The problem of bank apps deducting exorbitant fees as “bank charges” is one that’s all too familiar to Nigerians.

Sometime in 2018, when I was an undergraduate, I galloped happily to an ATM to withdraw my last ₦1k. On getting there, I got the most disappointing message a broke man could ever get: “insufficient funds”. My bank had deducted the routine ₦50 back charges, leaving me with ₦950. So I walked back home in disappointment, feeling betrayed by my own bank.

But in 2023, the days of bank charges are a thing of the past, thanks to innovative digital banks offering revolutionary financial experiences. One of the banks leading this charge is Kredi, and they’re committed to simplifying banking for all their customers. What exactly differentiates this digital bank from the banking old guard?

Safety is supreme

The delicate nature of money makes banking a business that is highly dependent on trust. The average Nigerian is skeptical about money; where their money is going and if it’s safe where it is. The advent of digital banking and making bank transfers initially met a lot of resistance from older Nigerians. Safety is probably the biggest fear with keeping money in these banks but Kredi immediately quenches that before the spark is even able to catch fire. You open the Kredi website and you’re immediately ushered in by the promise of safety.

Kredi is also licensed by the Central Bank of Nigeria and insured by the NDIC.

Digital banks today

In the early parts of 2023, the Central Bank of Nigeria’s Naira redesign policy forced many people to adopt a different method of paying for goods and services. While it was by no means an easy period for anyone it highlights the importance of not completely relying on physical cash.

Kredi, in its characteristic customer-first approach, has been actively adjusting its processes to suit the everyday customer. Kredi offers a comprehensive range of banking services, such as savings accounts, investments, and loans, and carefully caters to both individuals and businesses. In recognition of the importance of keeping the customer at the centre of the product, every new feature results in a more convenient banking experience.

What makes Kredi different?

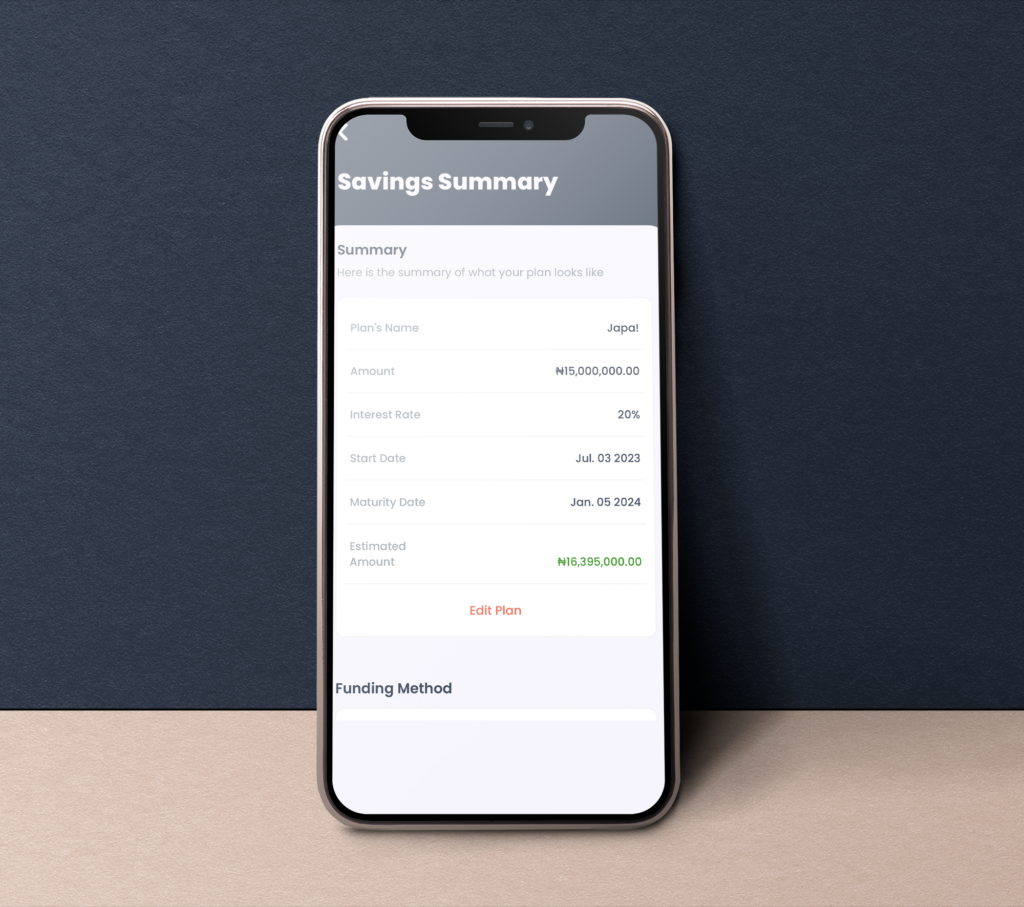

While most banks just help you save, Kredi helps you get richer while saving. The Kredi Savings Plan offers up to 20% interest per annum. Your money makes you money. This is a far cry from the trend with traditional banks. The charges are so many, it will leave you shocked. Now that’s where Kredi pot and Kredi vault come in.

Kredi Vault offers the option to lock away funds and resist the temptation to access those funds prematurely while Kredi Pot caters to specific financial goals. In saving for a goal, you also save faster as you accrue more interest. There’s never been a better win-win situation to exist.

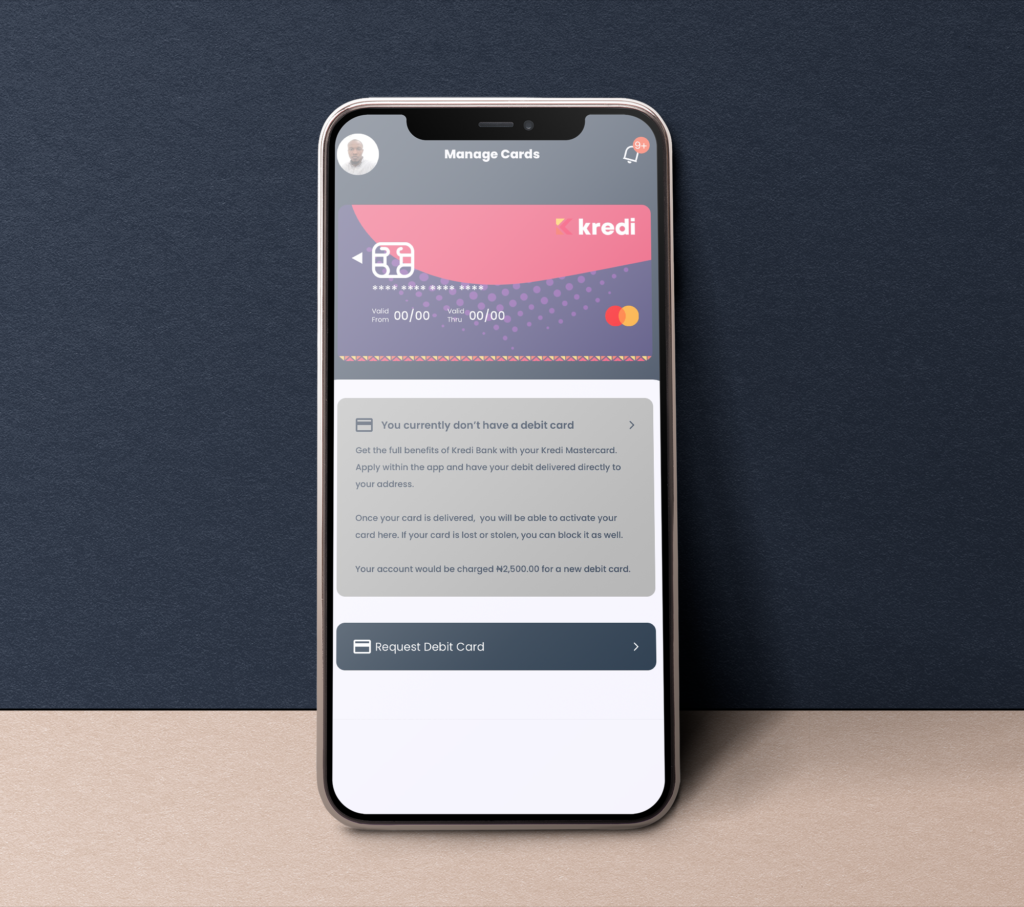

Okay, there’s one more win. When you request a Kredi Mastercard, you also get a Kredi Merchandise Package with a custom tote bag, shirt, and pen. The only other time you receive a gift and card on the same day is on your birthday.

With the high-interest rate, freebies, and absolutely no maintenance fees, it feels too good to be true. It’s truly inKREDIble.

Click here to join the Kredi train today