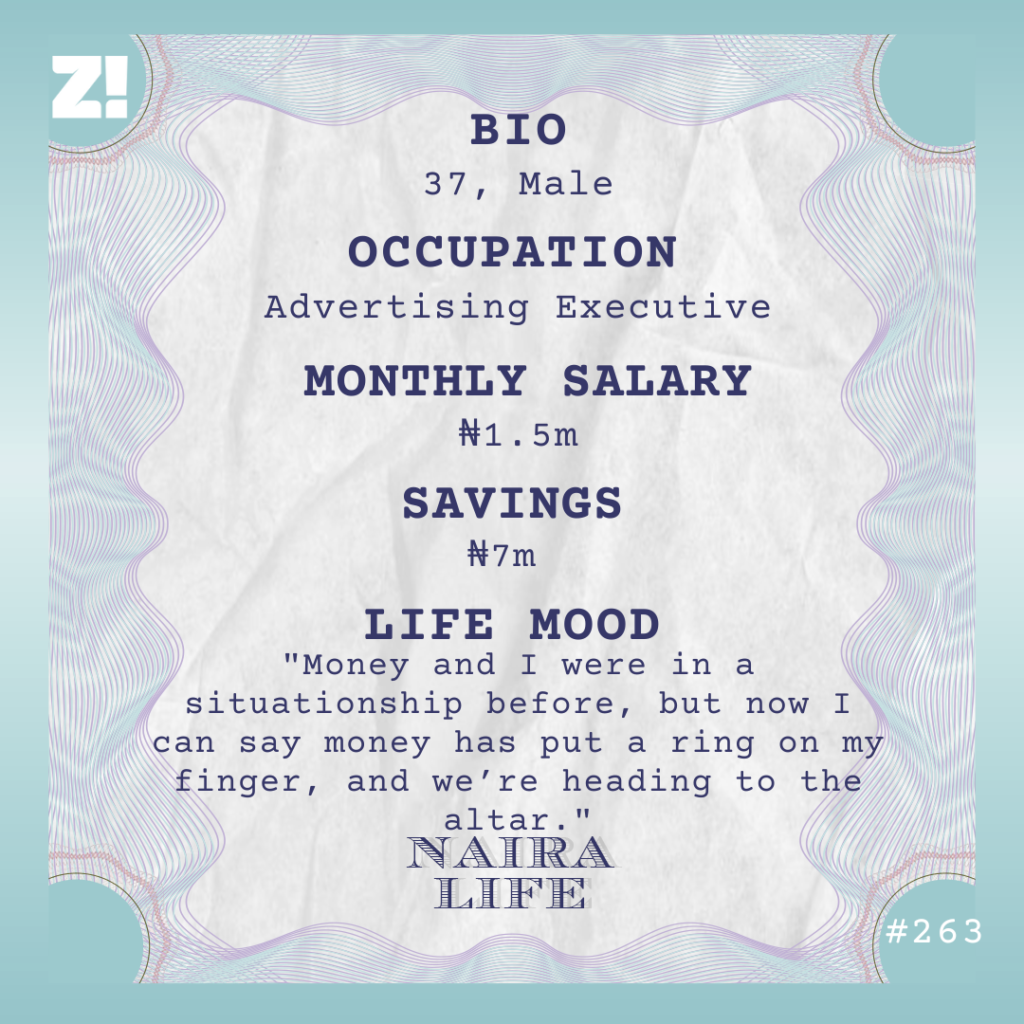

In 2023, I switched jobs again and got my current role, which also came with an official car. My salary also doubled to ₦1.5m/month.

I’m more stable financially now. My younger brother is done with uni, and one of my elder brothers has relocated abroad, so the load has slightly reduced. But there’s still black tax, especially since I’m married now.

When did you get married?

Right when I was in the thick of family responsibilities in 2020. I had like ₦3m in my money market account, so I emptied the account and divided the money into two. Half went into my wedding expenses, and the other half went into renting and setting up our new home. One helpful thing I did was to pay for most things in advance. So, I bought food and paid for electricity and internet to last us three months. Lockdown happened right after the wedding, so that helped.

How would you describe your relationship with money now?

Money and I were in a situationship before, but now I can say money has put a ring on my finger, and we’re heading to the altar. It’s a stable relationship. I can make plans now and know what I need to make those plans happen. It’s just that inflation puts us at odds sometimes. I earn far more now than I ever did, but I can’t make major lifestyle changes.

Why’s that?

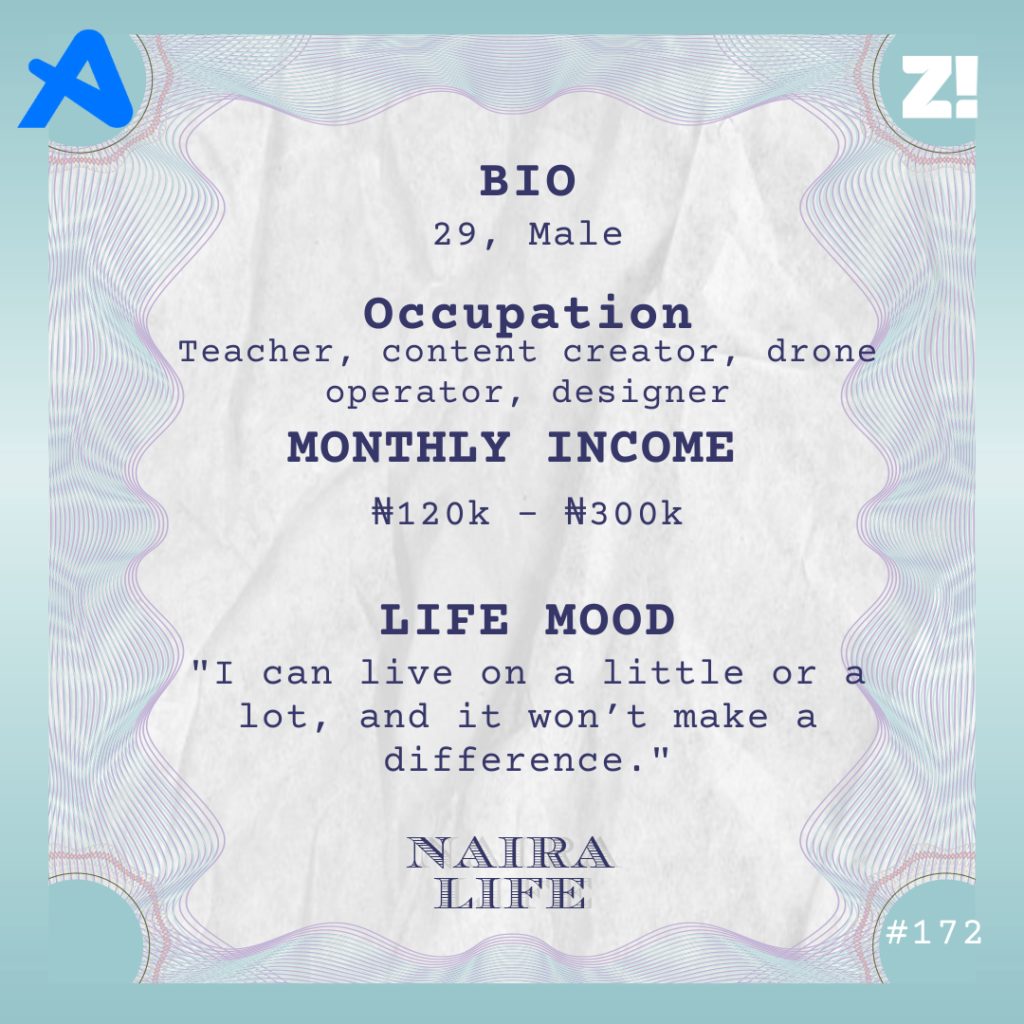

Everything is so expensive. I should be living a good life with what I earn, but I don’t. For one, I’d like to move to areas like Ogudu GRA, but I can’t even think of that even though I earn an additional ₦750k – ₦1m monthly from side gigs.

I’d love to travel, but I can only afford to visit African countries. I visited Ghana last year with a tour guide, and the five-day trip cost ₦1.2m. I’d also like to buy my dream car — a Toyota Venza — but last I checked, a Tokunbo 2018 model cost ₦19m. I can’t afford that, and I should be able to.

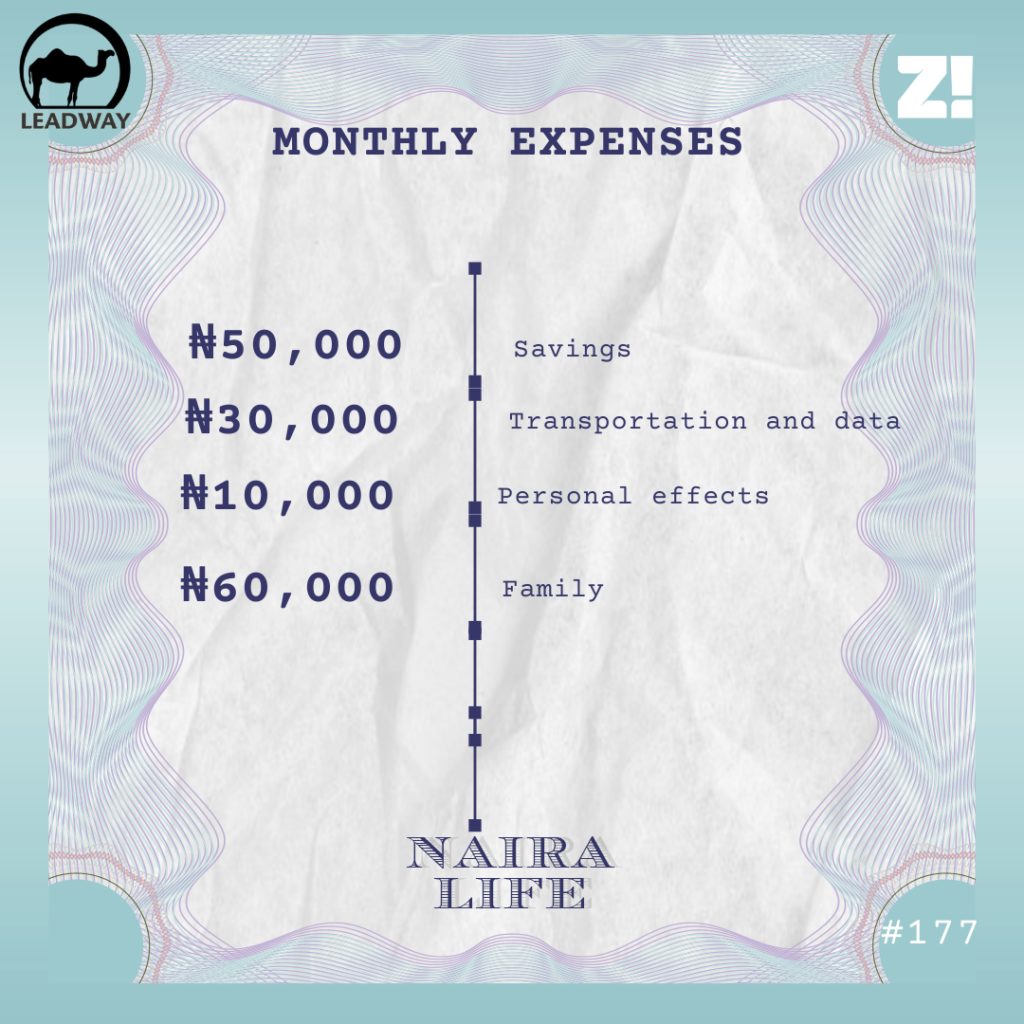

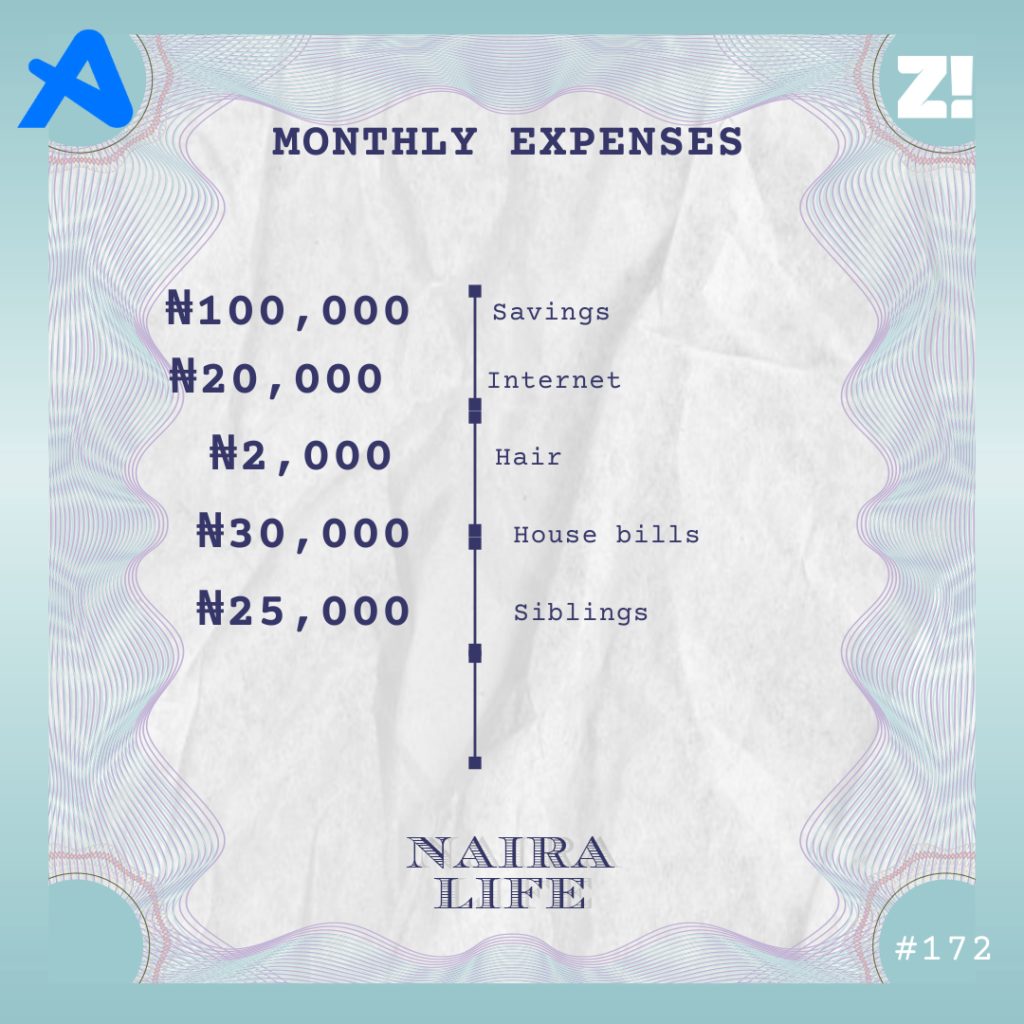

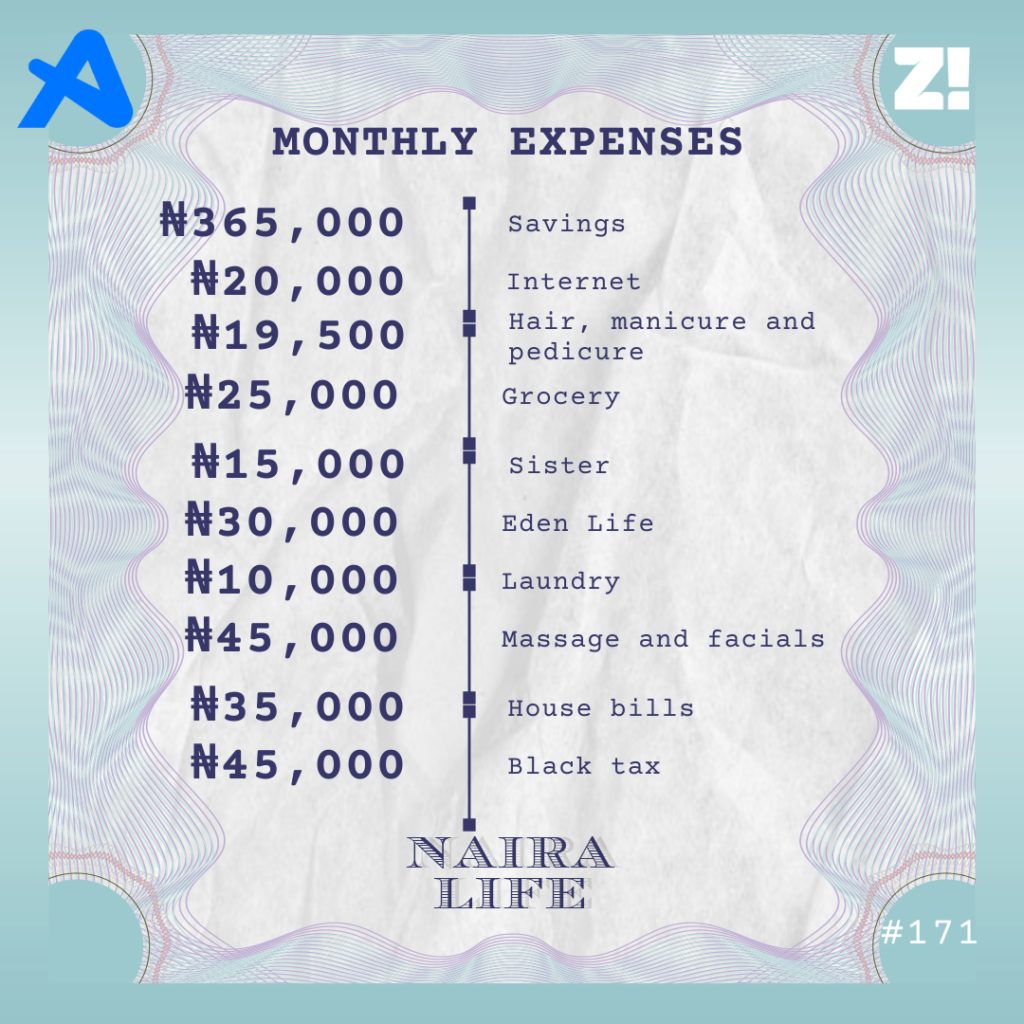

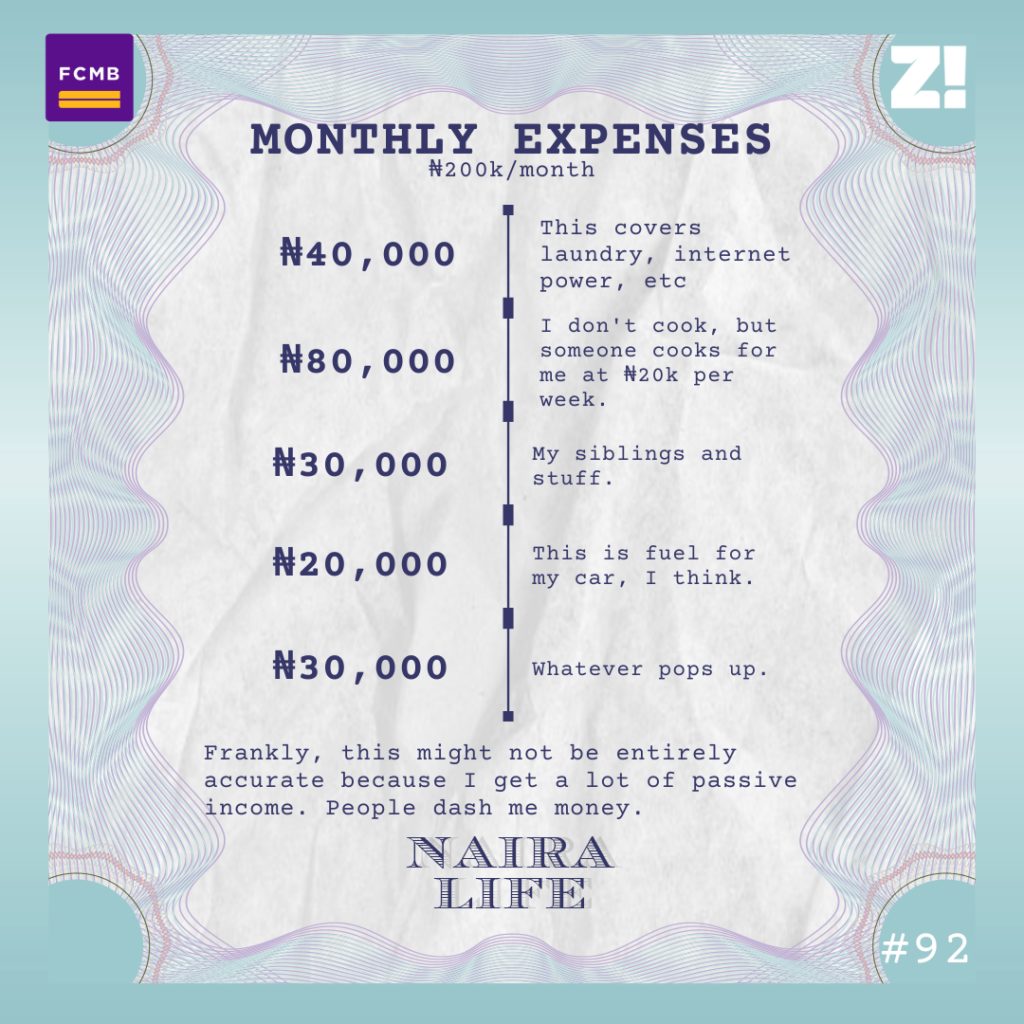

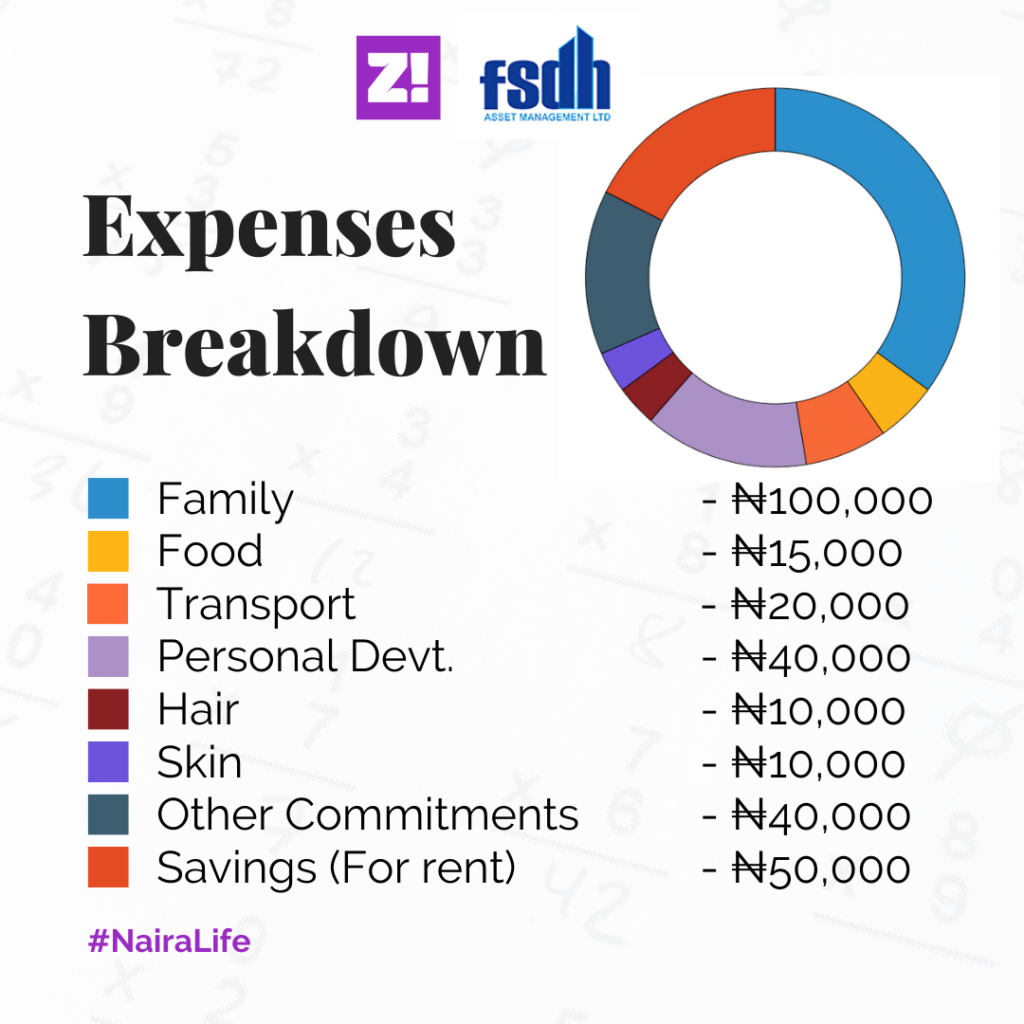

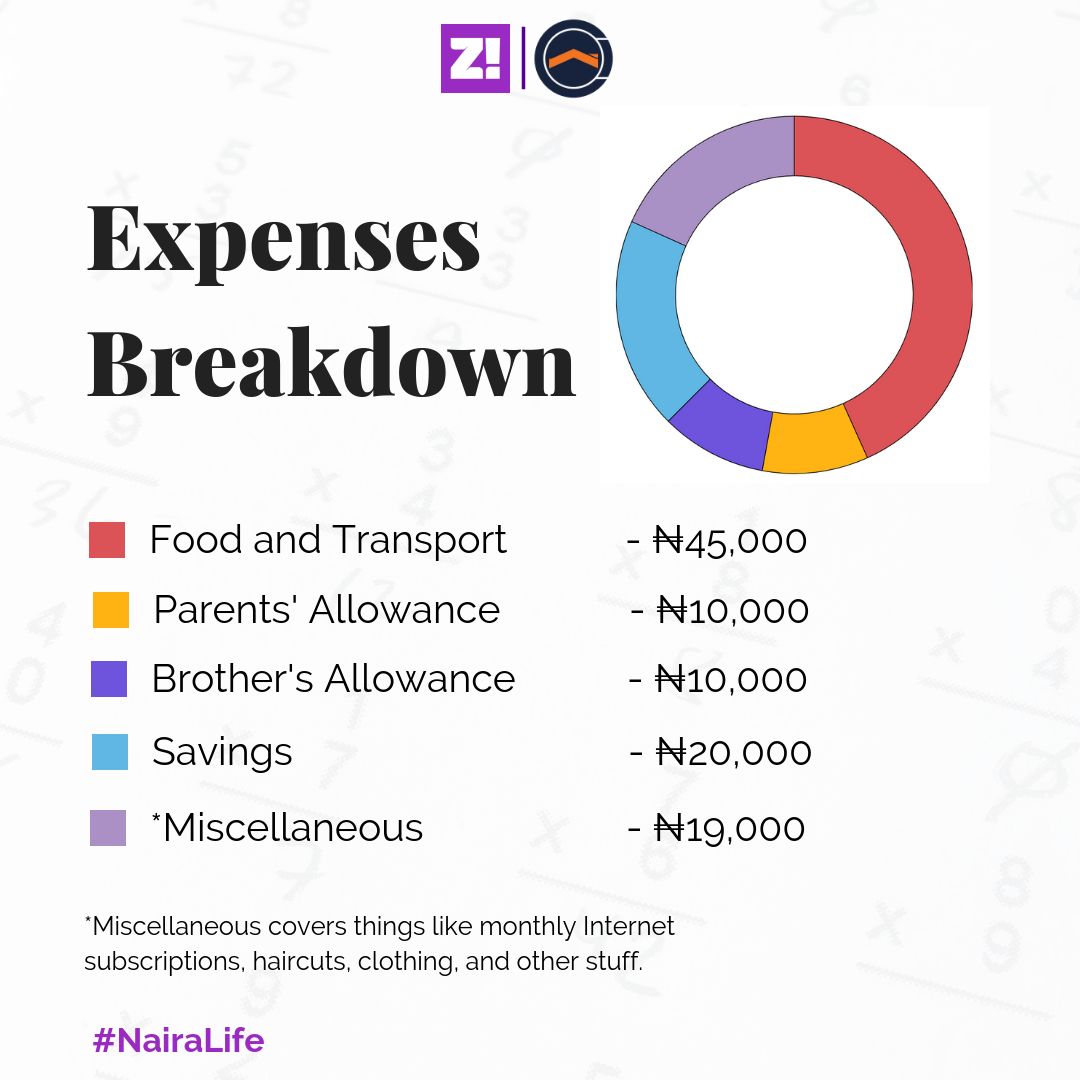

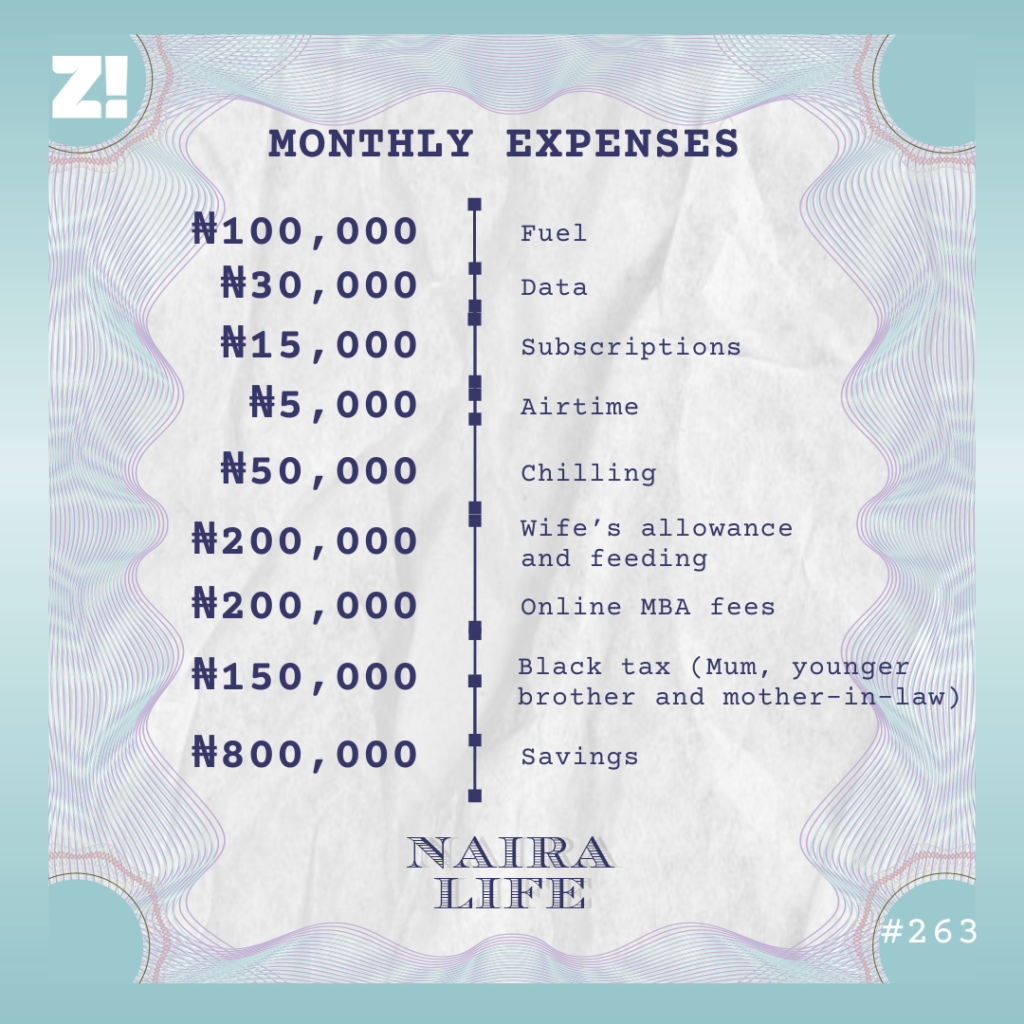

Let’s break down your monthly expenses

Right now, I have about ₦7m in savings, but I regret not saving most of it in dollars. If I’d started saving in dollars earlier, I’d be in a better financial position. Now, I try to buy $100 every now and then. I have $400 in my domiciliary account.

Do you have a savings goal?

My wife and I are considering relocating to Canada, so the savings will come in handy whenever we decide.

If ₦1.5m isn’t giving you a good life, how much will?

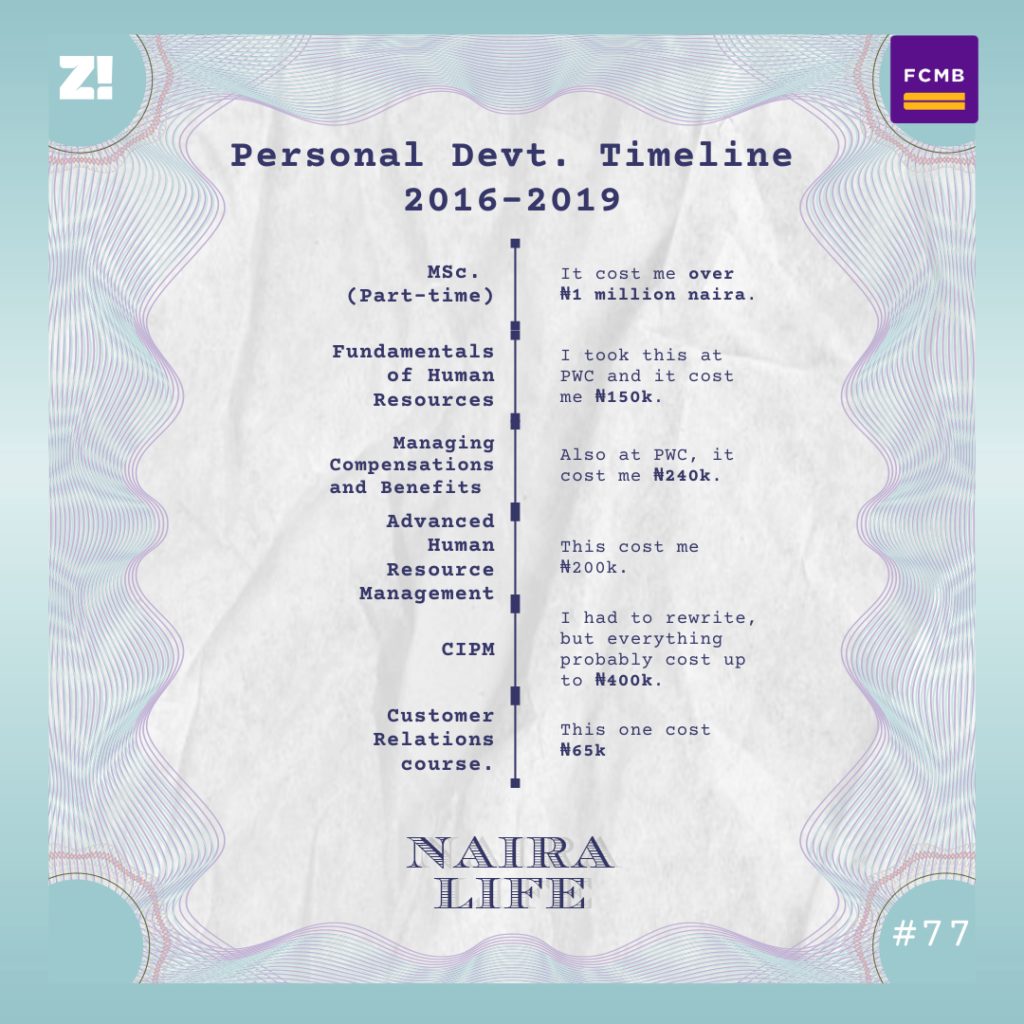

At least ₦5m/month. I’m currently studying for an MBA to improve my career and earning opportunities. Hopefully, I’ll transition to a Chief Marketing Officer role soon. The MBA has cost me about ₦900k so far, but I see it as investing in my career.

I’d also like to be able to provide more for my extended family. I haven’t always been happy with black tax, but I see it as a responsibility now. There are cultural nuances to it, so I can’t shy away from the fact that it’s my duty to my mum, in-laws and people I consider family. It’s just something I owe them to help them get by. If I’m able to help my brothers become even more financially stable, everyone gets to do their part in caring for our mum.

I know young people today like to ignore black tax, but a family raised you to the point where you are currently. I think that same family deserves your support, too. If anything ever happens to me, it’s still my family I’ll run back to. So why not build them up?

Makes sense. How would you rate your financial happiness on a scale of 1-10?

6.5. I’m okay, but I can’t upgrade my life the way I want to. Inflation is really spoiling things.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.